If you’re starting a limited liability company (LLC) in Washington and planning to sell goods subject to sales tax, you’ll need to get a resale certificate, or several of them, before doing business.

But don’t worry; this guide lays out all you need to do to get a resale certificate in Washington.

What Is a Resale Certificate?

If your LLC expects to sell tangible goods in Washington, a resale certificate will enable you to purchase those goods without paying sales tax. This prevents your goods from being double taxed, as you will need to charge your customer’s sales tax when they buy the goods.

If you purchase goods without paying sales tax and neglect to charge sales tax to customers who buy those goods, or if you fail to sell the goods, you and your LLC will be responsible for the sales tax and could face steep fines.

If you purposely purchase an item not intended for resale, such as office equipment, and use your resale certificate to avoid paying sales tax, that’s tax fraud, a federal offense.

In Washington, the penalty for tax fraud is repayment of the tax owed plus a 50% penalty and possible imprisonment.

Each resale certificate applies to only one vendor, so you’ll need one for each vendor.

Suppliers and vendors do not have to accept resale certificates. A vendor might refuse a resale certificate if your certificate is invalid, and the vendor would be responsible for the sales tax.

How to Obtain a Resale Certificate in Washington

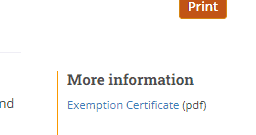

To obtain a resale certificate, known as an exemption certificate in Washington, visit the Department of Revenue website to download the form.

Obtaining the certificate is free; you can use the form as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Does an Exemption Certificate Expire in Washington?

Washington exemption certificates generally expire after four years. Certificates are only valid for two years if any of the following apply:

- The business is less than 12 months old

- You haven’t reported income within the last 12 months

- The business wasn’t active at the time you received your certificate was received

- You haven’t filed tax returns in the previous 12 months

- You are a contractor

To renew a certificate, you must complete a new one and present it to your vendor.

In Closing

In Washington, an exemption certificate is relatively easy to obtain yet provides significant savings. It will also help you and your LLC avoid potentially significant penalties.

Be sure to present the correct certificate to your vendors and keep track of expiration dates, so your certificates are always current. You don’t want to find yourself paying sales tax when you don’t have to.