As the owner of an LLC, one major responsibility you have is filing an annual report. Annual reports are necessary for most states to keep your business up to date and in compliance. However, filing them each year also commonly includes a fee, which must be paid along with your submission.

Whether you’re tackling your very first annual report or just need to brush up on the basics, this guide contains all you need to know about annual reports and how to file.

What Is an Annual Report?

Annual reports provide basic information about your LLC, including the names and addresses of members, managers, and your registered agent. They also offer a comprehensive report of all business activities throughout the year and capture financial performance.

States require annual reports to be publicly available and updated with the latest information. Some states also use annual reports to determine the amount of taxes owed.

As the owner of an LLC, you’re responsible for keeping your business up to date and fully compliant with federal, state, and local regulations, including taxes and annual reports. Failure to comply could result in massive fines or even the revocation of your company’s registration.

How to File Annual Report For Your LLC

1. Learn if Your State Requires Filing an Annual Report

- Research State Requirements: Start by checking the Secretary of State’s website for the state where your business is registered. Each state has different requirements and deadlines.

- Identify the Type of Business: Determine whether your LLC is required to file an annual report. Some states have different rules.

- Review Deadlines: Note the specific filing deadlines. These can vary widely – some states require annual reports on the anniversary of your business’s formation, while others have a set date for all businesses.

- Understand Penalties: Familiarize yourself with the penalties for late filing or failure to file, which can include fines and loss of good standing.

2. Complete the Annual Report Form

- Gather Required Information: Common information needed includes:

- Business name and address

- Names and addresses of directors, officers, or members

- Registered agent’s information

- Business identification number (if applicable)

- Use Accurate Information: Ensure all details are current and accurate to avoid issues with processing your report.

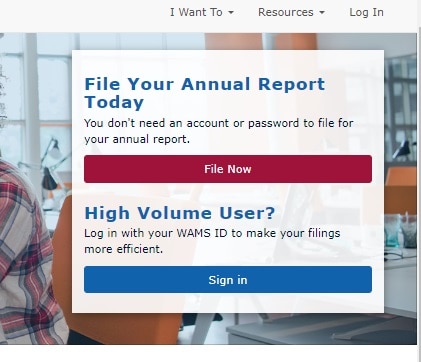

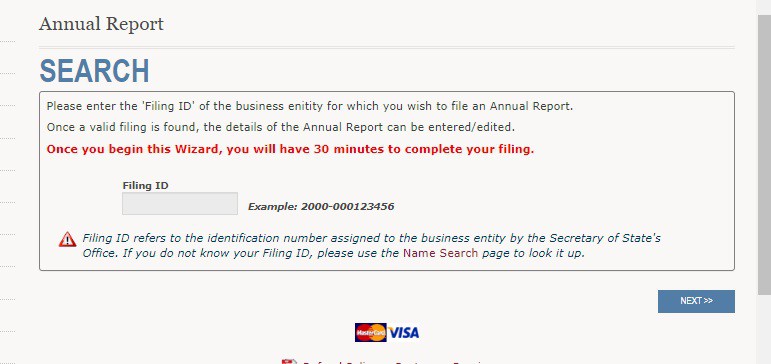

- Access the Form: Download the form from the state’s official website or complete it online if that option is available. Many states offer an online filing system that simplifies the process.

3. File Your Report and Pay the Required Fees

- Choose the Filing Method: Depending on the state, you may file online, by mail, or in person. Online filing is typically the quickest and most convenient.

- Calculate Fees: Be aware of the filing fees, which can vary by state and business type. Some states also charge additional fees for late filing.

- Submit Payment: Pay the required fees using the state’s accepted payment methods (credit card, check, etc.).

- Receive Confirmation: Keep a copy of the confirmation receipt or email for your records. This serves as proof that you filed on time.

4. File an Annual Report in Other States if Applicable

- Determine Nexus: If your business operates in multiple states, you might need to file an annual report in each state where you have a physical presence, employees, or significant business activities.

- Check Each State’s Requirements: Each state has its own filing requirements, forms, and deadlines, so treat each state’s filing as a separate task.

- Maintain Organization: Keep a calendar or spreadsheet to track filing deadlines and requirements for each state to ensure you stay compliant.

5. Prepare for Your Next Annual Report Deadline

- Set Reminders: Mark your calendar or set digital reminders for next year’s filing deadline to avoid missing it.

- Review Changes: Throughout the year, keep track of any changes in your business that might need to be reported, such as changes in directors or officers, address changes, or significant business activities.

- Organize Documents: Maintain a dedicated file (physical or digital) for all annual report-related documents to streamline the process next year.

- Stay Informed: Regularly check the Secretary of State’s website for any changes in filing requirements or fees.

Annual Report Best Practices

- Stay Organized: Keep thorough records and document any changes in your business structure or operations throughout the year.

- Timely Filing: File your annual report as soon as possible to avoid last-minute issues or penalties.

- Accurate Information: Double-check all information before submitting to ensure accuracy and completeness.

- Professional Assistance: Consider hiring a professional service or legal advisor to assist with filing, especially if you operate in multiple states.

- Compliance Management Tools: Use compliance management software or tools to track deadlines and requirements, ensuring you never miss a filing.

Pick your state from the table below to see the requirements for filing an annual report. Arizona, Ohio, Missouri, and New Mexico don’t require an LLC to file an annual report.

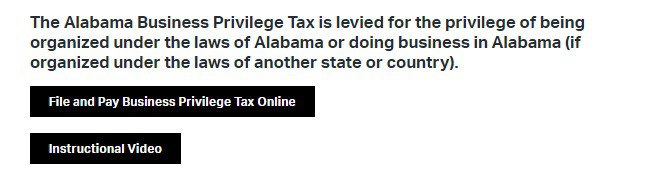

How to File an LLC Annual Report in Alabama

To file your annual report in Alabama, visit the Department of Revenue and select “file and pay business privilege tax online.”

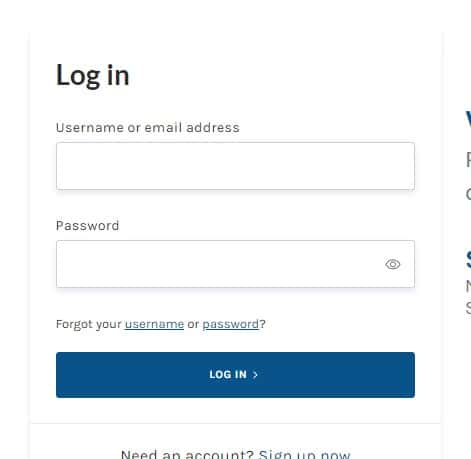

You’ll need to log in to your account to file.

Then you’ll fill out the business privilege tax and annual report form. The form includes a calculation of the business privilege taxes your company owes.

The fee for filing your annual report is $10, in addition to your business privilege tax.

Reports and returns are due on the 15th day of the 3rd month after the start of the taxable year. There is a $50 fee for filing late, plus accrued interest.

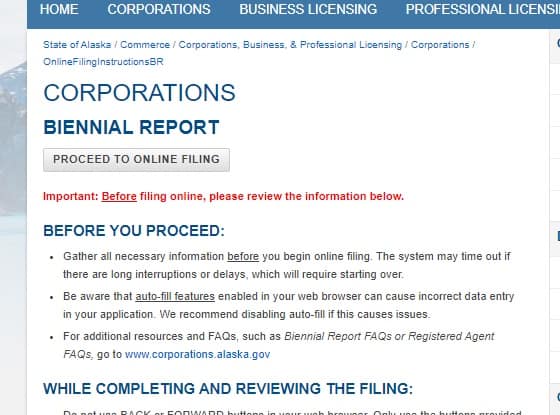

How to File an LLC Biennial Report in Alaska

To file your biennial report in Alaska, you must visit the Division of Corporations, Business, and Professional Licensing website.

Select “Proceed to online filing.”

Fill out all the required information.

The fee for filing your biennial report is $100, and reports are due every two years on January 2nd. In addition, there is a late fee of $37.50.

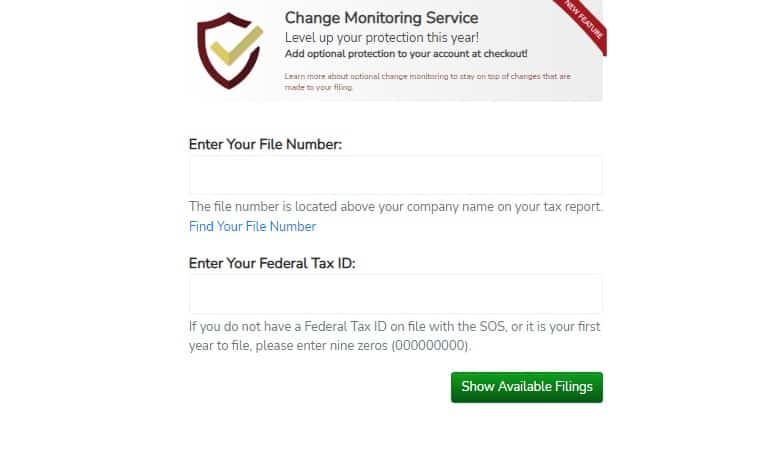

How to File an LLC Annual Franchise Tax Report in Arkansas

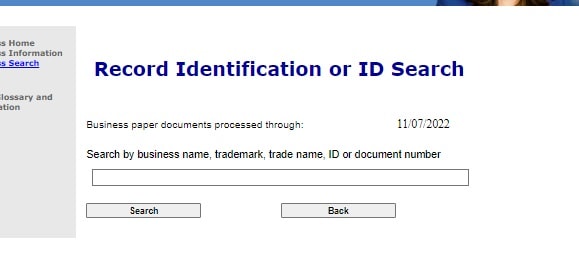

To file your annual franchise tax report in Arkansas, visit the Secretary of State’s website and enter your file number and EIN.

Fill in the required information.

The annual franchise tax is $150, and reports are due May 1.

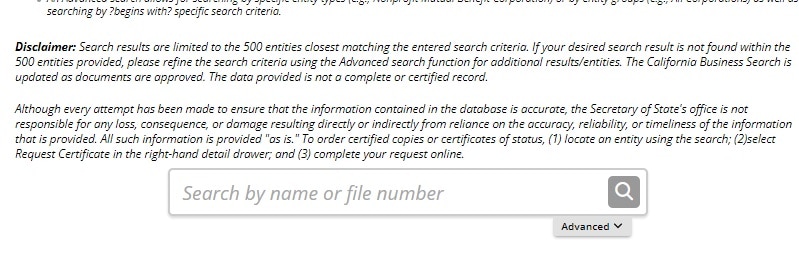

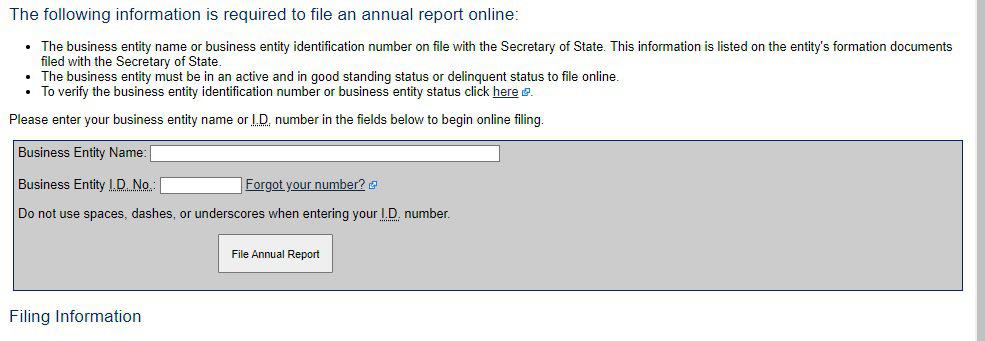

To file your statement of information in California, visit the Secretary of State’s website and enter your business entity number.

The fee for filing your statement of information is $20, and a $5 disclosure fee. Reports are due every two years within 90 days of the anniversary of your LLC formation.

How to File an LLC Periodic Report in Colorado

To file your periodic report in Colorado, visit the Secretary of State’s website and enter your business I.D. number.

Then select “periodic report” and fill out all the required information.

The filing fee is $10, and reports are due yearly on your LLC’s formation anniversary.

How to File an LLC Annual Report in Connecticut

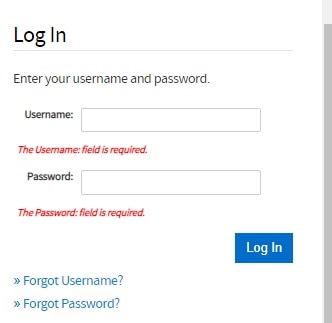

To file your annual report in Connecticut, visit the business division website and log in to your account.

Then you’ll select “file annual report” and fill in all the information.

The filing fee is $80, and reports are due March 31st.

How to File and Pay LLC Annual Tax in Delaware

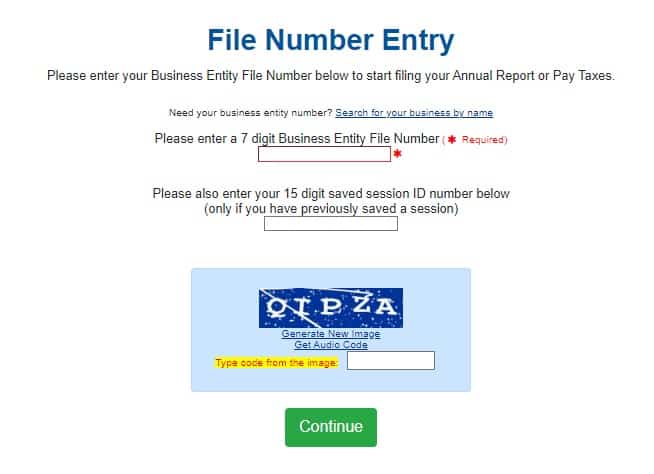

To file and pay your annual tax in Delaware, visit the Division of Corporations website and enter your business entity number.

Select “pay tax” and enter the required information, including your billing information.

The tax is $300, and reports are due March 1. The penalty for late filing is $200.

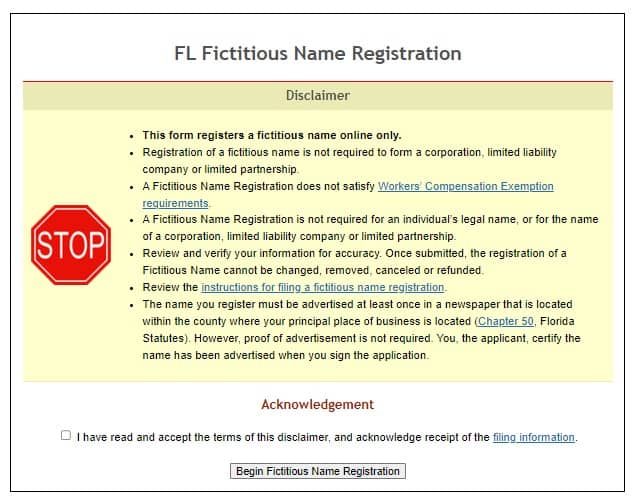

How to File an LLC Annual Report in Florida

To file your annual report in Florida, visit the Division of Corporation’s website and enter your business document number.

Fill out the required information.

The fee for filing your annual report is $138.75, and reports are due by May 1. If you file after May 1, the late fee is $400.

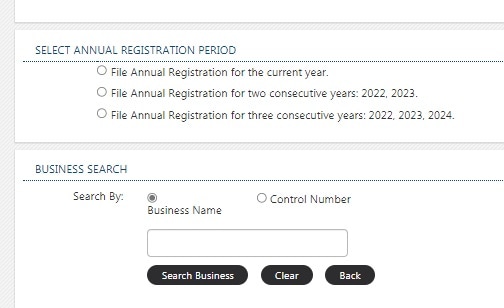

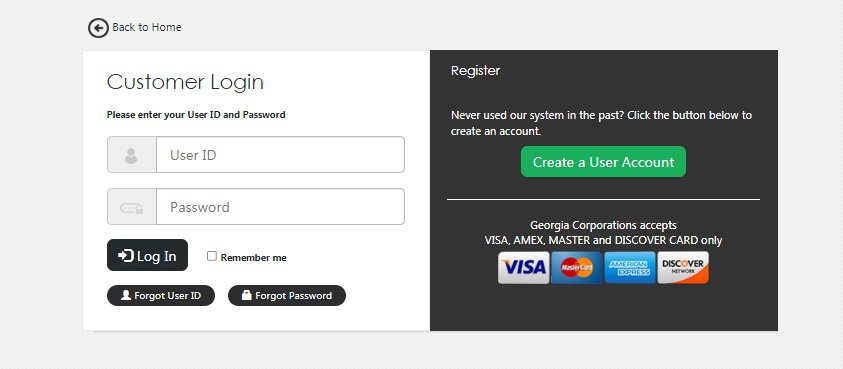

How to File LLC Annual Registration in Georgia

To file your annual registration with no changes in Georgia, visit the Corporation’s Division website, select the year for which you’re filing, and enter your business name or control number.

Follow the prompts to complete the registration.

You’ll need to sign in on the Corporation Division’s website to complete the registration if you’re making changes to your business information.

The fee for filing your annual registration is $50, and registrations are due April 1. If you file after April 1, there is a $25 late fee.

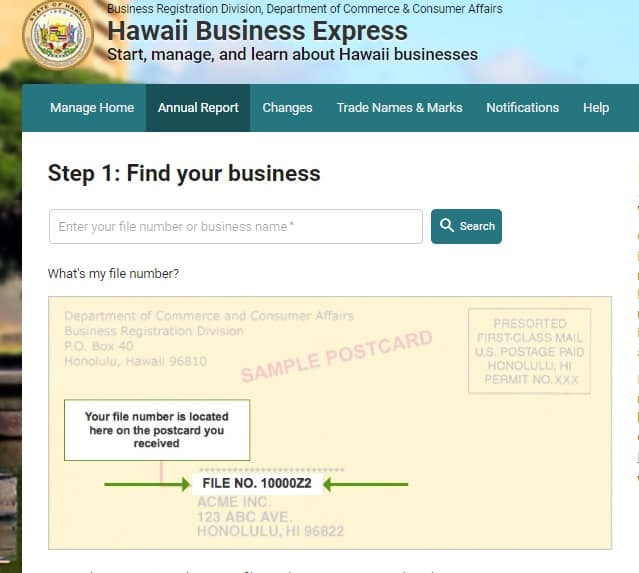

How to File an LLC Annual Report in Hawaii

To file your annual report in Hawaii, visit the Business Express website and enter your file number or business name.

Then simply fill in the required information and submit your report.

The fee for filing your annual report is $15, and reports are due depending on the registration date of the business as follows. If the registration is between:

- Jan. 1 and March 31, the annual report is due March 31 of each year

- April 1 and June 30, the annual report is due June 30 of each year

- July 1 and Sept. 30, the annual report is due Sept. 30 of each year

- Oct. 1 and Dec. 31, the annual report is due Dec. 31 of each year

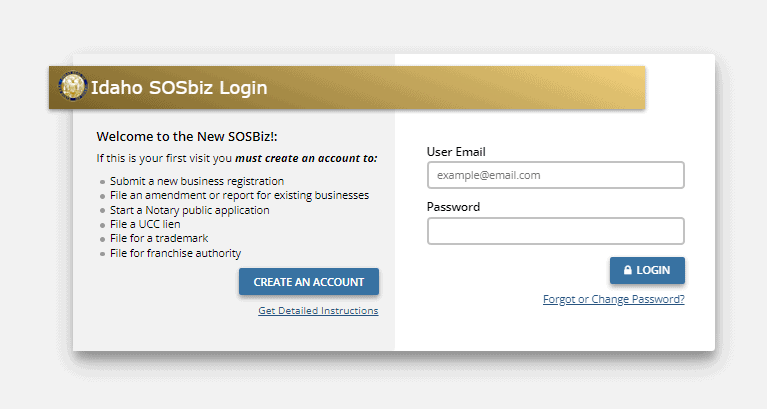

How to File an LLC Annual Report in Idaho

To file your annual report in Idaho, visit the Secretary of State’s website and log in to your account.

Then select “annual report” and fill in the required information.

Filing the report is free, and reports are due by the end of the anniversary month of LLC formation.

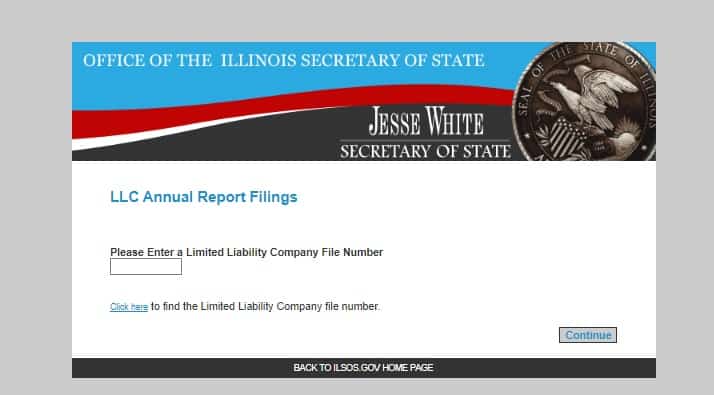

How to File an LLC Annual Report in Illinois

To file your annual report in Illinois, visit the Secretary of State’s website and enter your file number.

Then simply fill in the required information and submit your report.

The fee for filing your annual report is $75, and reports are due by the end of the month before your LLC’s formation anniversary.

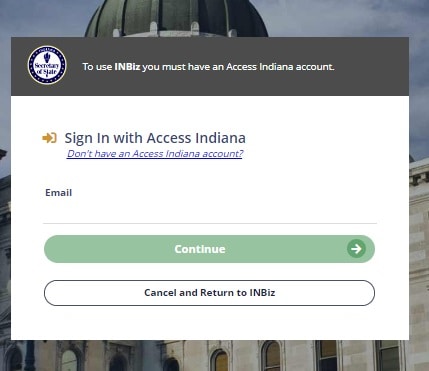

How to File an LLC Business Entity Report in Indiana

To file your business entity report in Indiana, visit the Access Indiana website and log in to your account.

Simply select “business entity report” and fill in the required information.

The fee for filing your business entity report is $50, and reports are due every other year by the end of the anniversary month of your LLC’s formation.

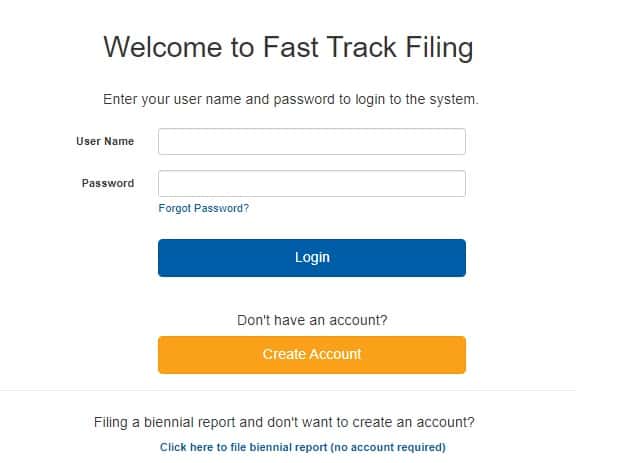

How to File an LLC Biennial Report in Iowa

To file your biennial report in Iowa, visit the Fast Track Filing System website and log in to your account.

Select “file biennial report,” enter your business ID number, and fill out the required information.

The filing fee is $30, and reports are due April 1 every other year.

How to File an LLC Annual Report in Kansas

To file your annual report in Kansas, visit the Secretary of State’s website and enter your business name and entity number.

Then simply fill in the required information.

The filing fee is $55, and reports are due April 15.

How to File an LLC Annual Report in Kentucky

To file your annual report in Kentucky, visit the Secretary of State’s website and enter your entity name.

The fee for filing your annual report is $15, and reports are due June 30.

How to File an LLC Annual Report in Louisiana

To file your annual report in Louisiana, visit the geauxBIZ website and log in to your account.

Select “File an amendment or annual report,” then enter your Louisiana charter number. Next, select “File annual report” and fill in the required information.

The fee for filing your annual report is $30 plus a $5 credit card fee, and reports are due on the anniversary date of your LLC’s formation.

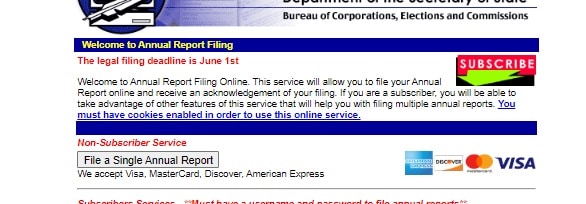

How to File an LLC Annual Report in Maine

To file your annual report in Maine, visit the Secretary of State’s website and select “File a single annual report.”

Fill in the required information and submit your report.

The fee for filing your annual report is $85, and reports are due June 1st. Reports filed after June 1st will be subject to a $50 late fee.

How to File an LLC Annual Report in Maryland

To file your annual report in Maryland, visit the Business Express website and log in to your account.

Select “File annual report” and fill in the required information.

The fee for filing your annual report is $300, and reports are due April 15. Fees for filing late depend on the number of days past due, with a minimum of $30 and a maximum of $500.

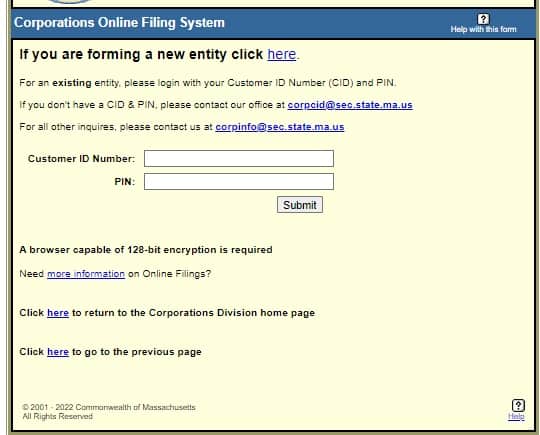

How to File an LLC Annual Report in Massachusetts

To file your annual report in Massachusetts, visit the Secretary of the Commonwealth’s website and log in to your account.

You’ll select “file annual report” and fill in all the required information.

The fee for filing your annual report is $500, and reports are due on the anniversary date of your LLC’s formation.

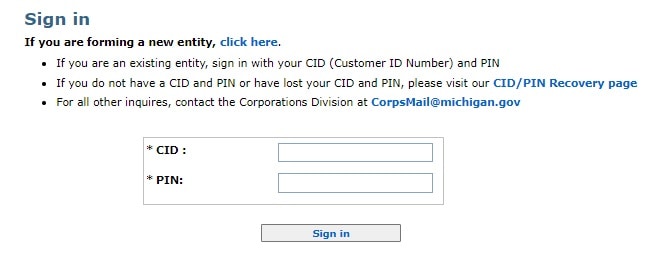

How to File an LLC Annual Statement in Michigan

To file your annual statement in Michigan, visit the corporation’s online filing system website through the Department of Licensing and Regulatory Affairs and log in to your account.

Select “file annual statement” and fill in all the required information.

The fee for filing your annual statement is $25, and reports are due February 15.

How to File an LLC Annual Renewal in Minnesota

To file your annual renewal in Minnesota, visit the Secretary of State’s website and enter your business name or entity number.

Select “annual renewal” and fill in all the required information.

Filing is free, and reports are due December 31.

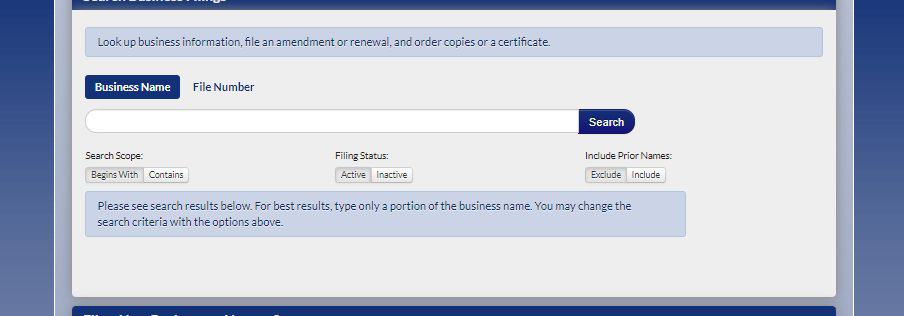

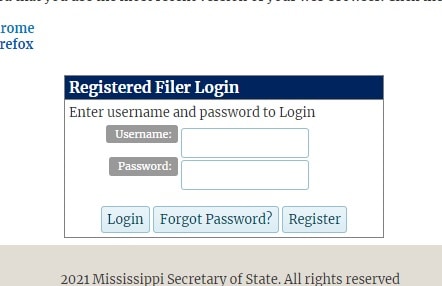

How to File an LLC Annual Report in Mississippi

To file your annual report in Mississippi, visit the Secretary of State’s website and log in to your account.

Then select “file annual report” and fill in the required information.

Filing is free, and reports are due April 15.

How to File an LLC Annual Report in Montana

To file your annual report in Montana, visit the Secretary of State’s business services website and select “file annual report.”

Enter your business name or filing number, then fill in the required information.

The filing fee is $20, and reports are due April 15. The fee for filing late is $15.

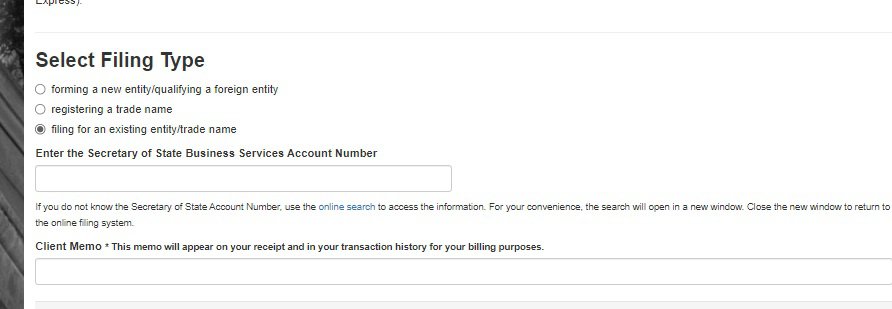

How to File an LLC Biennial Report in Nebraska

To file your biennial report in Nebraska, visit the Secretary of State’s website, select “filing for an existing entity,” and enter your business services account number.

Then you’ll select “file online” and fill in the required information.

The fee for filing your biennial report is $10. Reports are due by April 1 or every odd-numbered year.

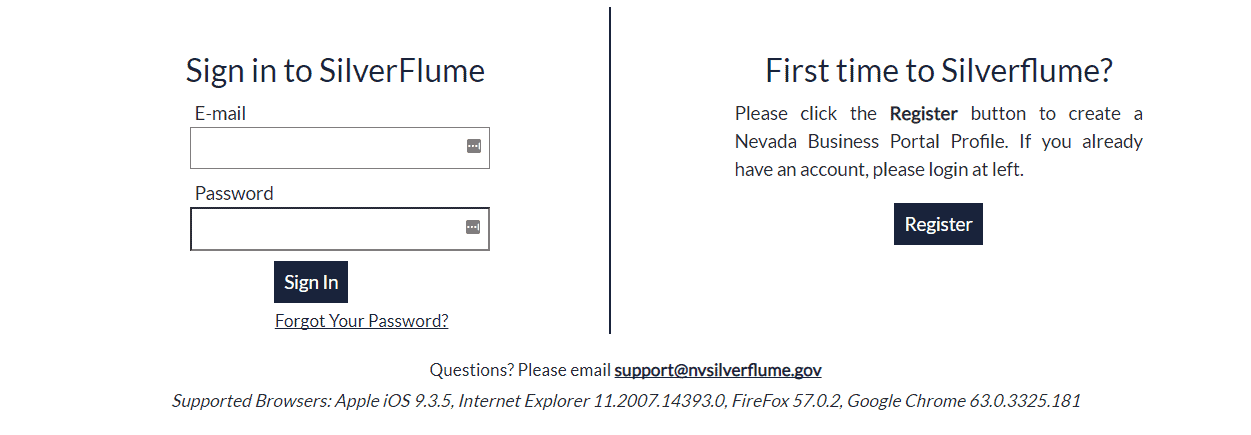

How to File an LLC Annual List in Nevada

To file your annual list in Nevada, visit the business portal website and log in to your account.

Then select “file annual list” and fill in all the required information.

The fee for filing your annual list is $150, and reports are due by the end of the anniversary month of your LLC’s formation. The fee for late filing is $75.

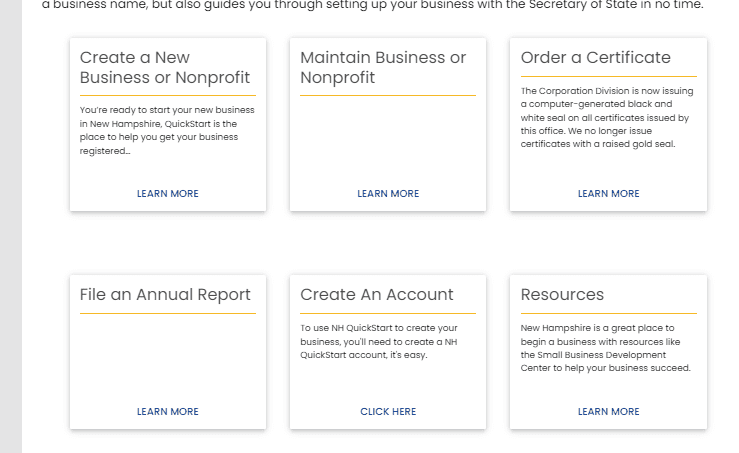

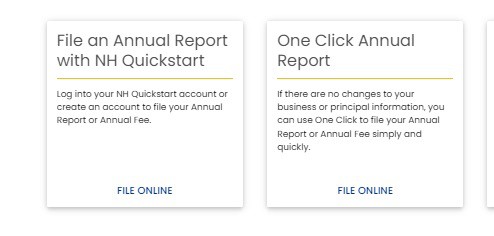

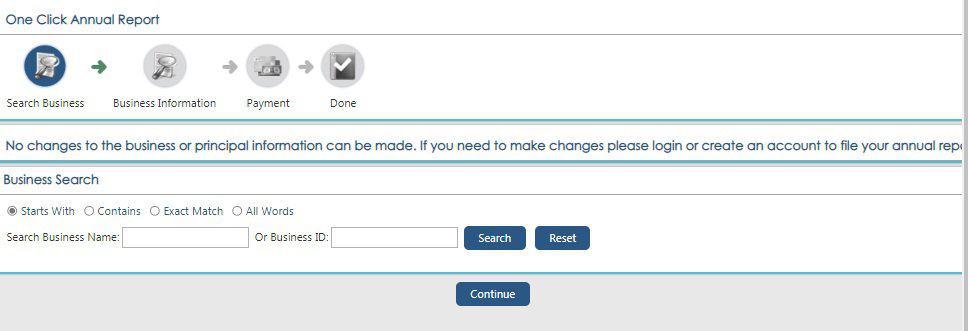

How to File an LLC Annual Report in New Hampshire

To file your annual report in New Hampshire, visit the Secretary of State’s website and select “file an annual report.”

You can log in to your account to file your report on the next page. You can choose a “one-click” filing option if there are no changes. You’ll have to log in to your account if you make changes.

You’ll then search for your business by name or business ID number and file your report.

The fee for filing your annual report is $100 plus a $2 online filing fee, and reports are due by April 1. The fee for filing late is $50.

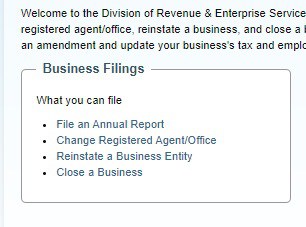

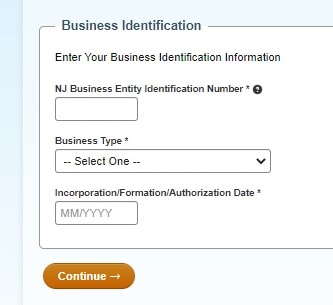

How to File an LLC Annual Report in New Jersey

To file your annual report in New Jersey, visit the Division of Revenue and Enterprise Services website and select “file annual report.”

Then you’ll enter your business ID number, select the type of business, and the date of your LLC’s formation.

Follow the prompts to complete the filing of your report.

The fee for filing your annual report is $75, and reports are due by the end of the anniversary month of your LLC’s formation.

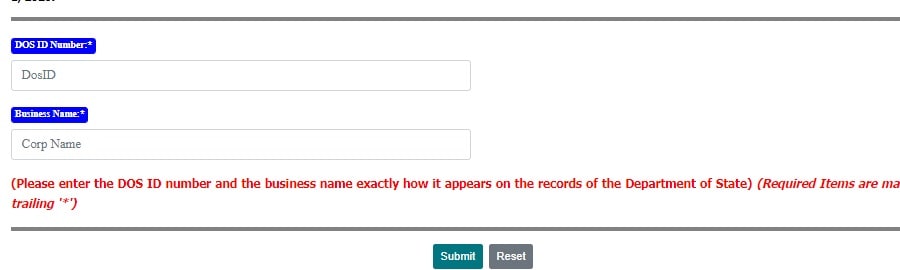

How to File an LLC Biennial Statement in New York

To file your biennial statement in New York, visit the Department of State’s website and enter your business ID number and name.

Then simply follow the prompts to complete the statement and submit it.

The filing fee is $9, and statements are due by the end of the anniversary month of your LLC’s formation.

How to File an LLC Annual Report in North Carolina

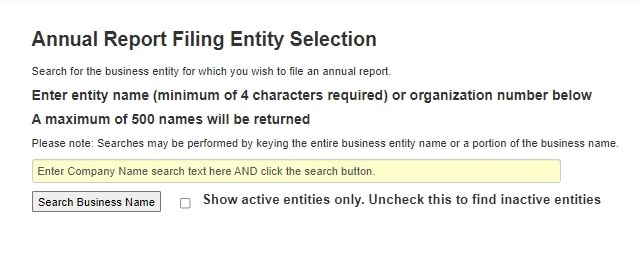

To file your annual report in North Carolina, visit the Secretary of State’s website and select “annual file report.”

Enter your business name in the search box and when the result comes up, select “annual report.” Then simply verify the required information or make changes as necessary.

The fee for filing your annual report is $202 online, and reports are due April 15.

How to File an LLC Annual Report in North Dakota

To file your annual report in North Dakota, visit the Secretary of State’s website and select “file annual report.”

Enter your business name or ID number in the business search box. When your business appears, click on the “file annual report” icon, fill in the required information, and submit the form.

The filing fee is $50, and reports are due November 15th. The fee for late filing is $50.

How to File an LLC Annual Certificate in Oklahoma

To file your annual certificate in Oklahoma, visit the Secretary of State’s website and select “annual certificate.”

Then follow the prompts to enter all the required information.

The filing fee is $25, and reports are due on the anniversary date of your LLC’s formation.

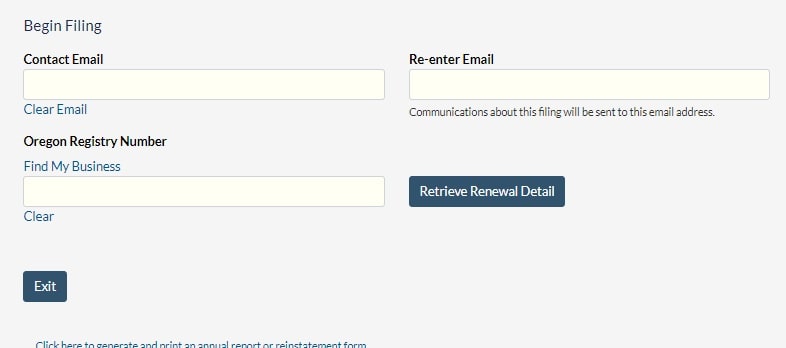

How to File an LLC Annual Report in Oregon

To file your annual report in Oregon, visit the Secretary of State’s website and enter your name, email, and Oregon registry number.

Your business information will appear for you to verify or change, then you’ll submit the report.

The filing fee is $100, and reports are due on the anniversary date of your LLC’s formation.

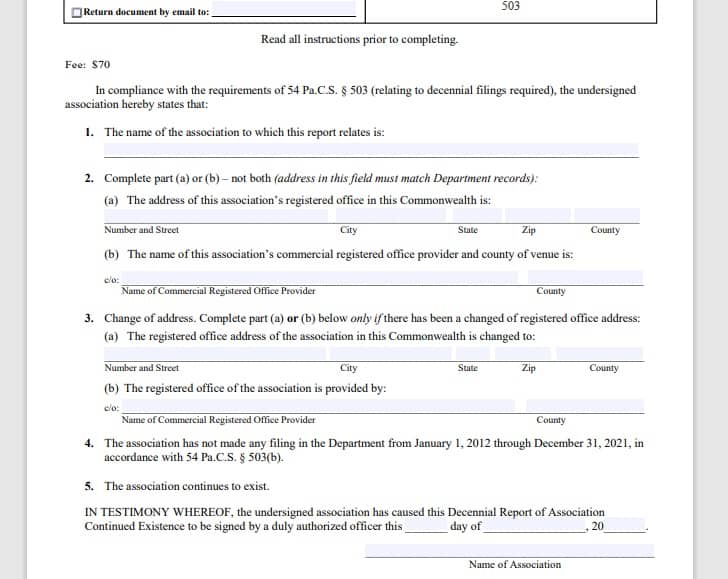

How to File an LLC Decennial Report in Pennsylvania

To file your decennial report in Pennsylvania, visit the Department of State’s website to download the form. Unfortunately, you cannot file online, only by mail.

Your LLC needs to file a decennial report if your business has had no new or amended filings processed with Pennsylvania’s Bureau of Corporations and Charitable Organizations in the last ten years. Review your LLC’s filings within that period to determine whether your business needs to file.

Every business in the state follows the same ten-year filing schedule. The filing years end with the number one, and decennial reports can be filed at any time during the year.

The filing fee is $70, and you’ll mail the report and the fee to:

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105

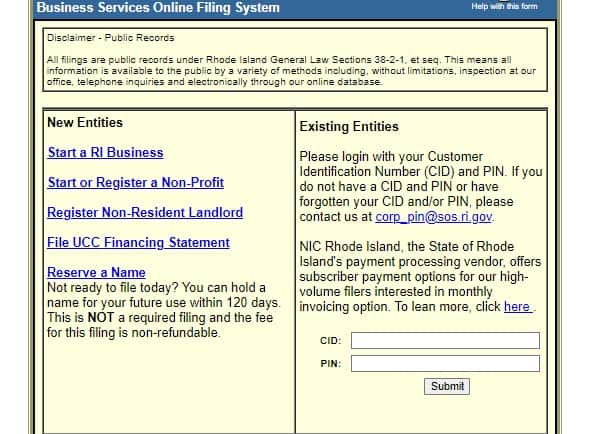

How to File an LLC Annual Report in Rhode Island

To file your annual report in Rhode Island, visit the Secretary of State’s website and log in to your account.

You’ll simply select “File Annual Report” and fill in the required information.

The fee for filing your annual report is $50, with reports due May 1. The fee for late filing is $25.

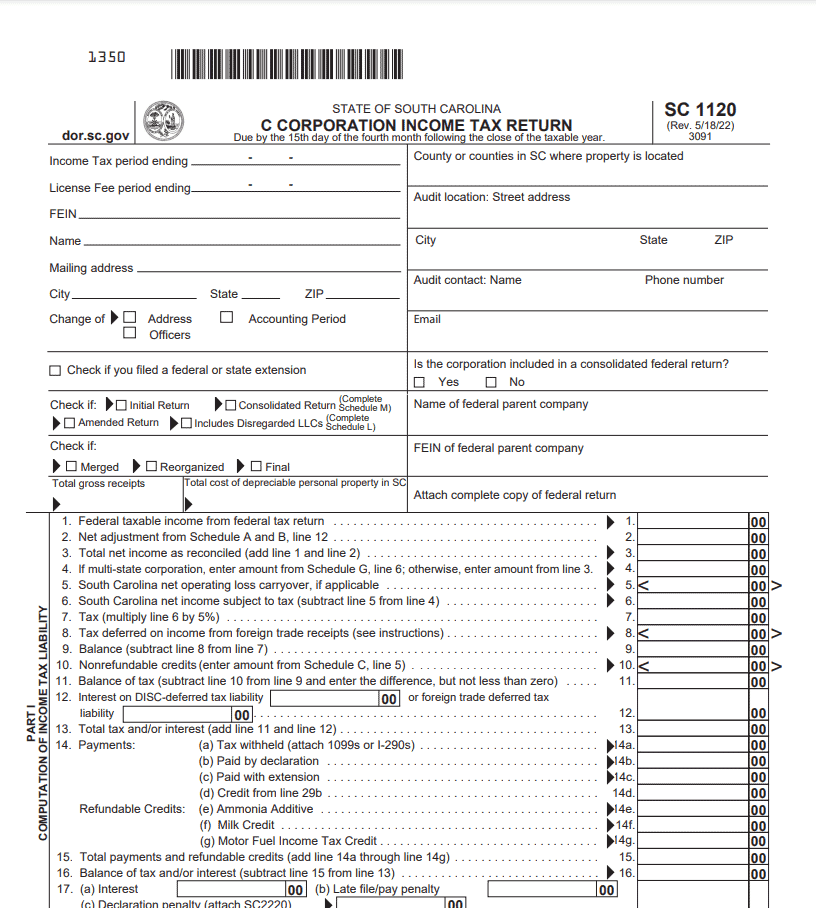

How to File an LLC Annual Report in South Carolina

In South Carolina, your annual report is filed as part of your state corporate tax return. To file online, you have to use approved tax software. In addition, you must file online if your tax liability is more than $15,000.

Approved software providers for South Carolina Corporate eFile (as of January 2022) are:

- Advanced Tax Solutions

- ATX – Universal

- BlockWorks

- CCH ProSystemFx

- CorpTax

- Crosslink

- Drake Software

- GoSystems/OneSource

- Intuit ProSeries

- Intuit Tax Online

- Online Taxes Inc

- RCS TaxSlayer

- TaxAct

- UltraTax CS (Creative Solutions)

- UTS – TaxWise

If you’re eligible and you wish to file by mail, you can download the form and mail it as follows:

Mail Balance Due returns to:

SCDOR Corporate Taxable

PO Box 100151

Columbia, SC 29202

Mail Refund or Zero Tax returns to:

SCDOR Corporate Refund

PO Box 125

Columbia, SC 29214-0032

South Carolina doesn’t charge a fee for filing your annual report besides the tax owed. Reports are due on or before the 15th day of the fourth month after the close of the taxable year.

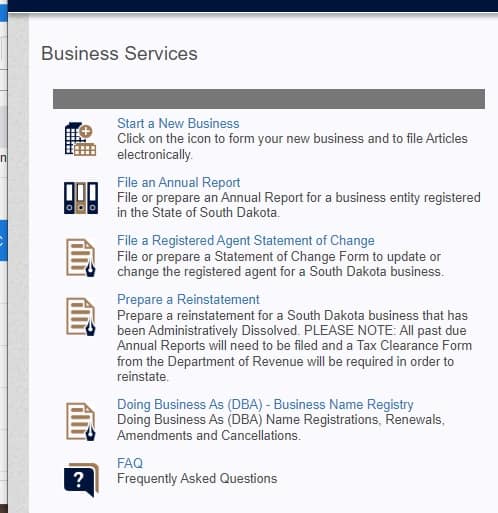

How to File an LLC Annual Report in South Dakota

To file your annual report in South Dakota, visit the Secretary of State’s website and select “File an Annual Report.”

On the next page, select “File Annual Report” again. Then you’ll enter your business ID number and follow the prompts to enter the required information.

The fee for filing your annual report is $50 if you file online and $65 if you file by mail.

Reports are due on the first day of the anniversary month

How to File an LLC Annual Report in Tennessee

To file your annual report in Tennessee, visit the Secretary of State’s yearly report website and click “Start Now.”

Then fill in the required information and submit your report.

The fee for filing your annual report is $50 per each LLC member, with a minimum of $300 and a maximum of $3,000.

Reports are due by the first day of the fourth month after the end of your LLC’s fiscal year.

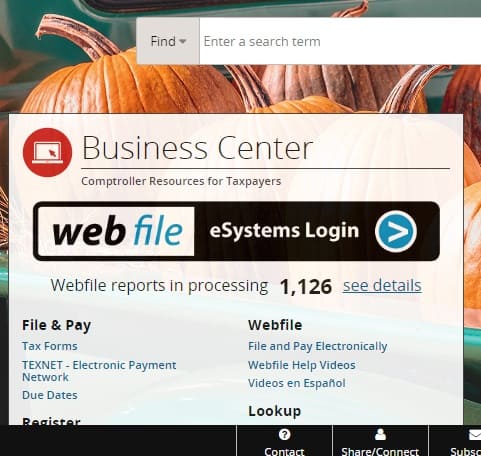

How to File an LLC Annual Report in Texas

In Texas, your annual report is filed with your annual franchise tax return. To file your annual report and franchise tax return in Texas, visit the Comptroller’s website and follow the link to the eSystems login.

Log in to your account and select “assign taxes/fees.” Next, enter your Texas tax ID number, follow the prompts to enter the required information, and pay your franchise tax.

Your tax due will depend on the amount of your revenue, and reports are due May 15th. Find instructions on calculating your tax due here.

How to File an LLC Annual Report in Utah

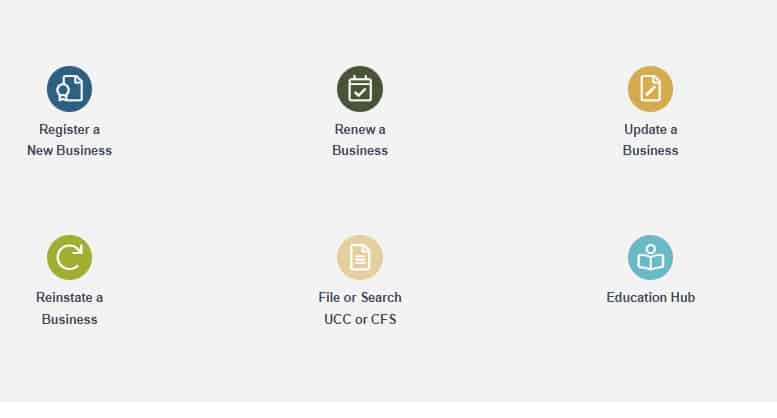

To file your annual report in Utah, visit the Division of Corporations and Commercial Code website and click “renew a business.”

Enter your business entity number and follow the prompts to enter the required information.

The filing fee is $18, and reports are due on the anniversary date of the LLC formation. The fee for late filing is $10.

How to File an LLC Annual Report in Vermont

To file your annual report in Vermont, visit the Secretary of State’s website and select “business services.”

Then select “reports and renewals” and then “annual reports.”

Follow the prompts and log in to your account to enter the required information and submit the report.

The fee for filing your annual report is $35, and reports are due within three months of the end of your latest fiscal year.

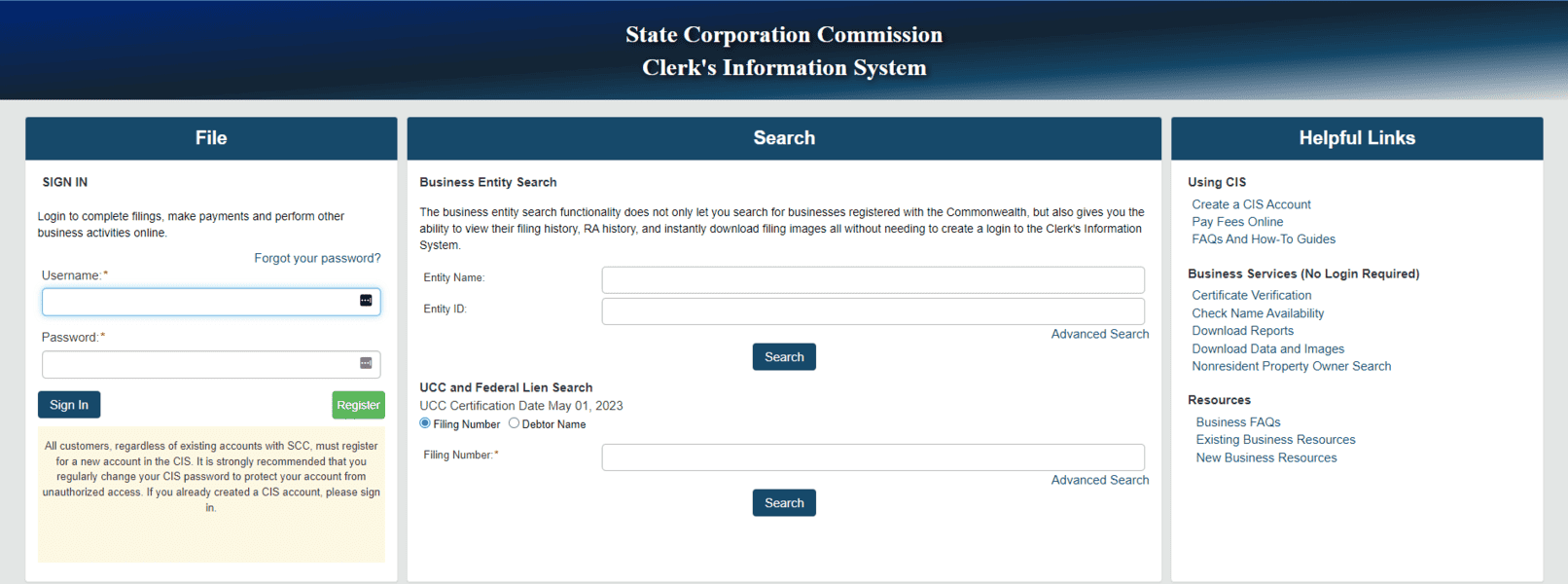

How to File an LLC Annual Report in Virginia

To file your annual report in Virginia, visit the State Corporation Commission’s website and log in to your account.

Click on “online services,” then click on the annual report link, search for your business, and enter all the required information.

The filing fee is $50, and reports are due on the last business day of the anniversary month of your LLC’s formation.

How to File an LLC Annual Report in Washington

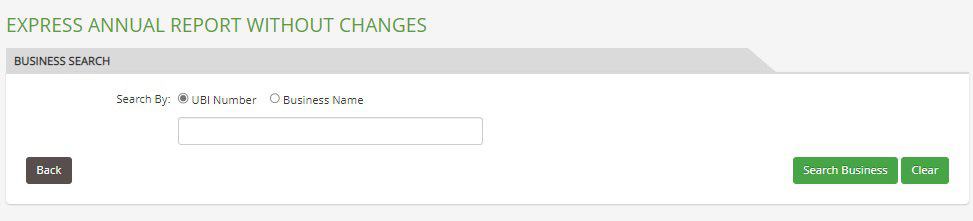

To file your annual report in Washington, visit the Express Annual Report website and enter your business name or UBI number.

Once you’ve located your business record, fill in the required information and submit your report.

The filing fee is $60, and reports are due on the last day of the anniversary month of your LLC’s formation.

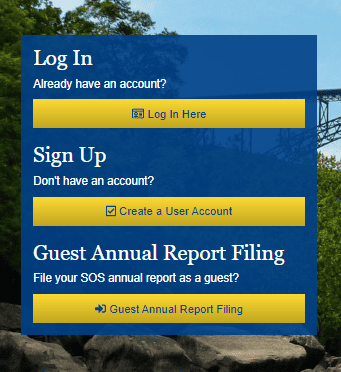

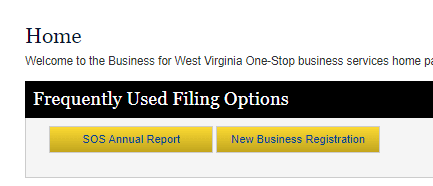

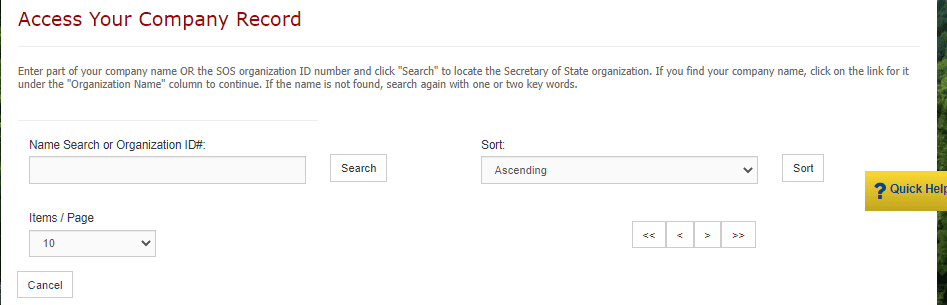

How to File an LLC Annual Report in West Virginia

To file your annual report in West Virginia, visit the WV One Stop Business Portal website and either log in to your account or click “Guest Annual Report Filing.”

Then select “SOS annual report” and search for your business on the next page.

Simply fill in the required information and submit your report.

The filing fee is $25, and reports are due July 1. The fee for late filing is $50.

How to File an LLC Annual Report in Wisconsin

To file your annual report in Wisconsin, visit the One Stop Business Portal and click “File Now.”

Then search for your business record and complete the required information.

The filing fee is $25, and reports are due by the end of the quarter in which your LLC was initially formed.

How to File an LLC Annual Report in Wyoming

To file your annual report in Wyoming, visit the Business Center website and enter your filing I.D. number.

Then simply fill in the required information and submit your report.

The filing fee is an annual report license tax, which is $60 or $0.00002 for every dollar of your assets, whichever is greater. You must file by mail if your tax is more than $500.

Reports are due on the first anniversary month of your LLC’s formation.

How to Renew Your LLC Annual Report

Annual renewal fees and filing requirements vary from state to state. Arizona has no annual reporting requirement for LLCs, for instance, while New York requires LLCs to file biennial statements. So make sure you’re aware of your state’s requirements and deadlines.

Renewal fees range from $50 to $750, and the filing process varies. Some states use different names for regular reports. Your state might call it a periodic report, a biennial statement, or a franchise tax report. Regardless, the purpose is the same.

Remember that you’ll have to abide by your state’s guidelines whether or not your business made a profit. Failure to comply could result in hefty fines or the dissolution of your business. Fortunately, in most states, annual filings can be completed online.

It’s important to pay close attention to filing due dates. In some states, annual reports are due on the anniversary of your business formation. In others, all businesses have exact due yearly dates.

Multi-State Businesses

LLCs that do business in multiple states must register as foreign LLCs in some states and comply with each state’s filing requirements. A foreign LLC is an LLC doing business in a state other than the one in which it initially registered.

For example, if your LLC is registered in Pennsylvania and you start doing business in New Jersey, you must register as a foreign LLC in New Jersey.

If you fit any of the following criteria, your LLC may be considered a foreign business:

- You have a physical presence of any kind in that state

- You have employees in that state

- You regularly meet with clients, managers, or investors in that state

- You are licensed to do business in that state

You may also need to register as a foreign LLC if your business has a bank account or property in that state. However, if you’re an online business registered in one state that makes sales in other states, you’re most likely not a foreign business.