If you own a rental property, you can transfer it to a limited liability company (LLC). You may already have an LLC or need to start one, but either ...

How to Choose a Tax Classification for Your LLC

Written by: Carolyn Young

Carolyn Young has over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Sarah Ruddle

For over 15 years, Sarah Ruddle has been a noteworthy leader in the business and nonprofit world.

Updated on July 18, 2024

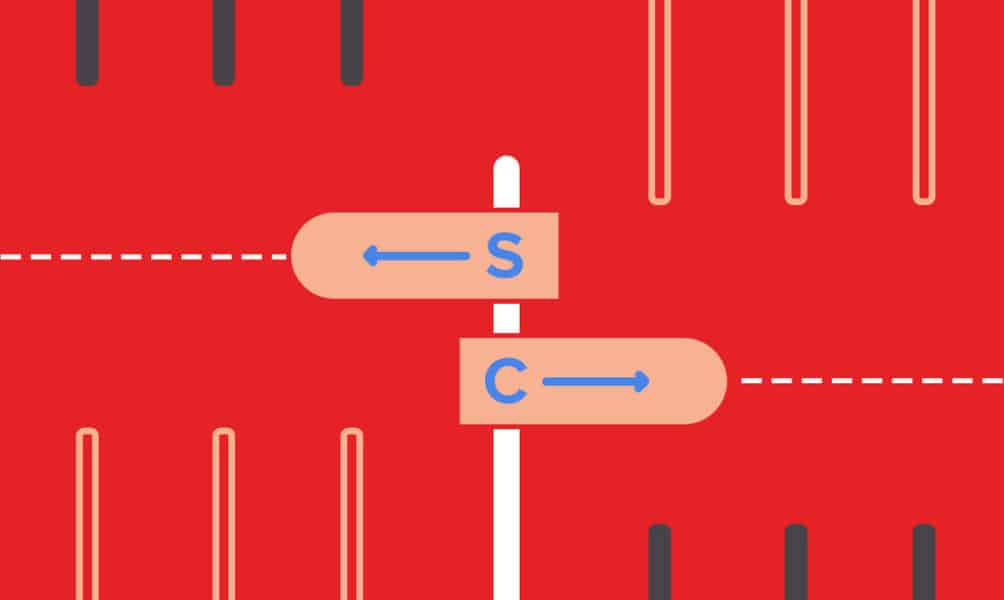

How to Choose a Tax Classification for Your LLC

- Default Tax Classification for LLCs

- S-Corp Status

- C-Corp Status

Limited liability companies (LLCs) offer many tax benefits, including personal liability protection and management flexibility. They also provide flexibility in terms of taxes. LLCs are unique because you can choose how you want your LLC to be taxed.

Read on to learn all about your various tax options so that you can choose the best one for you.

Default Tax Classification for LLCs

By default, LLCs are pass-through entities, which means income passes through to the member or members. If the LLC has only one member, it’s taxed as a sole proprietorship. If the LLC has more than one member, it’s taxed as a partnership.

Yet as mentioned above, LLCs are unique in that they can elect to be taxed as a corporation if the members decide it makes financial sense. This is done by filing an election form with the IRS. You can choose to be taxed as a C-Corp or an S-Corp.

C-Corp status means income is taxed at the current rate for corporations (21% as of late 2022), which is lower than the usual individual taxpayer rate. But keep in mind that C-Corp shareholders – who are members in the case of an LLC – must also pay taxes on their distributions. This is called double taxation.

However, members are subject to self-employment tax in an LLC that is taxed by default as a sole proprietorship or partnership. Once such LLC switches to being taxed as a corporation, self-employment taxes no longer apply.

Similarly, self-employment taxes do not apply to members with S-Corp status, which is the main advantage of electing S-Corp status. S-Corp status also means that your LLC will still be a pass-through entity and not subject to corporate taxes.

S-Corp Status

The IRS allows S-Corp status if your business meets certain conditions. For your LLC to become an S-corporation, it must:

- Be a domestic corporation

- Have only allowable shareholders

- Can be individuals, certain trusts, and estates

- Can not be partnerships, corporations, or non-resident alien shareholders

- Have no more than 100 shareholders

- Have only one class of stock

- Not be an ineligible corporation (i.e., certain financial institutions, insurance companies, and domestic and international sales corporations).

With S-Corp status, members are generally paid as company employees, which means more accounting and payroll expenses. Therefore, S-Corp status is only beneficial when the self-employment tax savings are more significant than those additional expenses.

Your tax advisor can help you to calculate the revenue level at which S-Corp status makes financial sense for your business. Then, to elect S Corp status, you must file form 2553 with the IRS.

C-Corp Status

Determining whether C-Corp status is financially beneficial for your LLC requires the same kind of calculations as an S-Corp, except you’ll have further considerations.

You’ll want to determine all the taxes you’d pay as a C-Corp compared to your LLC’s default taxation, including self-employment taxes. Also, consider the added expenses of running a C-Corp and paying employees.

The taxes you’ll pay will include corporate taxes, income taxes from your salary, payroll taxes, and taxes on dividends. You will not, however, pay self-employment taxes.

In most cases, C-Corp status is unlikely to save you money. Instead, the main reason that LLC owners choose C-Corp status is to make their business more attractive to investors since transferring ownership of C-Corp shares is easier than transferring a percentage of LLC membership.

Another advantage of electing C-Corp status and being classified as an employee means that you can give yourself tax-free benefits such as health insurance. To select C-Corp status, you’ll file form 8832 with the IRS.

Featured Resources

How to Transfer Rental Property to an LLC

Published on June 6, 2023

Read Now

How to Protect Your Assets as an LLC Owner

Published on June 6, 2023

Many entrepreneurs form a limited liability company (LLC) for their new business because of its many benefits, such as liability protection. An LLCi ...

Read Now

What is an L3C (Low-Profit Limited Liability Company)?

Published on June 6, 2023

A low-profit limited liability company, known as an L3C, is essentially a combination of a limited liability company (LLC) and a non-profit. Thegoal ...

Read Now