Suppose you’re starting a limited liability company (LLC) in Alaska and planning to sell goods subject to sales tax. In that case, you’ll needto ...

In Colorado, obtaining the certificate is free; as soon as you fill it out, you can begin using it.

Written by: Carolyn Young

Carolyn Young has over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Sarah Ruddle

For over 15 years, Sarah Ruddle has been a noteworthy leader in the business and nonprofit world.

Updated on July 17, 2024

Suppose you’re starting a limited liability company (LLC) in Colorado and planning to sell goods subject to sales tax. In that case, you’ll need to get a resale certificate, or perhaps several of them, before you start doing business.

This comprehensive guide explains why you need a resale certificate and how to get one in Colorado.

If your LLC expects to sell tangible goods in Colorado, a resale certificate will enable you to purchase those goods without paying sales tax. This prevents your goods from being double taxed, as you will need to charge your customer’s sales tax when they buy the goods.

If you purchase goods without paying sales tax and neglect to charge sales tax to customers who buy those goods, or if you fail to sell the goods, you and your LLC will be responsible for the sales tax and could face steep fines if you fail to pass it on to the state.

If you purposely purchase an item not intended for resale, such as office equipment, and use your resale certificate to avoid paying sales tax, that’s tax fraud, a federal offense. In Colorado, penalties for tax fraud include steep fines and even imprisonment.

Each resale certificate applies to only one vendor, so you’ll need one for each vendor.

Suppliers and vendors do not have to accept resale certificates. However, a vendor might refuse a resale certificate if it is invalid, which could make the vendor responsible for the sales tax.

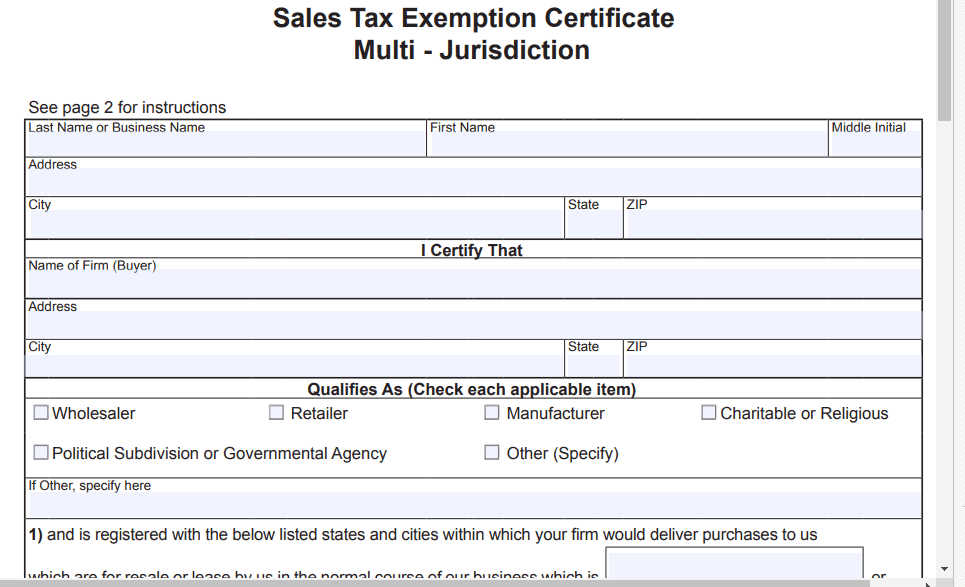

To obtain a resale or sales tax exemption certificate in Colorado, you’ll need to visit the Department of Revenue website to download the form.

The certificate is multi-jurisdictional, so you’ll list all the states where you make sales.

In Colorado, obtaining the certificate is free; as soon as you fill it out, you can begin using it.

Once you have the certificate, you’ll present it to your vendor. Be sure to keep a copy for your records.

Most resale certificates in Colorado need to be renewed every two years, and resale certificates are void if you don’t have an active sales tax permit.

Obtaining a resale certificate in Colorado is relatively easy and will save you thousands of dollars every year and help you and your LLC avoid potentially significant penalties.

Be sure to present the correct certificate to your vendors, keep copies for your records, and keep track of the expiration date for your sales tax permit. You don’t want to find yourself paying unnecessary sales tax.

Published on December 24, 2022

Suppose you’re starting a limited liability company (LLC) in Alaska and planning to sell goods subject to sales tax. In that case, you’ll needto ...

Read Now

Published on December 24, 2022

Suppose you’re starting a limited liability company (LLC) in Alabama and plan to sell goods subject to sales tax. In that case, you’ll need ares ...

Read Now

Published on December 24, 2022

Suppose you’re starting a limited liability company (LLC) in Arizona and planning to sell goods subject to sales tax. In that case, you’ll needt ...

Read Now