Indiana law requires your LLC to hire a registered agent, a person or company authorized to accept official correspondence on behalf of your business, such as legal or tax documents.

A registered agent ensures your business receives all key documents and notices and complies fully with state regulations.

Registered Agent Requirements in Indiana

In Indiana, an LLC owner, known as a member, can be the registered agent, or you can choose an individual that meets state requirements. In Indiana, registered agents must:

- Be 18 years or older

- Have a physical address in Indiana

- Be available during regular business hours

- Be registered to operate in Indiana (if the agent is a business)

- Not be your own LLC

Registered Agent Services

Many business owners hire a registered agent service to ensure all important documents are received and addressed promptly. A registered agent service also offers convenience.

If you choose to be your registered agent, you’ll have to be available at your registered agent’s address during regular business hours. However, a registered agent service will allow you the flexibility to run and grow your business wherever you need to be.

An agency also offers privacy. Since they will receive all official correspondence for your business, you would never be served with a summons for your business in front of customers or employees.

Choosing a Registered Agent Service

Some registered agent services operate nationally, allowing you to form LLCs in other states if your business expands. However, if you don’t choose a national agency, you’ll need one with an office in Indiana.

You’ll also want an agency that will:

- Send deadline reminders for things like annual reports to ensure your LLC stays in compliance

- Digitally store your documents so you can access them at any time

- Offer great customer service

Prices for registered agent services vary, which may affect your decision. Registered agent services generally run $50 to $300 annually.

How to Appoint a Registered Agent in Indiana

In Indiana, you’ll officially appoint your registered agent when you form your LLC by filling in the registered agent information on your articles of organization. Then, you can file by paper or online.

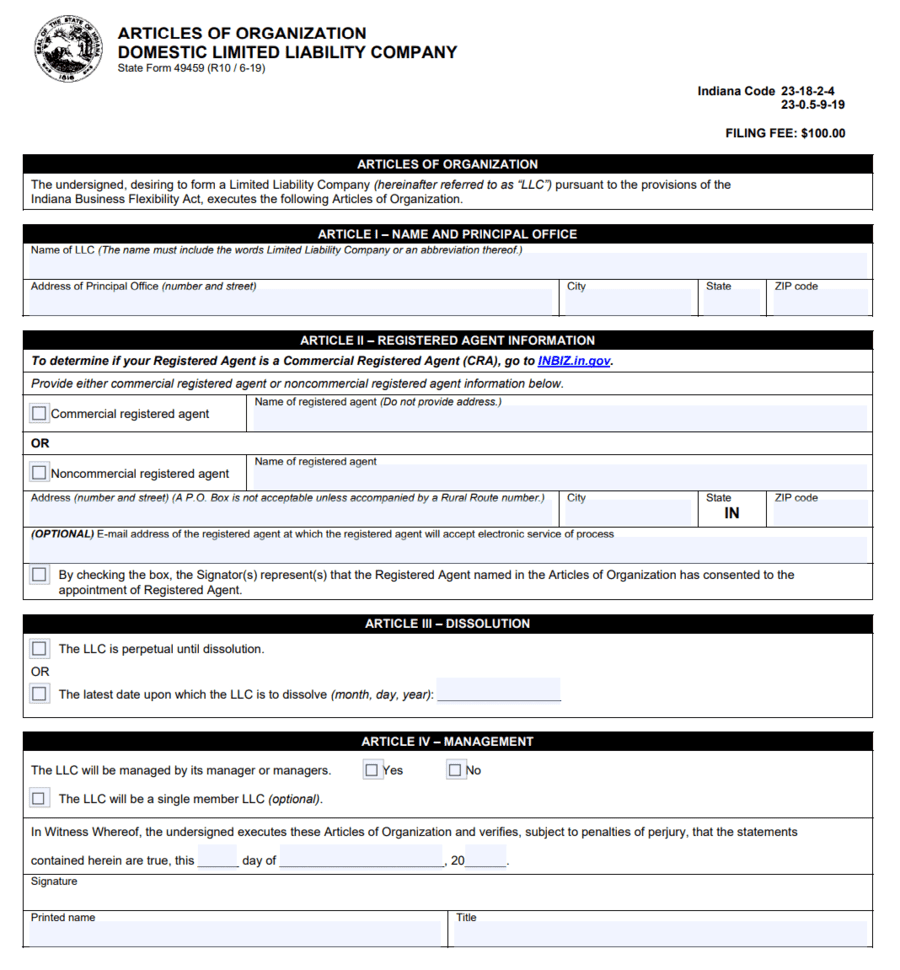

Paper Filing

To file by paper, download, fill out, and print your articles of organization form.

For Article II, write in your registered agent’s name and address. You can also add their email address if they’d like to receive electronic service of process.

If you’d like to be the registered agent for your LLC, fill this section in with your information.

The filing fee is $100, which you can pay by check or money order to the Secretary of State.

Mail your document and payment to:

Secretary of State

Business Services Division

302 West Washington Street, Room E018

Indianapolis, IN 46204

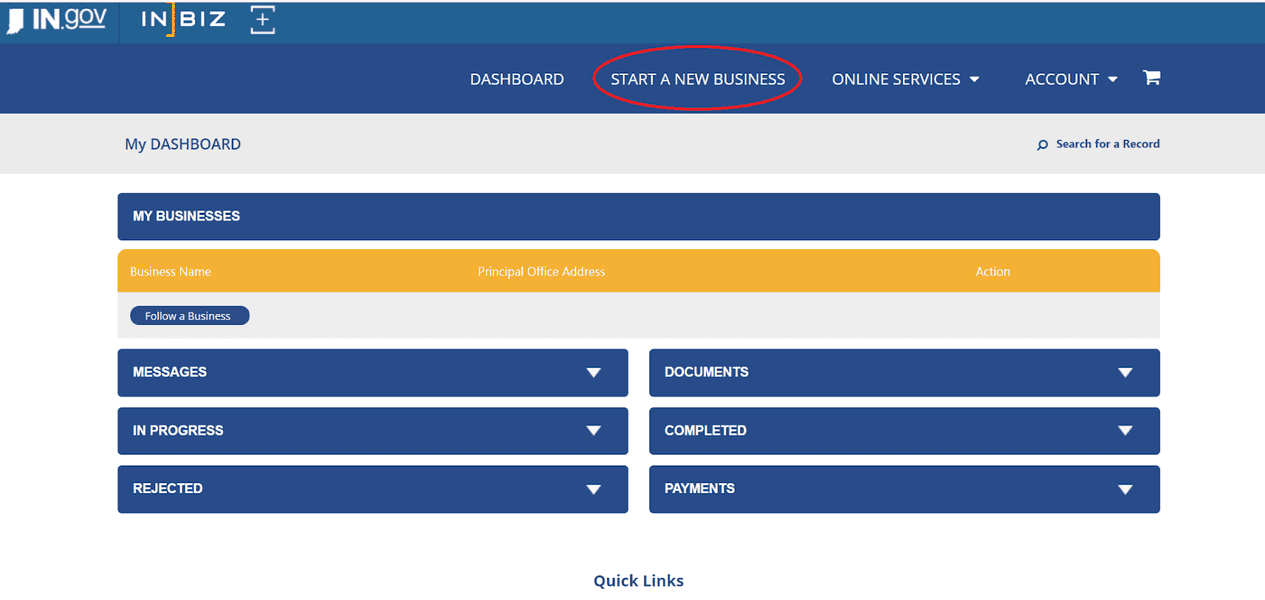

Online Filing

First, visit Indiana’s online business portal to file your articles of organization. Then, log in or create an account and navigate the page to start a new business from the top menu.

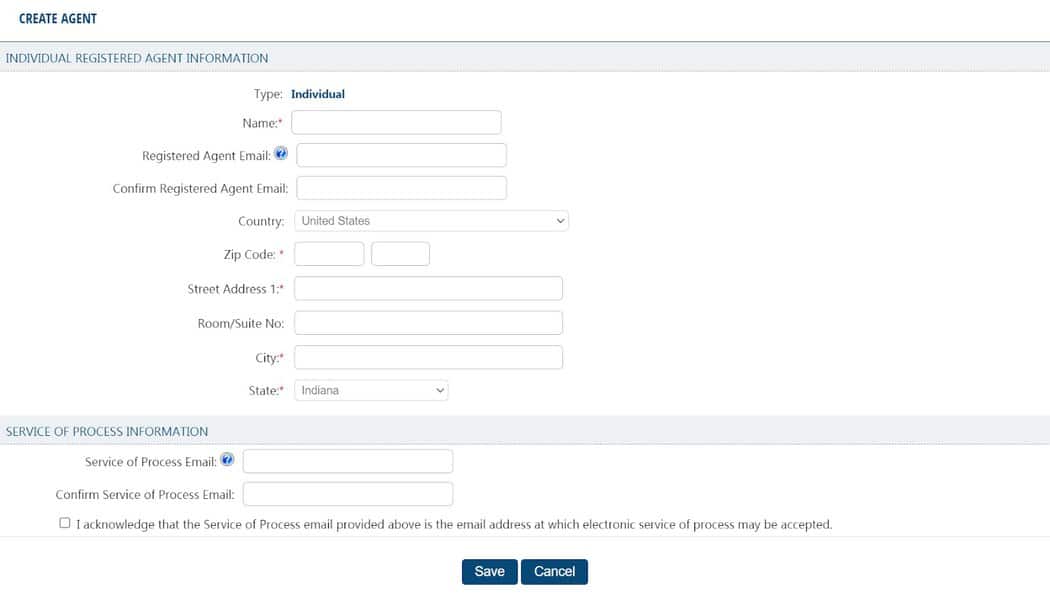

In the Registered Agent Info section, search for a registered corporate agent by their business name or click “Create Agent” for an individual.

Fill in your registered agent’s name and address and, optionally, their email addresses. The Registered Agent Email will be used for notifications from the Secretary of State. In contrast, the Service of Process Email will be publicly available for people who wish to file service of process.

If you’d like to be the registered agent for your LLC, fill in this section with your information.

Complete the form and pay the filing fee. Filing online costs $95, with an additional card processing fee of $2.25% and an e-check processing fee of 1.25%.

Once your LLC is approved in Indiana, your registered agent is officially appointed. You do not need to do anything further in terms of registering your agent.

In Closing

Indiana requires your LLC to have a registered agent. Some LLCs appoint a member as their registered agent, but hiring a professional service offers many advantages.

You’ll likely need to decide on whichever route you choose before you form your LLC. You can change your registered agent later if you do so, though it requires additional paperwork.

Indiana Registered Agent FAQs

Can I be my registered agent in Indiana?

Yes. When filling out your Articles of Organization, simply put your name and address in the space for a registered agent.

What does a registered agent do for an LLC in Indiana?

A registered agent receives all government notices and documents for your LLC and must be at the designated address during business hours. You can be your registered agent, but designating someone else helps you maintain privacy and gives you greater freedom of movement.