You do not need an EIN if you have a sole proprietorship with no employees or an LLC with only one member and no employees.

What is an EIN Number and How to Get One for your LLC

Written by: Carolyn Young

Carolyn Young has over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Sarah Ruddle

For over 15 years, Sarah Ruddle has been a noteworthy leader in the business and nonprofit world.

Updated on June 8, 2025

The Internal Revenue Service (IRS) uses your business’ employer identification number (EIN) to identify your company, much the way a Social Security number is used to identify individuals. An EIN is used for tax filing purposes, and when you form an LLC, you’ll probably need to obtain an EIN.

How an EIN is Used

An EIN is used to identify your company and contains information about the state where you do business. The IRS uses it to determine your company as a taxpayer. An EIN is also used to track your business credit and is usually necessary to open a business bank account.

Who Can Get an EIN?

Any business, regardless of entity type, can get an EIN, even a sole proprietorship. However, a sole proprietorship does not have to obtain an EIN if the business has no employees. The sole proprietor can use their Social Security number for tax filing purposes.

Do I Have to Get an EIN for my Business?

If you have a limited liability company (LLC) that has more than one member or if you are going to hire employees, you’ll need to have an EIN. But these aren’t the only factors. The IRS offers a test to determine if you need an EIN:

- Do you have employees?

- Do you operate your business as a corporation or a partnership?

- Do you file any of these tax returns: Employment, Excise, or Alcohol, Tobacco, and Firearms?

- Do you withhold taxes on income, other than wages, paid to a non-resident alien?

- Do you have a Keogh plan?

- Are you involved with any of the following types of organizations?

- Trusts, except certain grantor-owned revocable trusts, IRAs, Exempt Organization Business Income Tax Returns

- Estates

- Real estate mortgage investment conduits

- Non-profit organizations

- Farmers’ cooperatives

- Plan administrators

If you answer yes to any of those questions, you need an EIN.

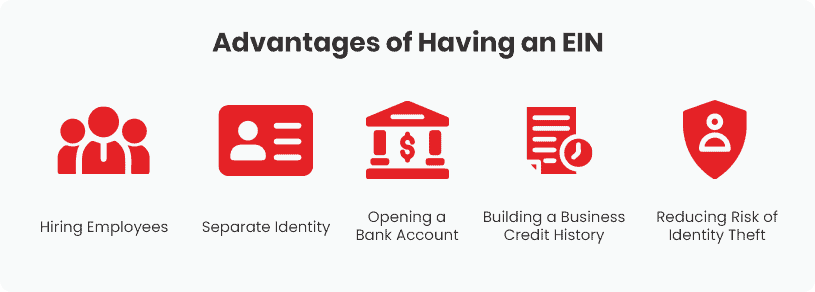

Benefits of an EIN

There are several reasons to get an EIN, even if you’re not required to have one. First of all, it adds a degree of separation between your business and personal finances. Besides, it’s usually needed to open a business bank account.

Also, it will allow you to establish business credit, which can help you access future financing. Finally, if you’re not hiring employees now but may do so, you’ll already have your EIN and be ready to go.

What Do I Need to Get an EIN?

According to the IRS:

All EIN applications (mail, fax, electronic) must disclose the name and Taxpayer Identification Number (SSN, ITIN, or EIN) of the true principal officer, general partner, grantor, owner or trustor. This individual or entity, which the IRS will call the ‘responsible party,’ controls, manages, or directs the applicant entity and the disposition of its funds and assets. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity.

When you fill out the application, you’ll need the following:

- DBA name, if you have one

- Name, title, and Social Security number of managing member or owner

- Business address

- State in which your business is registered

- Reason for applying

- Main business activity

- Products/services offered

- Closing month of your accounting year

- Contact phone number and email

How to Apply for an EIN

The application is Form SS-4, and you can submit it via the IRS website. You can print the form or mail it. If you apply online, your EIN will be issued immediately.

To learn what you need to do to get an EIN in your state, pick your state from the list below. You’ll get all the important details and resources required to obtain an EIN for your business registered in that state.

FAQs

No. The IRS issues EINs free of charge when you apply online, by fax, or by mail using Form SS-4.

Online applications issue an EIN immediately. Fax requests take about four business days, and paper applications arrive in 4–6 weeks.

Yes. Complete Form SS-4, enter “Foreign” in the SSN field, and fax or mail it. You’ll receive your EIN via return fax or mail.

Yes. Converting from a single-member to multi-member LLC or changing from disregarded-entity to corporation taxation requires a new EIN.

File Form 8822-B within 60 days of the change to update your responsible party or business mailing address.

EINs are permanent and cannot be “cancelled,” but you must notify the IRS in writing of the LLC’s dissolution to close your business account.