If you have a limited liability company (LLC) in Nevada, you may need to shut down the business. On the other hand, maybe you’ve started anotherco ...

In both cases, the filing fee is $25.

Written by: Carolyn Young

Carolyn Young has over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Sarah Ruddle

For over 15 years, Sarah Ruddle has been a noteworthy leader in the business and nonprofit world.

Updated on July 16, 2024

If you have a limited liability company (LLC) in Florida, you may need to shut down the business at some point. On the other hand, maybe you’ve started another company or decided to relocate to another state — whatever the reason, you’ll need to follow the somewhat complicated LLC dissolution process.

If done incorrectly, you’ll still be responsible for annual reports and fees and could face penalties down the line. But, lucky for you, this handy guide explains how to dissolve an LLC in Florida.

Properly shutting down an LLC involves several crucial steps, as detailed below.

LLC owners must vote to dissolve the LLC. Hopefully, you have an operating agreement that details the process. If not, Florida law requires you to gain consent of all members. Once you do so, you’ll need to draft a resolution to dissolve the LLC.

If you were required to get licenses and permits for your business, you’d need to contact the issuing agencies to cancel them so that you’re not charged renewal fees. If you have any outstanding fees, you’ll likely need to pay them before you are allowed to cancel.

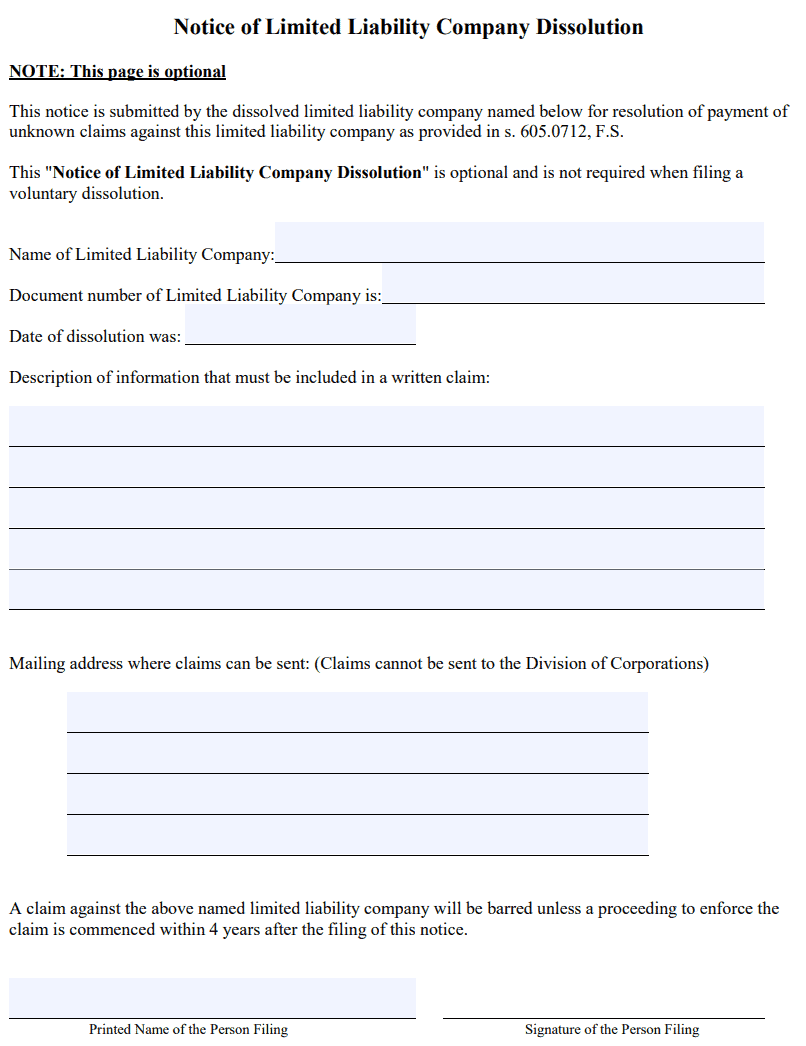

If you owe money to any creditors, you’ll need to notify them in writing of the dissolution and give them detailed instructions on filing any claims for the outstanding debt. In Florida, your notice must provide a mailing address for claims and a deadline of at least four months from the effective date of the notice.

In Florida, you can only give notice to creditors after you’ve officially dissolved. But the good news is that Florida allows you to file a Notice of LLC Dissolution alongside your Articles of Dissolution, which fulfills this requirement. See Section 7 for more details.

Notify any relevant tax authorities of the dissolution and pay any outstanding taxes due.

If you have contracts with vendors, lessors, or any other outstanding financial obligations, you’ll need to ensure all your obligations are fulfilled and all contracts are canceled.

If the LLC has any assets remaining in any form after all financial obligations have been settled, they must be distributed to members based on LLC ownership percentages. If the assets are equipment, property, or other non-cash assets, they’ll need to be sold first so distributions can be made in cash.

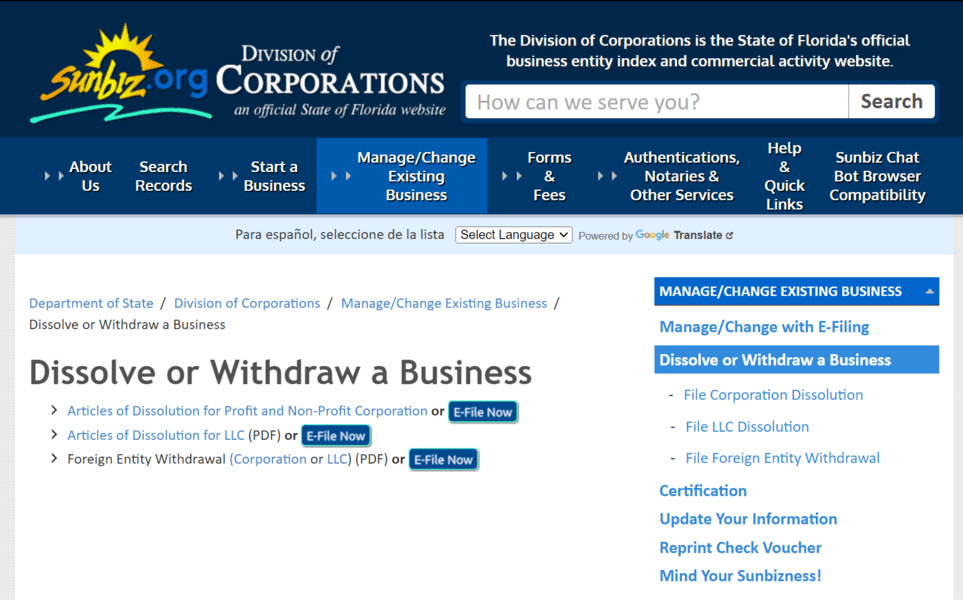

In Florida, the Division of Corporations processes dissolutions. To start, go to their site to Dissolve or Withdraw a Business.

You’ll see that next to “Articles of Dissolution for LLC,” there are options to either download and mail the document or file it online.

In both cases, the filing fee is $25.

Read on to see which option is better for you.

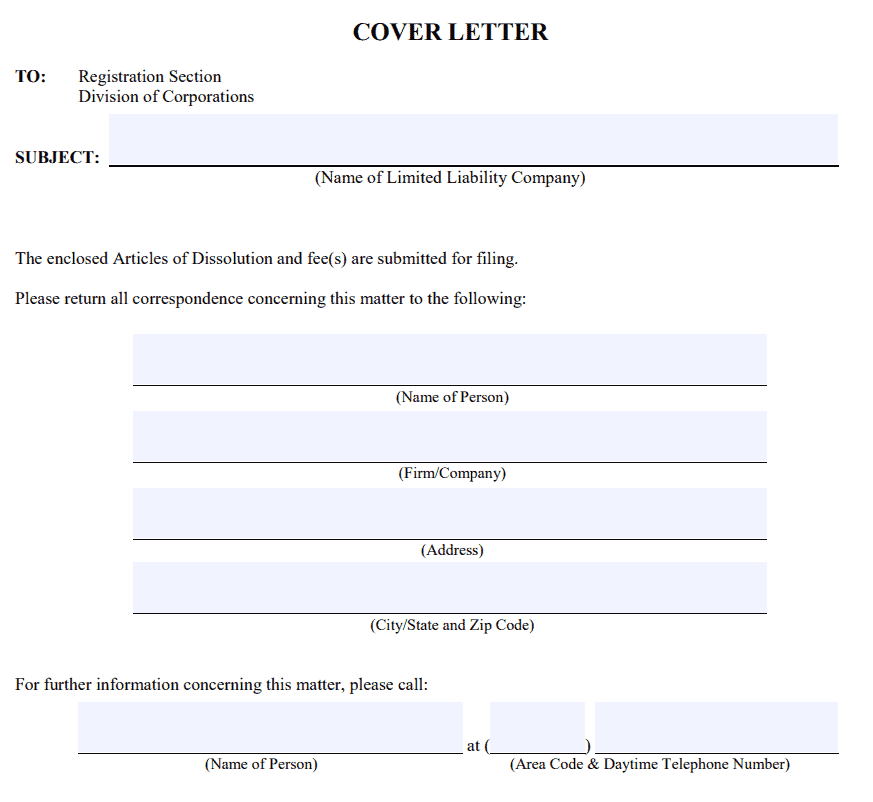

In the PDF link, you’ll find a variety of documents. But first, fill out the Cover Letter. This tells the Division of Corporations where to send your documents once filed.

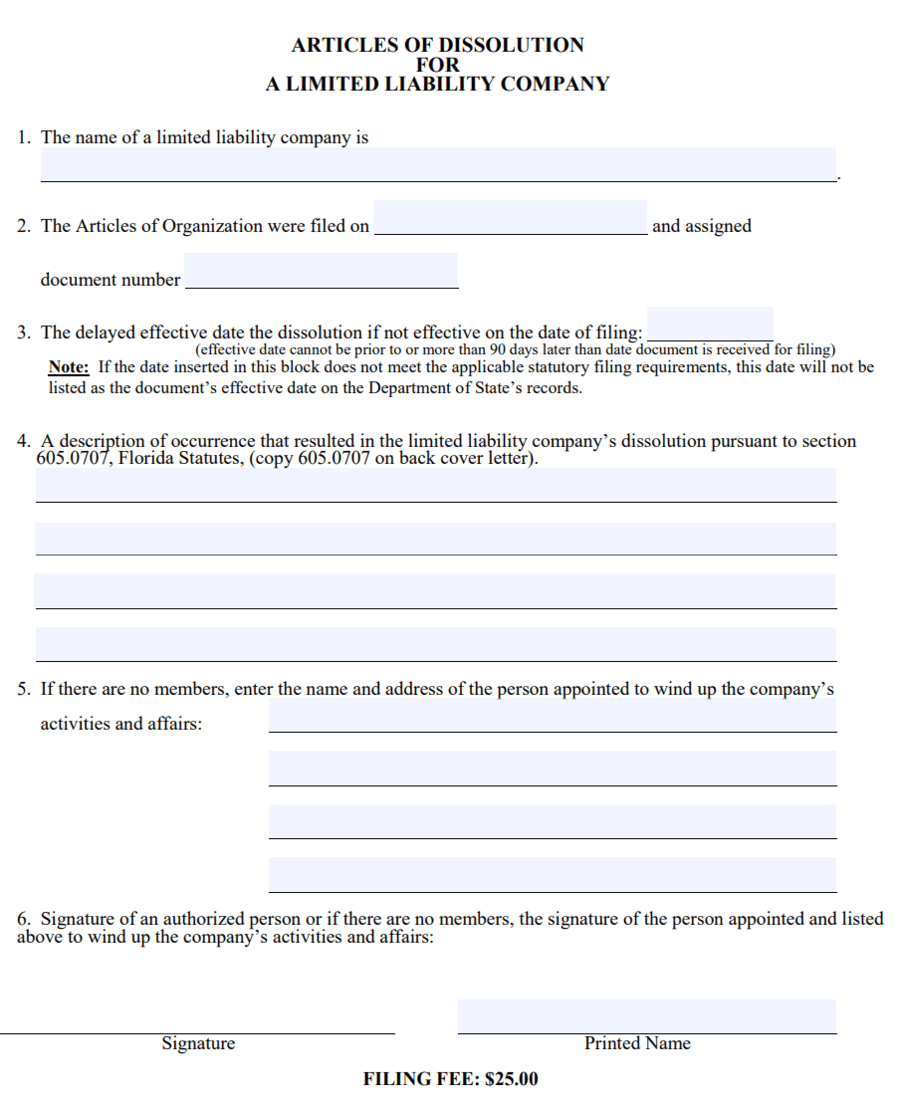

On the next page, fill out the Articles of Dissolution.

As a nice bonus, the documents include a Notice of Limited Liability Company Dissolution form that you can file for free with your Articles of Dissolution. This will serve as a general public notice to inform any creditors, as required by the state.

The notice is free if you file it with your Articles of Dissolution but $25 if filed on its own, so we recommend you file these two forms together.

Include a $25 check or money order payable to the Florida Department of State, and mail your documents to:

Division of Corporations

PO Box 6327

Tallahassee, FL 32314

Be aware that Florida does NOT accept physical deliveries— if you choose to fill out and print these documents, you must mail them to the Division of Corporations.

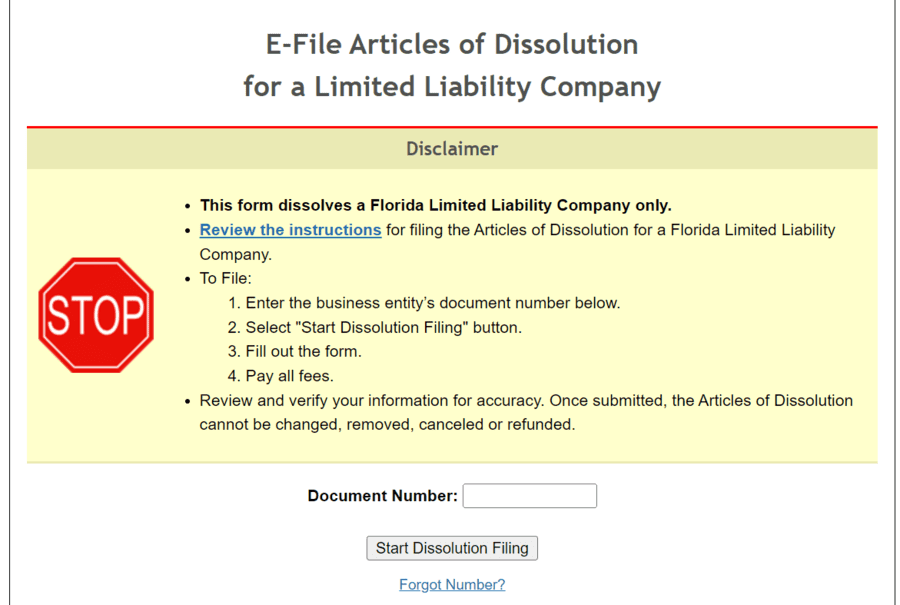

To file online, go to the Division of Corporations’ E-File page for Articles of Dissolution for an LLC.

Enter your business’s document number and click “Start Dissolution Filing.” If you don’t remember your document number, you can search for it here.

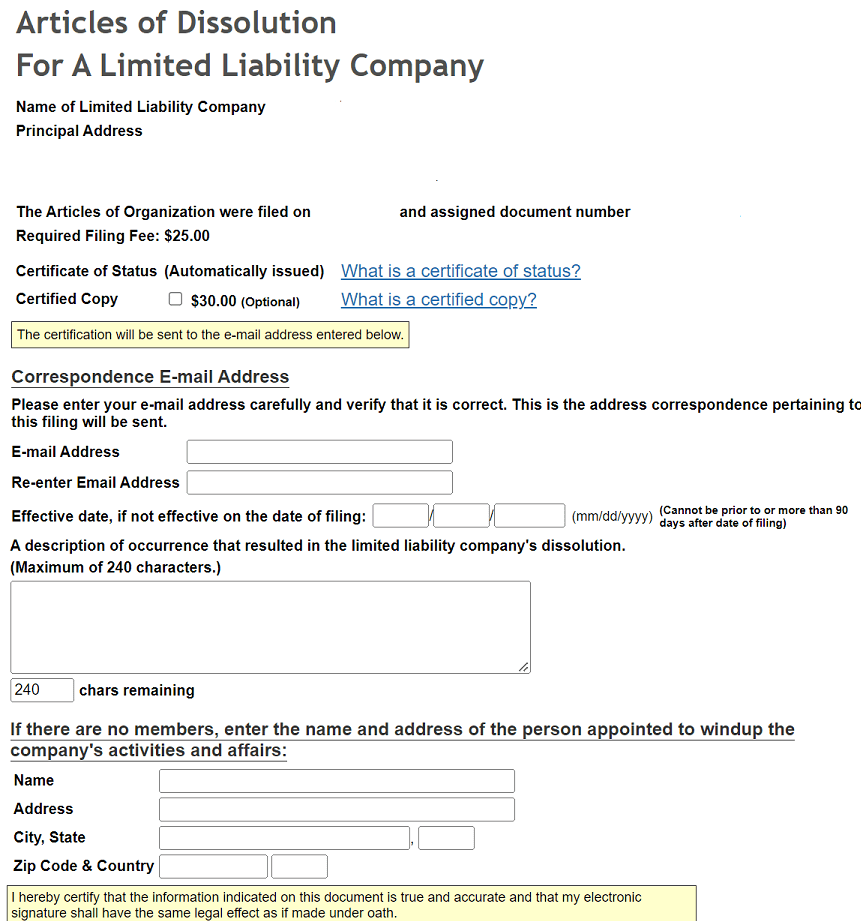

Fill out the form and sign it at the bottom. Click “Continue.”

Confirm your information is correct on the next page, and click “Continue” again.

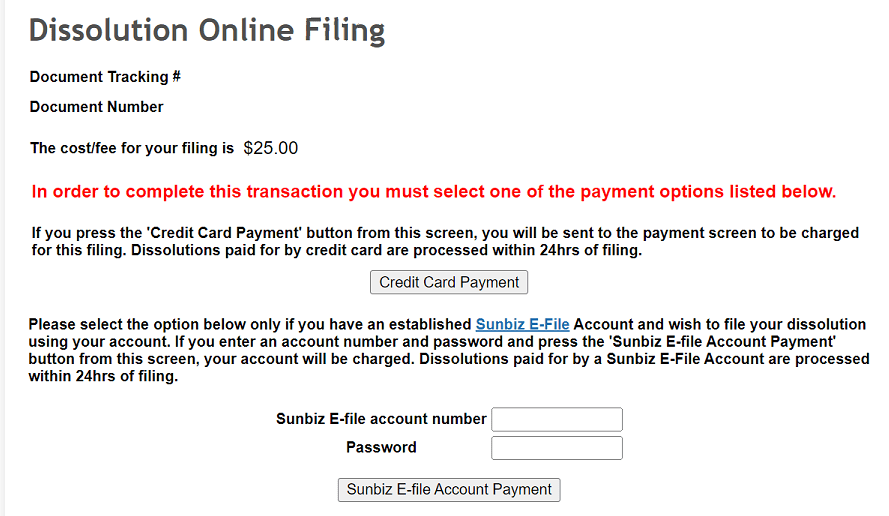

On this page, select pay by credit card or Sunbiz E-file account.

Finally, submit payment and complete your filing.

Regardless of the reason, LLC dissolution must be done right to avoid legal issues and financial penalties. Therefore, it’s highly recommended that you employ the services of an attorney to ensure everything is done correctly and all bases are covered.

It costs $25 to file the Articles of Dissolution in Florida.

If you file online, it will take about two to three days for your dissolution to take effect. However, a filing by mail takes up to three months to process.

If you’re not using your LLC, you should dissolve it to avoid unnecessary fees, filings, and liabilities, such as your annual report.

If you don’t dissolve your LLC, you’ll still be accountable for any fees, filings, and responsibilities in maintaining your LLC. Additionally, if you fail to file your annual report by September, your LLC will be administratively dissolved.

After you file your Articles of Dissolution in Florida, your LLC can operate on a limited capacity for the sake of winding up, liquidizing assets, and settling liabilities. Once you’re done settling your affairs, your LLC is officially terminated.

Published on May 21, 2023

If you have a limited liability company (LLC) in Nevada, you may need to shut down the business. On the other hand, maybe you’ve started anotherco ...

Read Now

Published on May 21, 2023

If you have a limited liability company (LLC) in Wyoming, you may need to shut down the business at some point. Maybe you’ve started anothercompan ...

Read Now

Published on May 21, 2023

If you have a limited liability company (LLC) in Wisconsin, you may need to shut down the business at some point. On the other hand, maybe you’ves ...

Read Now