If you have a limited liability company (LLC) in Indiana, you may need to shut down the business at some point. On the other hand, maybe you’ve started another company or decided to relocate to another state— whatever the reason, you’ll need to follow the somewhat complicated LLC dissolution process.

If done incorrectly, you’ll still be responsible for annual reports and fees and could face additional penalties. But, lucky for you, this handy guide explains how to dissolve an LLC in Indiana.

Properly shutting down an LLC involves several crucial steps, as detailed below.

1. Vote for Dissolution

LLC owners, known as members, must vote to dissolve the LLC. Hopefully, you have an operating agreement that details the process to do so. If not, Indiana law has different dissolution requirements based on when your LLC was formed:

- Before June 30, 1999: written consent of all members

- June 30, 1999, to June 30, 2013: written consent of two-thirds of ownership:

- If there’s only one class of members, obtain the written consent of two-thirds of LLC ownership

- If your operating agreement creates different member classes, two-thirds of the ownership shares of each member class must submit written consent.

- After June 30, 2013: unanimous consent of all members, unless your operating agreement states otherwise.

Once your LLC has decided to dissolve, you’ll need to draft a resolution to dissolve the LLC, which you’ll keep in your records.

2. Cancel Business Licenses and Permits

If you were required to get licenses and permits for your business, you’d need to contact the issuing agencies to cancel them so that you’re not charged renewal fees. If you have any outstanding fees, you’ll likely need to pay them before you are allowed to cancel.

3. Notify Creditors

If you owe money to any creditors, you’ll need to notify them in writing of the dissolution and give them detailed instructions on filing any claims for the outstanding debt.

In Indiana, you can either publish a notice in the newspaper or notify claimants individually. If you publish your notice in the newspaper, claimants will have two years to mail claims. If you notify claimants individually, you must include a dollar amount you believe will satisfy the claim and a deadline of at least 60 days for claimants to accept or dispute the settlement payment.

If a creditor or claimant cannot receive the funds owed to them by your business, you must deposit those funds with the Indiana Treasurer of State for safekeeping. The creditor or claimant will be able to receive the funds after providing proof of their claim.

4. Notify Tax Departments

Notify any relevant tax authorities of the dissolution and pay any outstanding taxes due. You should check with the IRS, the Indiana Department of Revenue, and the Department of Workforce Development to see if you have any outstanding taxes or liabilities.

You’ll also have to notify your local county assessor of your dissolution, which you can do through Indiana’s Department of Local Government Finance website.

5. Cancel Contracts and Settle Financial Obligations

If you have contracts with vendors, lessors, or any other outstanding financial obligations, ensure all your obligations are fulfilled and all contracts are canceled.

6. Distribute Assets to Members

If the LLC has any assets remaining in any form after all financial obligations have been settled, they must be distributed to members based on LLC ownership percentages. If the assets are equipment, property, or other non-cash assets, they’ll need to be sold first so distributions can be made in cash.

7. File the Dissolution Papers with Indiana

In Indiana, you must file your dissolution with the Secretary of State before closing your business. You can file your dissolution papers online or on paper.

Online Filing

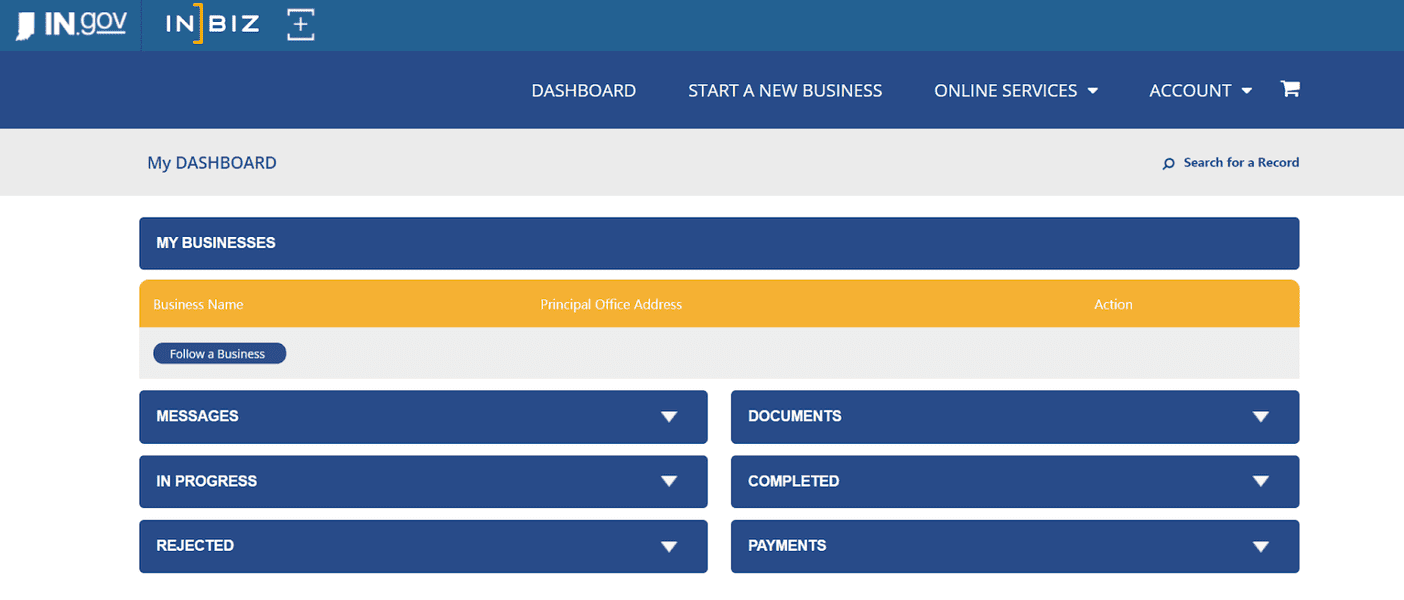

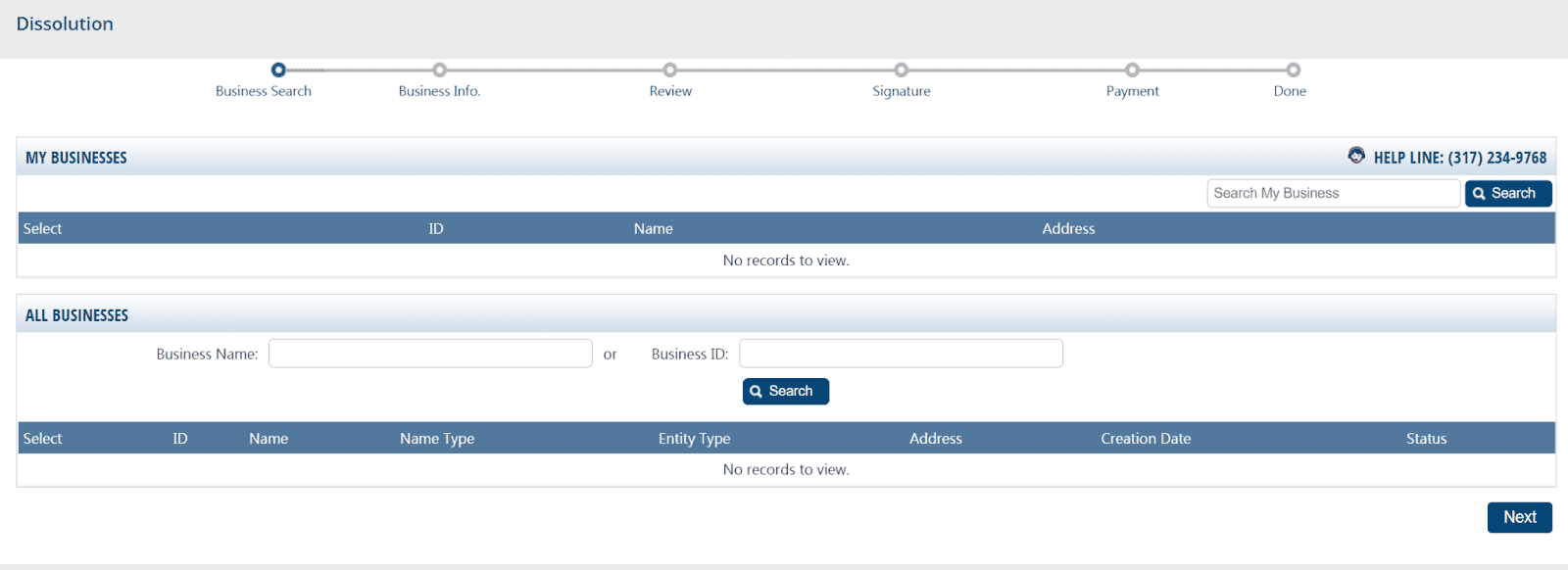

To file online, visit INBiz, and log in or create an account.

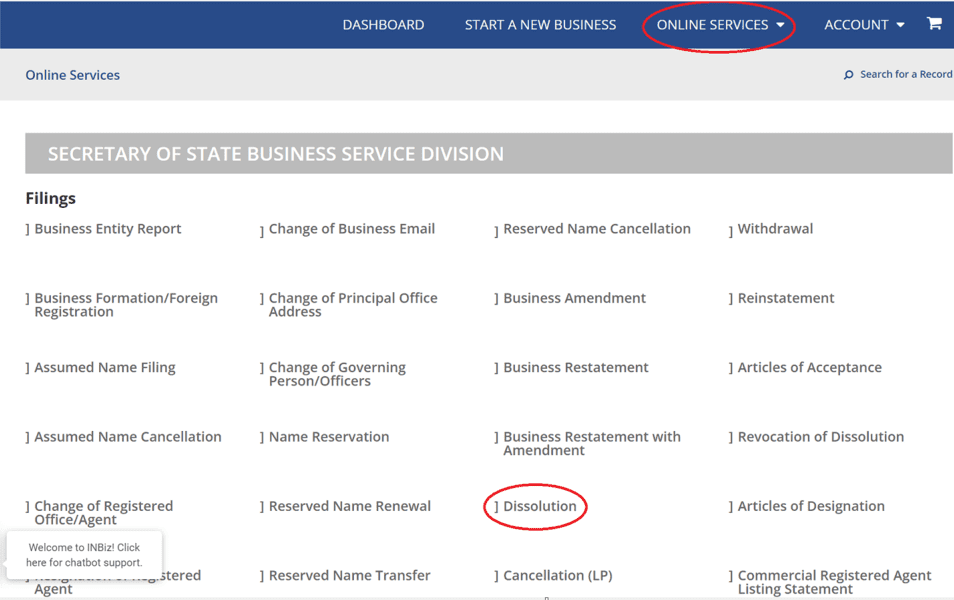

Click on the “Online Services” tab, and select “Dissolution” from the results.

Go through the following few pages to search for your LLC, fill out the required information, and sign your filing.

The fee is $20 for the filing. There’s also an additional processing fee for paying by credit card ($1) and e-check ($1.50).

Once you submit your payment, you’ve completed your dissolution filing.

Paper Filing

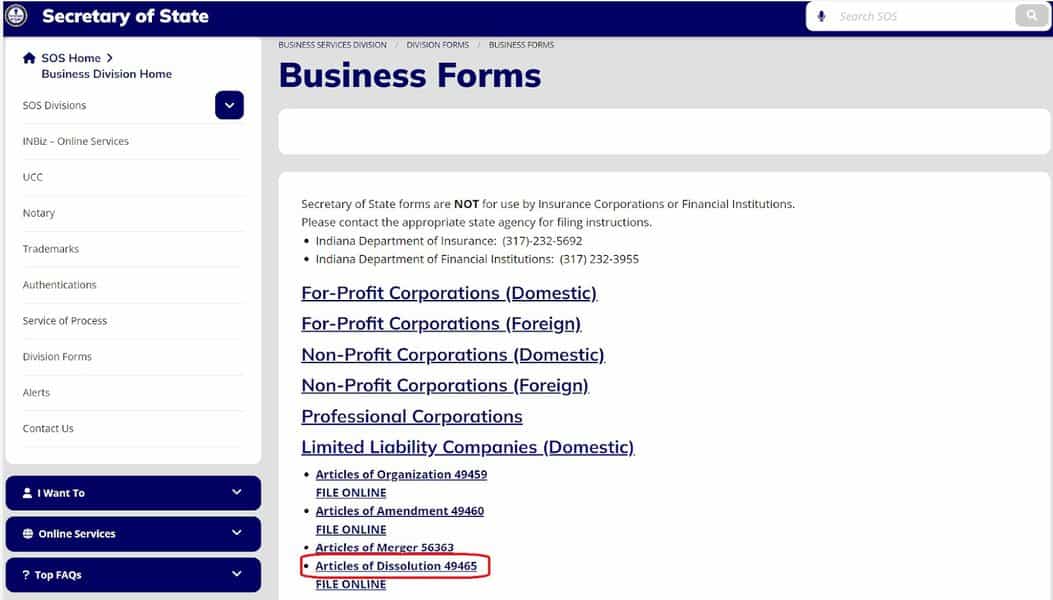

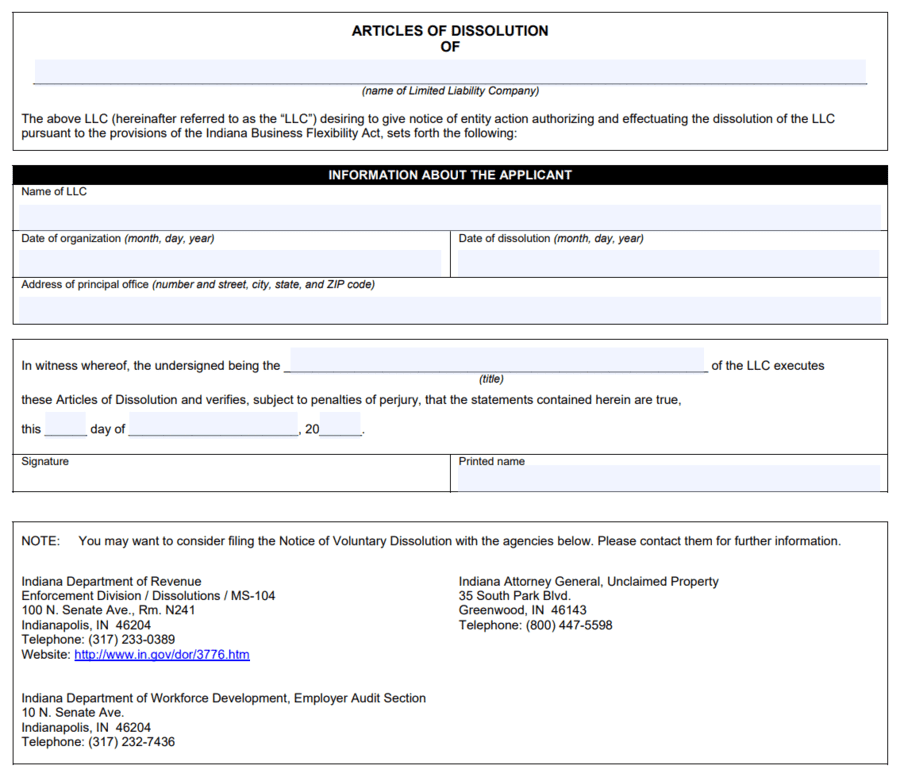

To file by paper, visit the Secretary of State’s page for Business Forms, scroll down to the domestic LLCs section and select “Articles of Dissolution 49465” to download the form.

Fill out and print your document, and either mail or deliver it to:

Business Services Division

302 West Washington Street, Room E-018

Indianapolis, IN 46204

The filing fee is $30, paid by check or money order to the Secretary of State.

Due to COVID-19 restrictions, the Business Services Division is not accepting walk-ins. However, if you’d like to deliver your documents by hand, you can make an appointment online here.

In Closing

Regardless of the reason, LLC dissolution must be done right to avoid legal issues and financial penalties. Therefore, it’s highly recommended that you employ the services of an attorney to ensure everything is done correctly and all bases are covered.

FAQs

How much does it cost to dissolve an LLC in Indiana?

It costs $20 to file your Articles of Dissolution online and $30 to file by paper.

How long does it take to dissolve an Indiana LLC?

Online filings through INBiz are processed in 15 to 20 minutes. Paper filings take 3-5 business days.

Should I close an unused LLC in Indiana?

If you’re not using your Indiana LLC, you should close it to avoid unnecessary fees, filings, and responsibilities.

What happens if I don't dissolve my LLC in Indiana?

If you don’t dissolve your LLC, you’ll still be responsible for any fees, filings, and liabilities your LLC may incur, such as filing your business entity report every two years.

What is the difference between the dissolution and termination of an LLC in Indiana?

Dissolution is the decision to close your LLC and declare so to the Indiana Secretary of State. Once you decide to dissolve, your business can only operate in a limited capacity for closing up, liquidizing assets, and settling claims. Once you’ve settled all your affairs, your LLC is officially terminated.