If you have a limited liability company (LLC) in Nevada, you may need to shut down the business. On the other hand, maybe you’ve started anotherco ...

In Pennsylvania, this must be done before you formally dissolve your LLC with the state.

Written by: Carolyn Young

Carolyn Young has over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Sarah Ruddle

For over 15 years, Sarah Ruddle has been a noteworthy leader in the business and nonprofit world.

Updated on August 27, 2023

If you have a limited liability company (LLC) in Pennsylvania, you may need to shut down the business at some point. Maybe you’ve started another company or decided to relocate to another state — whatever the reason, you’ll need to follow the somewhat complicated LLC dissolution process.

If done incorrectly, you’ll still be responsible for annual reports and fees and could face additional penalties. But, lucky for you, this handy guide explains how to dissolve an LLC in Pennsylvania.

Properly shutting down an LLC involves several crucial steps, as detailed below.

LLC owners must vote to dissolve the LLC. Hopefully, you have an operating agreement that details the process. If not, Pennsylvania law requires consent of all members or a court order at the application of one of the members. Once this occurs, you’ll draft a resolution to dissolve the LLC.

If you were required to get licenses and permits for your business, you’d need to contact the issuing agencies to cancel them so that you’re not charged renewal fees. If you have any outstanding fees, you’ll likely need to pay them before you are allowed to cancel.

If you owe money to any creditors, you’ll need to notify them in writing of the dissolution and give them detailed instructions on filing any claims for the outstanding debt. In Pennsylvania, claims must be filed by the deadline set by the LLC owner, which must be at least 120 days from receipt of the notice.

In Pennsylvania, this must be done before you formally dissolve your LLC with the state.

Notify any relevant tax authorities of the dissolution and pay any outstanding taxes due.

If you have contracts with vendors, lessors, or any other outstanding financial obligations, you’ll need to ensure all your obligations are fulfilled and all contracts are canceled.

If the LLC has any assets remaining in any form after all financial obligations have been settled, they must be distributed to members based on LLC ownership percentages. If the assets are equipment, property, or other non-cash assets, they’ll need to be sold first so distributions can be made in cash.

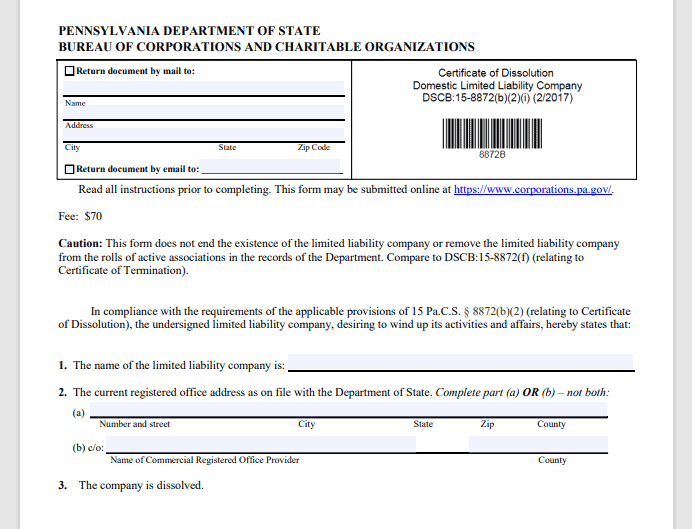

In Pennsylvania, officially dissolving your LLC is the first to file a certificate of dissolution. This should be done when the determination to dissolve was initially made and the resolution to dissolve the LLC was drafted.

You’ll download the form, fill it out, and mail it to:

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105-8722

The fee for filing the dissolution papers in Pennsylvania is $70.

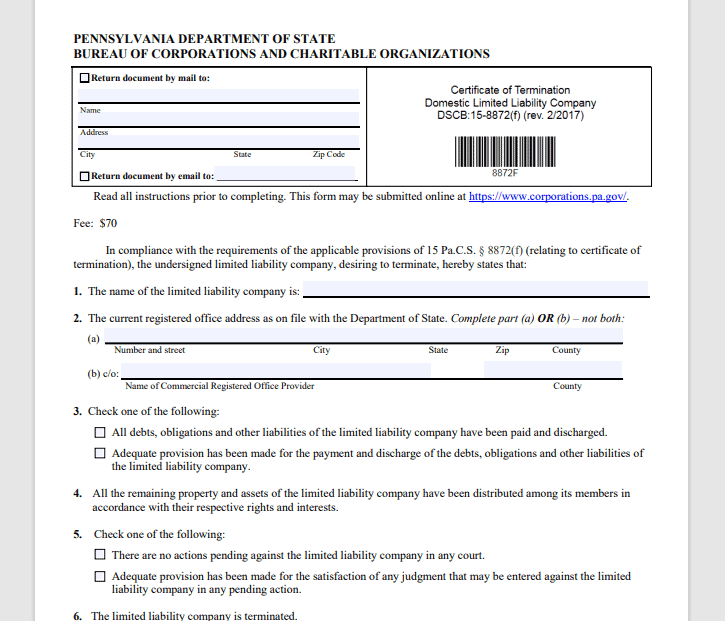

Once you’ve completed all the steps to wind up and dissolve your LLC, you’ll need to file a certificate of termination. Then, again, you’ll download the form and fill it out.

You’ll need to attach tax clearance certificates from the Department of Revenue and Labor and Industry stating that all taxes have been paid.

You’ll mail the form to the address specified above. The fee for filing this form is $70.

Regardless of the reason, LLC dissolution must be done right to avoid legal issues and financial penalties. Therefore, it’s highly recommended that you employ the services of an attorney to ensure everything is done correctly and all bases are covered.

You’ll need to file a certificate of dissolution and a certificate of termination, with a filing fee of $70.

It can take 15 business days for dissolution and termination paperwork to be processed in Pennsylvania.

If you have no plans to operate your Pennsylvania LLC in the future, you should dissolve the LLC. However, you’ll still be responsible for annual reporting and fee requirements if you don’t.

You will remain responsible for all your LLC’s filings and fees. If you don’t keep up with them, penalties may accrue.

In Pennsylvania, dissolution begins with the triggering event, such as a vote of members per the operating agreement. Termination is when all LLC activities stop, including winding up affairs and filing dissolution paperwork with the state. The filing of those documents finally terminates the LLC.

Published on May 21, 2023

If you have a limited liability company (LLC) in Nevada, you may need to shut down the business. On the other hand, maybe you’ve started anotherco ...

Read Now

Published on May 21, 2023

If you have a limited liability company (LLC) in Wyoming, you may need to shut down the business at some point. Maybe you’ve started anothercompan ...

Read Now

Published on May 21, 2023

If you have a limited liability company (LLC) in Wisconsin, you may need to shut down the business at some point. On the other hand, maybe you’ves ...

Read Now