If you have a limited liability company (LLC) in California, you may need to shut down the business at some point. On the other hand, maybe you’ve started another company or decided to relocate to another state— whatever the reason, you’ll need to follow the somewhat complicated LLC dissolution process.

If done incorrectly, you’ll still be responsible for annual reports and fees and could face additional penalties. But, lucky for you, this handy guide explains how to dissolve an LLC in California.

Properly shutting down an LLC involves several crucial steps, as detailed below.

1. Vote for Dissolution

LLC owners, known as members, must vote to dissolve the LLC. Hopefully, you have an operating agreement that details the process. If not, California law requires you to gain a majority vote from members. Once you do so, you’ll need to draft a resolution to dissolve the LLC, which you’ll keep in your records.

2. Cancel Business Licenses and Permits

If you were required to get licenses and permits for your business, you’d need to contact the issuing agencies to cancel them so that you’re not charged renewal fees. If you have any outstanding fees, you’ll likely need to pay them before you are allowed to cancel.

3. Notify Creditors

If you owe money to any creditors or claimants, you’ll need to notify them by mail of the dissolution and give them detailed instructions on filing any claims for the outstanding debt. In California, dissolving your LLC does not prevent creditors from filing claims, and your dissolved LLC’s assets, undistributed or not, may be used to satisfy claims.

4. Notify Tax Departments

You must be in good standing with the California Franchise Tax Board (FTB) before you file to dissolve. Then, head to the FTB’s page for LLCs to file your final/current year tax return and pay any outstanding taxes due.

After your final taxable year, you must cease business to dissolve your LLC.

5. Cancel Contracts and Settle Financial Obligations

If you have contracts with vendors, lessors, or any other outstanding financial obligations, you’ll need to ensure all your obligations are fulfilled and all contracts are canceled.

6. Distribute Assets to Members

If the LLC has any assets remaining in any form after all financial obligations have been settled, they must be distributed to members based on LLC ownership percentages. If the assets are equipment, property, or other non-cash assets, they’ll need to be sold first so distributions can be made in cash.

7. File the Dissolution Papers with California

You can file three forms to dissolve your LLC in California: the Certificate of Dissolution, the Certificate of Cancellation, and the Short Form Cancellation Certificate. You can file online at Bizfile Online or physically with this PDF packet.

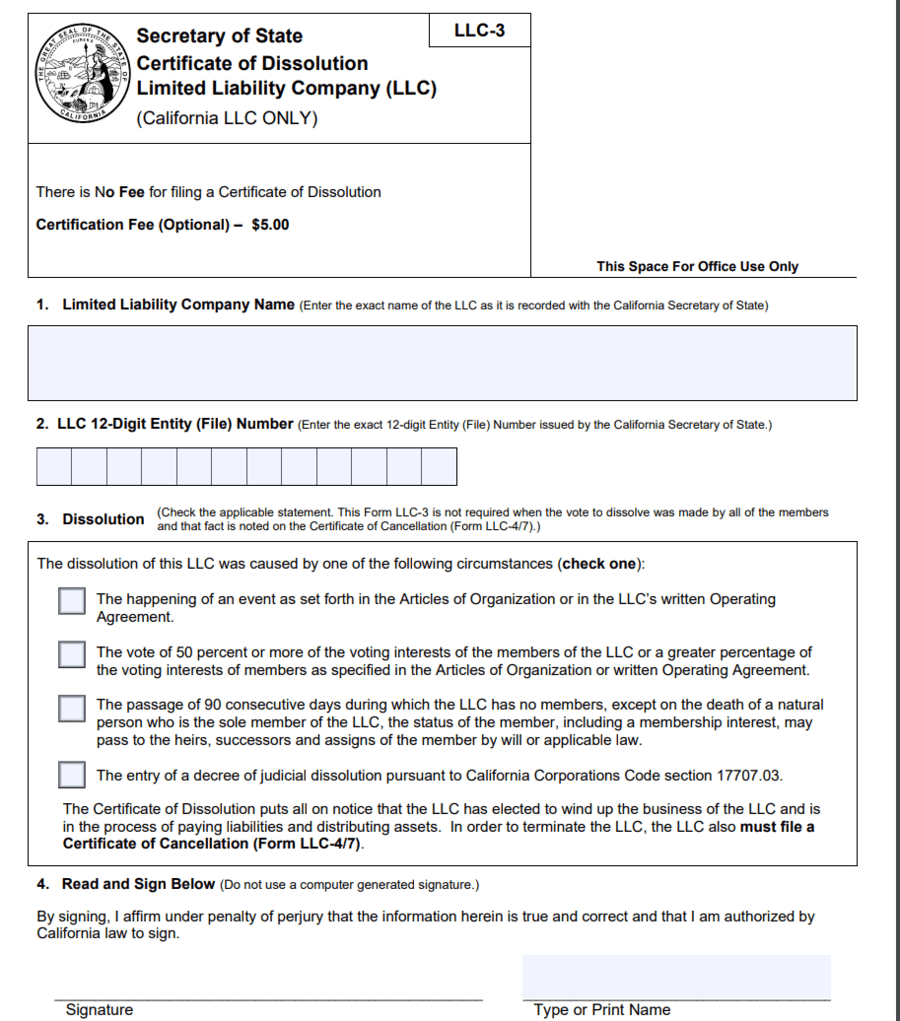

Certificate of Dissolution

If ALL members of your LLC were included when you voted to dissolve, you could skip this one. However, if not, you’ll have to file this Certificate of Dissolution to notify the state that you’re dissolving.

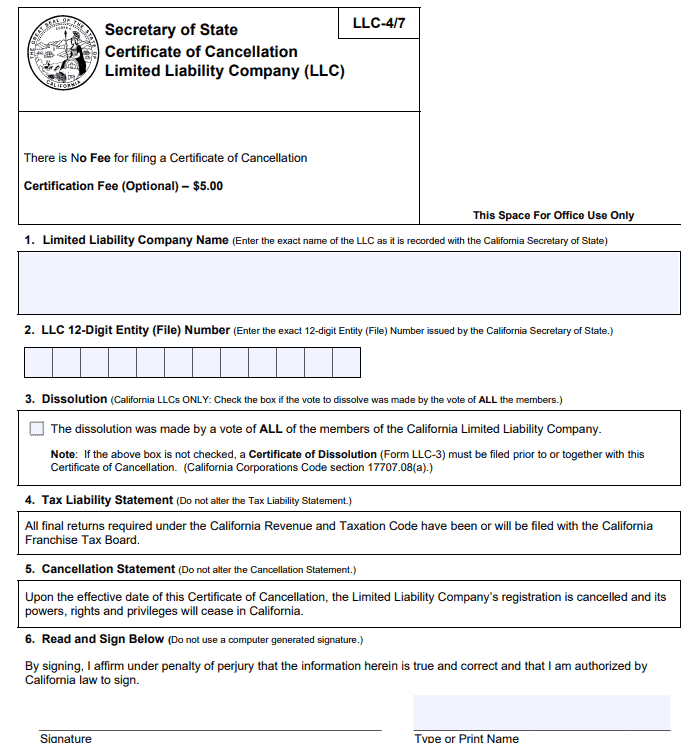

Certificate of Cancellation

If your LLC has done any business or is older than one year, you’ll need to file this Certificate of Cancellation. Note that Item three tells you that if you didn’t vote with all members, you’d also need to file the Certificate of Dissolution.

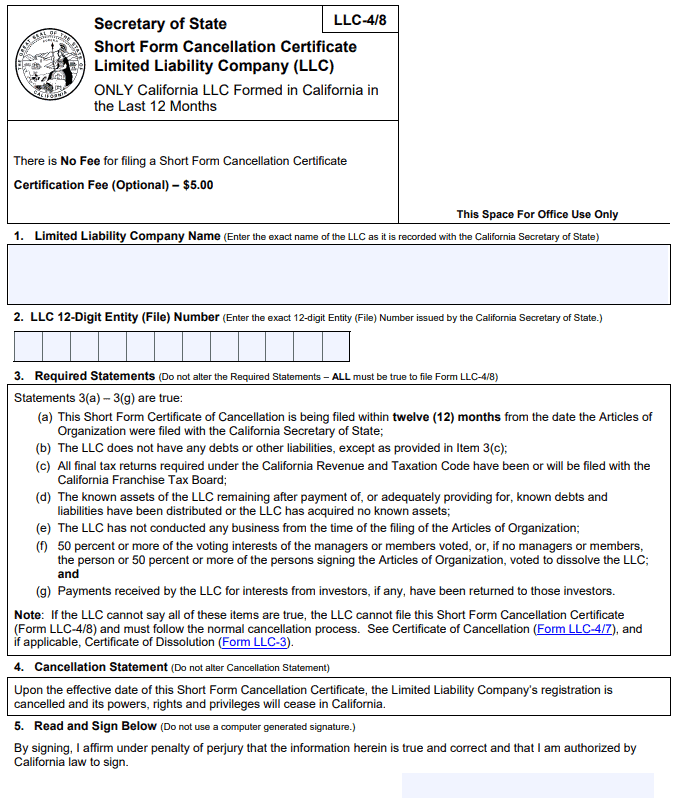

Short Form Cancellation Certificate

If your LLC is less than a year old, hasn’t had any operations, and meets a few other criteria, you can easily dissolve your LLC with this form without the other two.

Include the cover sheet if you’re filing by mail or in person. Deliver it to:

1500 11th Street

Sacramento, CA 95814

There is no fee to file dissolution papers in California. However, if you file in person, a handling fee of $15 must be paid by check or money order to the Secretary of State.

In Closing

Regardless of the reason, LLC dissolution must be done right to avoid legal issues and financial penalties. Therefore, it’s highly recommended that you employ the services of an attorney to ensure everything is done correctly and all bases are covered.

FAQs

How much does it cost to dissolve an LLC in California?

There’s no fee for filing a Certificate of Dissolution, a Certificate of Cancellation, or a Short Form Cancellation Certificate. However, a $15 special handling fee is required if you file in person.

How long does it take to dissolve a California LLC?

Once you file your dissolution papers, it should take approximately five days for the Secretary of State to process them. The wait may be longer at the end of the year, when more people are filing.

Should I close an unused LLC in California?

If you’re not going to use your LLC, you should close it to avoid any filings, fees, or responsibilities. If your LLC hasn’t conducted any operations in its first year, California has a special Short Form Cancellation that makes it easy to dissolve your LLC and will waive the standard annual LLC tax.

What happens if I don't dissolve my LLC in California?

If you don’t dissolve your LLC, you’ll be responsible for all filings, fees, and claims until you dissolve. At the very least, you’ll have to pay $800 annually to renew your LLC.

What is the difference between dissolution and termination of a California LLC?

In California, the Certificate of Dissolution serves as a notice that the LLC is winding up operations, paying liabilities, and distributing assets. Once you file your Certificate of Cancellation, your business is terminated, and you lose your registration, powers, rights, and privileges.