If you have a limited liability company (LLC) in Nevada, you may need to shut down the business. On the other hand, maybe you’ve started anotherco ...

In New York, this must be done before you formally dissolve your LLC with the state.

Written by: Carolyn Young

Carolyn Young has over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Sarah Ruddle

For over 15 years, Sarah Ruddle has been a noteworthy leader in the business and nonprofit world.

Updated on July 16, 2024

If you have a limited liability company (LLC) in New York, you may need to shut down the business at some point. On the other hand, maybe you’ve started another company or decided to relocate to another state — whatever the reason, you’ll need to follow the somewhat complicated LLC dissolution process.

If done incorrectly, you’ll still be responsible for annual reports and fees and could face additional penalties. But, lucky for you, this handy guide explains how to dissolve an LLC in New York.

Properly shutting down an LLC involves several crucial steps, as detailed below.

LLC owners, known as members, must vote to dissolve the LLC. In New York, you must have an operating agreement that details the process to do so. If not, New York law requires a majority vote of the members based on ownership percentages or a judicial decree.

Once one of the above events occurs, draft a resolution to dissolve the LLC and keep it in your records. Again, it’s a good idea to hire an attorney to assist with the process, as the lack of a proper operating agreement complicates dissolution and may cause legal issues.

If you were required to get licenses and permits for your business, you’d need to contact the issuing agencies to cancel them so that you’re not charged renewal fees. If you have any outstanding fees, you’ll likely need to pay them before you are allowed to cancel.

In most states, there are formal procedures and requirements for notifying creditors of the LLC’s dissolution. However, new York does not have such requirements. Instead, the law simply states that you must satisfy all liabilities before distributing the remaining assets to members.

In New York, this must be done before you formally dissolve your LLC with the state.

Notify any relevant tax authorities of the dissolution and pay any outstanding taxes due.

If you have contracts with vendors, lessors, or any other outstanding financial obligations, you’ll need to ensure all your obligations are fulfilled and all contracts are canceled.

If the LLC has any assets remaining in any form after all financial obligations have been settled, they must be distributed to members based on LLC ownership percentages. If the assets are equipment, property, or other non-cash assets, they’ll need to be sold first so distributions can be made in cash.

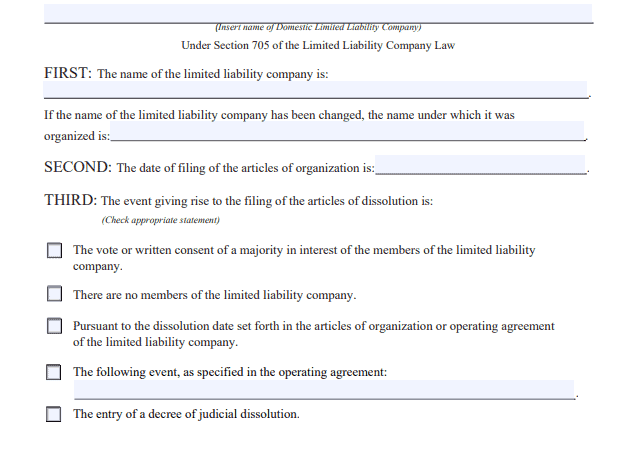

In New York, the process to officially dissolve your LLC is to download the articles of dissolution form, fill it out, and file it by mail.

The mailing address is:

New York Department of State

Division of Corporations

One Commerce Plaza

99 Washington Avenue

Albany, NY 12231

The fee for filing dissolution papers in New York is $60.

Regardless of the reason, LLC dissolution must be done right to avoid legal issues and financial penalties. Therefore, it’s highly recommended that you employ the services of an attorney to ensure everything is done correctly and all bases are covered.

The fee for filing articles of dissolution in New York is $60.

The processing time for articles of dissolution in New York is approximately seven business days.

If you have no plans to operate your New York LLC in the future, you should dissolve the LLC. However, you’ll still be responsible for annual reporting and fee requirements if you don’t.

You will remain responsible for all your LLC’s filings and fees. If you don’t keep up with them, penalties may accrue.

Dissolution begins with the triggering event, such as a vote of members per the operating agreement. Termination is when all LLC activities stop, including winding up affairs and filing dissolution paperwork with the state. The filing of those documents finally terminates the LLC.

Published on May 21, 2023

If you have a limited liability company (LLC) in Nevada, you may need to shut down the business. On the other hand, maybe you’ve started anotherco ...

Read Now

Published on May 21, 2023

If you have a limited liability company (LLC) in Wyoming, you may need to shut down the business at some point. Maybe you’ve started anothercompan ...

Read Now

Published on May 21, 2023

If you have a limited liability company (LLC) in Wisconsin, you may need to shut down the business at some point. On the other hand, maybe you’ves ...

Read Now