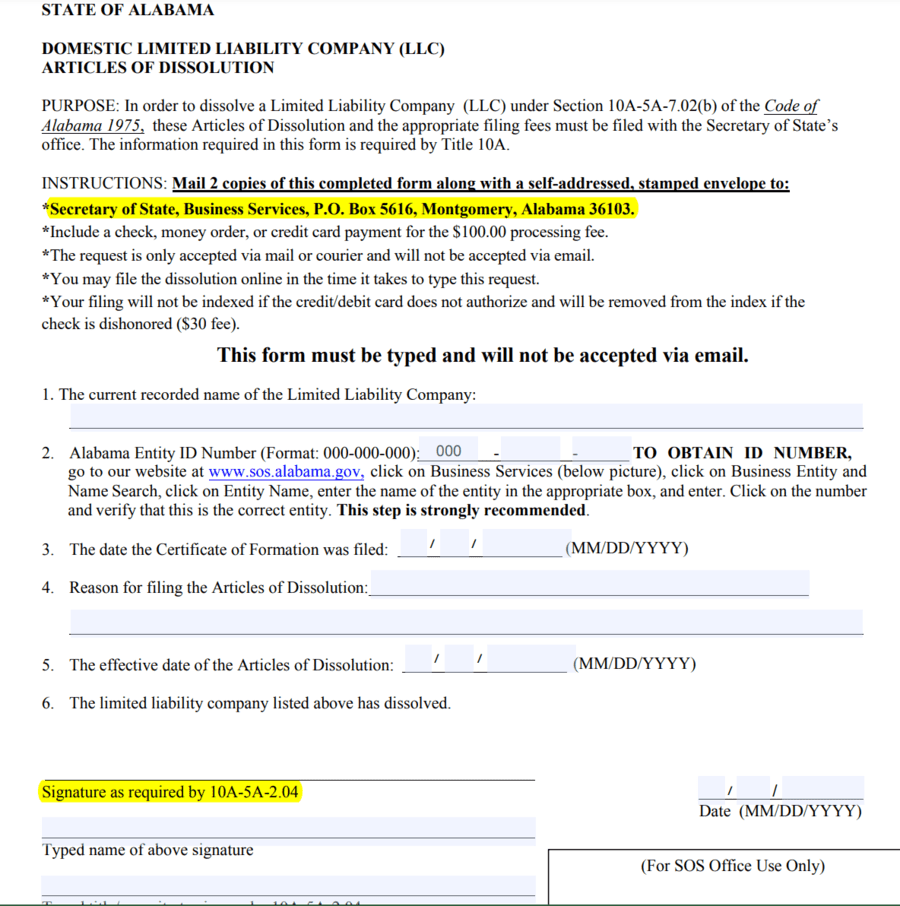

The fee for filing the dissolution papers in Alabama is $100.

How to Dissolve an LLC in 7 Steps

Written by: Carolyn Young

Carolyn Young has over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Sarah Ruddle

For over 15 years, Sarah Ruddle has been a noteworthy leader in the business and nonprofit world.

Updated on January 3, 2025

If you have a limited liability company (LLC), you may need to dissolve it at some point. For example, maybe you’re moving to another state, changing your business to a corporation, or even going out of business.

Whatever the reason, there are steps to follow to dissolve your LLC correctly with the state. If you fail, you’ll still be responsible for filing annual reports and paying the associated fees.

Read on to learn how to get it done the right way.

1. Vote for Dissolution

LLC owners, known as members, must vote to dissolve the LLC. Hopefully, you have an operating agreement that details the process to do so. Once you do so, you’ll need to draft a resolution to dissolve the LLC, which you’ll keep in your records.

2. Cancel Business Licenses and Permits

If you were required to get licenses and permits for your business, you’d need to contact the issuing agencies to cancel them so that you’re not charged renewal fees. Likewise, if you have any outstanding fees, you’ll likely need to pay them to cancel.

3. Notify Creditors

If you owe money to any creditors, you’ll need to notify them in writing of the dissolution and give them detailed instructions on filing any claims for the outstanding debt. This must be done before you formally dissolve your LLC with the state.

4. Notify Tax Departments

Notify any relevant tax authorities of the dissolution and pay any outstanding taxes due.

5. Cancel Contracts and Settle Financial Obligations

If you have contracts with vendors, lessors, or any other outstanding financial obligations, you’ll need to ensure all your obligations are fulfilled and all contracts are canceled.

6. Distribute Assets to Members

If the LLC has any assets remaining in any form after all financial obligations have been settled, they must be distributed to members based on LLC ownership percentages. If the assets are equipment, property, or other non-cash assets, they’ll need to be sold first so distributions can be made in cash.

7. File the Dissolution Papers with the State

You’ll need to go to the relevant state website, usually the Secretary of State’s, to file dissolution papers. You’ll likely also need to submit verification that your tax obligations have been settled.

Alabama

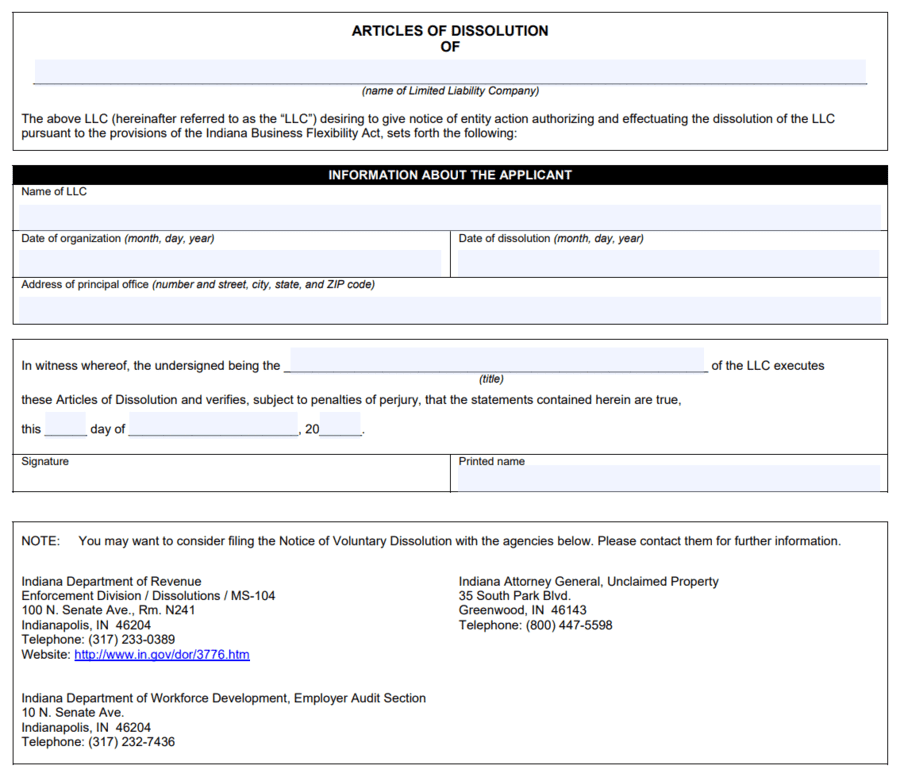

First, download and fill out the Articles of Dissolution from the Alabama Secretary of State website to officially dissolve your Alabama LLC.

Mail two copies of the completed form, along with a self-addressed stamped envelope, to:

Secretary of State, Business Services

PO Box 5616

Montgomery, Alabama 36103

You can pay by check, money order, or credit card payment through the second page of the Articles of Dissolution PDF.

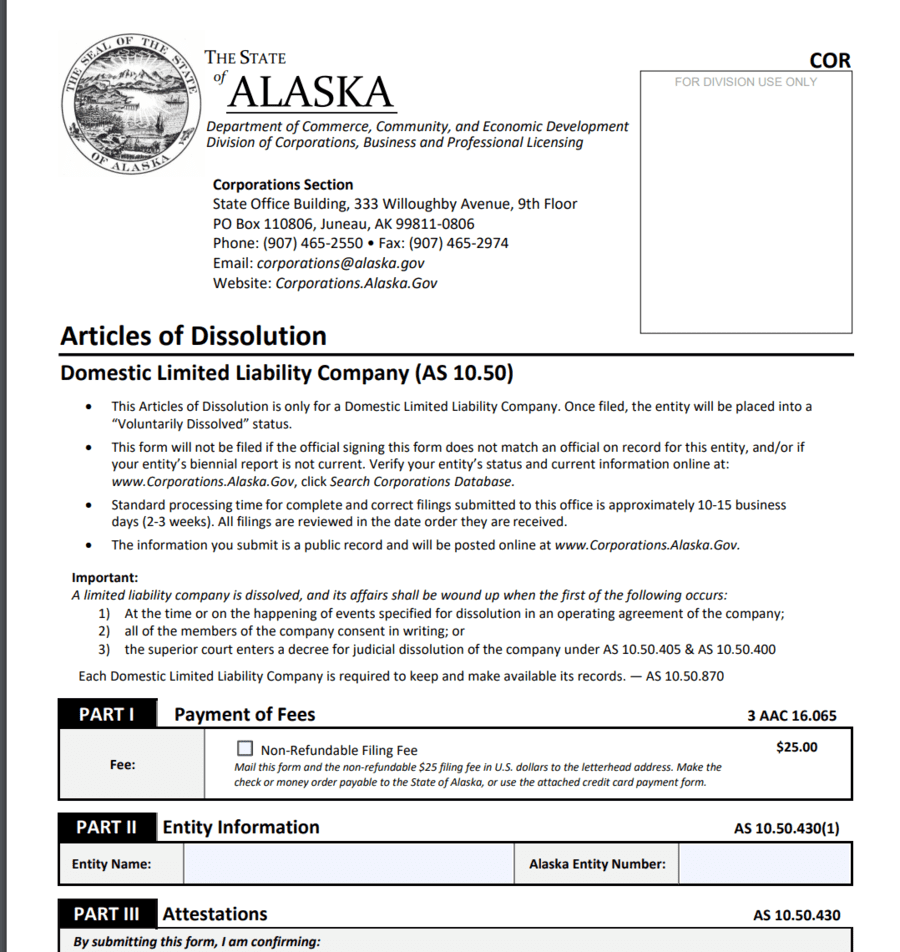

Alaska

In Alaska, the process to officially dissolve your LLC is to print and mail your Articles of Dissolution.

First, go to Alaska’s Department of Commerce, Community, and Economic Development’s Forms by Event Type page, and download the Articles of Dissolution.

Fill it out and print it. Then, you can either file it in person at the Anchorage or Juneau offices or mail it to the Juneau office.

The fee is $25. Cash will only be accepted for in-person filings, so you must use a check or credit card if you mail it.

The Anchorage office is:

550 W 7th AVE, STE 1500

Anchorage, AK 99501-3567

The Juneau office is:

PO Box 110806

Juneau, AK 99811-0806

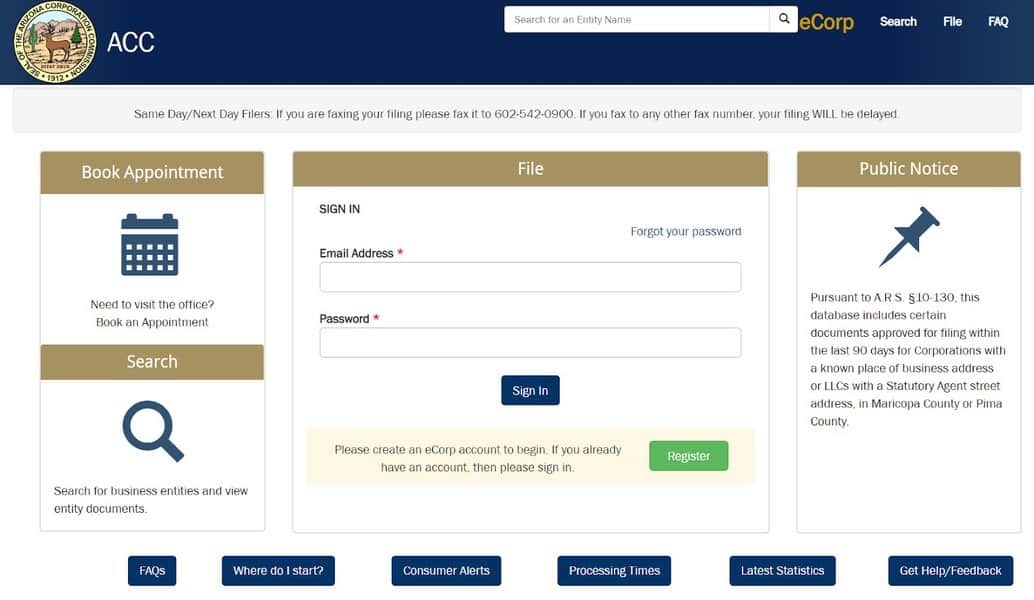

Arizona

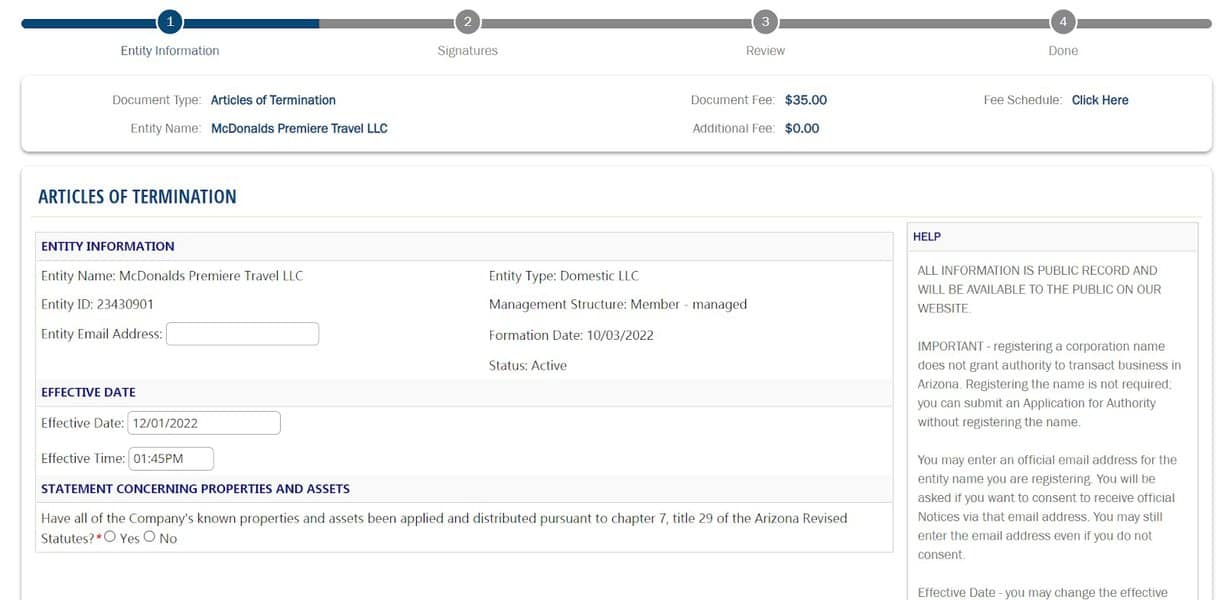

In Arizona, officially dissolving your LLC is to wind up all activities, distribute all properties and assets, and then file for termination. You can either file online or physically.

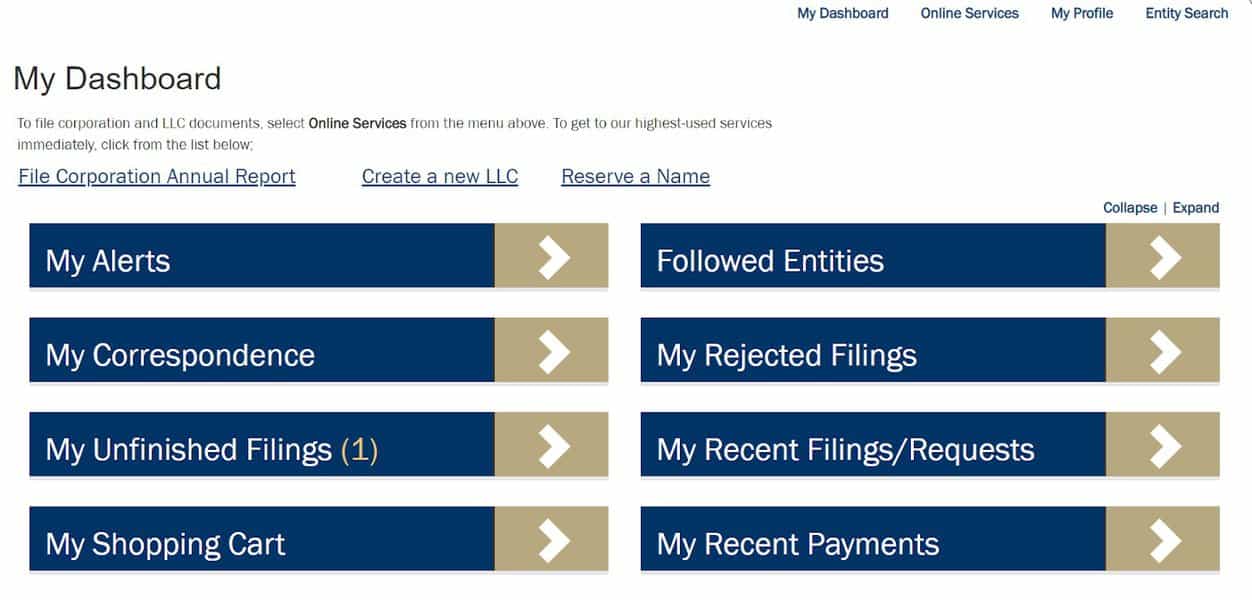

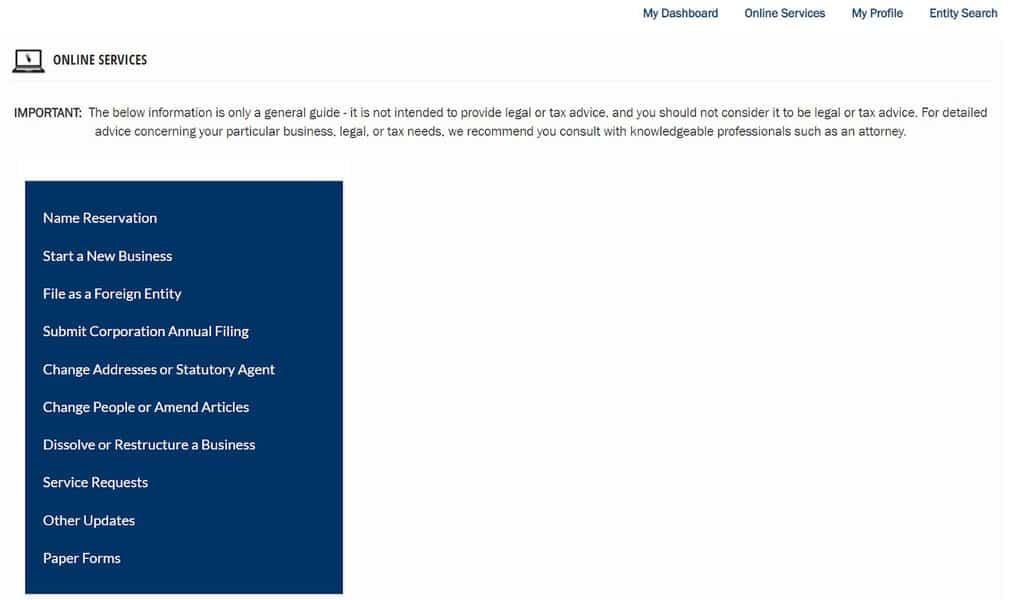

Filing Online

To file your Articles of Termination online, visit the Arizona Corporation Commission (ACC)’s online filing site and create an account.

At the top header, click “Online Services.”

From the left-hand menu, click “Dissolve or Restructure a Business.”

Search for your LLC, and enter your information where prompted. Notice that you can specify an effective date for your termination, and that Arizona requires all properties and assets to be distributed before termination.

Sign and pay for your filing.

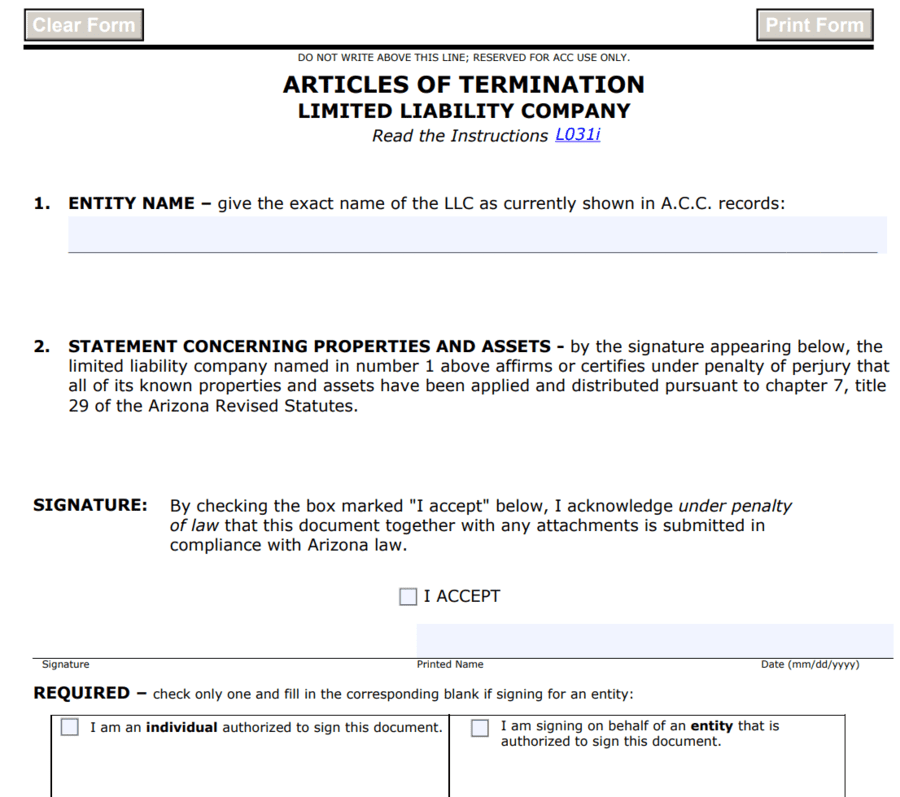

Filing Physically

To file by mail or in person, fill out and print out a filing cover sheet and the Articles of Termination. Once again, note that all properties and assets must be distributed before you can file this form.

Bring these documents and your payment to:

Arizona Corporation Commission – Examination Section

1300 W. Washington St., Phoenix, Arizona 85007

Alternatively, you can mail it to the same address. However, you can only pay for mail filings by check or money order payable to the “Arizona Corporation Commission.”

The fee for filing the termination papers in Arizona is $35.

If you’d like to pay more for expedited service (three to five days, the next day, same day, or two-hour), select the option on the cover sheet or online and pay the appropriate fee.

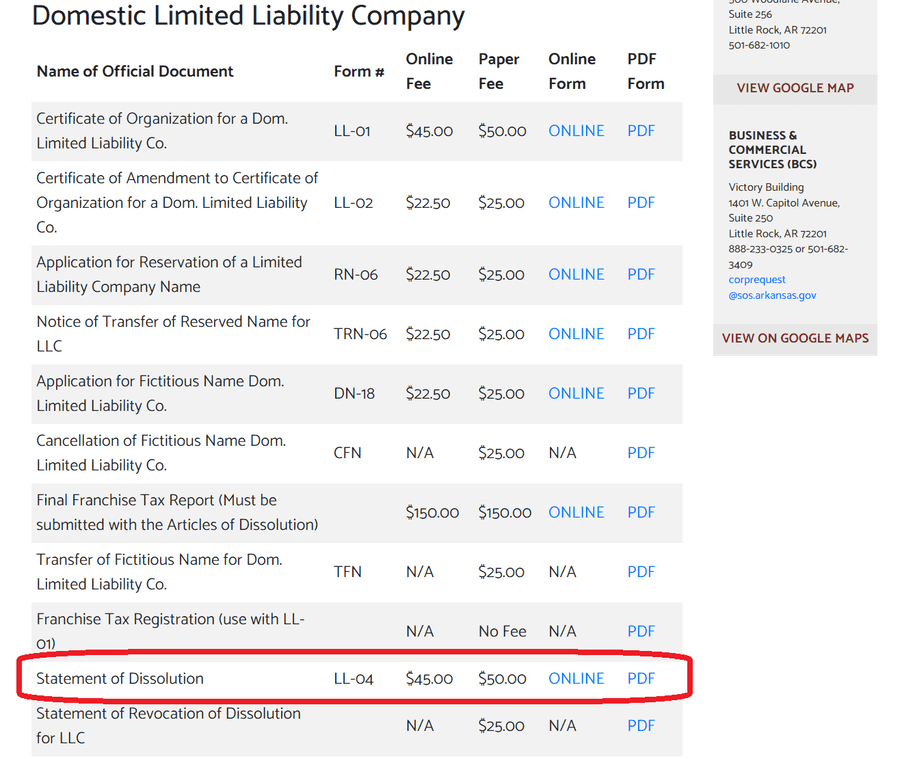

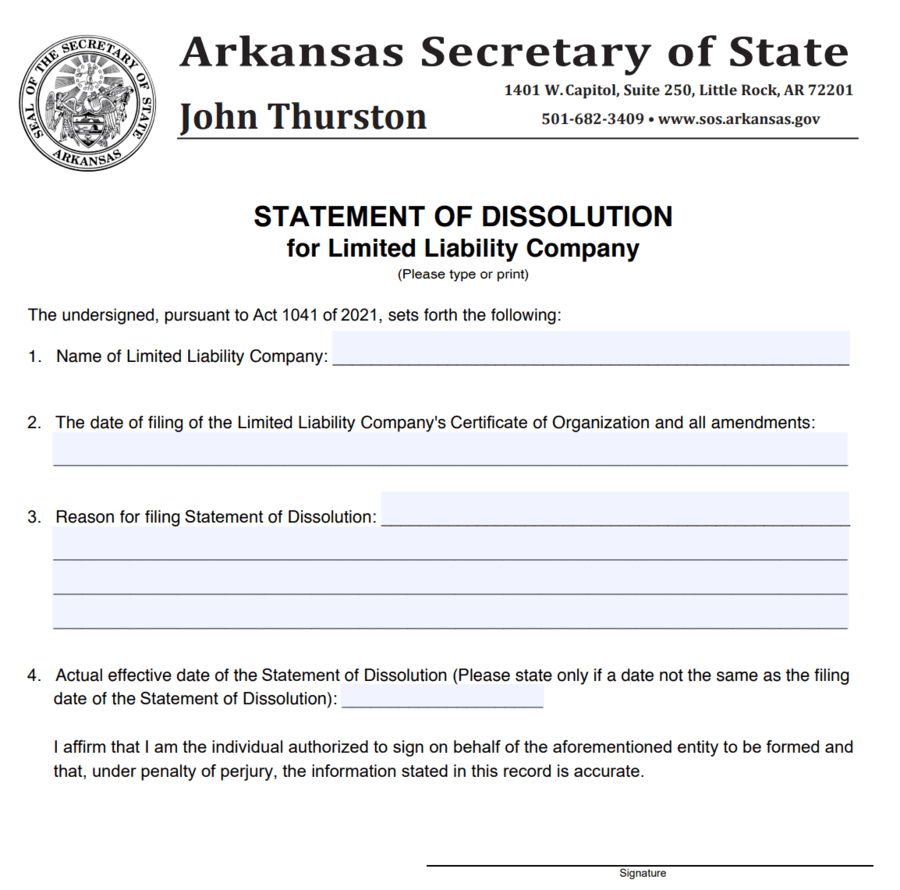

Arkansas

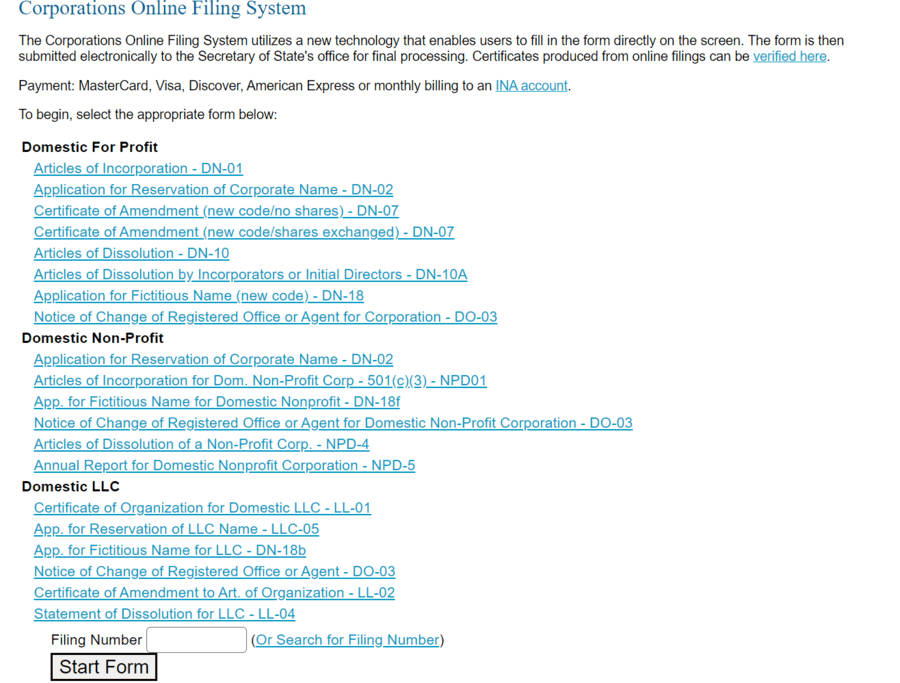

You must officially file a Statement of Dissolution in Arkansas to dissolve your LLC. You can do so either online or physically through the Arkansas Secretary of State’s LLC forms page. Scroll down until the row says “Statement of Dissolution.”

Filing Online

From the Arkansas Corporations Online Filing System, find the section for Domestic LLCs and click on “Statement of Dissolution for LLC – LL-04”. Next, enter your LLC’s filing number, and click “Start Form.”

Go through the form, and pay the $45 online filing fee.

Filing Physically

To file by mail or in person, download the Statement of Dissolution from the Secretary of State’s website, fill it in, and print it out.

Attach the $50 filing payment payable to “Arkansas Secretary of State,” and either mail it or deliver it to:

Business & Commercial Services

Victory Building

1401 W. Capitol Avenue, Suite 250

Little Rock, AR 72201

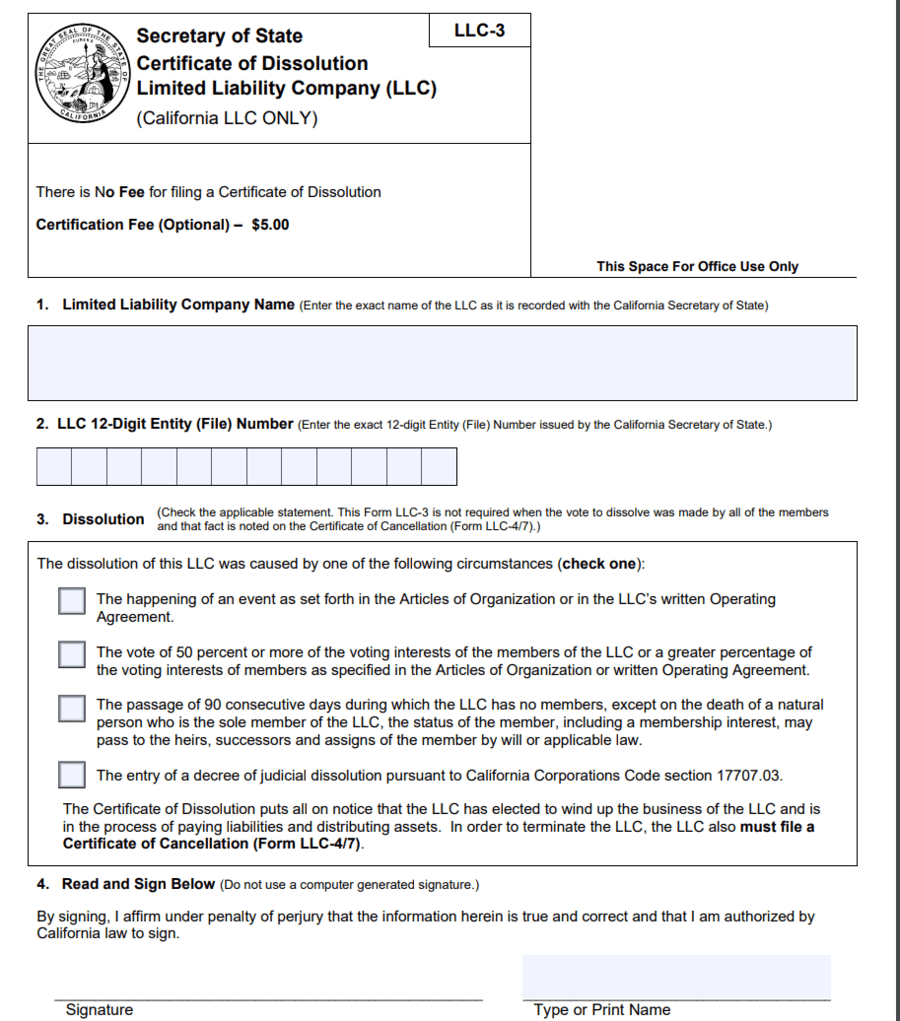

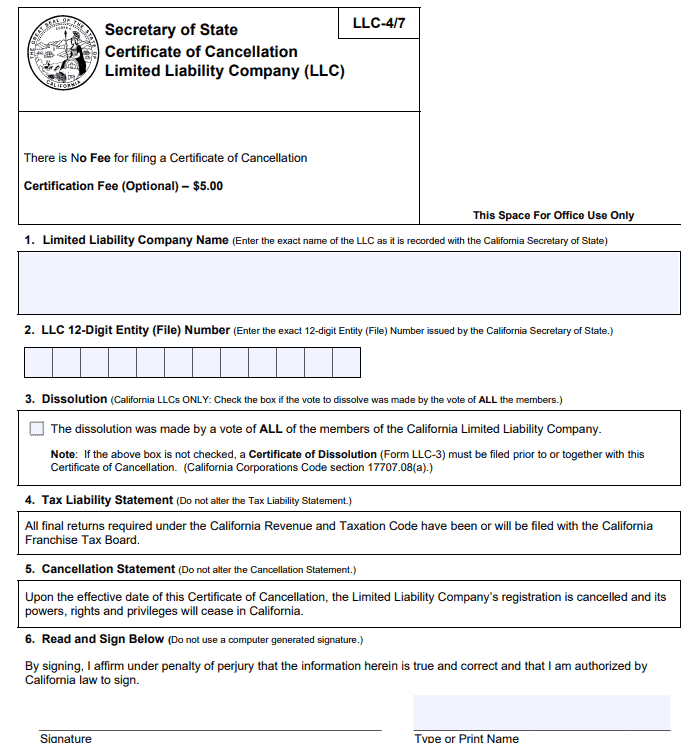

California

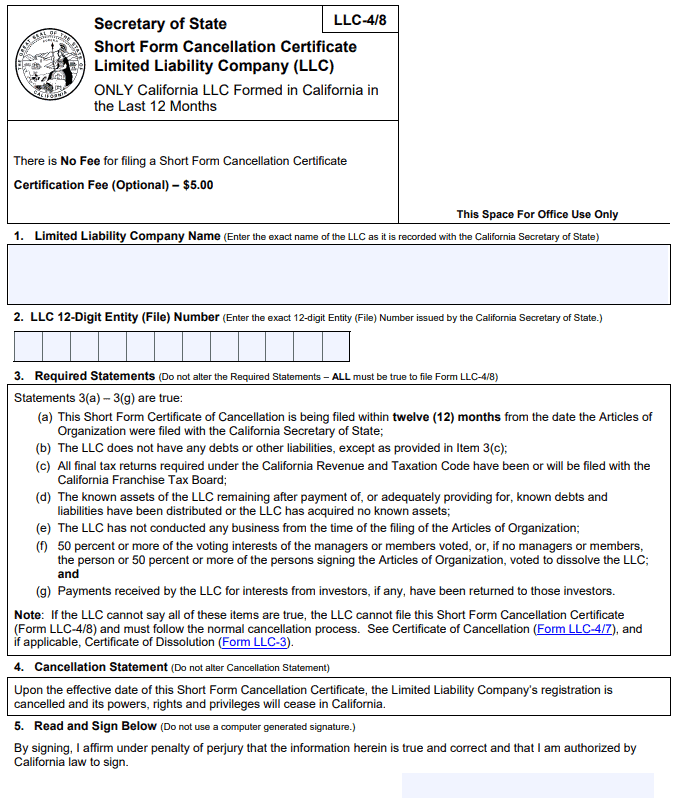

You can file three forms to dissolve your LLC in California: the Certificate of Dissolution, the Certificate of Cancellation, and the Short Form Cancellation Certificate. You can file online at Bizfile Online or physically with this PDF packet.

Certificate of Dissolution

If ALL members of your LLC were included when you voted to dissolve, you could skip this one. However, if not, you’ll have to file this Certificate of Dissolution to notify the state that you’re dissolving.

Certificate of Cancellation

If your LLC has done any business or is older than one year, you’ll need to file this Certificate of Cancellation. Note that Item three tells you that if you didn’t vote with all members, you’d also need to file the Certificate of Dissolution.

Short Form Cancellation Certificate

If your LLC is less than a year old, hasn’t had any operations, and meets a few other criteria, you can easily dissolve your LLC with this form without the other two.

Include the cover sheet if you’re filing by mail or in person. Deliver it to:

1500 11th Street

Sacramento, CA 95814

There is no fee to file dissolution papers in California. However, if you file in person, a handling fee of $15 must be paid by check or money order to the Secretary of State.

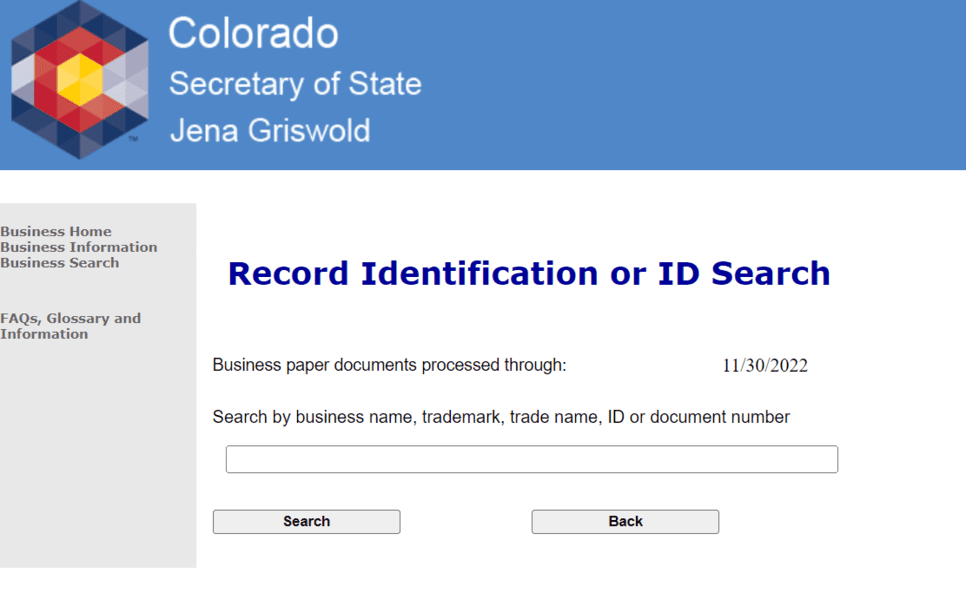

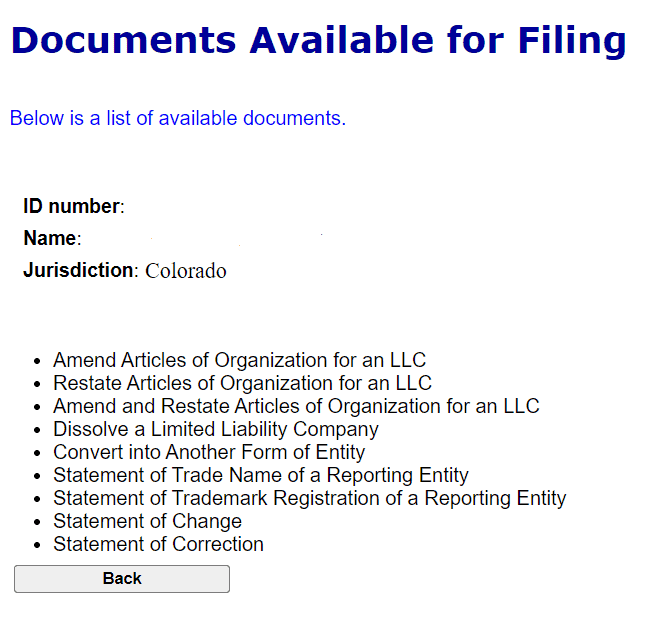

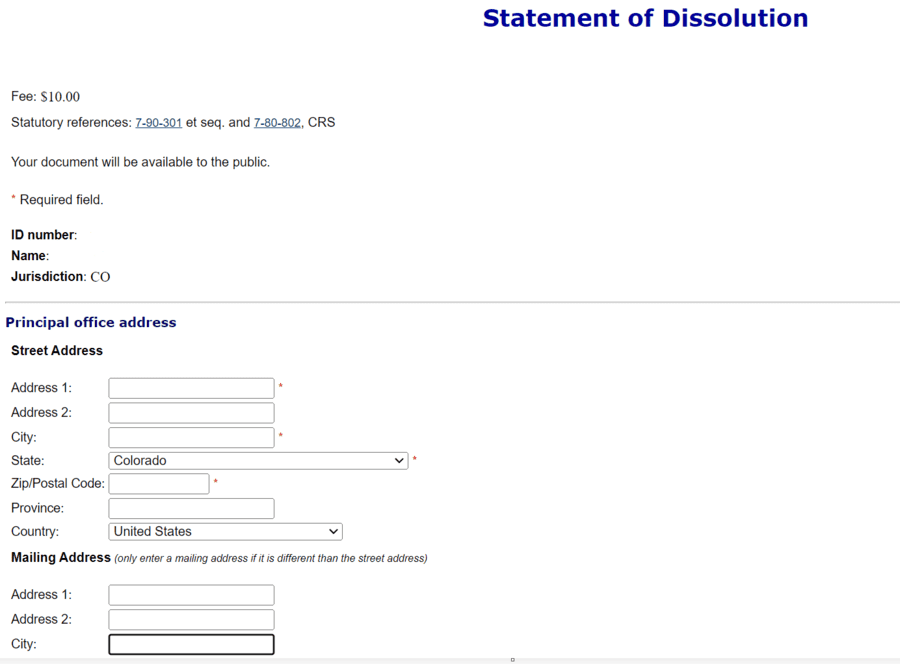

Colorado

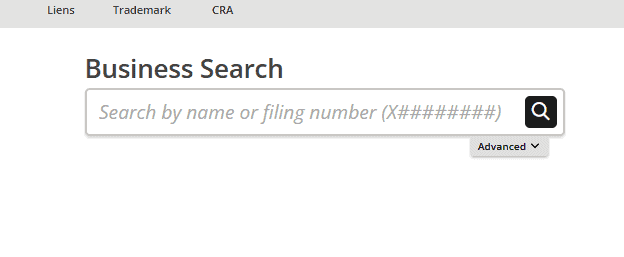

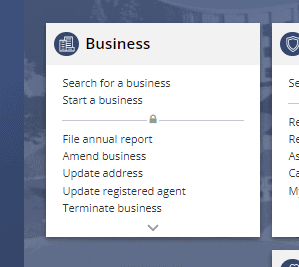

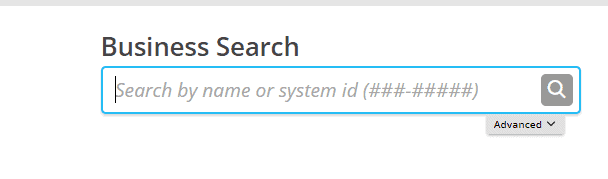

In Colorado, you can only file your Statement of Dissolution online. To start, go to the Secretary of State’s Business Search site, and find your LLC by name.

Select your LLC, and confirm that you can change this business. Then, on this next page, select that you’re filing to “Dissolve a Limited Liability Company.”

Fill out your information on this page.

Hit “Submit” at the bottom, and go through the review and payment processes. When you see a Confirmation page, your filing has been completed.

The filing fee is $10. Because you can only file online, you can only pay by credit card, debit card, or prepaid account with the Secretary of State.

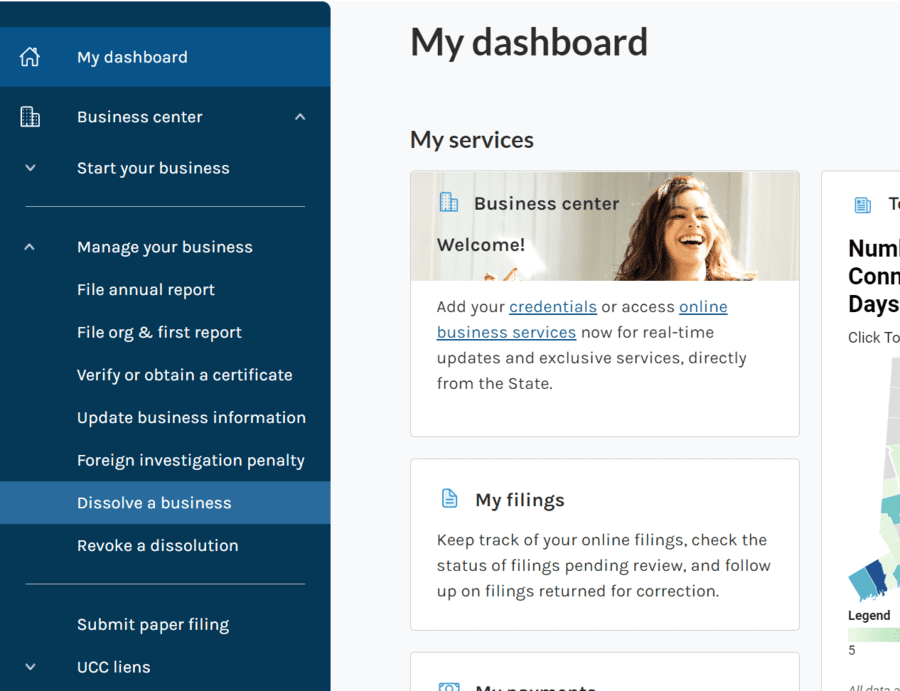

Connecticut

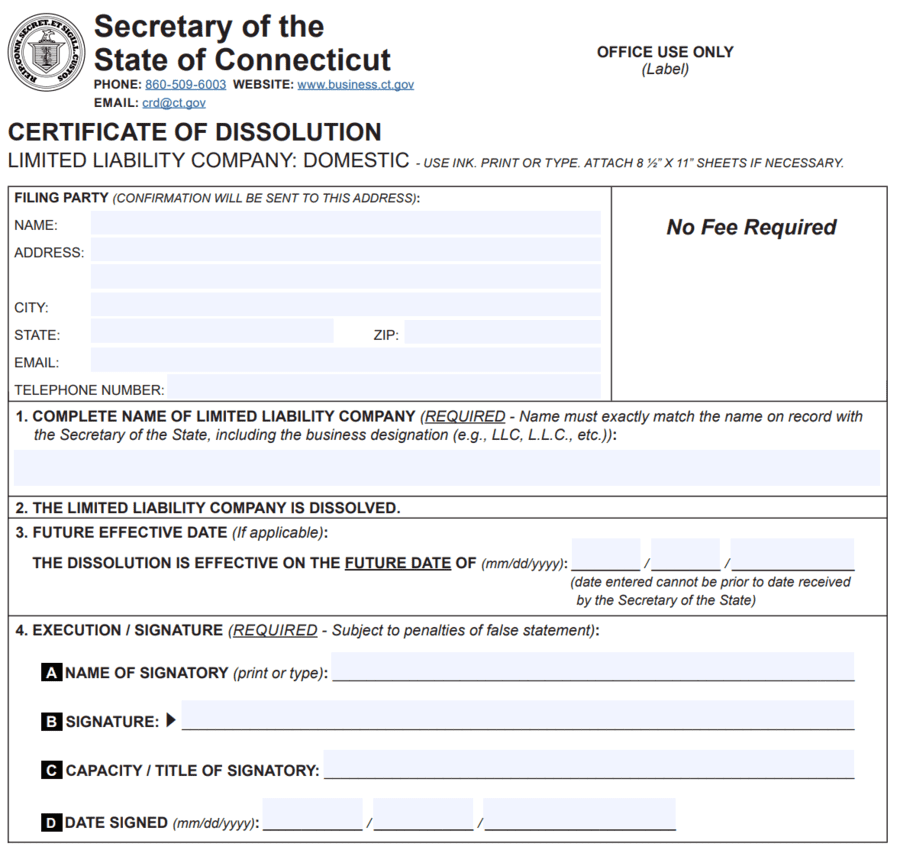

In Connecticut, the Secretary of the State will process your dissolution papers. You can either file online, digitally submit a paper filing, or file physically. In all cases, filing your Certificate of Dissolution is free.

Online Filing

You can also file online through Connecticut’s online Business Center. First, create an account, and select “Dissolve my Business” on the left-hand menu.

Click “Start Now.”

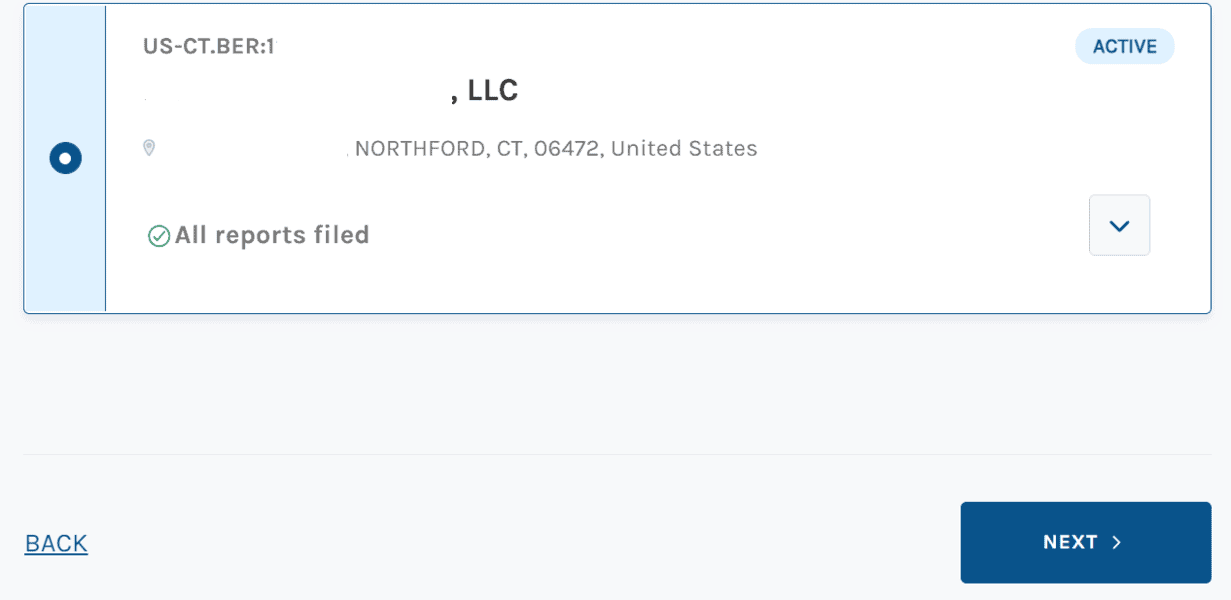

On this page, search for your business. Once you’ve selected it, scroll down to the bottom and click “Next.”

Go through the Dissolution Details and specify an exact date and time for your dissolution to take effect.

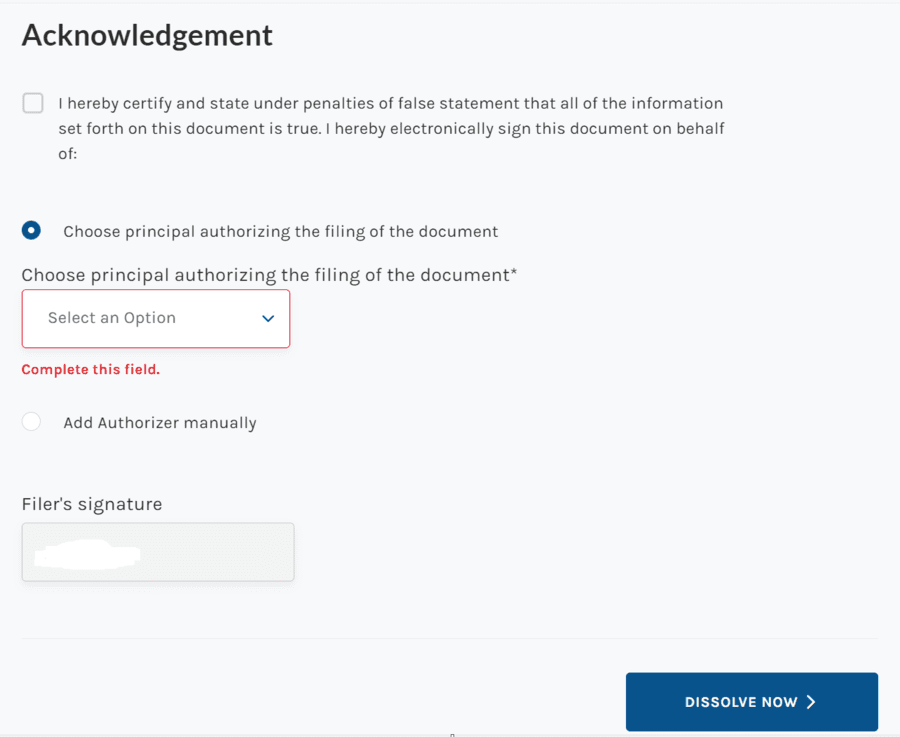

On the next page, review your information, click the acknowledgment notice, and choose a principal to authorize the filing. Then, click “Dissolve Now” at the bottom to officially dissolve your LLC.

Online Paper Filing

Visit the business center’s page for submitting paper filings to get started.

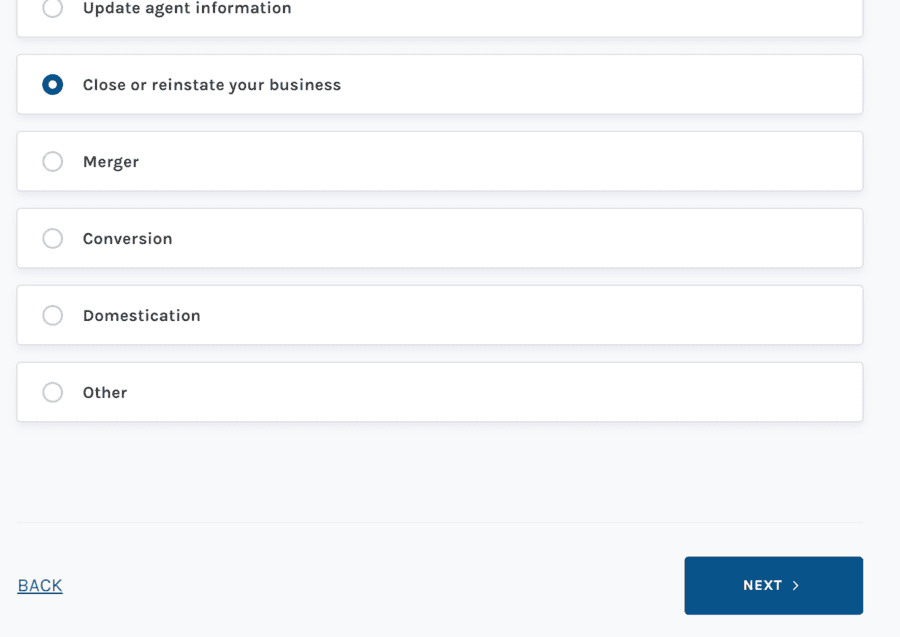

Select “Close or reinstate your business” and click “Next” at the bottom of the page.

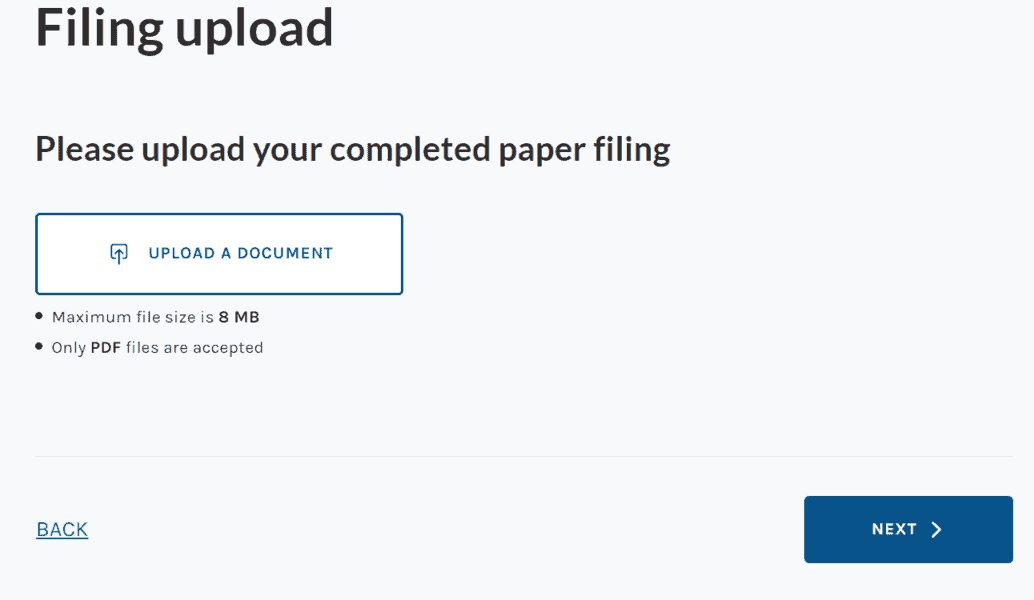

Click through the next few pages, and follow the same steps above to search for your business. Then, download, complete, and upload your Certificate of Dissolution PDF on this page.

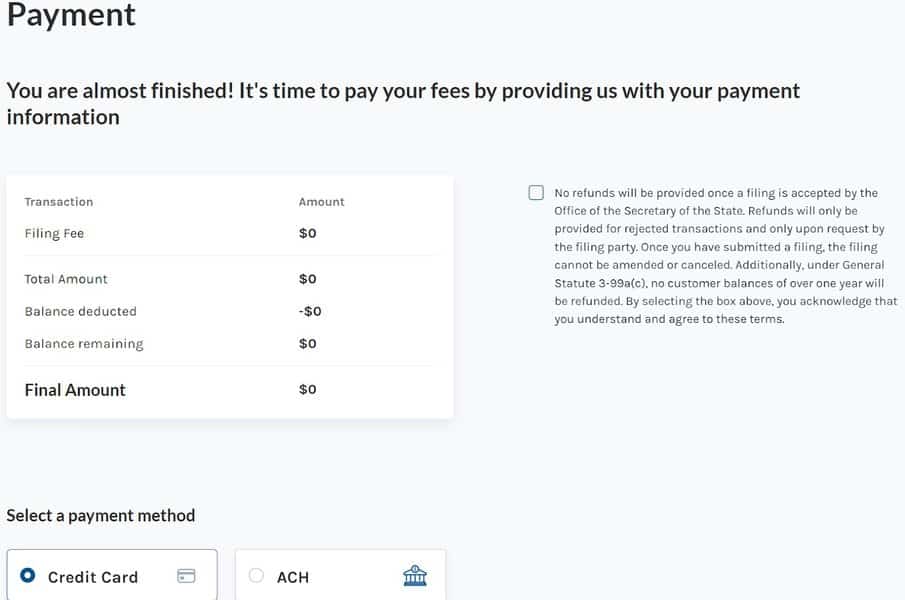

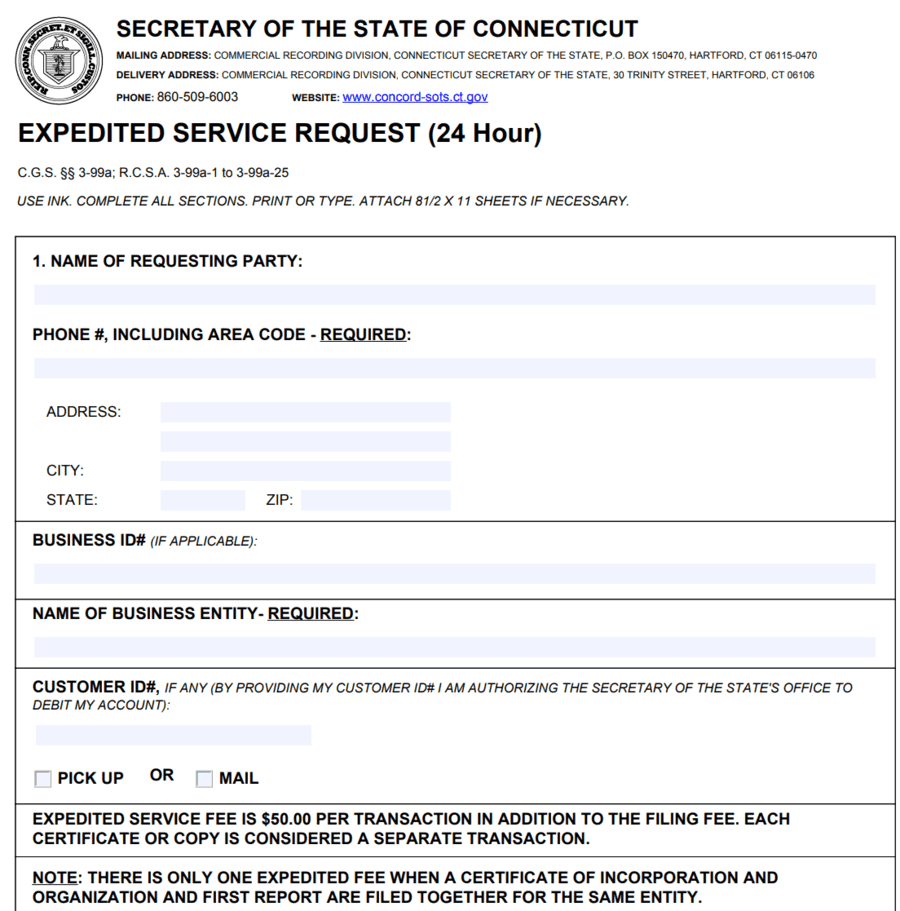

Review your submission, and go through the payment process. Filing is free unless you want to pay $50 for expedited processing.

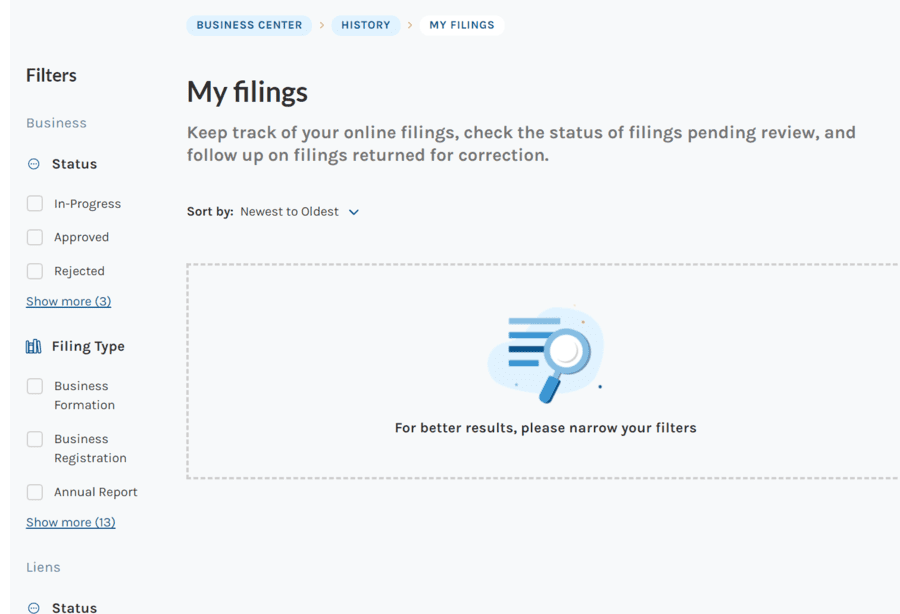

Once you submit, your filing will appear on your account dashboard under “My Filings.”

Physical Filing

To file by mail or in person, download and complete the Certificate of Dissolution PDF.

Additionally, you can print a $50 expedited service request and submit it alongside your filing.

If you’re delivering it, go to the following:

Business Services Division

Connecticut Secretary of the State

165 Capitol Ave Suite 1000

Hartford, CT 06106

If you’re mailing it, send it to:

Business Services Division

Connecticut Secretary of the State

PO Box 150470

Hartford, CT 06115-0470

Delaware

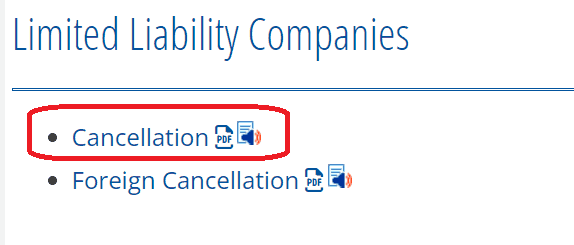

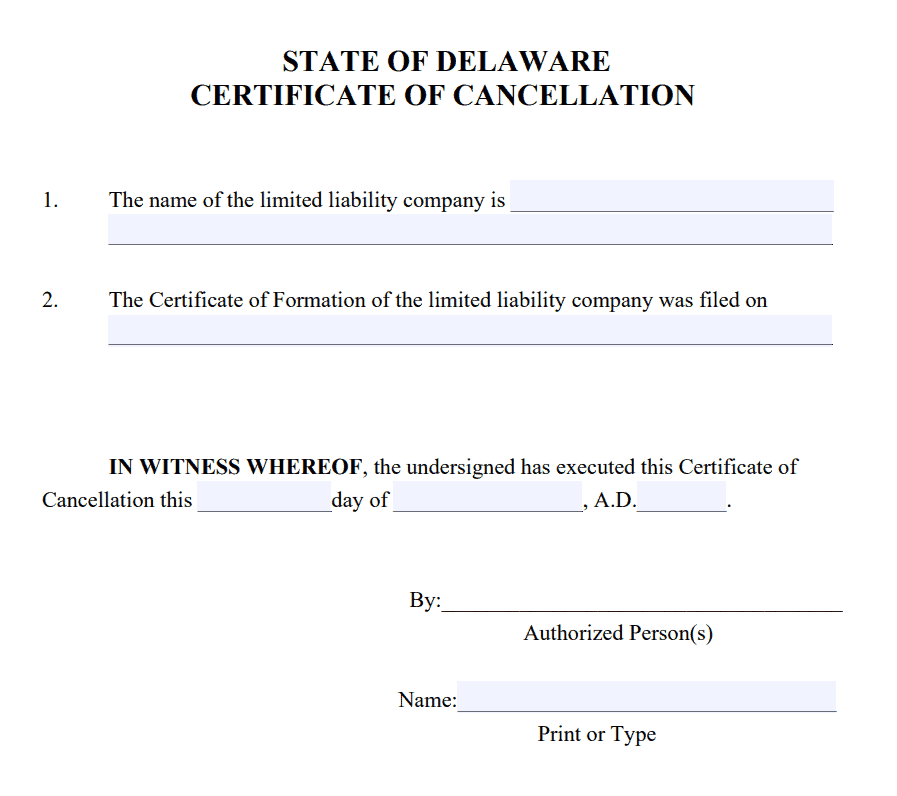

In Delaware, the Division of Corporations processes your dissolution. To get started, head to their Dissolutions and Cancellations page and scroll down to the section for LLCs. Because we’re filing for a domestic LLC, click the regular “Cancellation” link to download the PDF.

Fill out the form and save it as a PDF.

From here, you can either file it online or physically.

Online Filing

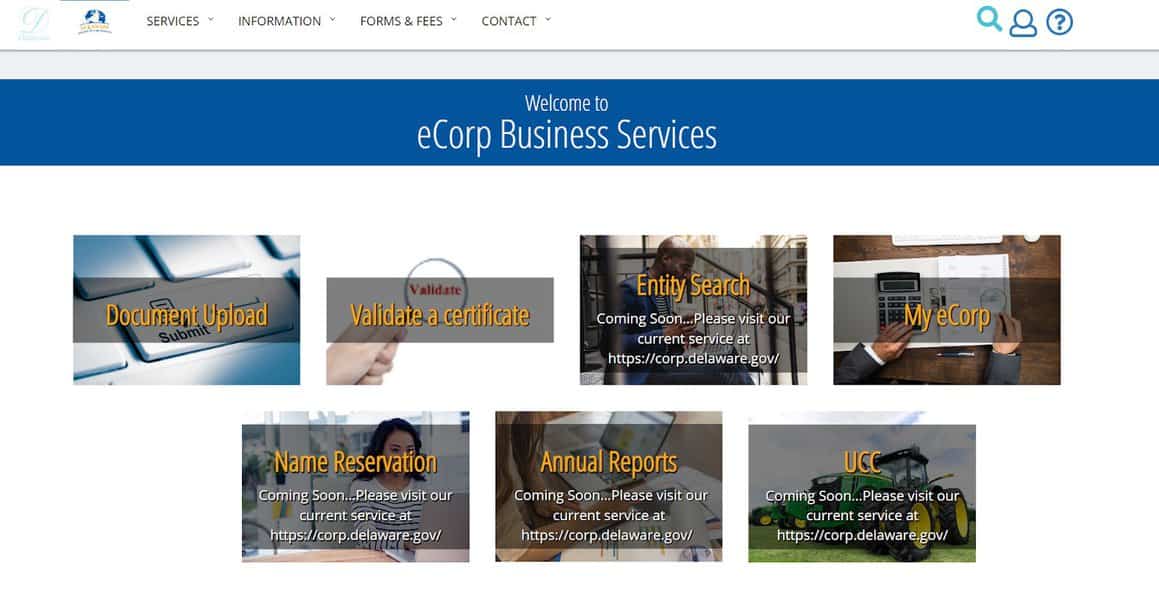

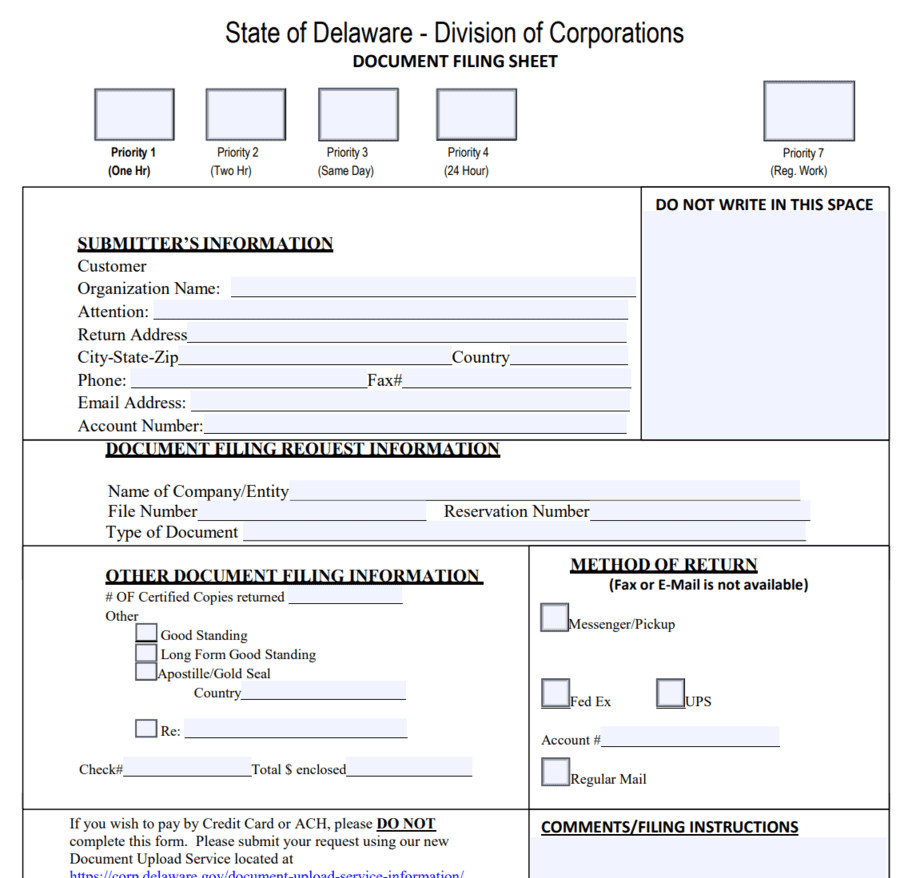

You can upload your document through Delaware’s eCorp Business Services.

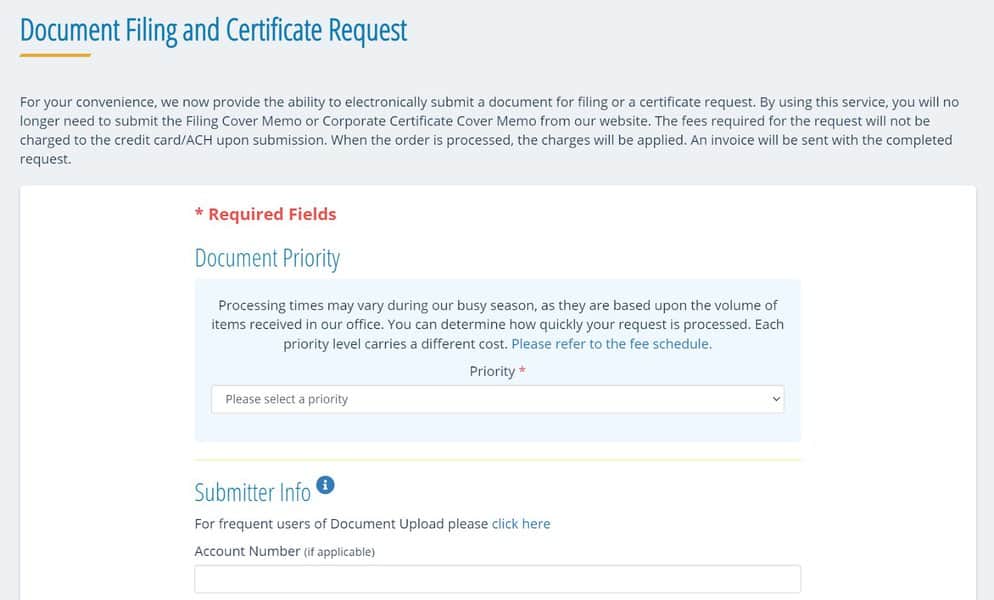

Click on Document Upload. On the next page, “Document Filing and Certificate Request,” select your document priority, fill out your information, upload your document, and choose a method of return.

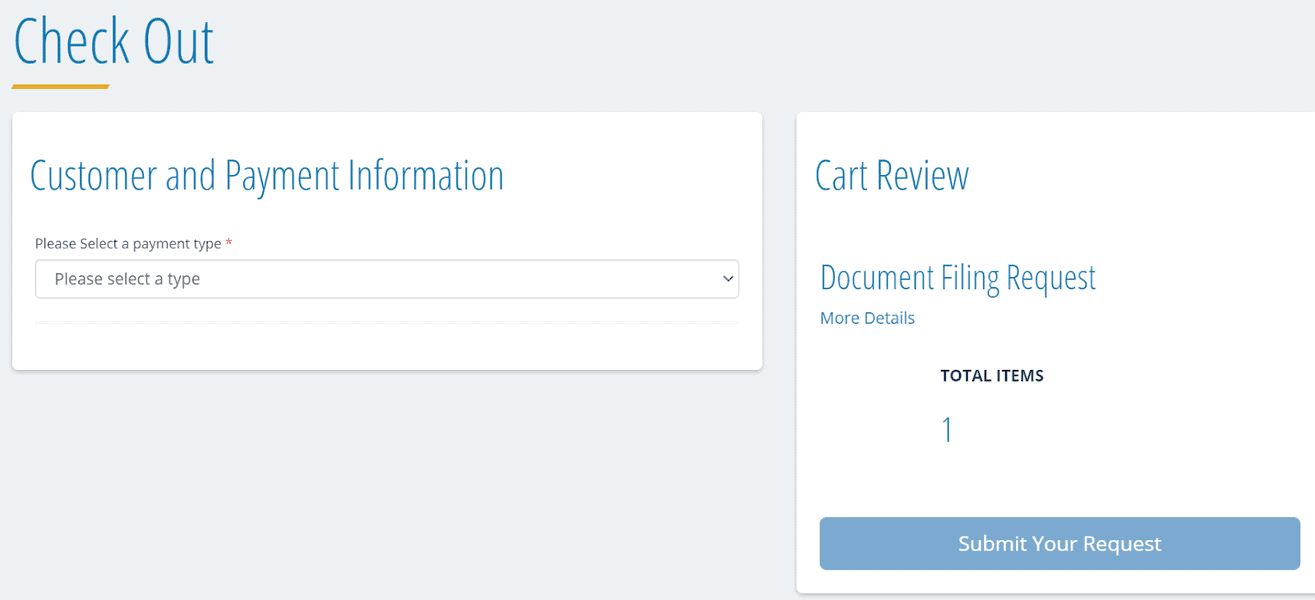

Review your information and continue to checkout.

The fee for filing your Certificate of Cancellation is $200, plus any expediting fees. You can pay by credit card or ACH account.

Click “Submit Your Request” to finish filing. Be aware that the fee won’t be charged until your order is processed.

Physical Filing

If you’re filing physically, print out your Certificate of Cancellation from earlier. You’ll also have to fill out and print a Filing Cover Memo.

Include a check payable to the “Delaware Secretary of State” covering the $200 filing fee, any due taxes, and expediting fees. Do NOT staple your papers together.

In-person filing at the Division of Corporations is by appointment only. Call 302-739-3077 to make an appointment.

Otherwise, you can file by mail to:

Delaware Division of Corporations

401 Federal Street – Suite 4

Dover, DE 19901

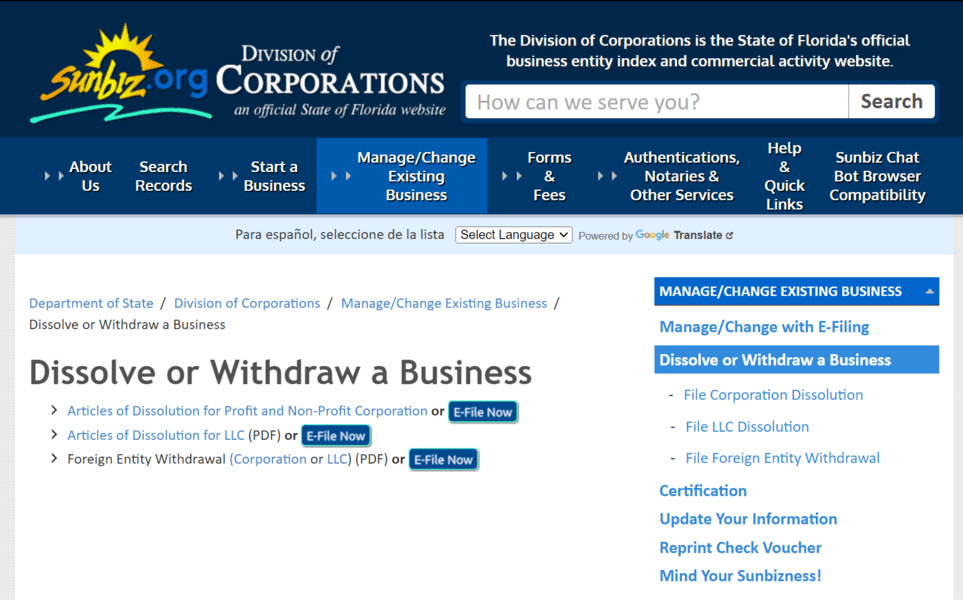

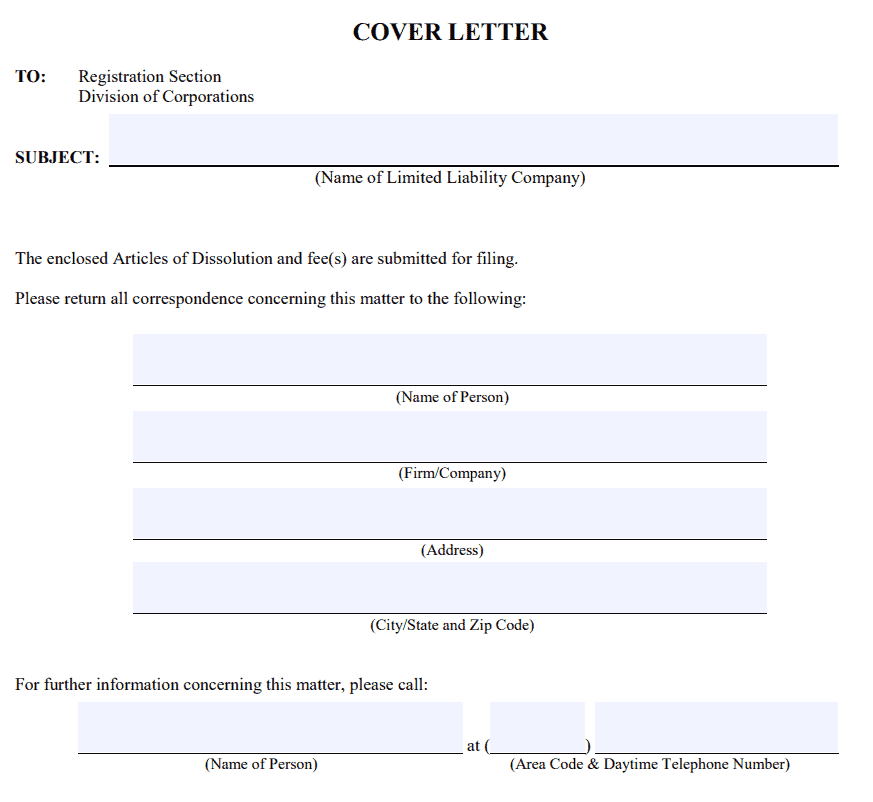

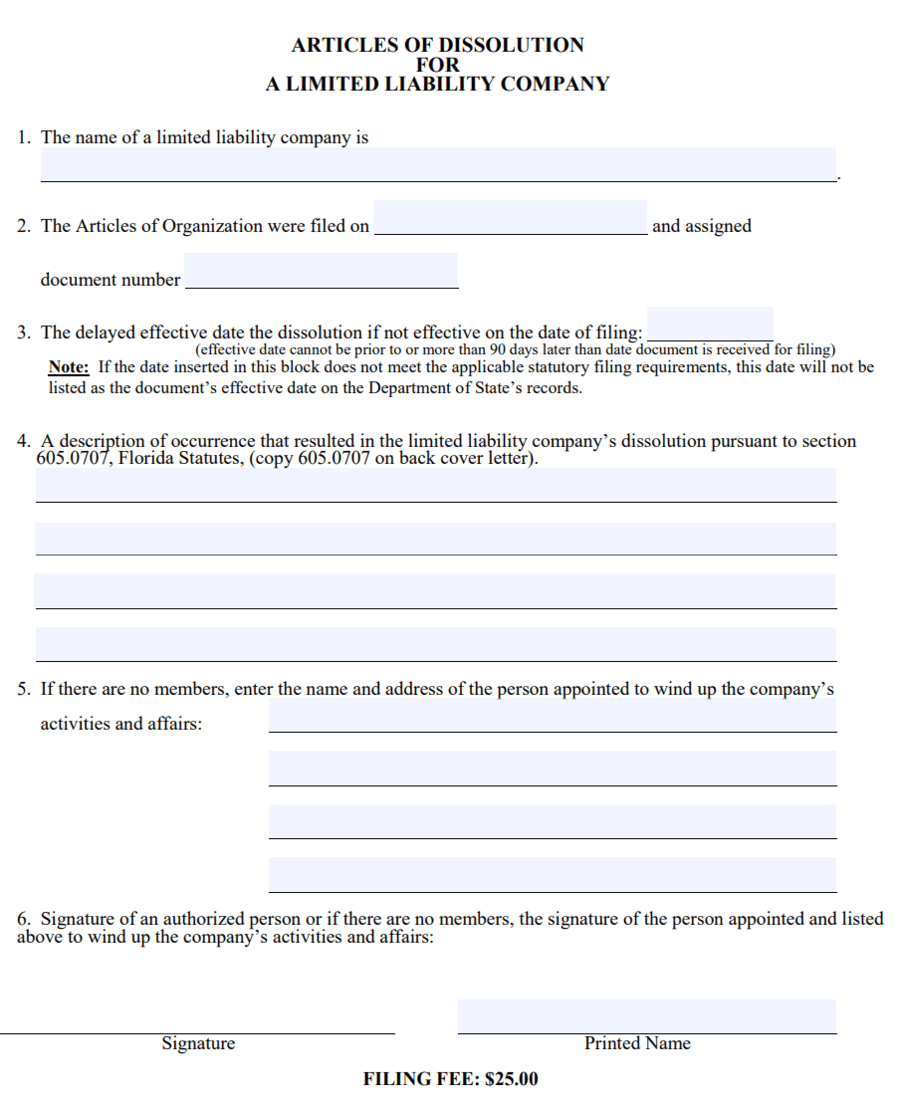

Florida

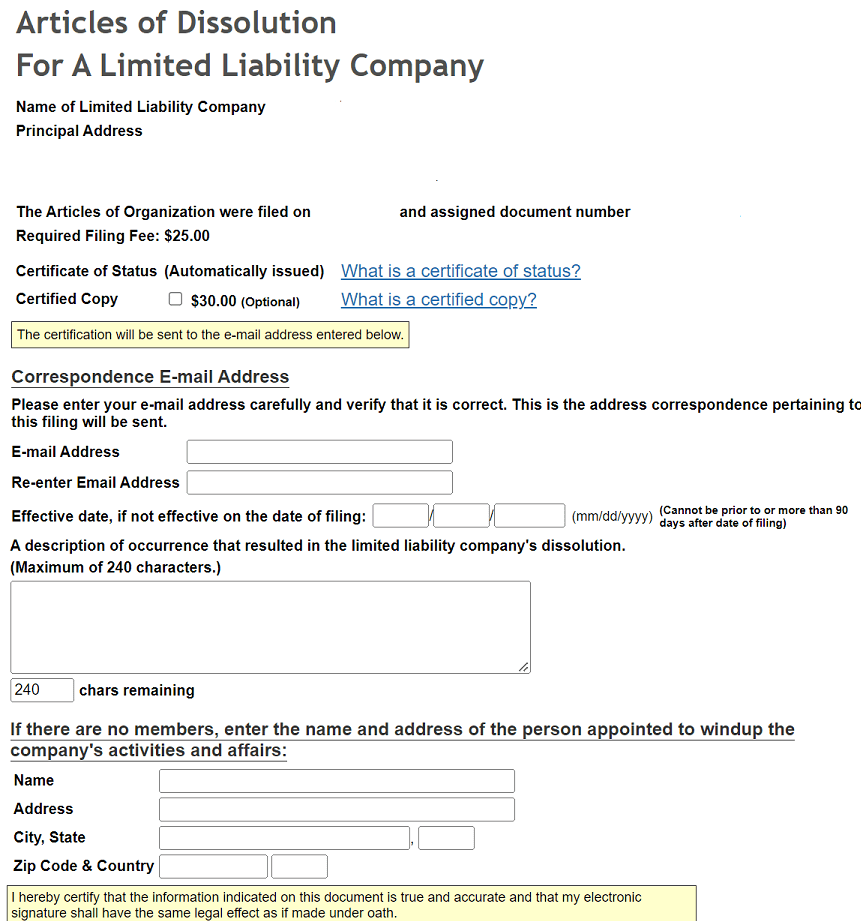

In Florida, the Division of Corporations processes dissolutions. To start, go to their site to Dissolve or Withdraw a Business.

You’ll see that next to “Articles of Dissolution for LLC,” there are options to either download and mail the document or file it online.

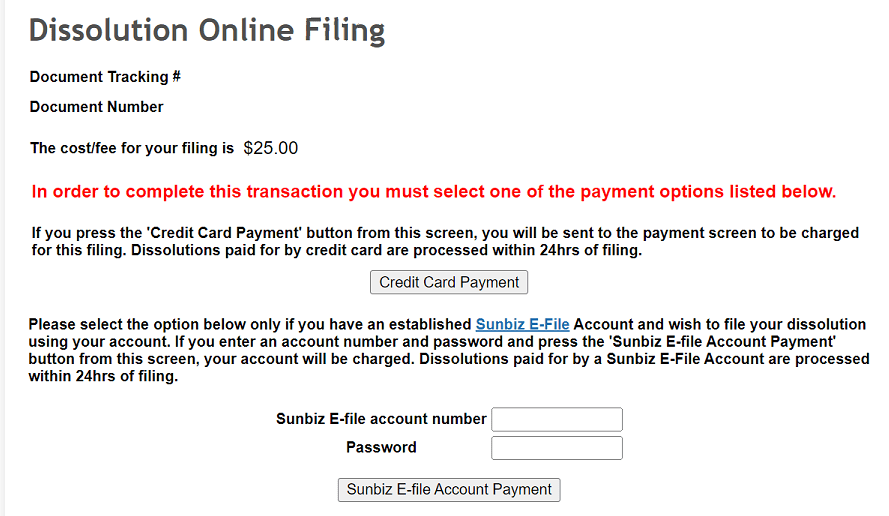

In both cases, the filing fee is $25.

Read on to see which option is better for you.

Mail Filing

In the PDF link, you’ll find a variety of documents. But first, fill out the Cover Letter. This tells the Division of Corporations where to send your documents once filed.

On the next page, fill out the Articles of Dissolution.

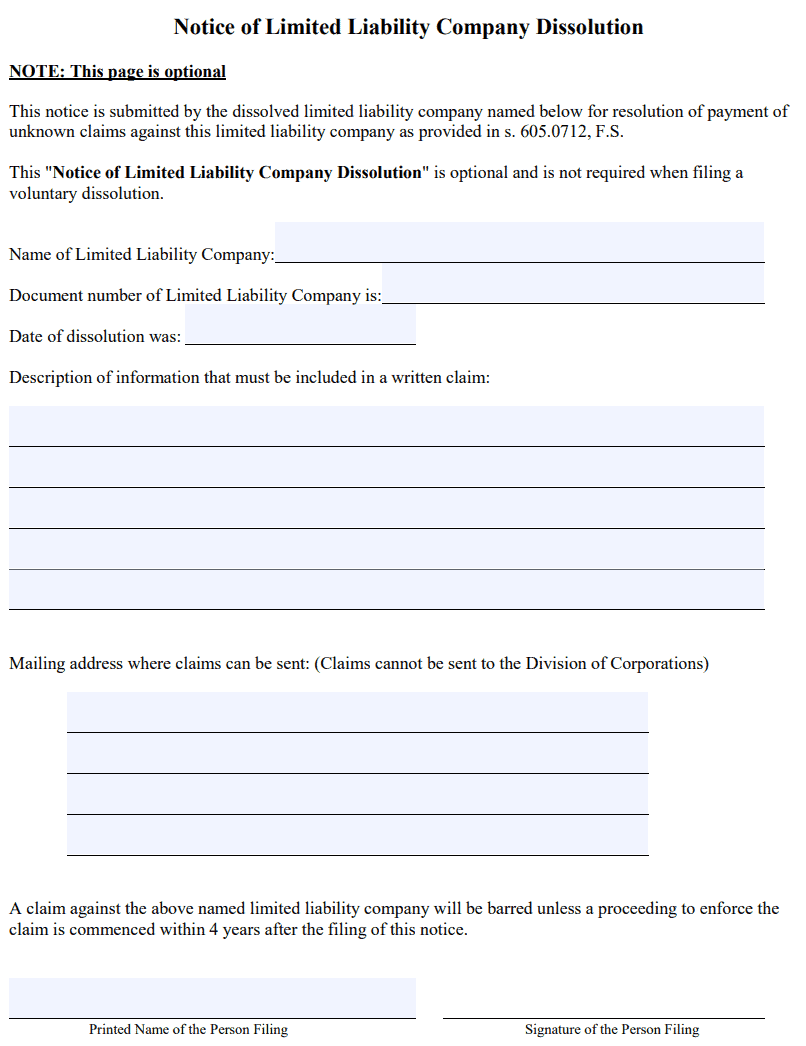

As a nice bonus, the documents include a Notice of Limited Liability Company Dissolution form that you can file for free with your Articles of Dissolution. This will serve as a general public notice to inform any creditors, as required by the state.

The notice is free if you file it with your Articles of Dissolution but $25 if filed on its own, so we recommend you file these two forms together.

Include a $25 check or money order payable to the Florida Department of State, and mail your documents to:

Division of Corporations

PO Box 6327

Tallahassee, FL 32314

Be aware that Florida does NOT accept physical deliveries— if you choose to fill out and print these documents, you must mail them to the Division of Corporations.

Online Filing

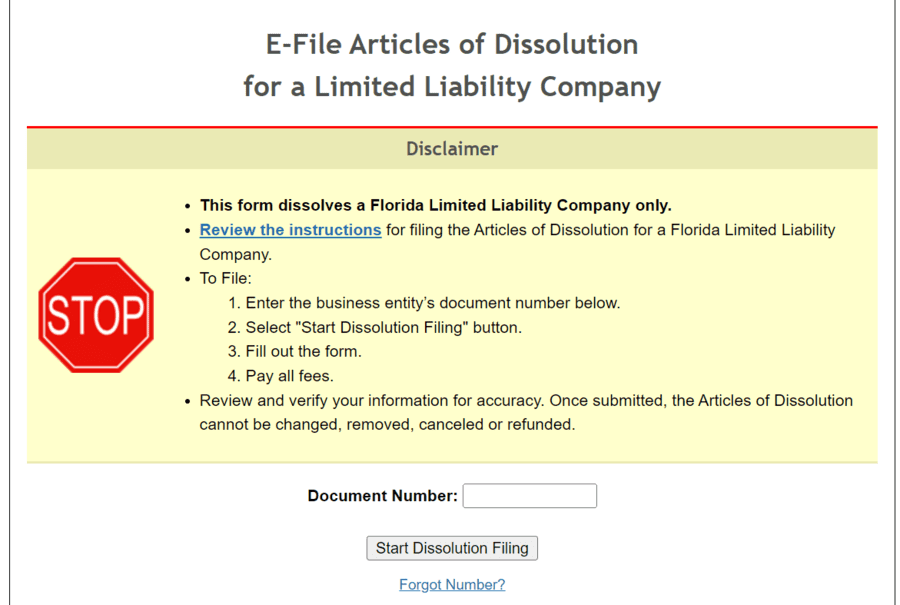

To file online, go to the Division of Corporations’ E-File page for Articles of Dissolution for an LLC.

Enter your business’s document number and click “Start Dissolution Filing.” If you don’t remember your document number, you can search for it here.

Fill out the form and sign it at the bottom. Click “Continue.”

Confirm your information is correct on the next page, and click “Continue” again.

On this page, select pay by credit card or Sunbiz E-file account.

Finally, submit payment and complete your filing.

Georgia

In Georgia, dissolutions are processed by the Secretary of State’s Corporation Division. You can either file online or by paper.

Online Filing

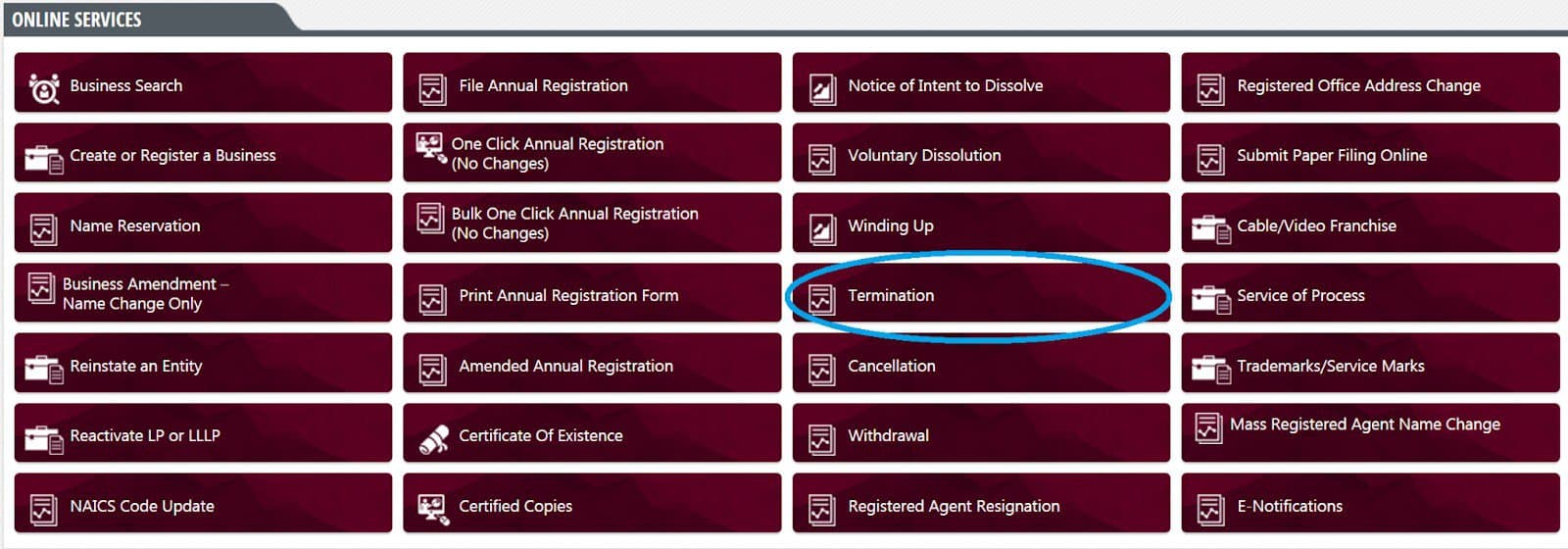

To file online, visit the Corporations Division’s eCorp website. Log in or make an account, and click the “Termination” button from the home page. Don’t worry about the forms for dissolution, winding up, or cancellation— those are optional or for other business types.

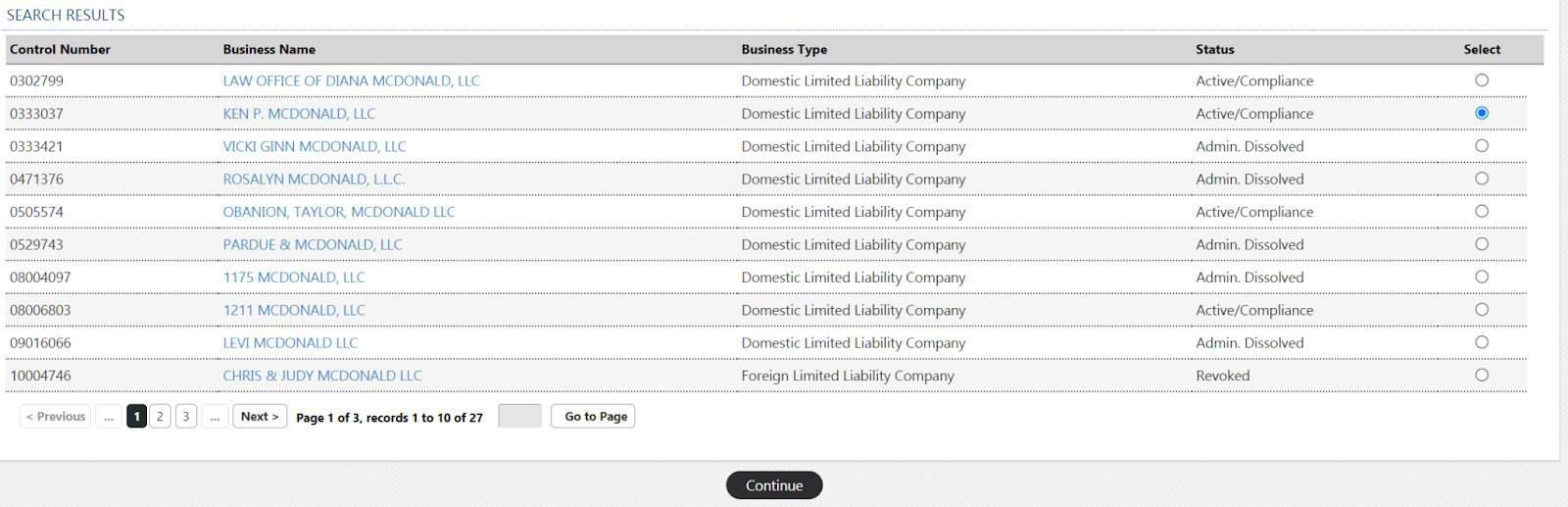

Search for your business and select it from the list using the button on the right. Then, scroll to the bottom and click “Continue.”

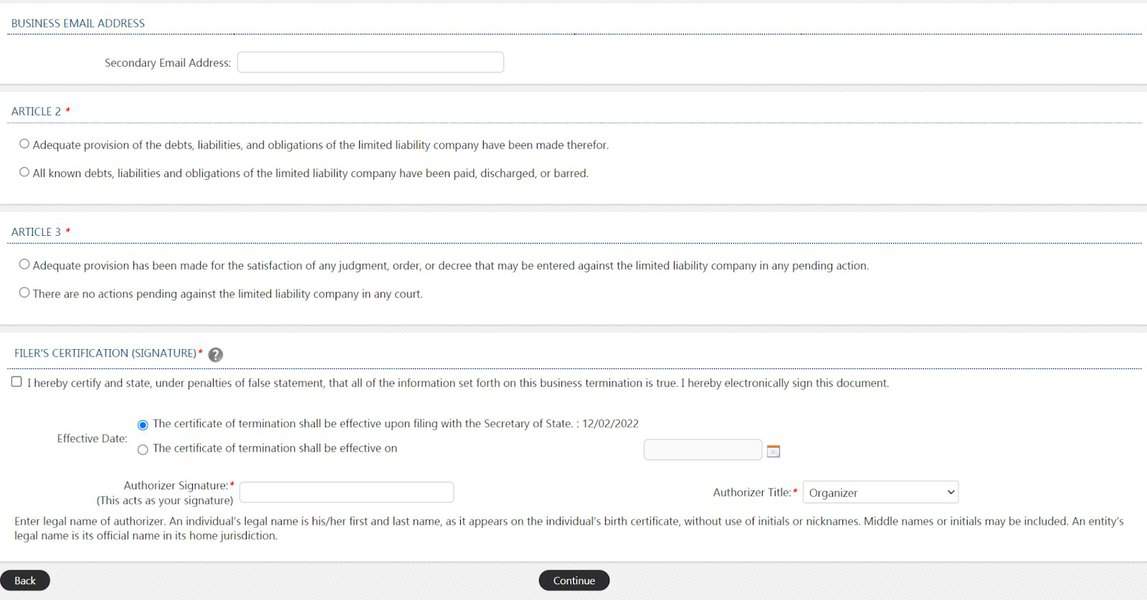

Fill out the next page, acknowledging that you’ve settled or provided for all debts, liabilities, obligations, and claims.

If you’d like your termination to take effect on a different day, specify one in the field below.

Continue to the next page to review your filing and submit it.

Paper Filing

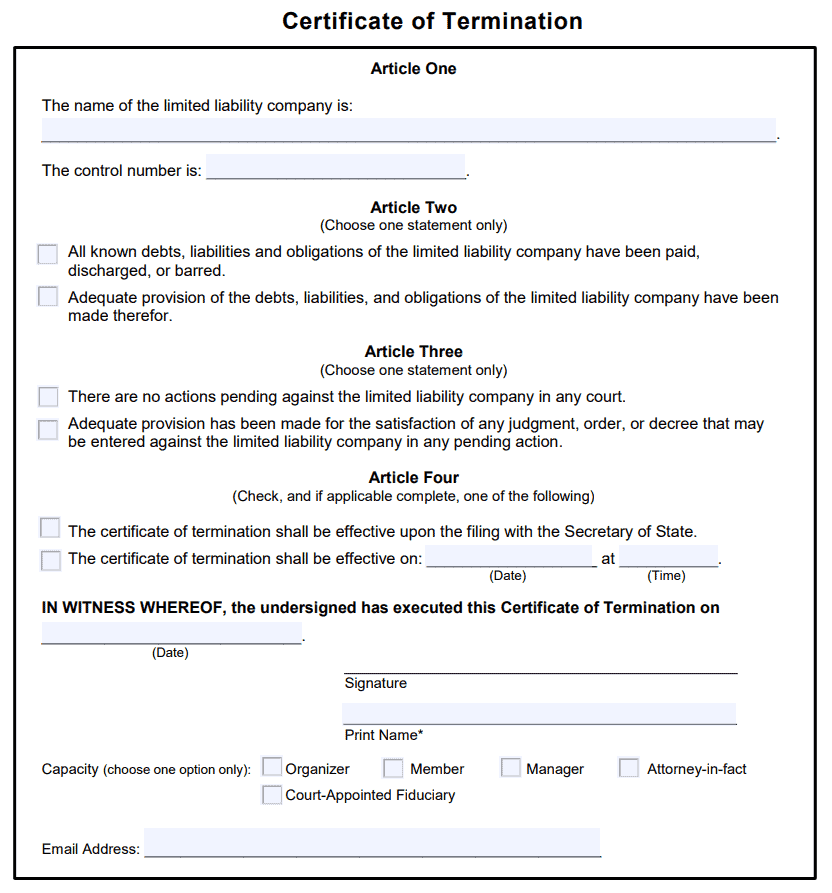

If you’d like to file by mail or in person, download the Certificate of Termination PDF, fill it out, and print it.

Be aware that filing papers incurs a $10 service charge. If you’re filing by mail, you can pay by check, certified bank check, or money order. Cash is NOT accepted.

Deliver your documents and payment to:

2 MLK Jr. Drive

Suite 314, Floyd West Tower

Atlanta, Georgia 30334-1530

Hawaii

In Hawaii, you can file your Articles of Termination online or by paper. The fee is $25.

Online Filing

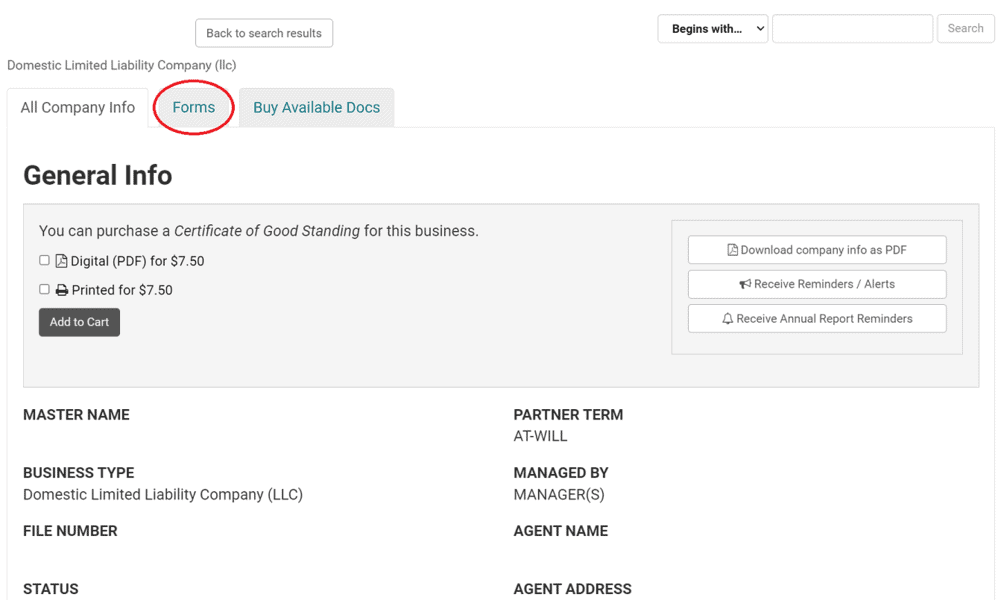

To file online, go to the Hawaii Business Express website and either log in or create an account.

Search for your business, and click on it to view your LLC’s page.

Near the top, select “Forms.”

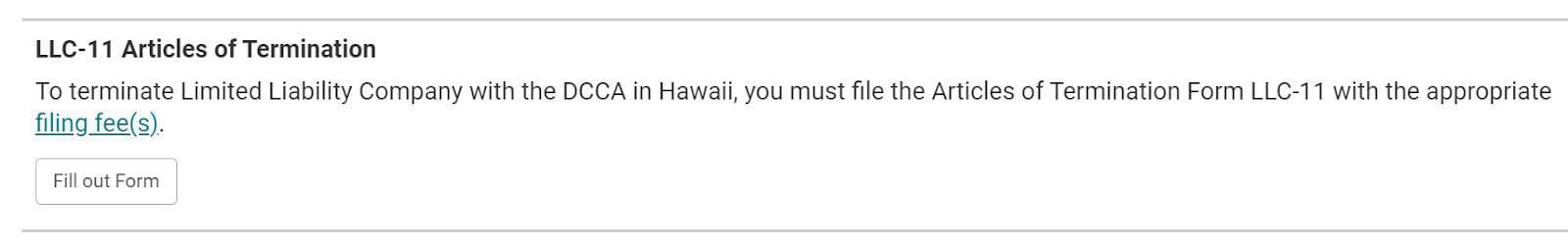

Scroll down to “LLC-11 Articles of Termination”. Then, click “Fill out Form.”

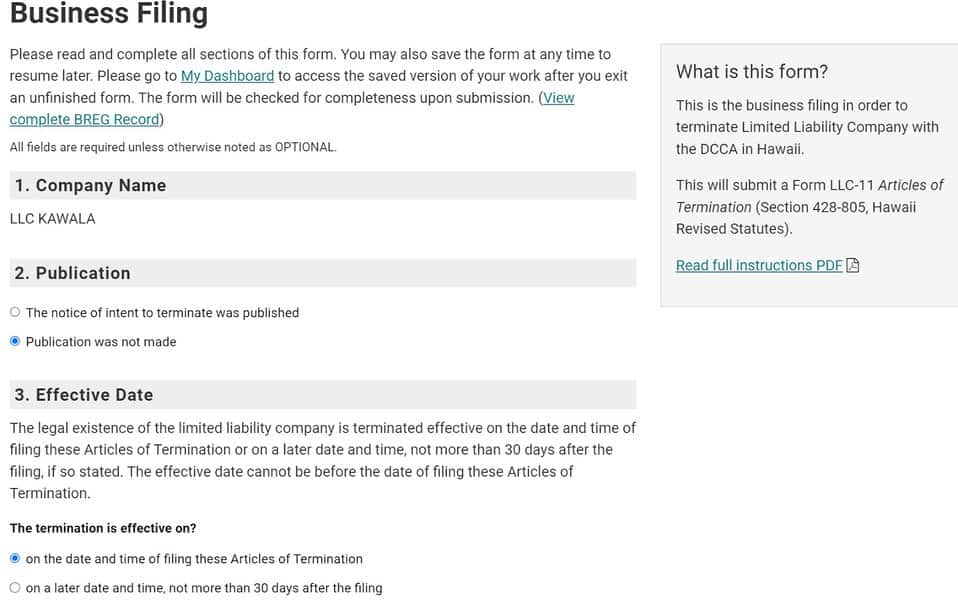

Fill out the form. Be careful not to confuse the “Publication” section for the creditors’ notice from earlier— it’s asking if you published a termination notice in a local newspaper.

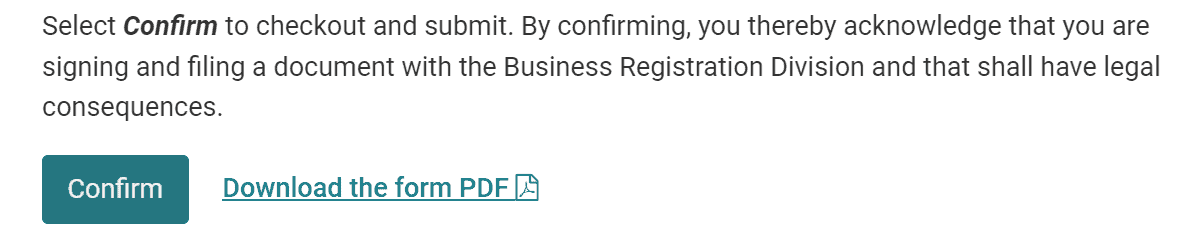

On the next page, review your information, and click “Confirm” to file and pay for your Articles of Termination.

Paper Filing

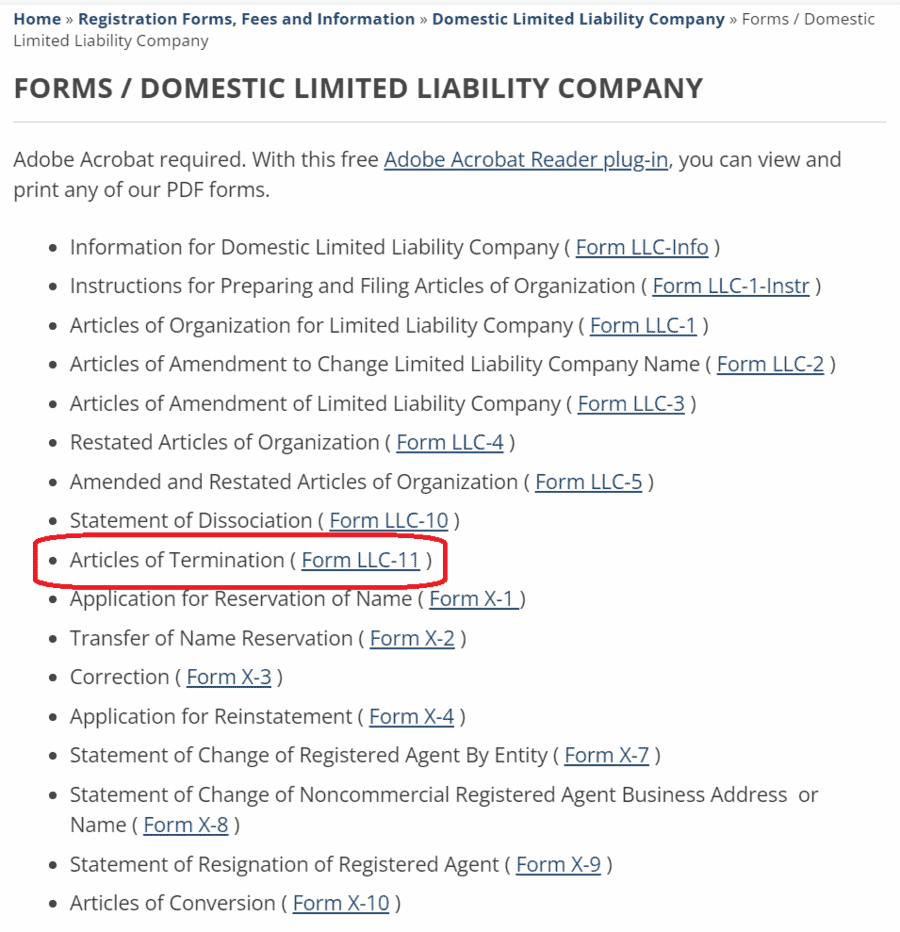

To file by paper, go to the Hawaii Department of Commerce and Consumer Affairs page for Domestic Limited Liability Company Forms, scroll down, and select “Articles of Termination.”

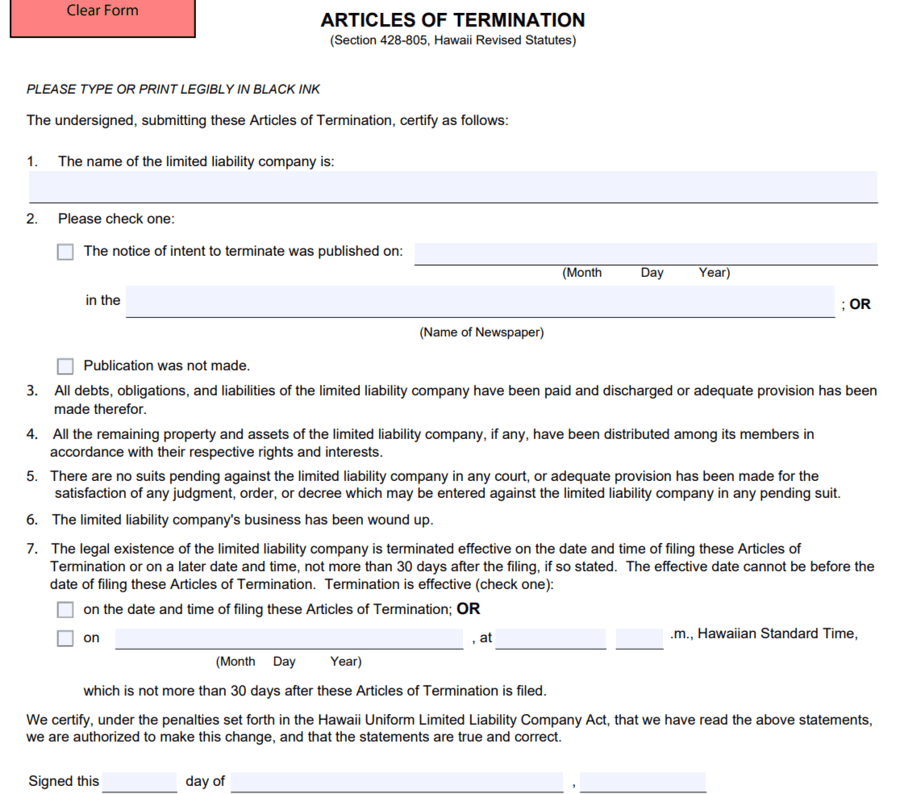

Fill out the Articles of Termination. Notice that you must confirm that all your debts, obligations, liabilities, and suits have been settled, that your properties and assets have been distributed, and that your business has been fully wound down.

If you printed out the form by hand, you must fill it out in black ink.

You can pay the $25 filing fee by cash, certified/cashier’s check, bank/postal money order, or credit card.

Make checks or money orders payable to “Department of Commerce and Consumer Affairs” and mail them to:

Department of Commerce and Consumer Affairs

Business Registration Division

PO Box 40

Honolulu, HI 96810

Or deliver them to:

335 Merchant Street, Room 201

Honolulu, HI 96813

Or you can scan them and email or fax them with a credit card payment to:

[email protected]

(808) 586-2733

Idaho

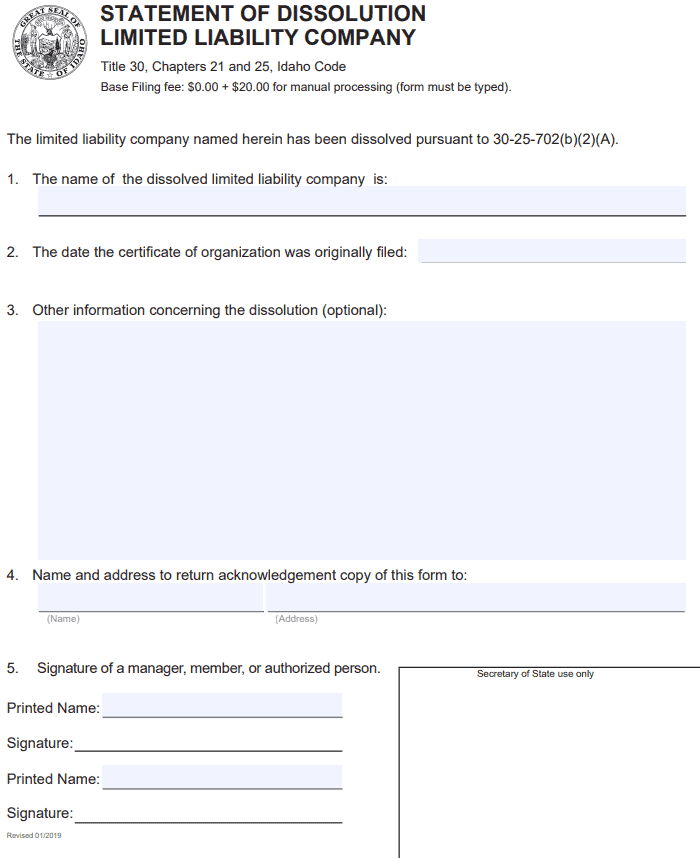

In Idaho, the process to officially dissolve your LLC is to file the Articles of Dissolution with the Idaho Secretary of State.

You can file your dissolution online or by paper. Read on for instructions on each of these options.

Online Filing

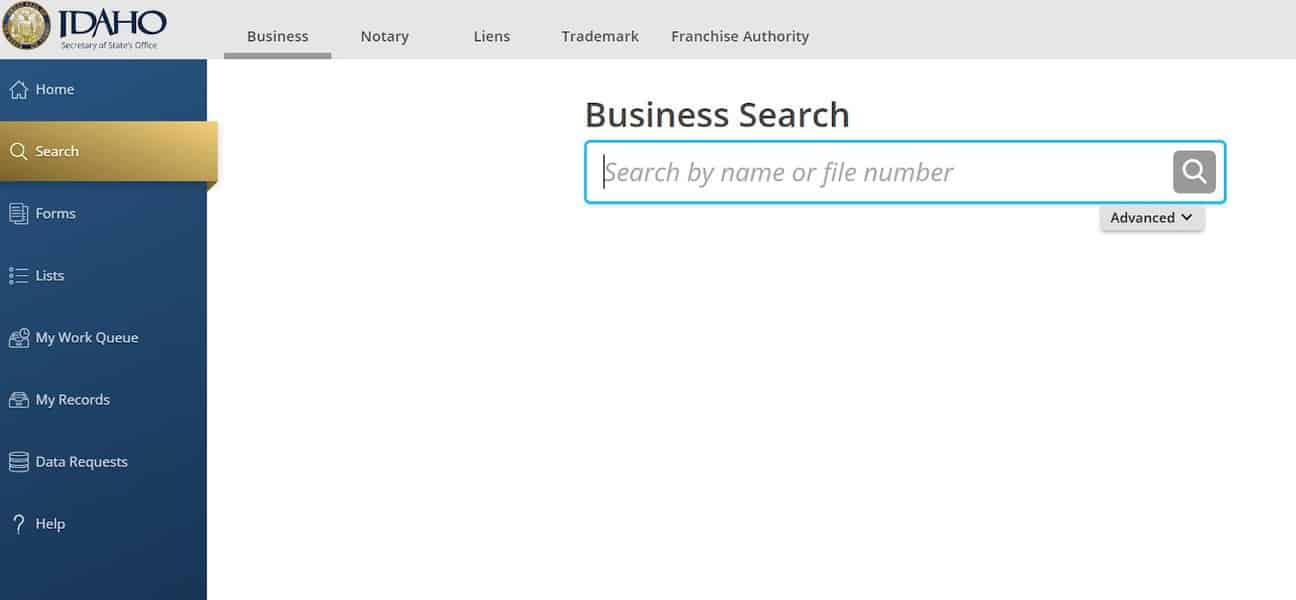

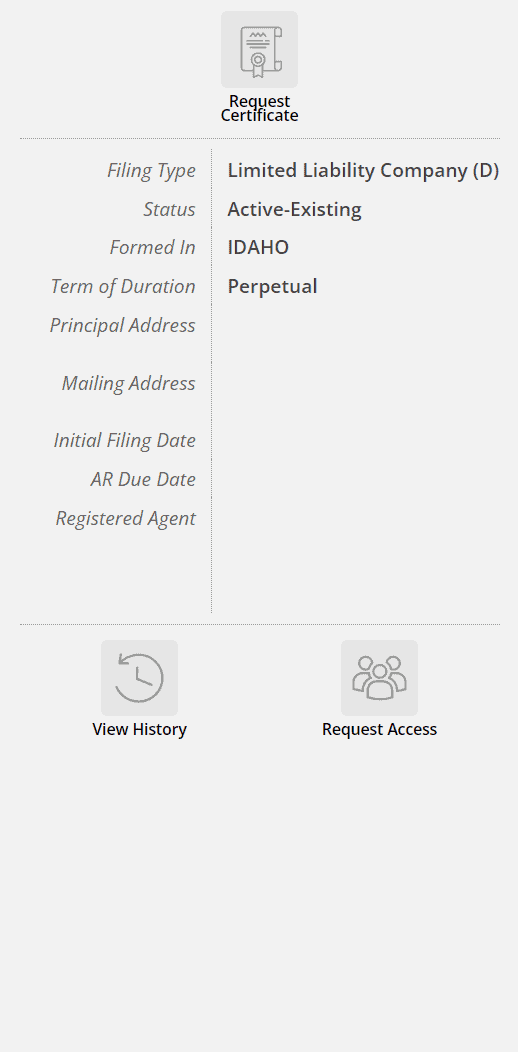

If you’d like to file online, visit Idaho’s Online Business Services website and log in or create an account.

From the left-hand menu, click on the Business Search icon.

Search for your business and select it from the list. A menu should appear on the right-hand side.

Click on “Request Access” to send an email to the business holder’s email address on file.

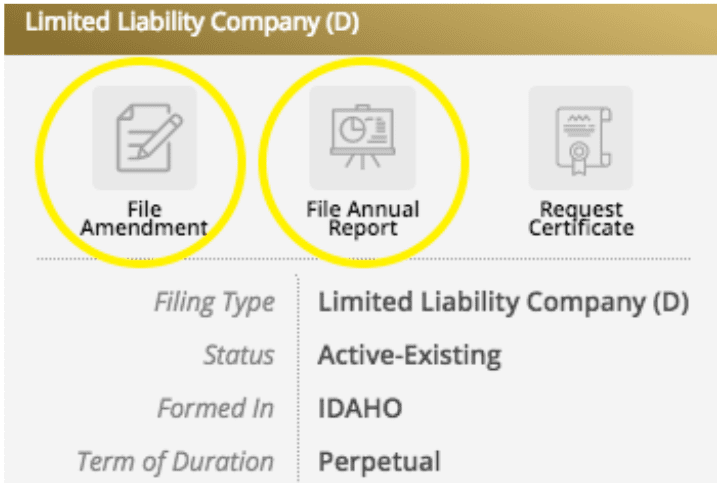

Once you’ve verified that this business belongs to you, go back to your listing. Next to “Request Certificate,” there should be two new buttons.

Click on “File Amendment” and fill out and submit your Articles of Termination.

Filing online is free and will be processed immediately.

Paper Filing

Suppose you’d like to file by paper; download and fill out the Articles of Dissolution PDF. Unfortunately, the Secretary of State’s office will only accept typed forms— you cannot fill them out by hand.

Paper filings cost $20.

Prepare a check or money order payable to the Secretary of State and mail or deliver your document and fee to:

Office of the Secretary of State

450 N 4th Street

PO Box 83720

Boise ID 83720-0080

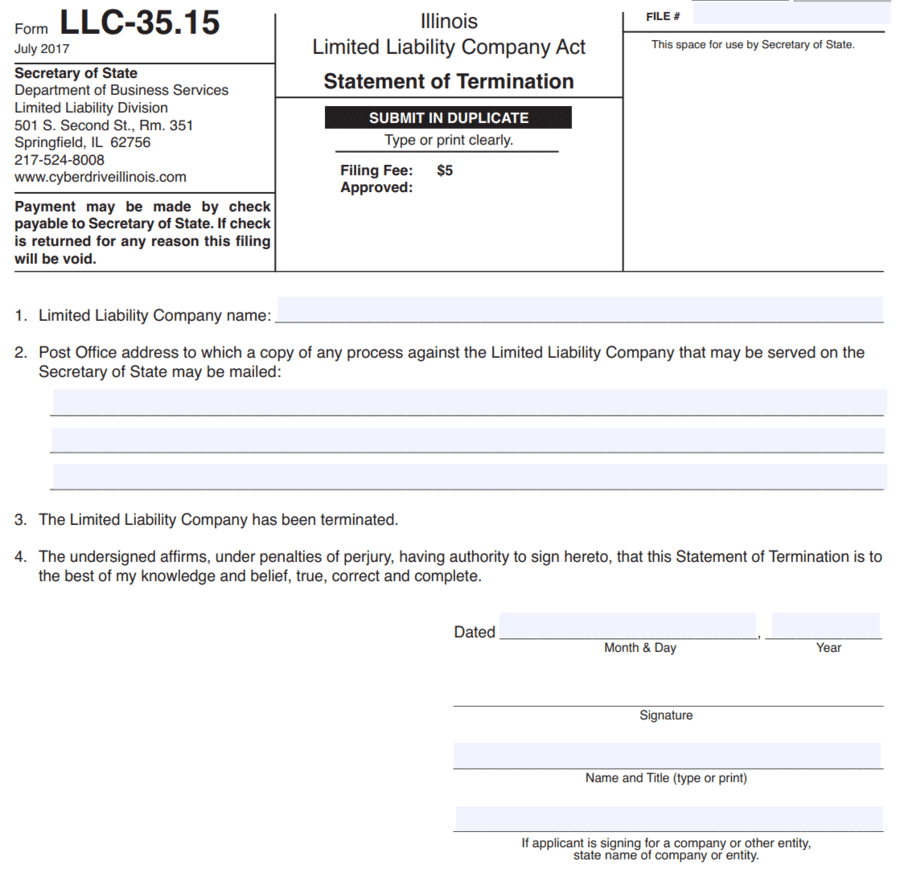

Illinois

Once you’ve finished settling your affairs, the last step is to file your Statement of Termination with the Illinois Secretary of State.

To start, download the Statement of Termination PDF.

Fill out the form and print it. Include a $5 check payable to the Illinois Secretary of State to cover the filing fee— cash will not be accepted.

Mail or deliver your form to either:

Secretary of State

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62756

Or the Chicago address:

Secretary of State

Department of Business Services

Limited Liability Division

69 W. Washington St., Ste. 1240

Chicago, IL 60602

Indiana

In Indiana, you must file your dissolution with the Secretary of State before closing your business. You can file your dissolution papers online or on paper.

Online Filing

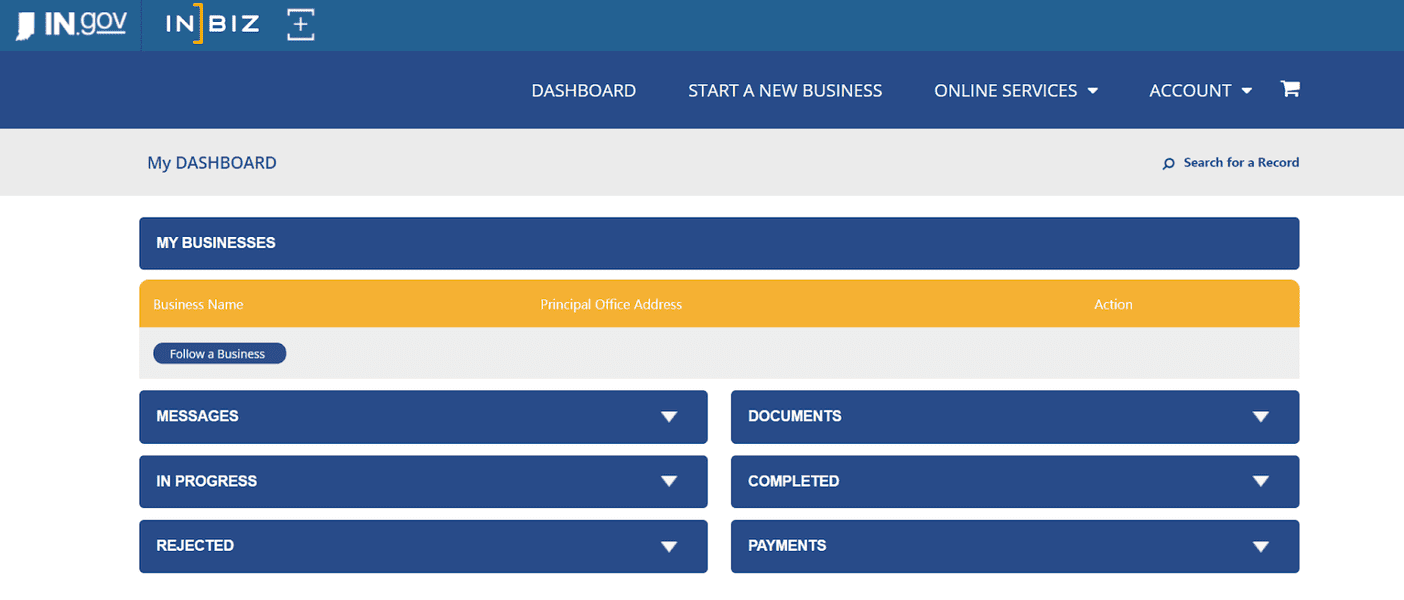

To file online, visit INBiz, and log in or create an account.

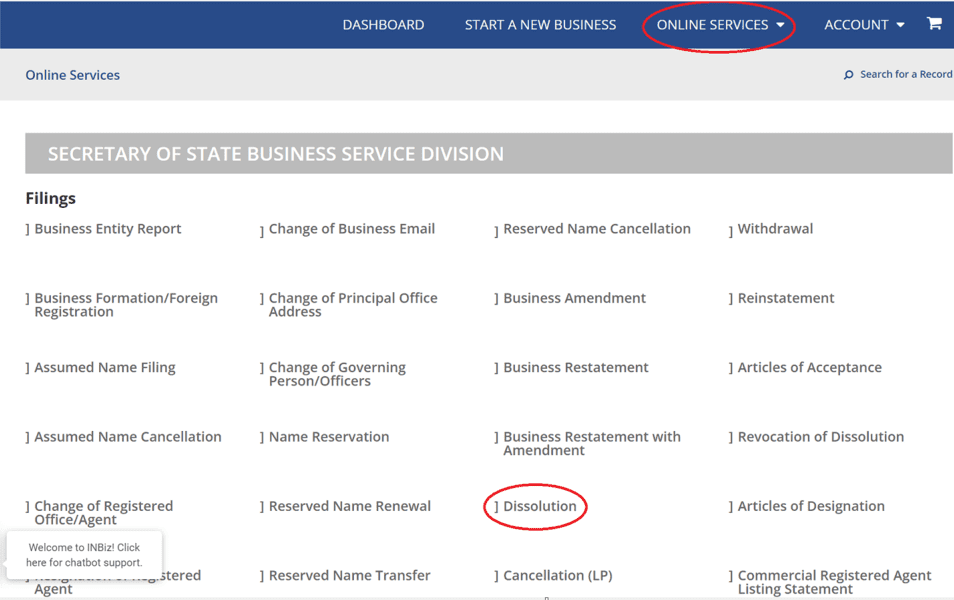

Click on the “Online Services” tab, and select “Dissolution” from the results.

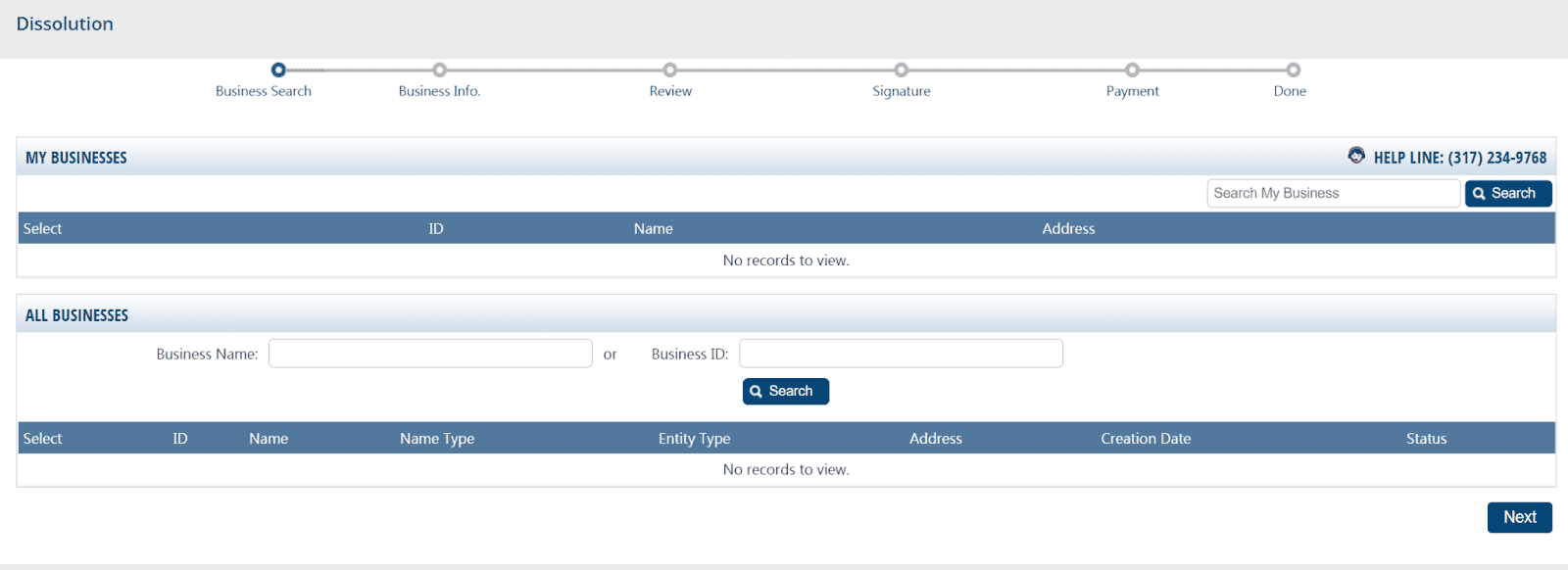

Go through the following few pages to search for your LLC, fill out the required information, and sign your filing.

The fee is $20 for the filing. There’s also an additional processing fee for paying by credit card ($1) and e-check ($1.50).

Once you submit your payment, you’ve completed your dissolution filing.

Paper Filing

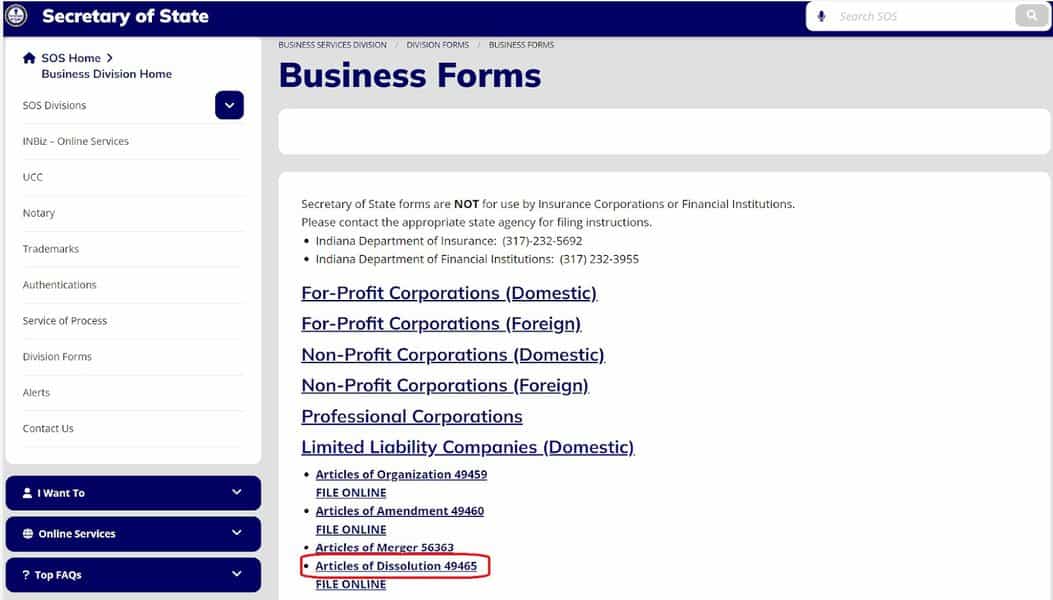

To file by paper, visit the Secretary of State’s page for Business Forms, scroll down to the domestic LLCs section and select “Articles of Dissolution 49465” to download the form.

Fill out and print your document, and either mail or deliver it to:

Business Services Division

302 West Washington Street, Room E-018

Indianapolis, IN 46204

The filing fee is $30, paid by check or money order to the Secretary of State.

Due to COVID-19 restrictions, the Business Services Division is not accepting walk-ins. However, if you’d like to deliver your documents by hand, you can make an appointment online here.

Iowa

In Iowa, officially dissolving your LLC includes filing a Statement of Dissolution and a Statement of Termination.

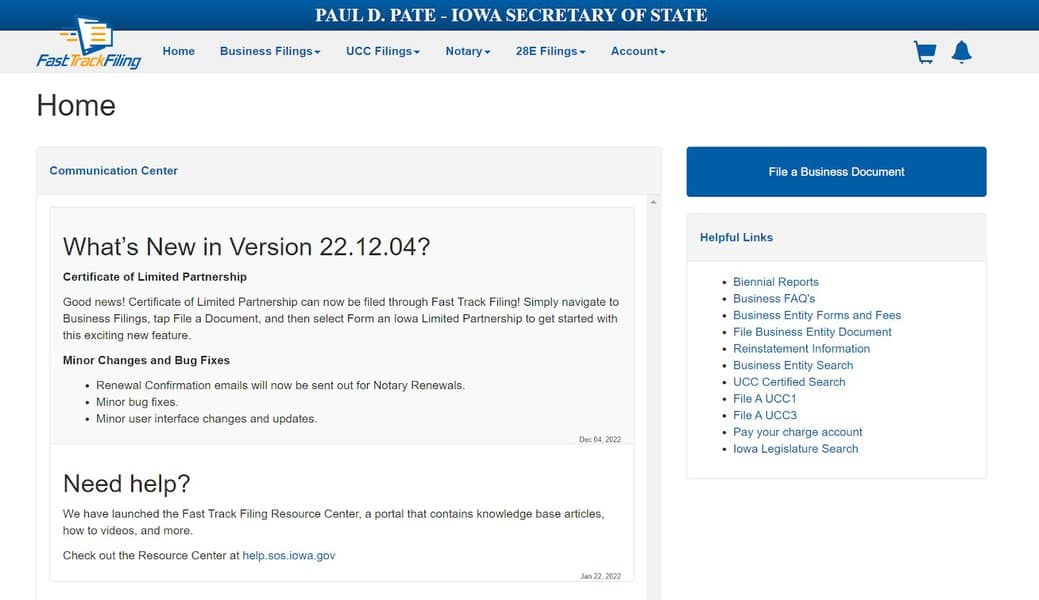

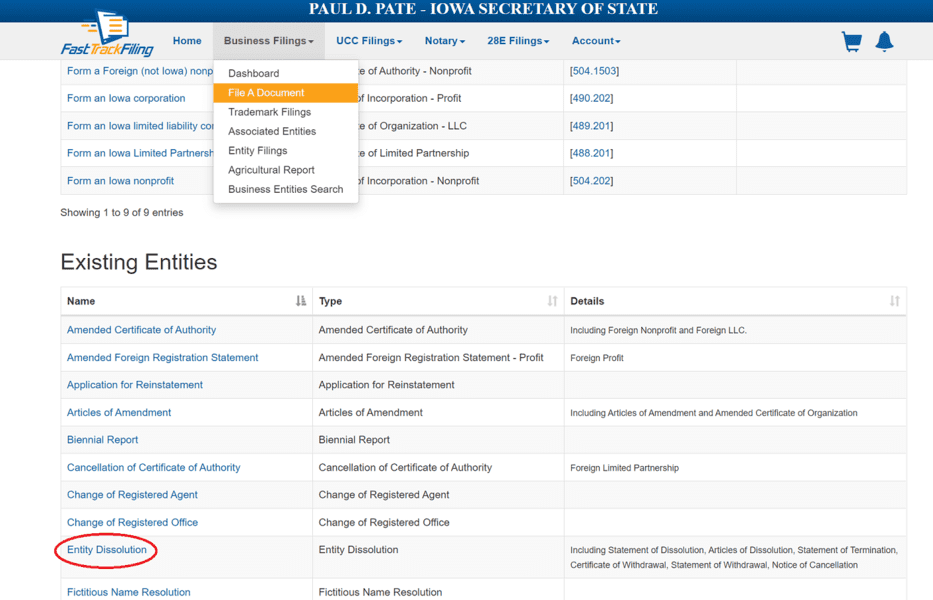

First, go to Iowa’s Fast Track Filing website to file either of them.

From the top menu, hover over “Business Filings” and select “File a Document.”

Scroll down to the “Existing Entities” section, and click on “Entity Dissolution.”

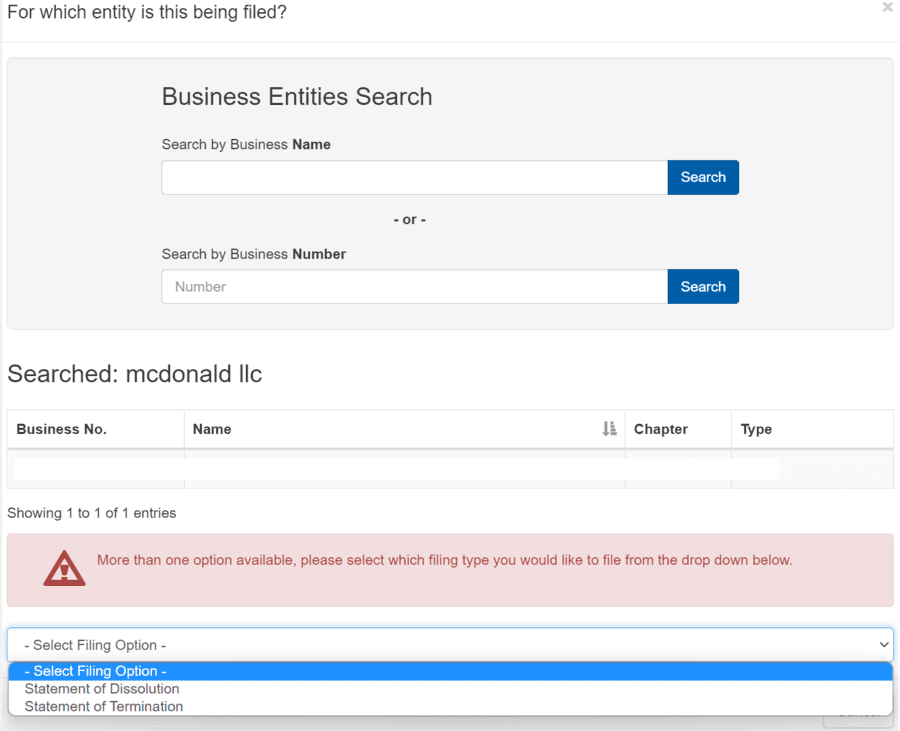

Search for your business, and select it from the list. Below, there should also be a drop-down menu from which you can choose the statement you’re filing.

If you’ve just decided to close your LLC and haven’t finished winding up yet, choose “Statement of Dissolution.”

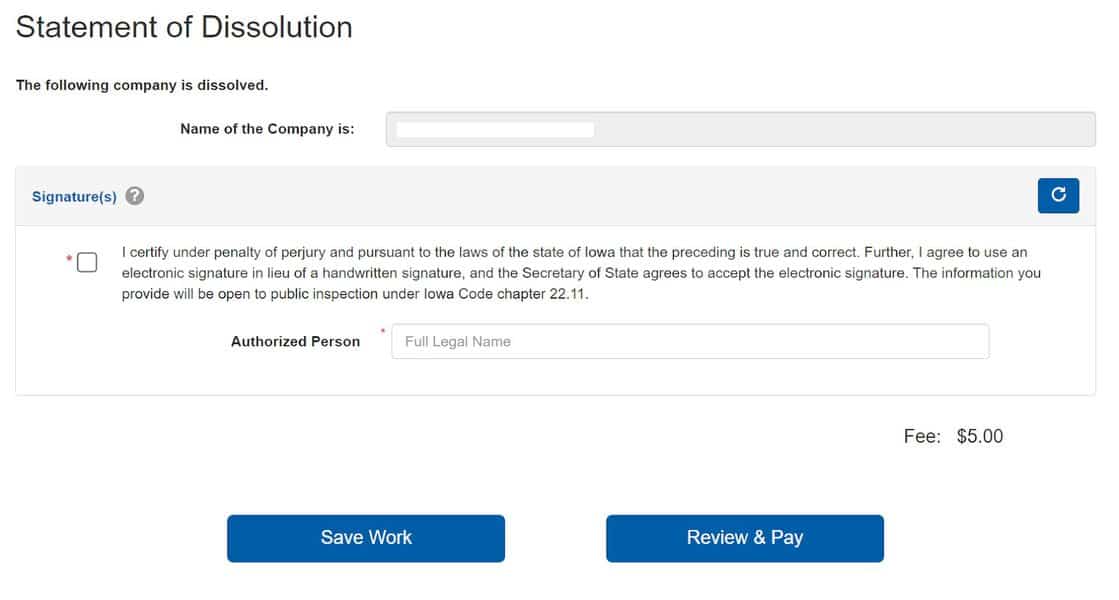

Fill out this next page with your electronic signature.

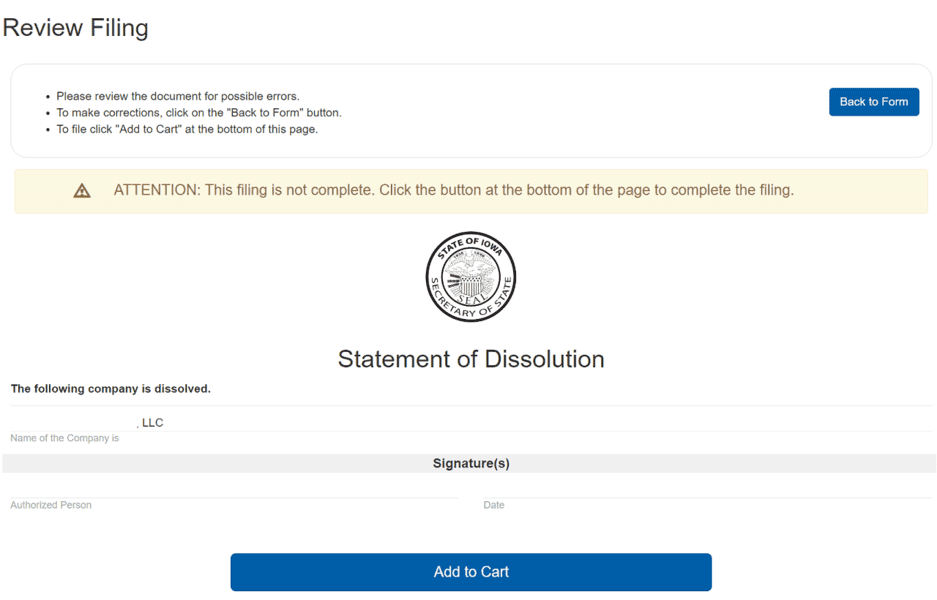

Review your information, and click “Add to Cart” to file your Statement of Dissolution and pay.

Once you’ve finished winding up your business, return to this website and follow the same process to file your Statement of Termination.

The fee for filing the dissolution and termination papers is $5 each.

Kansas

In Kansas, you must file your Certificate of Cancellation to dissolve your business officially. Be aware that your annual report must be up-to-date with the current tax year before you can dissolve.

You can file online or by paper. Read below for full details on both types of filing.

Online Filing

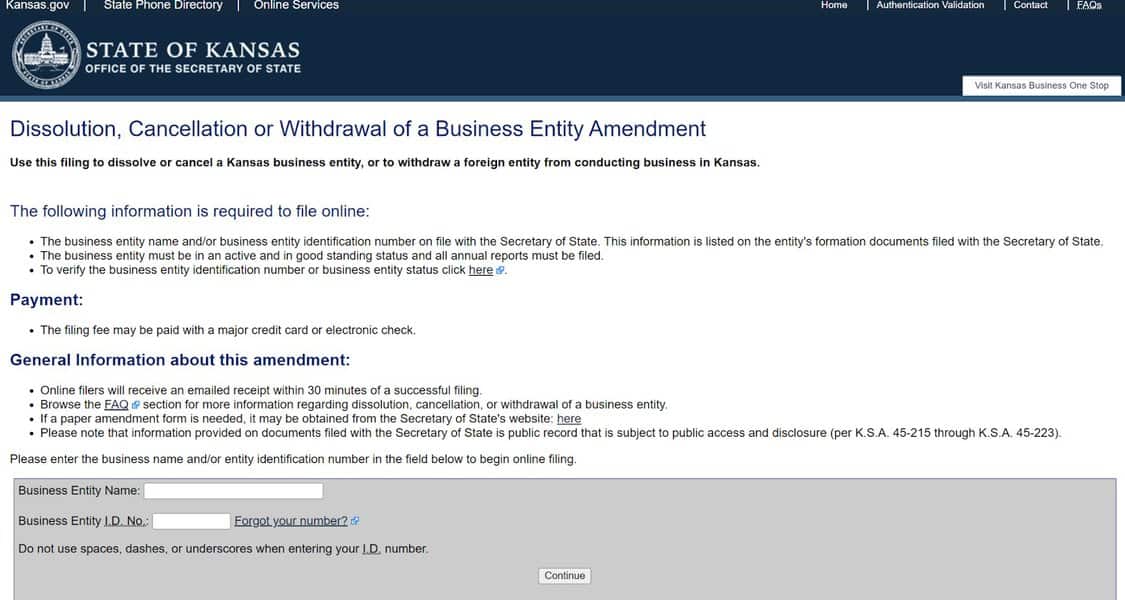

To start, visit the Secretary of State’s page for the Dissolution, Cancellation, or Withdrawal of a Business Entity.

At the bottom, enter your business name and business entity ID number.

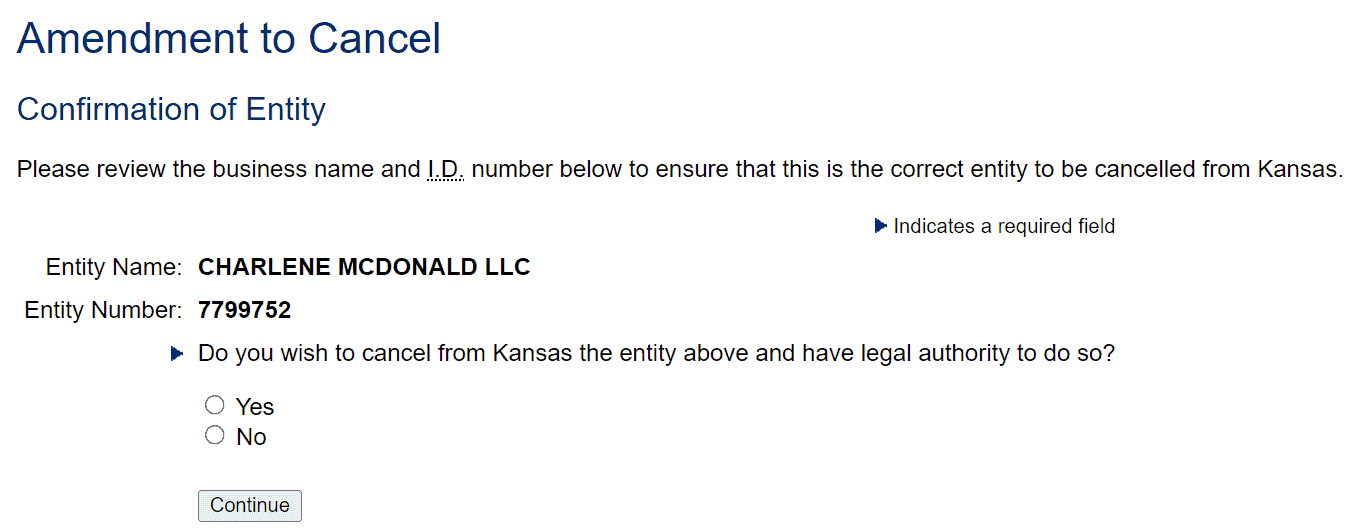

Confirm your business.

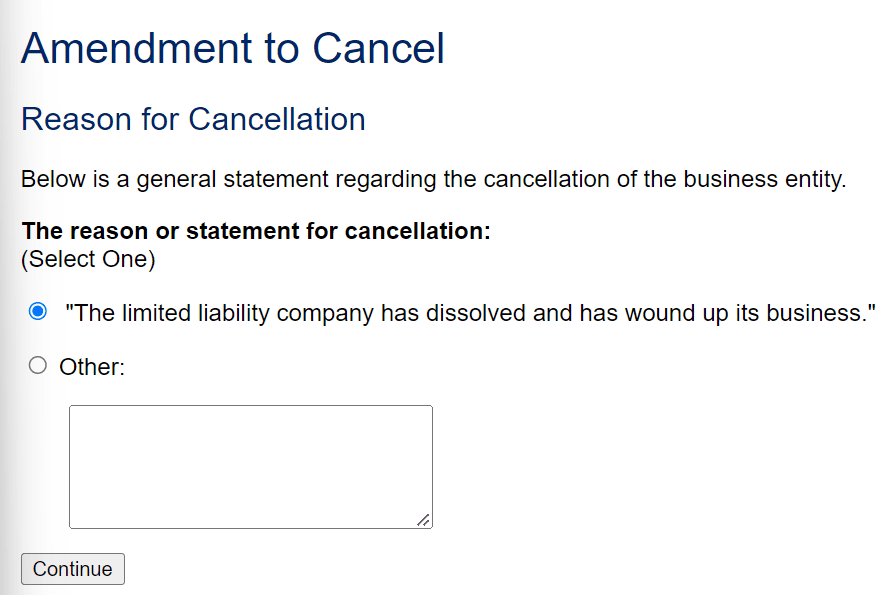

Select the provided statement for cancellation or type in your reason on the next page.

On the next screen, review your information and click “Continue.”

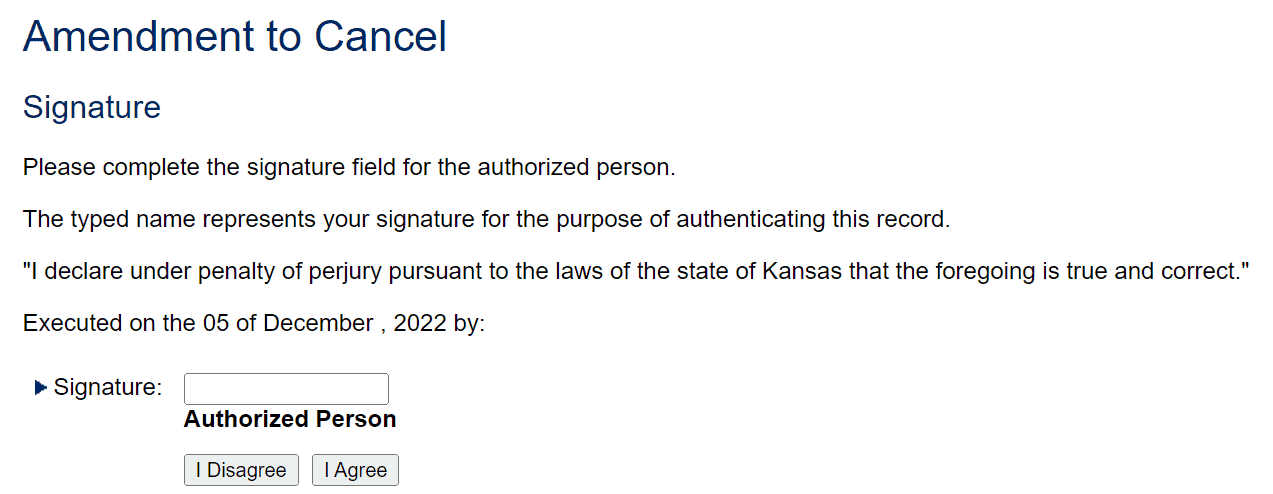

Finally, type your name to sign your Certificate of Cancellation.

Proceed to the payment page, and pay the $30 filing fee by credit card or echeck.

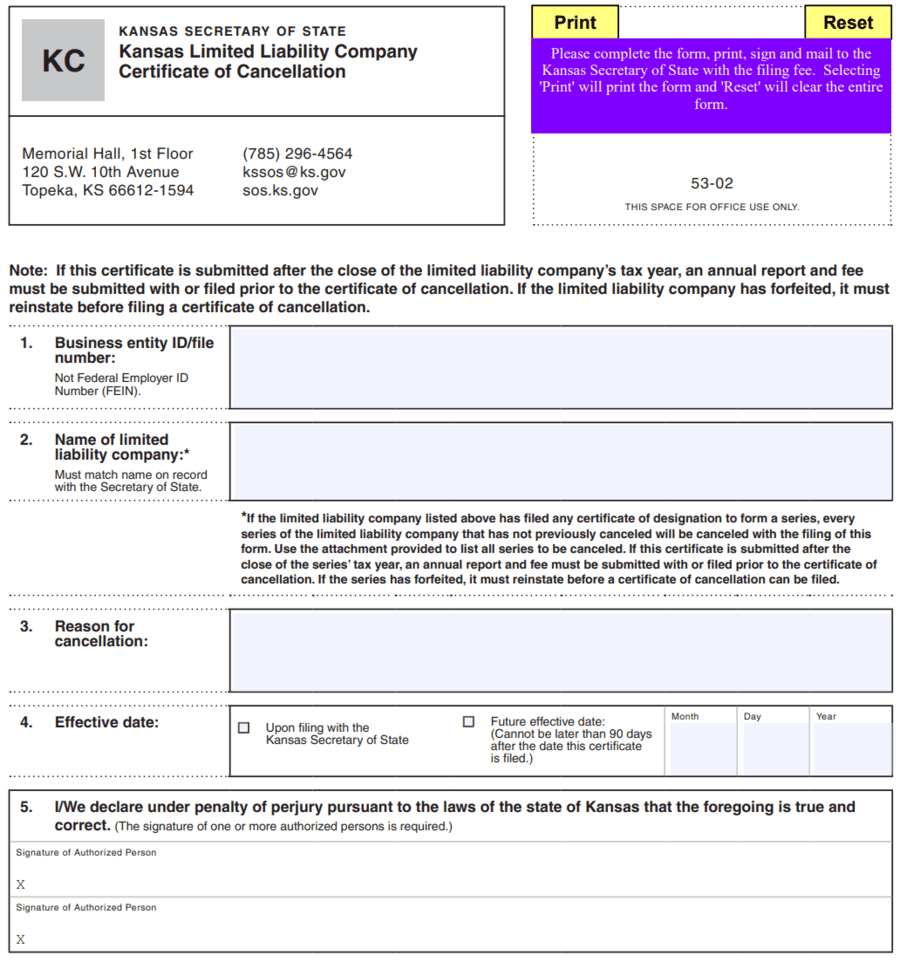

Paper Filing

Download and fill out Kansas’s Certificate of Cancellation.

Print your forms. Make sure not to staple them together.

Prepare a $35 filing fee, payable by check or money order to the Secretary of State or payable by credit card through the filing cover sheet attached to the form. Cash is not accepted.

Mail your documents and payment to:

Business Services

Memorial Hall, 1st Floor

120 S.W. 10th Avenue

Topeka, KS 66612

Kentucky

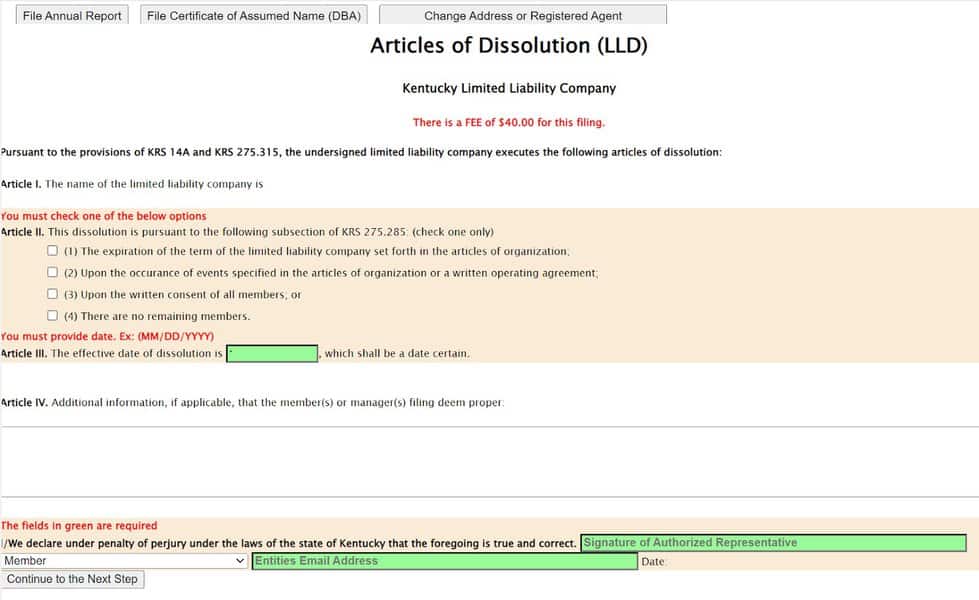

To officially dissolve your LLC, you’ll need to file your Articles of Dissolution with the Kentucky Secretary of State.

You can file your dissolution either online or by paper. Read on to see instructions for both options.

Online Filing

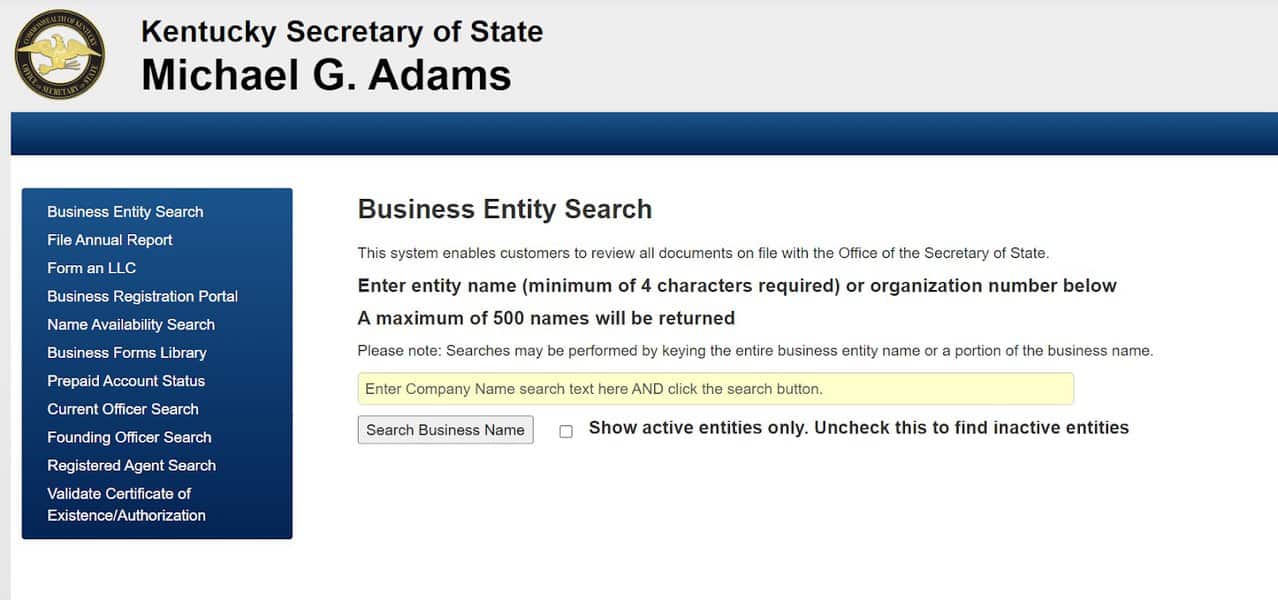

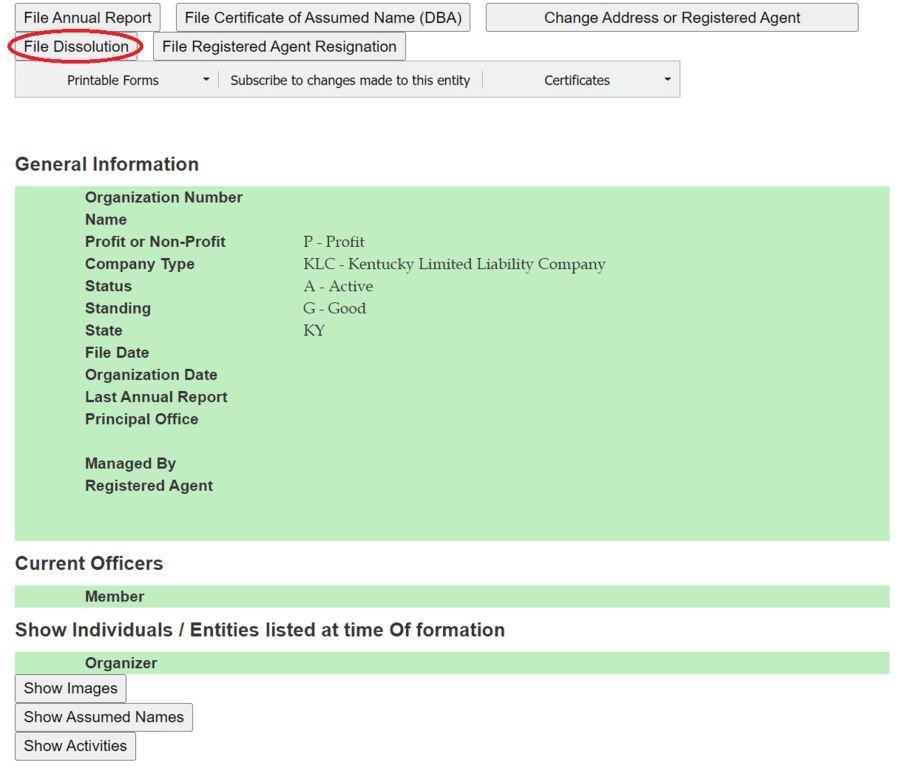

To file your dissolution online, visit Kentucky’s online filing portal and search for your business by name.

From the results, select your LLC to view its information.

At the top, click the “File Dissolution” button.

Fill out the next page and type your name at the bottom to electronically sign your filing.

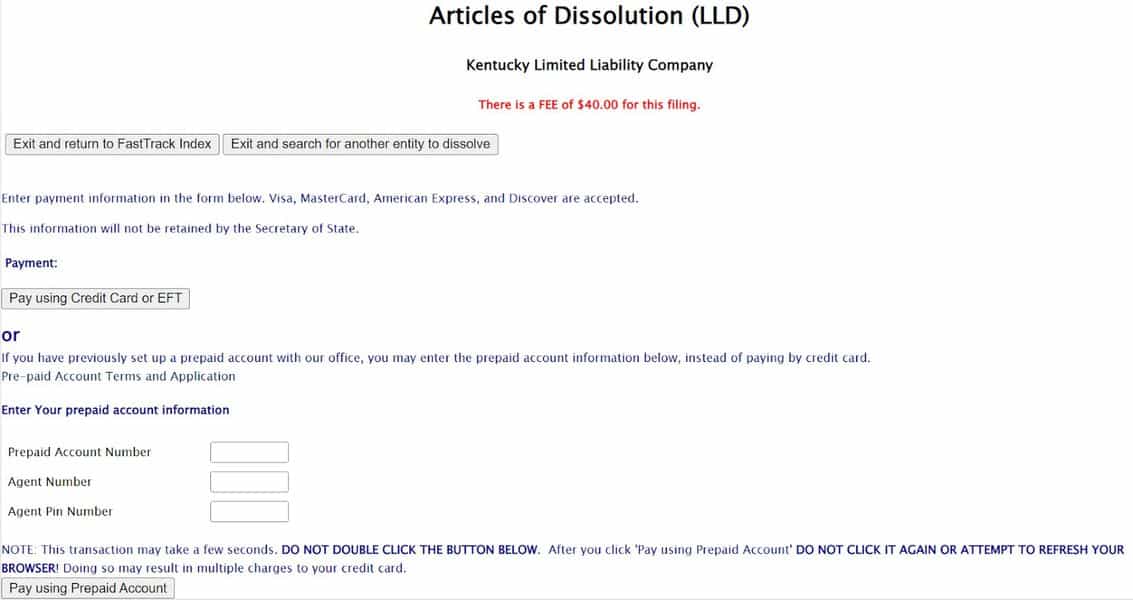

Review your document and proceed to the payment screen.

Pay the $40 filing fee by credit card, EFT, or prepaid account with the Secretary of State’s Office.

Once your payment has been confirmed, your Articles of Dissolution will be filed.

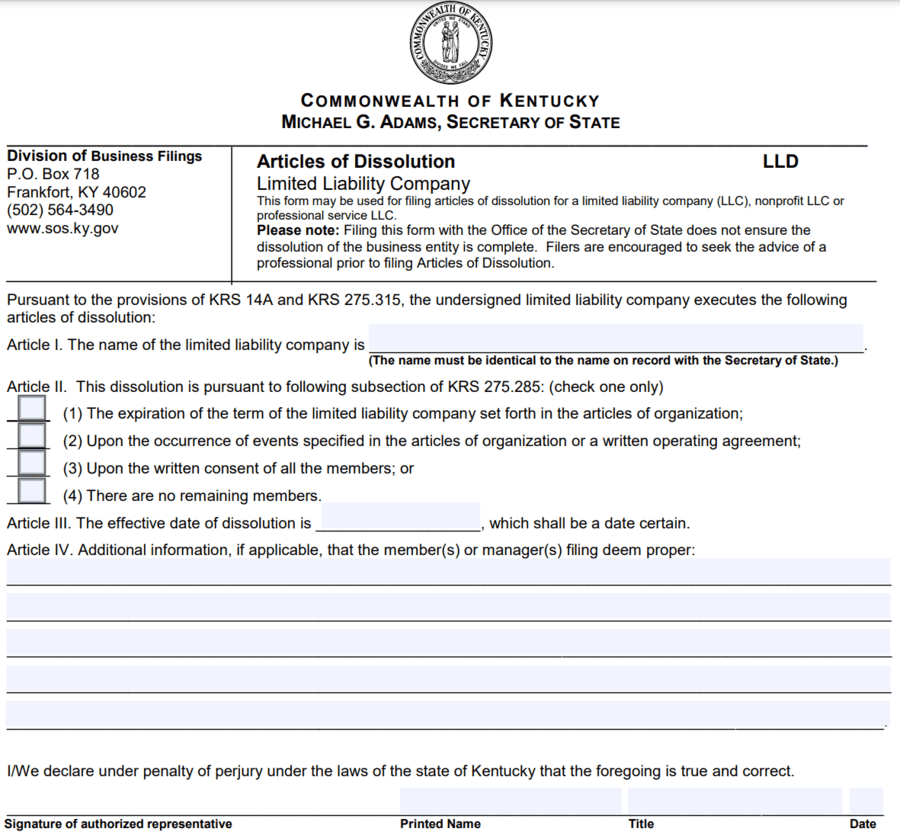

Paper Filing

To file your dissolution by paper, download, fill out, and print the Articles of Dissolution.

If you’re mailing your document, make a $40 check payable to the Kentucky State Treasurer.

Mail your document and payment to:

Michael Adams

Secretary of State

PO Box 718

Frankfort, KY 40602

If you’re delivering your document in person, you can pay by cash, check, debit or credit card, or prepaid account with the Secretary of State. Within their business hours of 8:00 AM to 4:30 PM M-F, visit the Division of Business Filings at:

Room 154, Capitol Building

700 Capital Avenue

Frankfort, KY 40601

Louisiana

Once you’ve wound up your business, cleared your debts, and liquidized your assets and property, the last step to dissolve your LLC is to file an Affidavit to Dissolve with the Louisiana Secretary of State and receive a Certificate of Dissolution in return.

You can file your affidavit online or by paper. Read below to see detailed instructions for both methods.

Online Filing

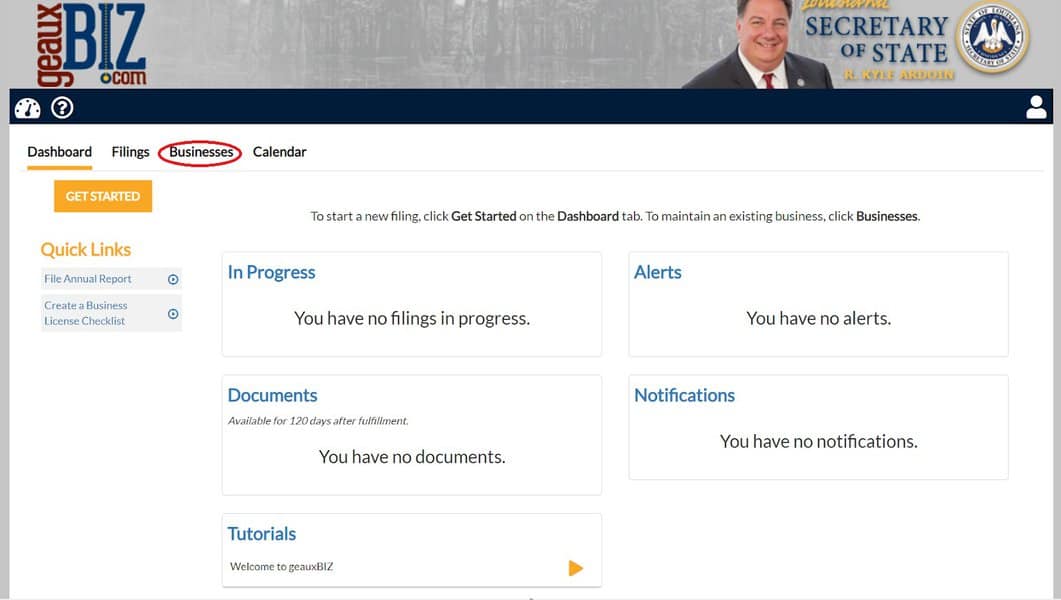

To file your affidavit online, visit the state’s geauxBIZ portal and log in or create an account. Then, click “Businesses” from the home screen at the top menu.

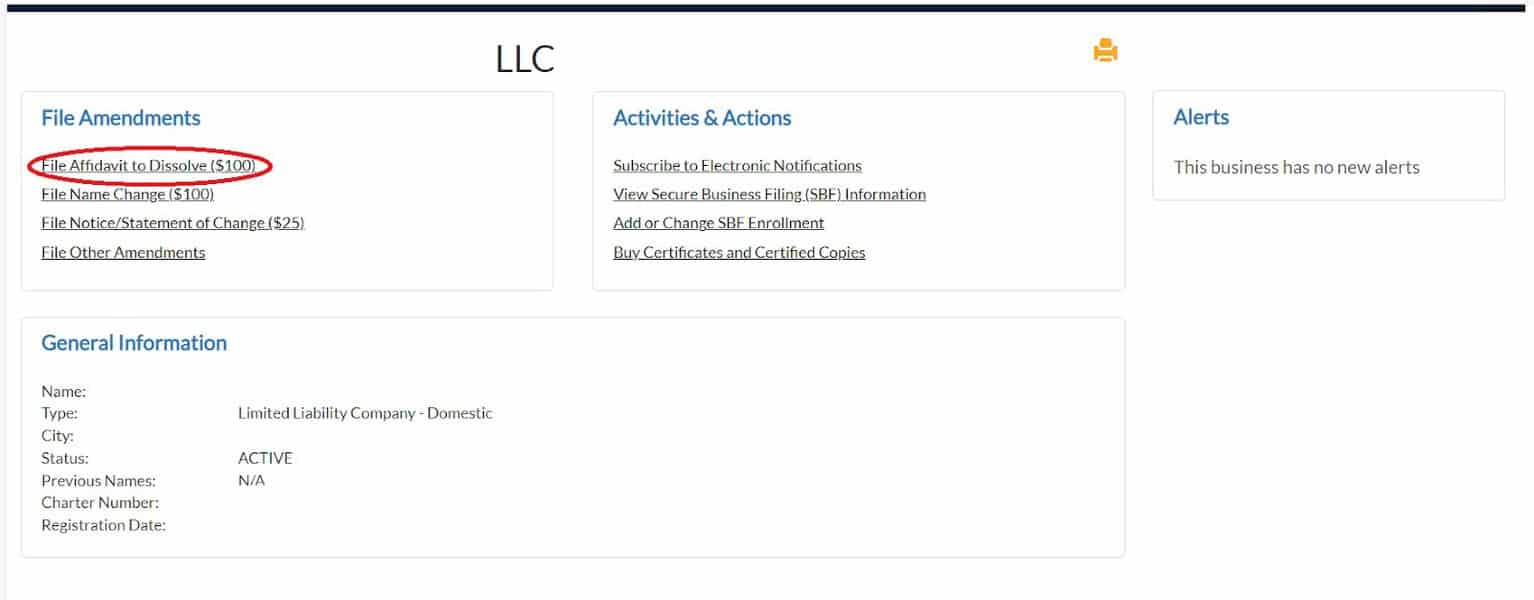

If you haven’t already linked your business with your account, you can do so at this stage by searching for it. Once you’ve done so, click on your business and view its page.

At the top, under “File Amendments,” click on “File Affidavit to Dissolve.”

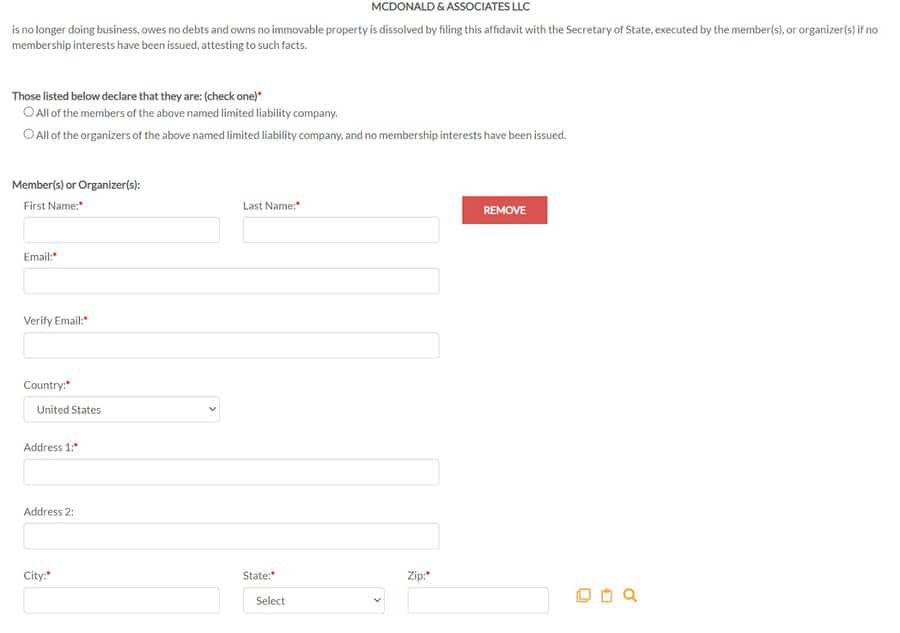

Go through the following few pages and fill out your information.

At the bottom, type your name and date and sign the document electronically.

Proceed to the payment. The filing fee is $100, payable by credit card.

Once your payment has been processed, your filing is complete.

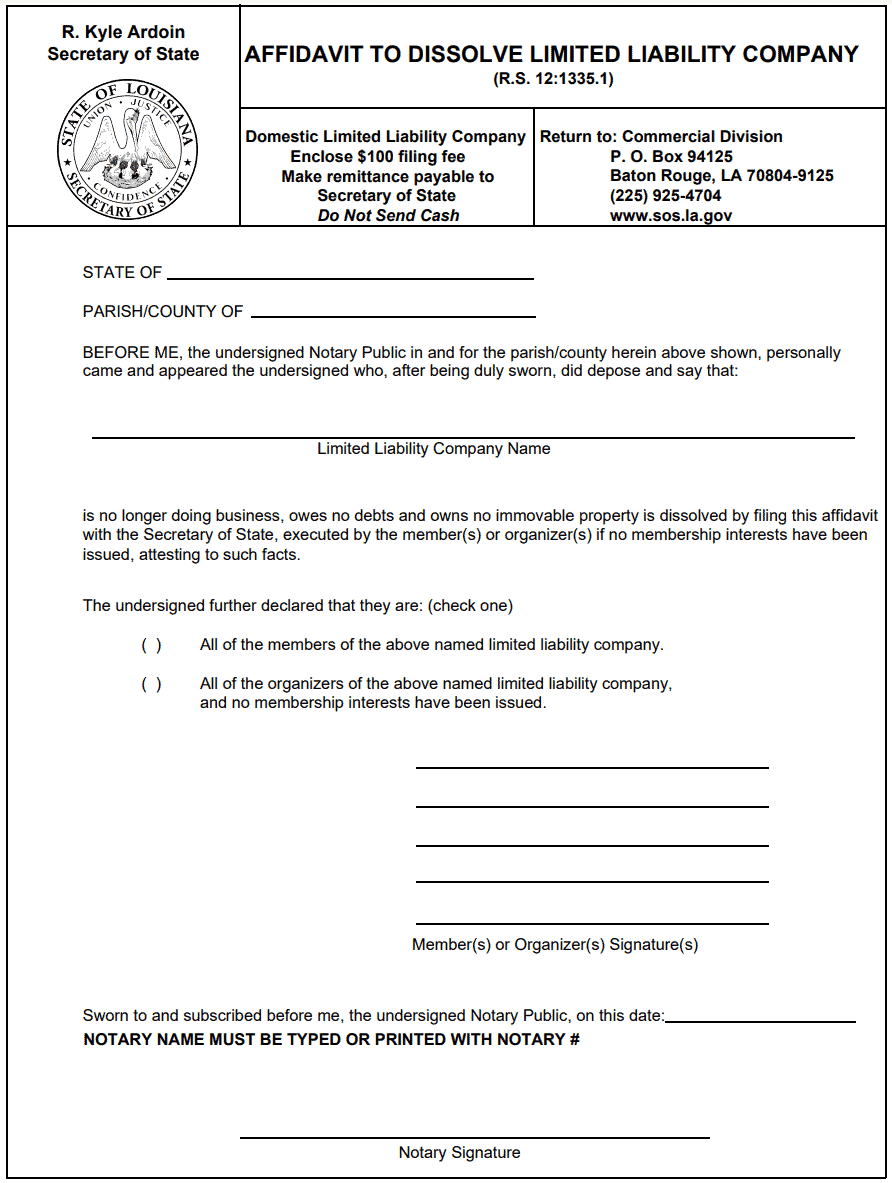

Paper Filing

To file your affidavit by paper, download, fill out, and print the Affidavit to Dissolve.

The filing fee for your Affidavit is $100, which you can pay by check or money order payable to the Secretary of State.

Mail your documents and payment to:

Commercial Division

PO Box 94125

Baton Rouge, LA 70804

Alternatively, you can file your documents in person at:

8585 Archives Avenue

Baton Rouge, LA 70809

If you’re paying in person, you can pay by check, money order, cash, or credit card. However, credit card payments incur an additional $5 convenience fee.

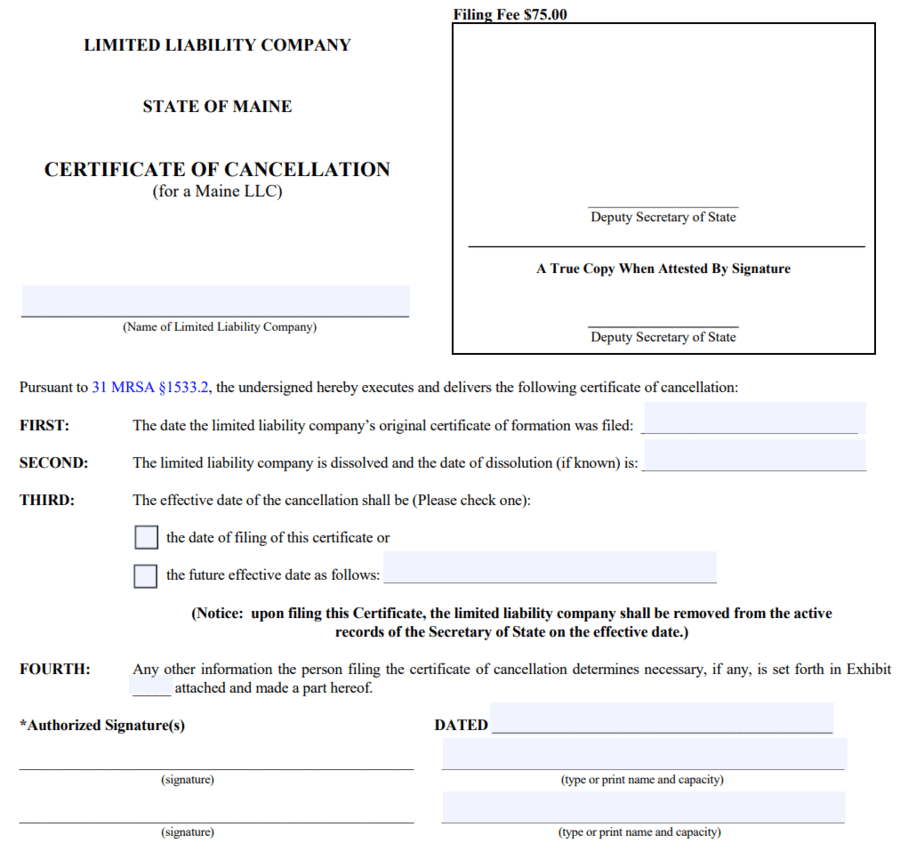

Maine

To officially dissolve your LLC in Maine, you’ll need to file dissolution papers with the Secretary of State.

To start, download the Certificate of Cancellation, fill it out, and print it.

The fee for filing the dissolution papers in Maine is $75.

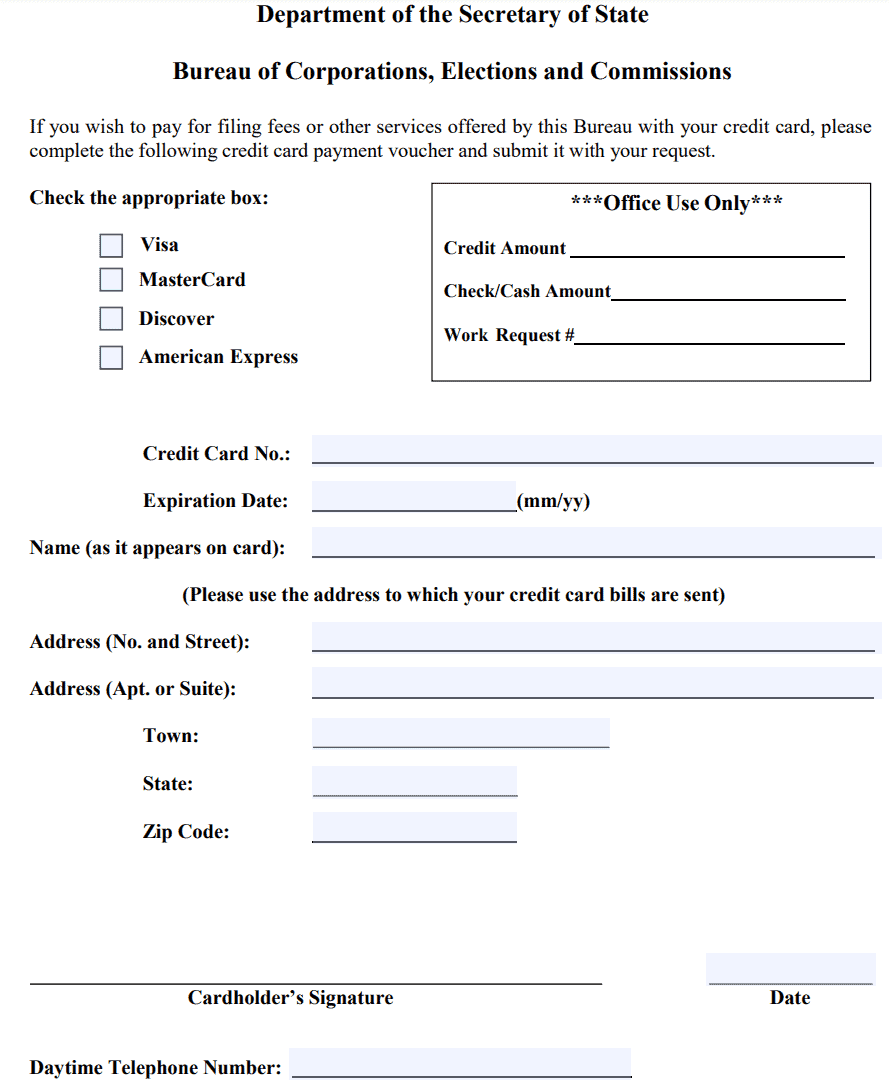

You can pay by check or money order payable to the Maine Secretary of State or by credit card, including a credit card payment voucher with your documents.

If you’re mailing your document and payment using USPS, send them to:

Department of the Secretary of State

Corporations, UCC, and Commissions

101 State House Station

Augusta, ME 04333-0101

If you plan to deliver them in person or by mail using FedEx or UPS, send them to:

Department of the Secretary of State

Corporations, UCC, and Commissions

111 Sewall Street, 4th Floor

Augusta, ME 04330

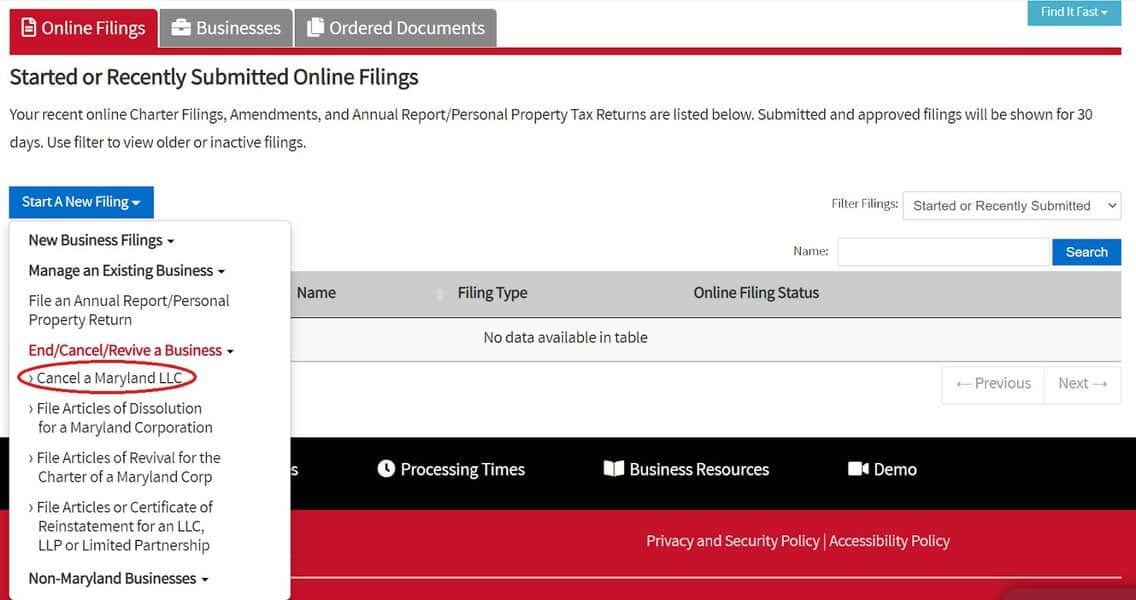

Maryland

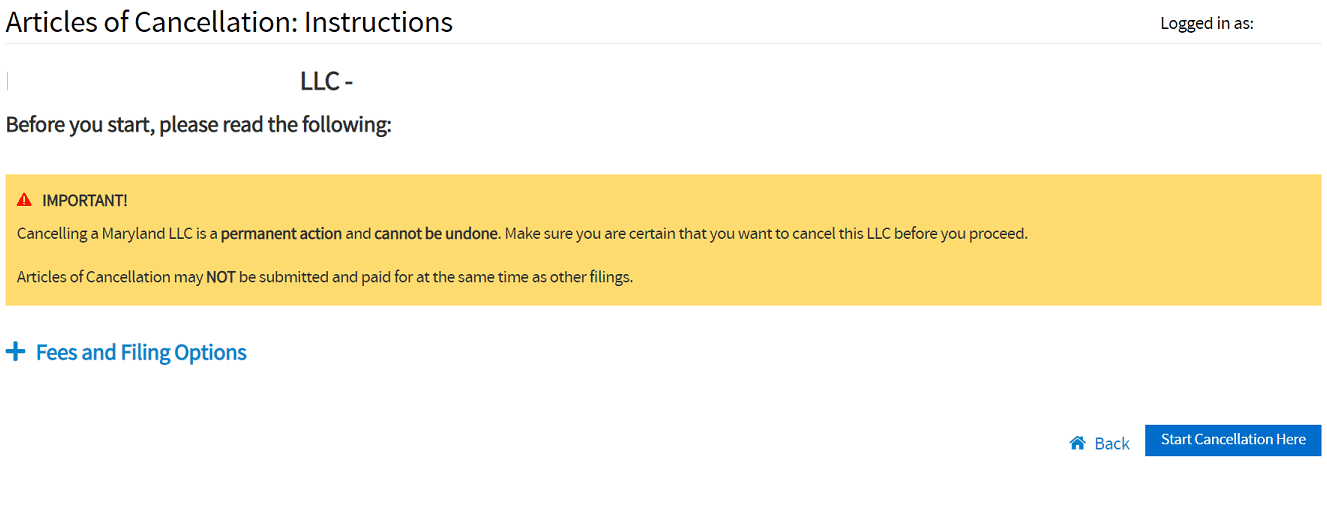

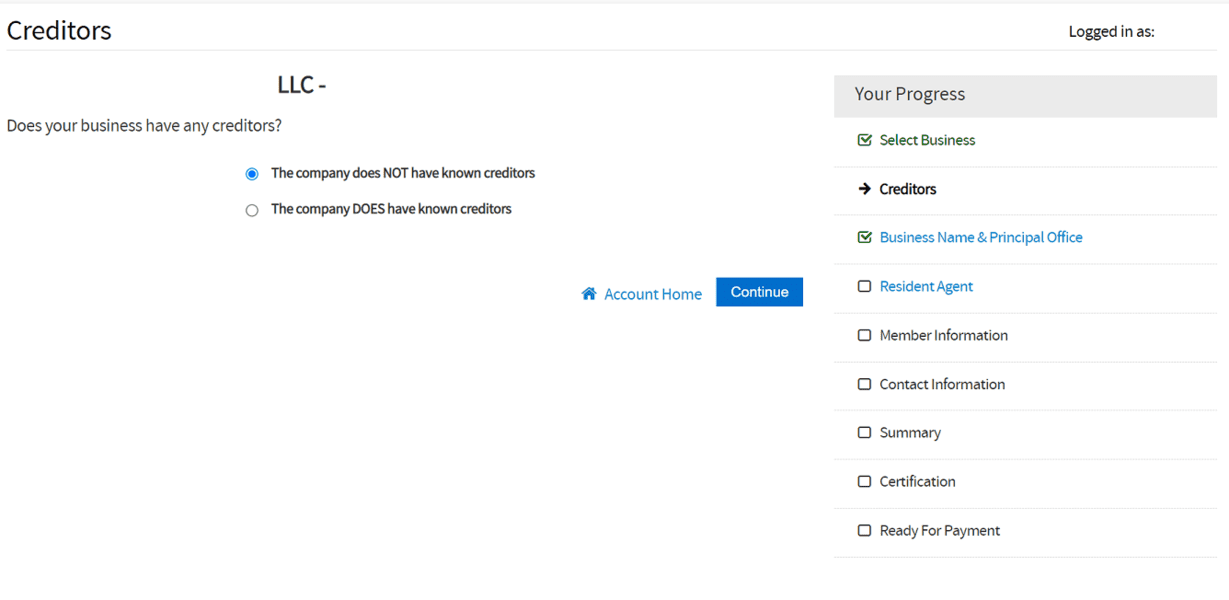

To officially terminate your LLC, you’ll have to file your Articles of Cancellation with the Maryland Department of Assessments and Taxation (SDAT). You can do so either online or by paper for free. Read on to see detailed instructions for both options.

Online Filing

To file your Articles of Cancellation online, visit Maryland’s filing website Business Express. Log in or create an account.

From your account home page, click “Start a New Filing,” then “End/Cancel/Revive a Business,” and finally, “Cancel a Maryland LLC.”

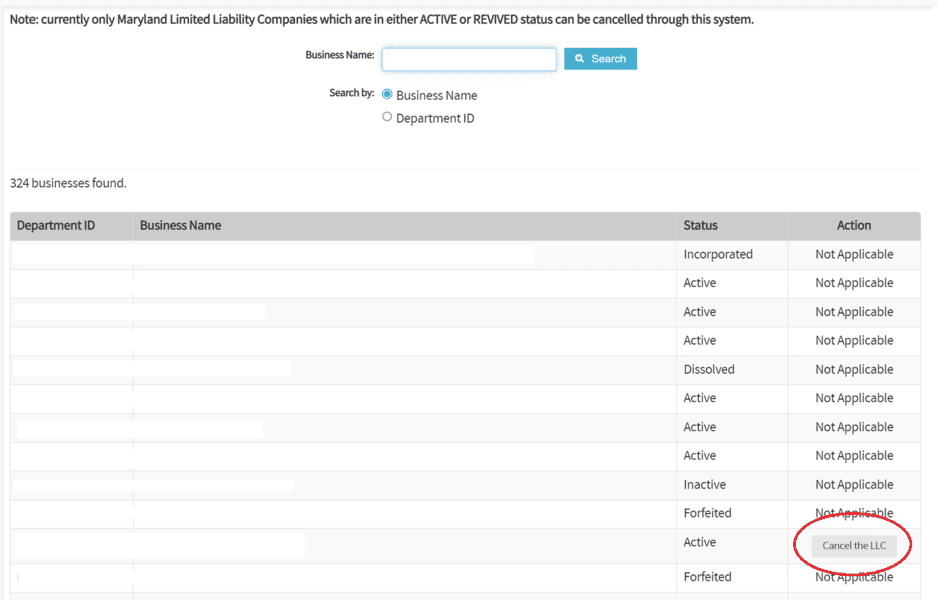

Search for your business by name or Department ID. From the results, click the “Cancel the LLC” button next to your business.

On this next page, you can view the disclaimer and fees. Once you’re done, click “Start Cancellation Here.”

On this new page, go through the following sections and fill out all the information requested.

There is no base cost for filing your Articles of Cancellation, but you can request expedited processing (seven business days) for $50 or rush processing (three business hours) for $425. However, be aware there is a 3% credit card fee and a $3 echeck fee.

Once you’ve completed your payment, submit your form to file your Articles of Cancellation.

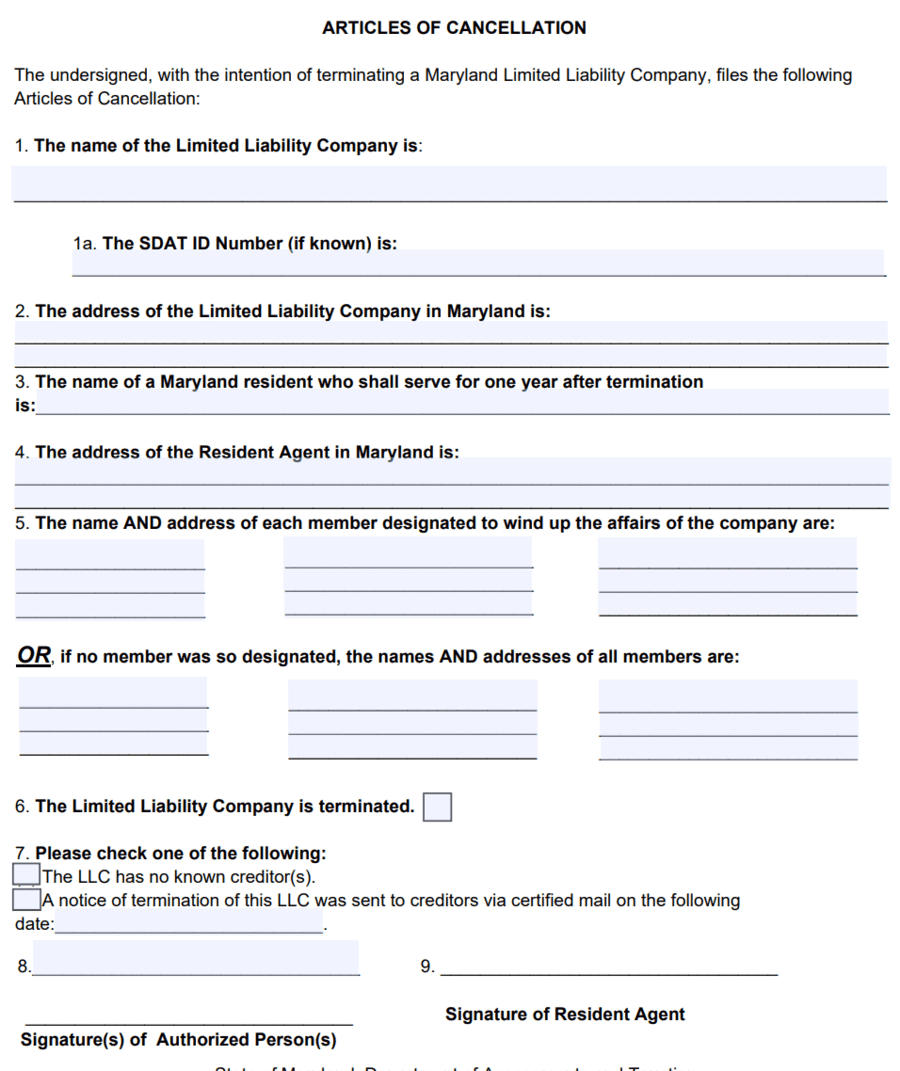

Paper Filing

To file your by paper, download, fill out, and print the Articles of Cancellation.

There is no charge to file your Articles of Cancellation. However, if you’d like to purchase expedited ten-day processing for $50, include a check or money order payable to “SDAT.”

Mail your documents to:

State of Maryland, Department of Assessments and Taxation

301 West Preston Street, Room 801

Baltimore, Maryland 21201

Note that due to construction work, walk-in appointments will not be available until Spring 2023. However, once construction has ended, you may file in person at the address above.

Additionally, if you need three-hour service, you can place your documents and a $425 payment in a dropbox located at the same address between 7:45 AM and 10 AM.

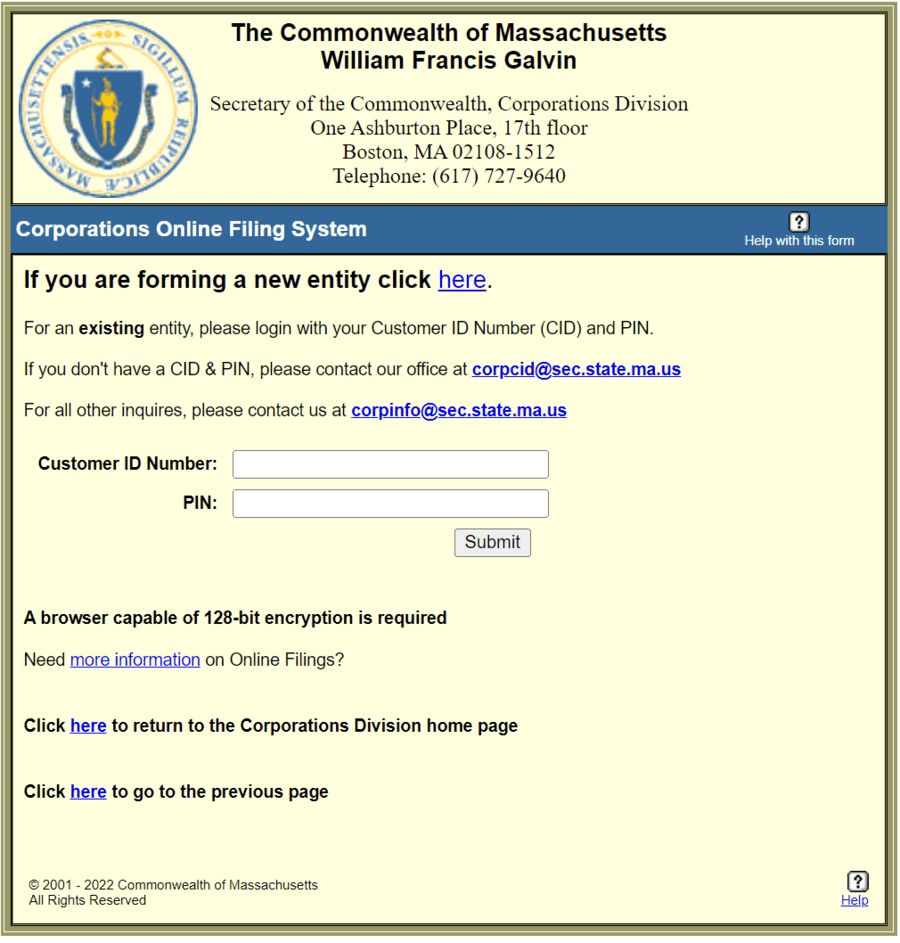

Massachusetts

The last step to dissolving your LLC is to file your Certificate of Cancellation with the Massachusetts Secretary of the Commonwealth.

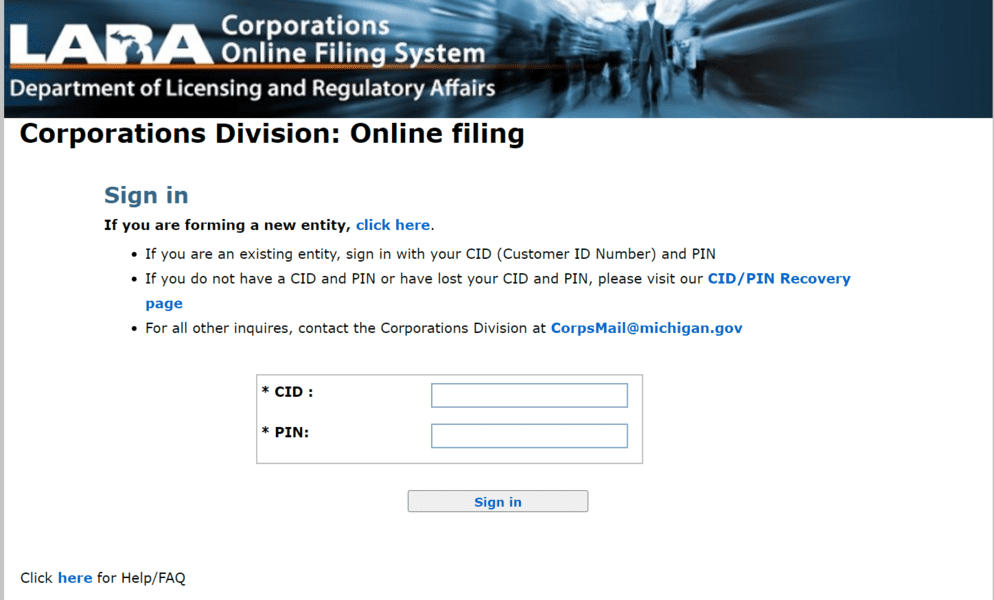

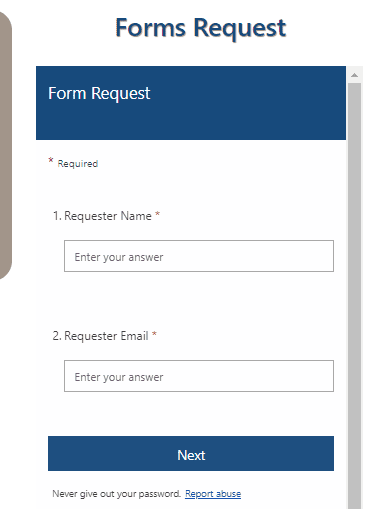

You can only do so online using Massachusetts’ Corporations Online Filing System.

Log in with your business’s Customer ID Number and PIN. If you don’t have these, contact the Corporations Division at [email protected].

Fill in the following information:

- Your federal employer ID number

- The name of your LLC

- The date you filed your original certificate of organization

- The date you’d like your cancellation to take effect

- Any other relevant information

Once you submit your filing, proceed to the payment process.

The fee for filing your Certificate of Cancellation is $100, and you can pay an additional $10 for expedited processing. You can pay by credit card, e-check, or EFT.

Michigan

In Michigan, the Licensing and Regulatory Affairs office (LARA) will process your Certificate of Dissolution for a $10 filing fee.

You can file your Certificate of Dissolution either online or by paper. Read below for instructions on both options.

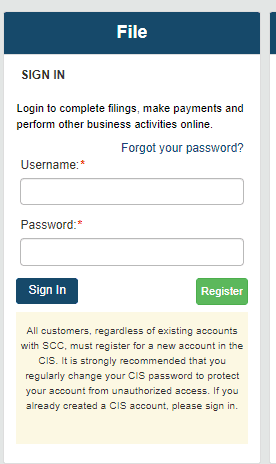

File Online

To file your dissolution online, visit LARA’s Corporations Online Filing System.

Log in with your Customer ID Number and PIN.

Fill out and submit your Certificate of Dissolution and pay the $10 filing fee by credit card.

File by Paper

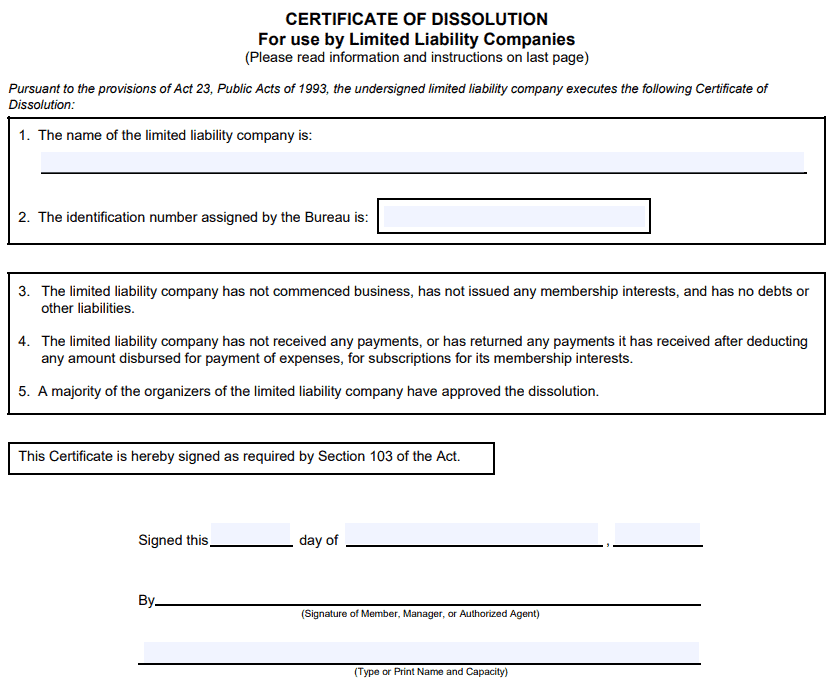

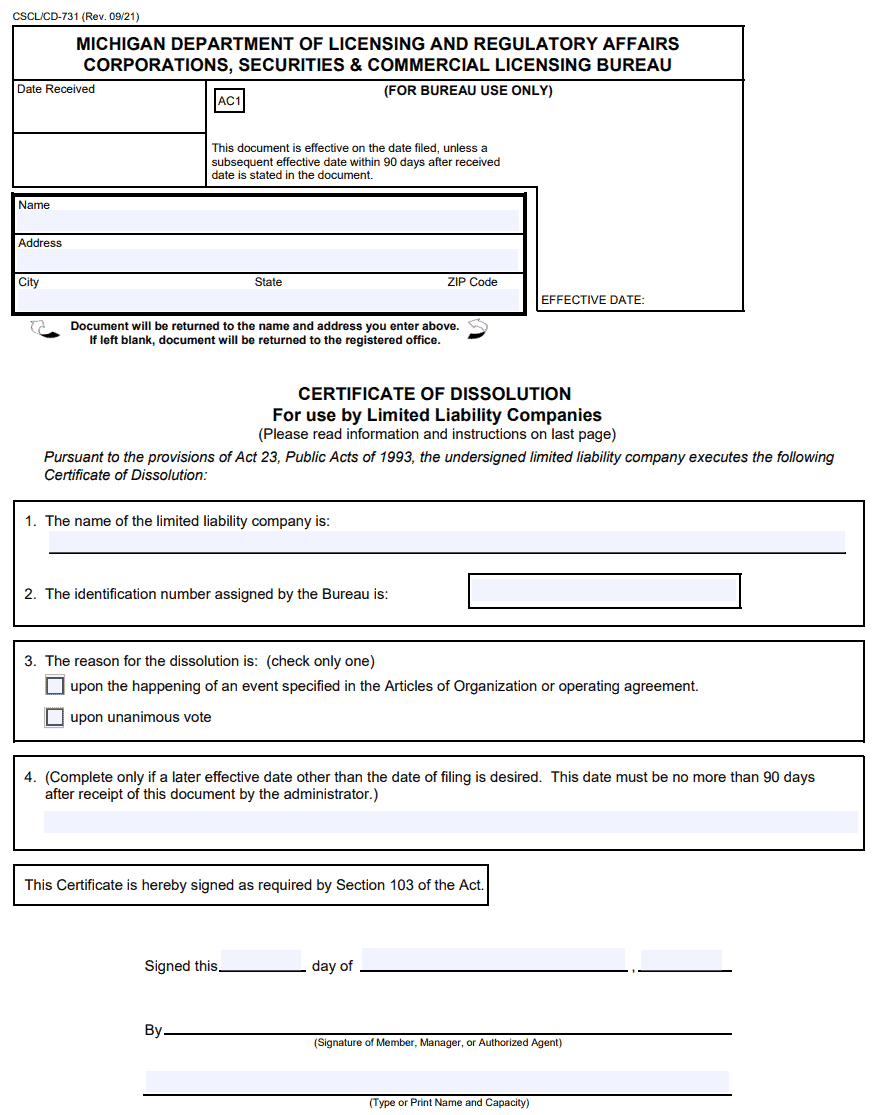

If you’re filing by paper, you can file two possible Certificates of Dissolution documents, depending on your LLC’s operations.

If your LLC hasn’t commenced business, issued any membership interests, has no liabilities, and hasn’t received any payments, complete and print the Certificate of Dissolution CD-730.

For all other LLCs, complete and print the Certificate of Dissolution CD-731.

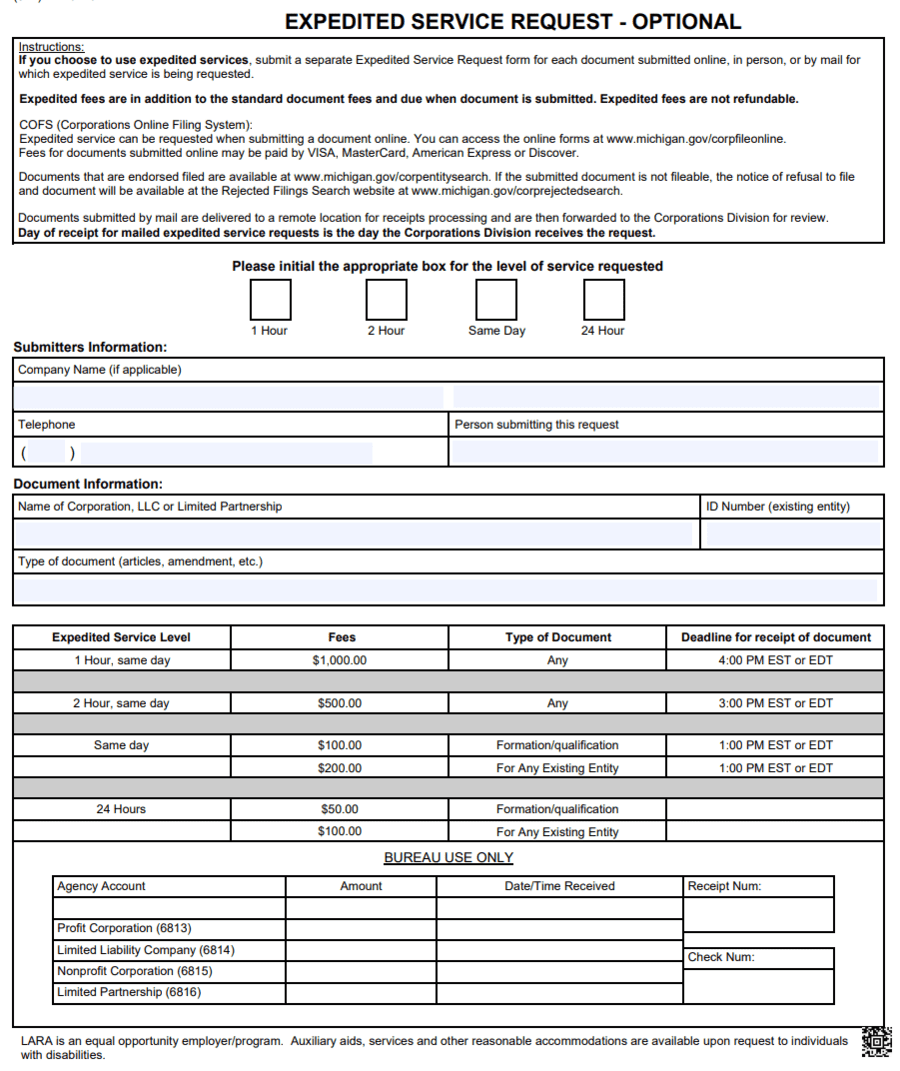

If you’d like expedited service, fill out the Expedited Service Request form. You can request 24-hour, same-day, two-hour, or one-hour service from the time of receipt by the office.

To file by mail, prepare a check or mail order payable to the State of Michigan with your LLC’s name and ID number included. Mail your documents and payment to:

Michigan Department of Licensing and Regulatory Affairs

Corporations, Securities & Commercial Licensing Bureau

Corporations Division

PO Box 30054

Lansing, MI 48909

If you’d like to file in person, visit the LARA Appointment Scheduling Calendar to book a 15-minute payment appointment. At your appointment, you can pay by check or money order as described above or by cash or credit card. Bring your documents and payment to:

2407 N. Grand River Ave.

Lansing, MI 48906

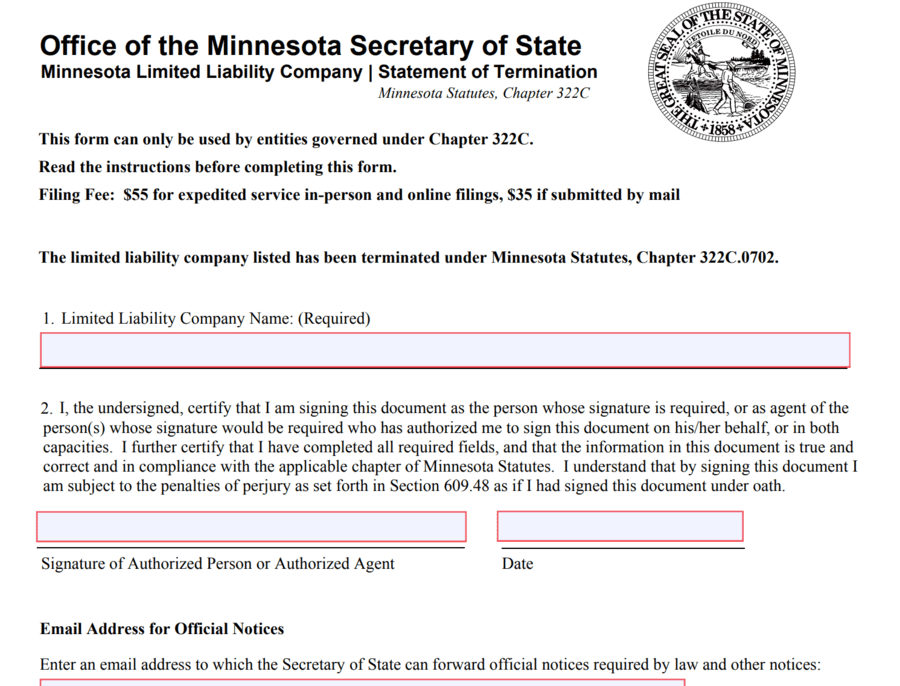

Minnesota

In Minnesota, the process to officially dissolve your LLC is fairly simple. First, fill out the Secretary of State’s Statement of Termination, and save it as a PDF on your computer.

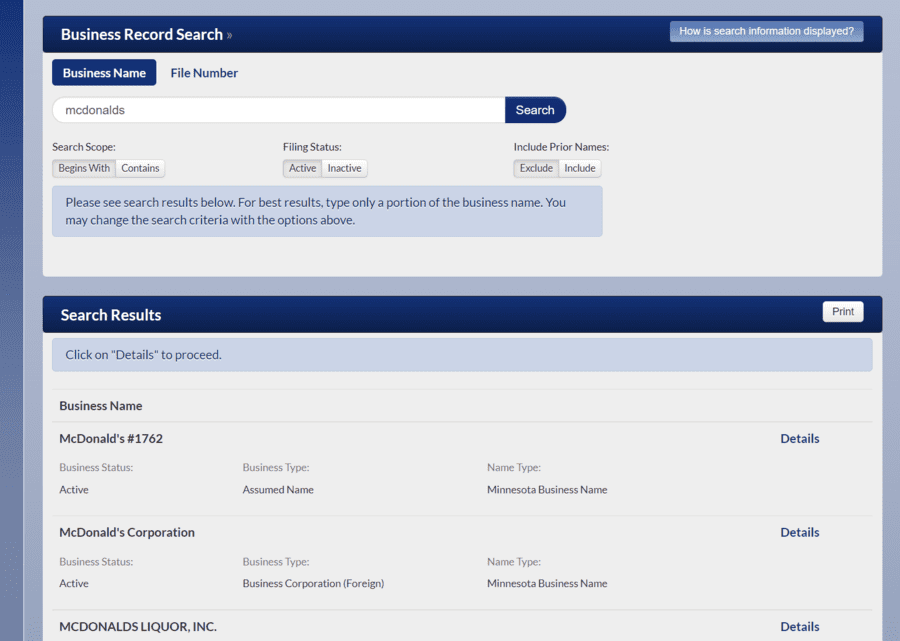

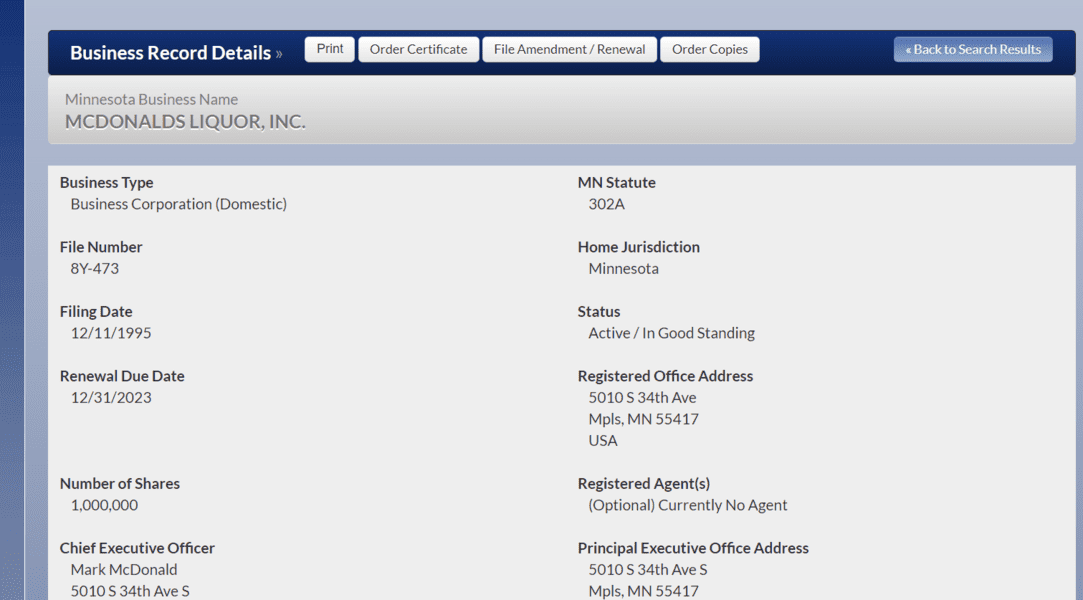

Then, you can file it online through the Secretary of State’s website. Head over to their Business Search page, and search for your business by name. From the drop-down menu, select “details” next to your business.

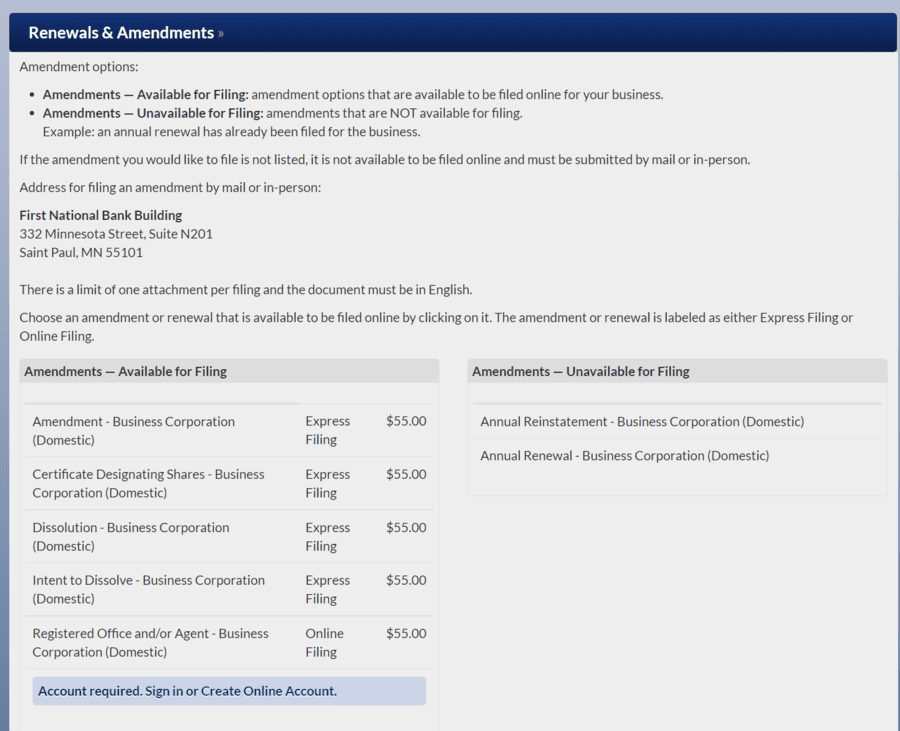

At the top dark blue banner, click “File Amendment / Renewal.”

From here, you’ll need to sign in or create an account with the Secretary of State website. Then, you can upload your Statement of Termination and pay through US Bank.

Alternatively, you can print out the form and either file it in person or mail it to:

Minnesota Secretary of State – Business Services

First National Bank Building

332 Minnesota Street, Suite N201

Saint Paul, MN 55101

The fee for filing the statement of termination in Minnesota is $55 for expedited in-person or online filings and $35 by mail.

A check should be paid to the Minnesota Secretary of State if you mail it.

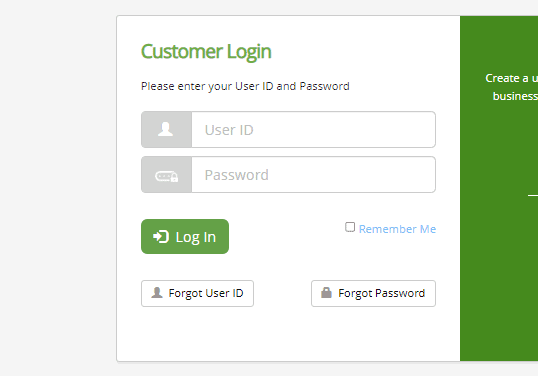

Mississippi

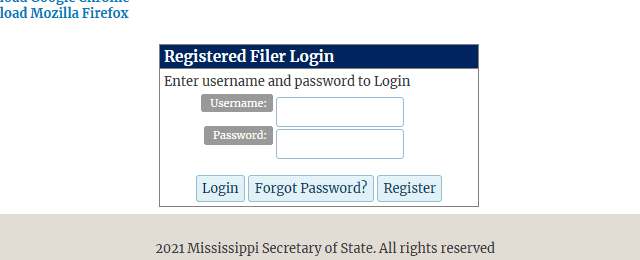

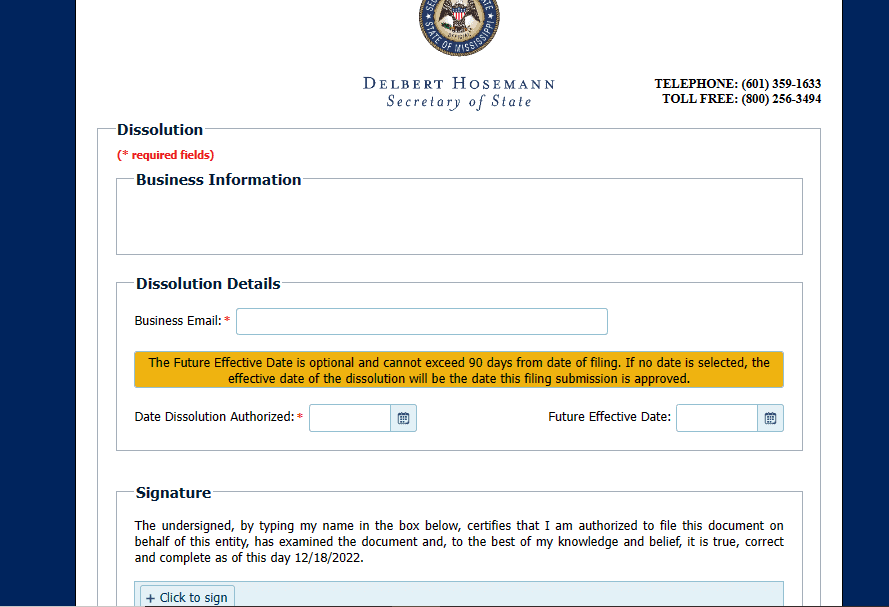

In Mississippi, the process to dissolve your LLC is to visit the Secretary of State’s website, sign into your account, and follow the prompts to fill out the certificate of dissolution form.

Alternatively, you can fill out the form online, print it, and file it by mail.

The mailing address is:

Mississippi Secretary of State

Business Services Division

700 North Street P.O. Box 136

Jackson, MS 39205-0136

The fee for filing the dissolution papers in Mississippi is $50.

Missouri

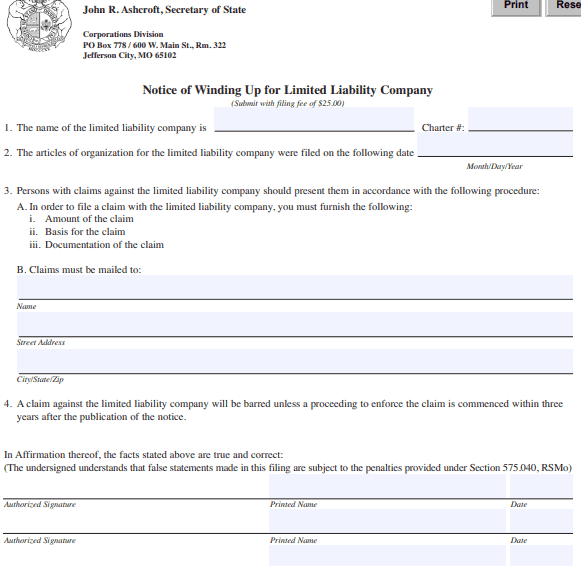

In Missouri, you must first file a notice of winding up after the triggering event for dissolution, whether it’s a vote, consent of all members, or a judicial decree.

You can download the form and file it by mail.

The mailing address is:

Corporations Division

PO Box 778 / 600 W. Main St., Rm. 322

Jefferson City, MO 65102

The fee for filing the notice of winding up is $25.

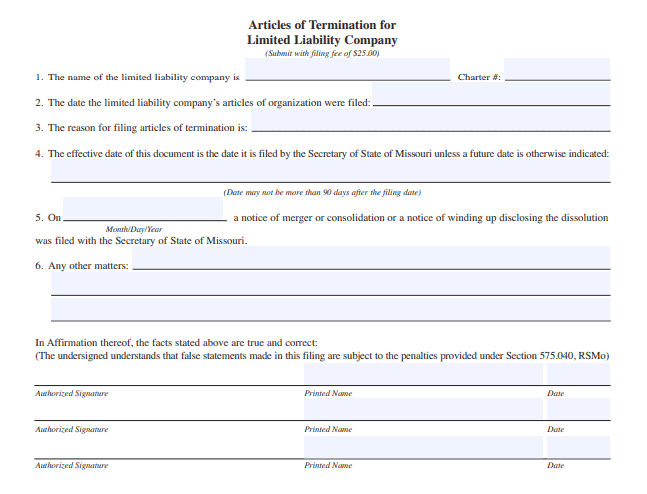

Then, to officially dissolve your LLC after you’ve completed all the dissolution steps is to download the articles of termination form, fill it out, and file it by mail.

The mailing address is the same as above.

The fee for filing the dissolution papers in Missouri is $25.

Montana

In Montana, the process to officially dissolve your LLC is to file articles of termination with the Secretary of State. You can do so on the Secretary of State’s website by searching for your business and following the prompts to fill out the form.

Montana does not have a mail filing option, so you must file your articles of termination online.

The fee for filing the dissolution papers in Montana is $15.

Nebraska

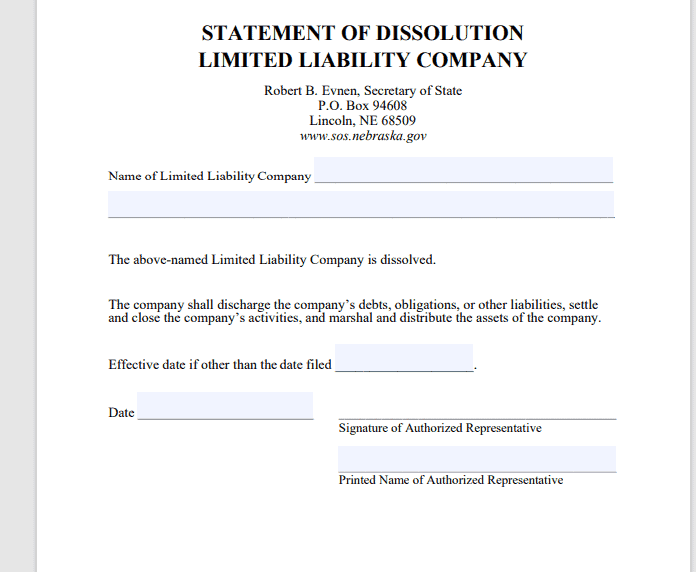

In Nebraska, the process to officially dissolve your LLC is to download the statement of dissolution form, fill it out, and file it by mail.

The mailing address is:

Robert B. Evnen, Secretary of State

PO Box 94608

Lincoln, NE 68509

The fee for filing the dissolution papers in Nebraska is $30.

Nevada

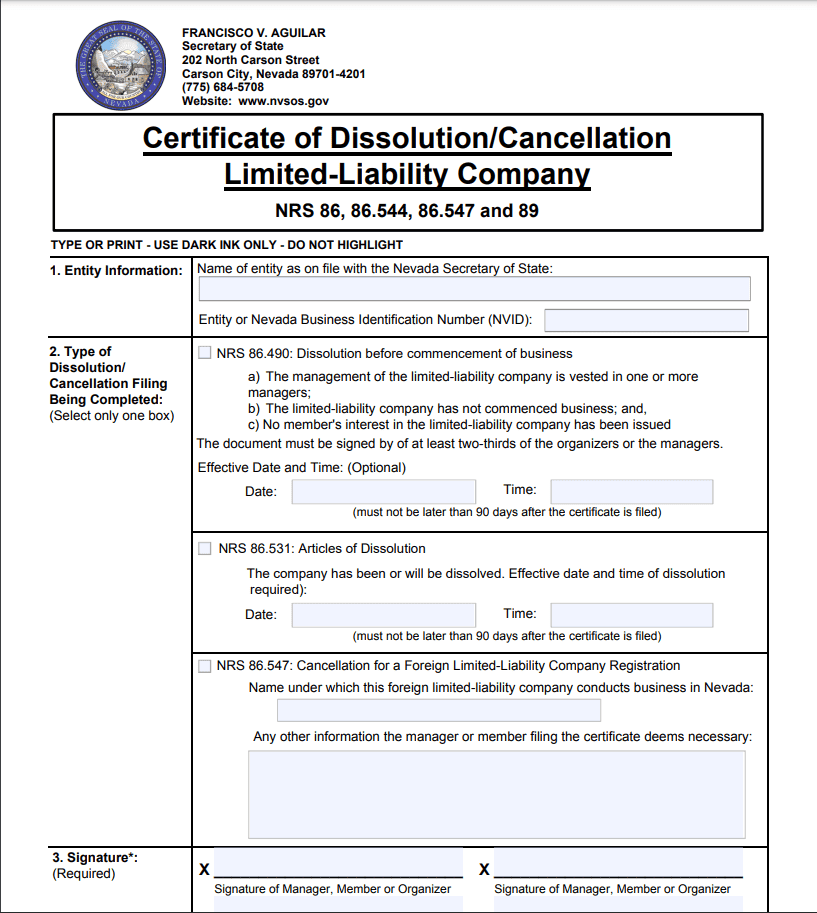

In Nevada, the process to officially dissolve your LLC is to download the Certificate of Dissolution/Cancellation form, fill it out, and file it by mail.

The mailing address is:

Secretary of State

Amendments Division

202 North Carson Street

Carson City NV 89701-4201

The fee for filing the dissolution papers in Nevada is $100.

New Hampshire

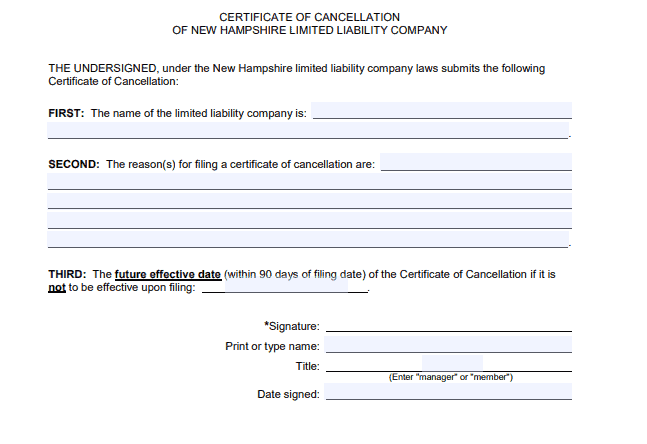

In New Hampshire, officially dissolve your LLC by downloading a certificate of cancellation, filling out the form, and filing it by mail.

The mailing address is:

Corporation Division

NH Dept. of State

107 N Main St, Rm 204

Concord, NH 03301-4989

The fee for filing the dissolution papers in New Hampshire is $35.

New Jersey

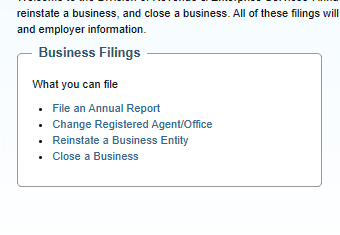

In New Jersey, officially dissolve your LLC by filing a certificate of dissolution and termination on the Division of Revenue and Enterprise Services website.

Select “close a business” and follow the prompts to complete the form.

If you prefer to file by mail, you can request the form from the Division of Revenue and Enterprise Services at (609) 292-9292.

The mailing address is:

Division of Revenue and Enterprise Services

33 W State St #5th

Trenton, NJ 08608

The fee for filing the dissolution papers in New Jersey is $125.

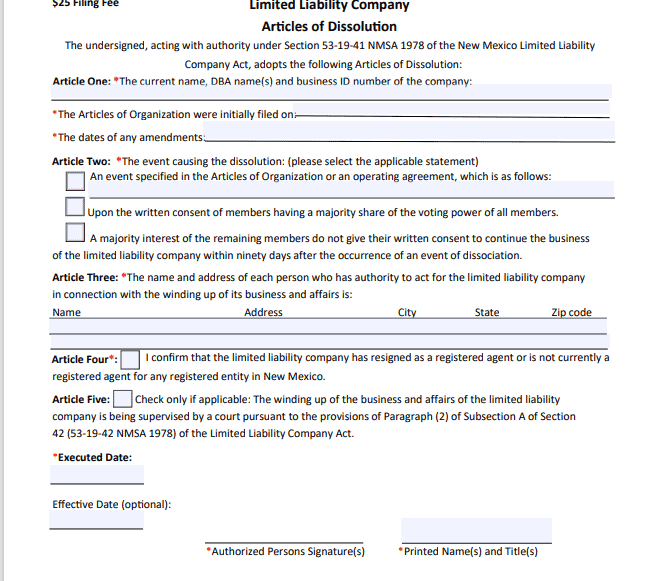

New Mexico

In New Mexico, the process to officially dissolve your LLC is to download the articles of dissolution form, fill it out, and file it by mail.

The mailing address is:

New Mexico Secretary of State

Business Services Division

325 Don Gaspar, Suite 300

Santa Fe, NM 87501

The fee for filing the dissolution papers in New Mexico is $25.

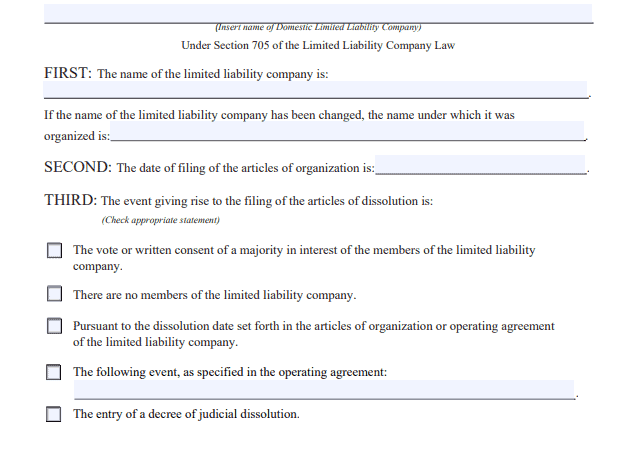

New York

In New York, the process to officially dissolve your LLC is to download the articles of dissolution form, fill it out, and file it by mail.

The mailing address is:

New York Department of State

Division of Corporations

One Commerce Plaza

99 Washington Avenue

Albany, NY 12231

The fee for filing dissolution papers in New York is $60.

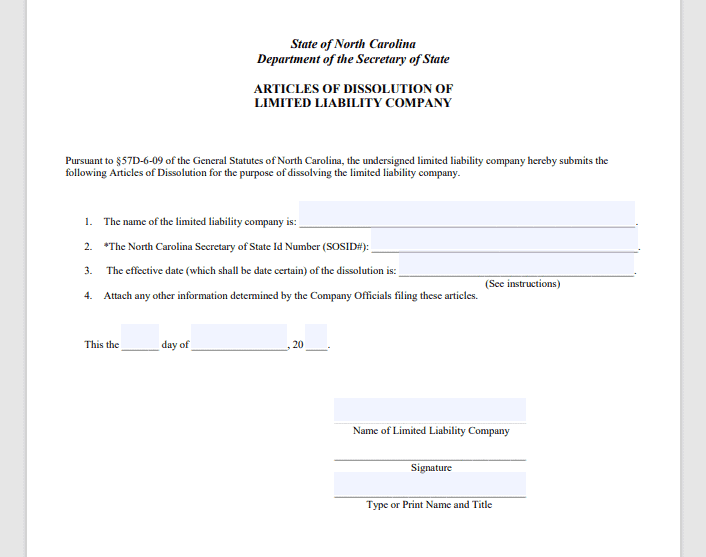

North Carolina

In North Carolina, the process to officially dissolve your LLC is to download the articles of dissolution, fill them out, and file them by mail.

The mailing address is:

NC Secretary of State

Business Registration Division

PO Box 29622

Raleigh, NC 27626-0622

The fee for filing the dissolution papers in North Carolina is $30.

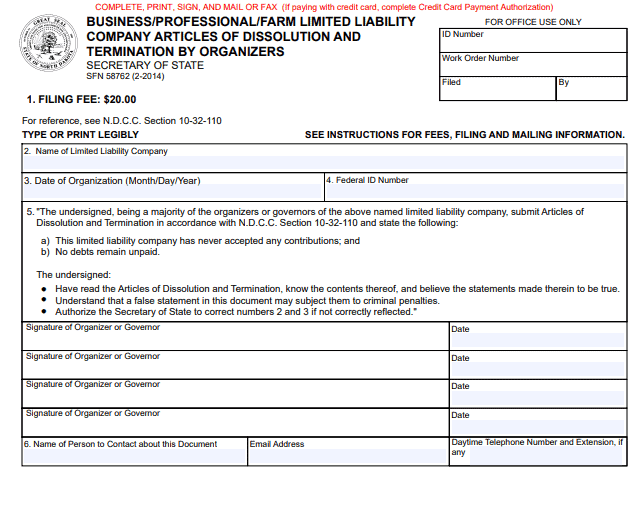

North Dakota

In North Dakota, the process to officially dissolve your LLC is to file articles of dissolution, which you can do on the Secretary of State’s website by selecting “terminate a business” and searching for your business record.

There are two different forms you might file. First, if all your debts are paid, you’ll file articles of dissolution by organizers.

If you have unpaid debts, you must file articles of dissolution by members. You must also file a notice of dissolution, which must be published once a week in a news publication in the county in which the LLC is located.

Alternatively, you can download the articles of dissolution by organizers form and file them by mail.

The mailing address is:

Secretary of State

State of North Dakota

600 East Boulevard Avenue Department 108

Bismark, North Dakota 58505 – 0500

Mail filing is not available for articles of dissolution by members. If you have questions, contact the Secretary of State’s office at 701-328-2904.

The fee for filing the dissolution papers in North Dakota is $20.

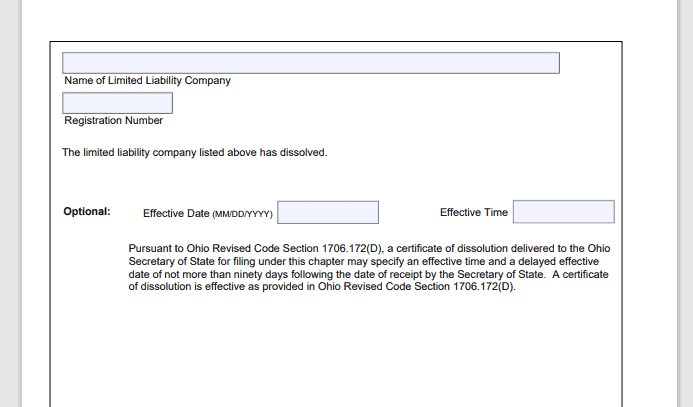

Ohio

In Ohio, the process to officially dissolve your LLC is to download the certificate of dissolution, fill it out, and file it by mail.

The mailing address is:

Ohio Secretary of State

P.O. Box 1329

Columbus, OH 43216

The fee for filing dissolution papers in Ohio is $50.

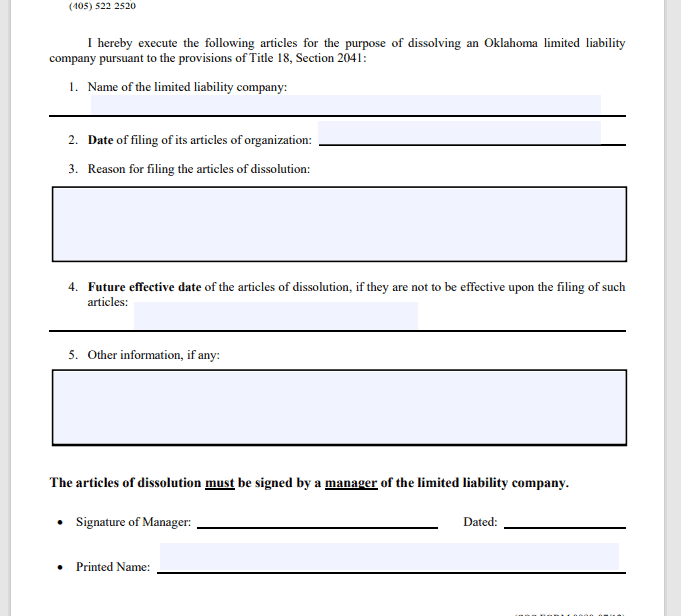

Oklahoma

In Oklahoma, the process to officially dissolve your LLC is to download the articles of dissolution, fill out the form, and file it by mail.

The mailing address is:

Oklahoma Secretary of State

421 N.W. 13th Suite 210

Oklahoma City, OK 73103

The fee for filing dissolution papers in Oklahoma is $50.

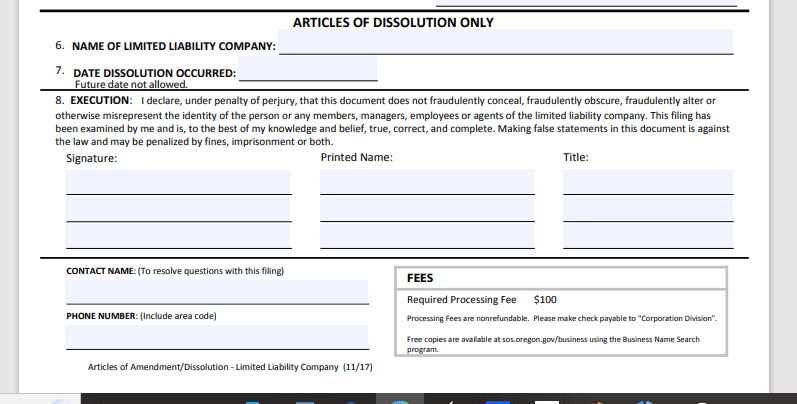

Oregon

In Oregon, the process to dissolve an LLC is to download the articles of amendment/dissolution form, fill it out, and mail it to the Secretary of State, Corporations Division.

The mailing address is:

Secretary of State

Corporation Division

255 Capitol St. NE, Suite 151

Salem, OR 97310-1327

The fee for filing the dissolution papers in Oregon is $100.

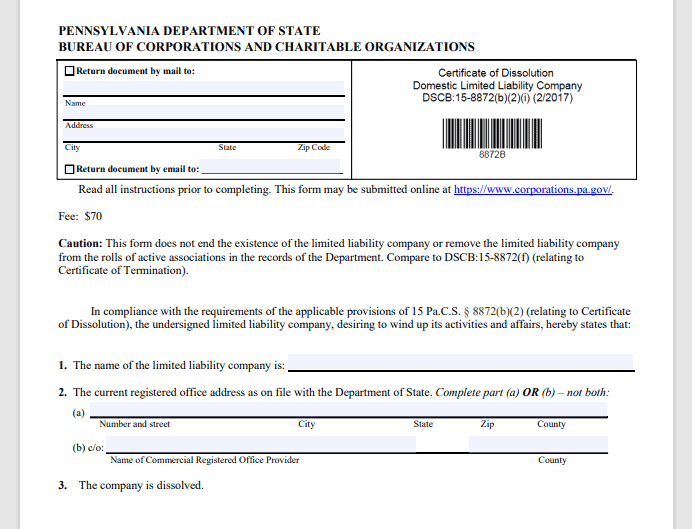

Pennsylvania

In Pennsylvania, officially dissolving your LLC is the first to file a certificate of dissolution. This should be done when the determination to dissolve was initially made and the resolution to dissolve the LLC was drafted.

You’ll download the form, fill it out, and mail it to:

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105-8722

The fee for filing the dissolution papers in Pennsylvania is $70.

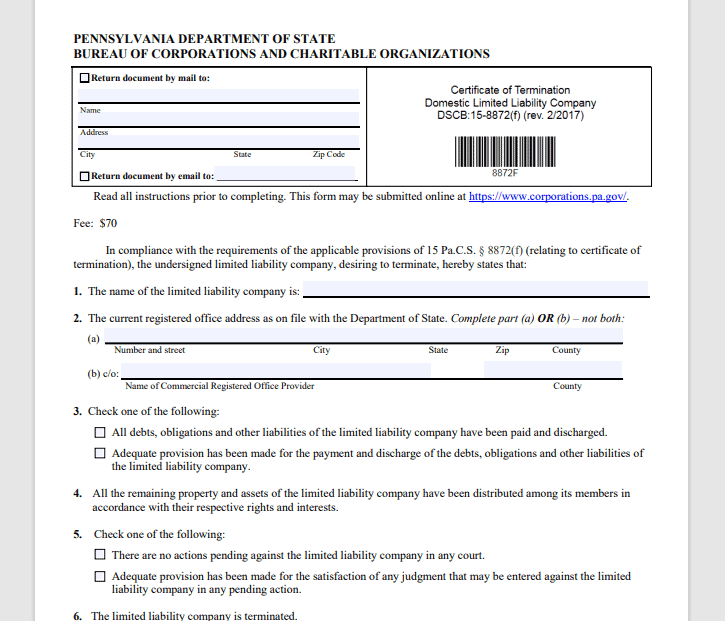

Once you’ve completed all the steps to wind up and dissolve your LLC, you’ll need to file a certificate of termination. Then, again, you’ll download the form and fill it out.

You’ll need to attach tax clearance certificates from the Department of Revenue and Labor and Industry stating that all taxes have been paid.

You’ll mail the form to the address specified above. The fee for filing this form is $70.

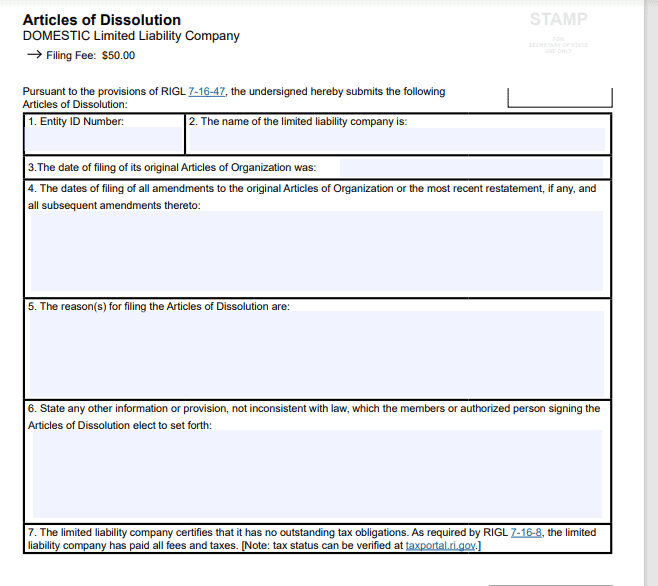

Rhode Island

In Rhode Island, the process to officially dissolve your LLC is to download the articles of dissolution and mail them to the Department of State, Business Services Division. On the form, you must certify that all taxes and fees of the LLC have been paid.

The mailing address is:

Business Services Division

148 W. River Street, Ste. 1

Providence, RI 02904.

The fee for filing the dissolution papers in Rhode Island is $50.

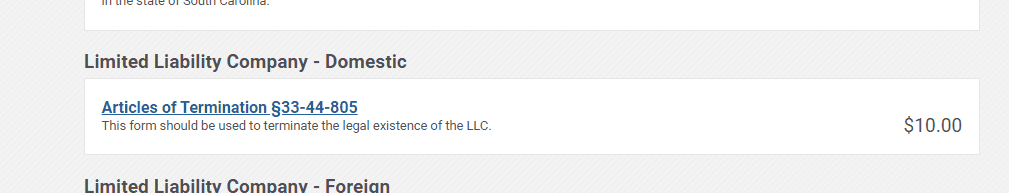

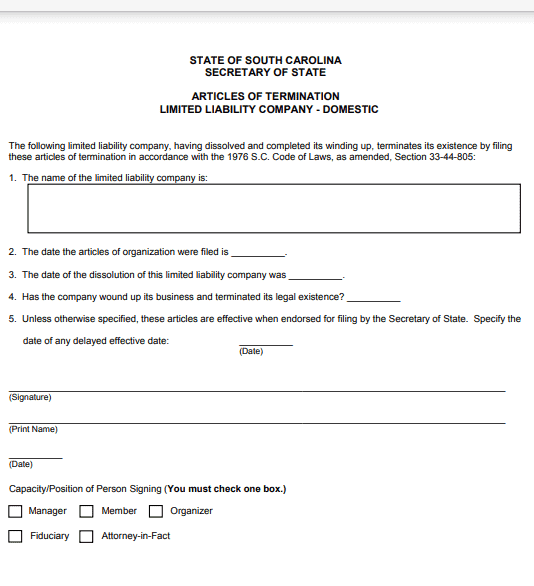

South Carolina

In South Carolina, the process to officially dissolve your LLC is to download the articles of termination form and mail it to the Secretary of State.

The mailing address is:

Secretary of State

Attn: Corporate Filings

1205 Pendleton Street, Suite 525

Columbia, SC 29201

The fee for filing the dissolution papers in South Carolina is $10.

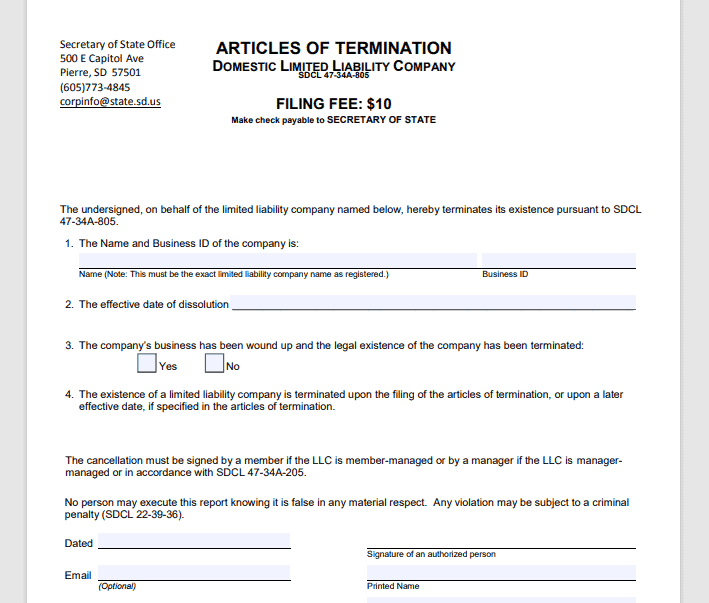

South Dakota

In South Dakota, the process to officially dissolve your LLC is to download the articles of termination form, fill it out, and mail it to the Secretary of State.

The mailing address is:

Secretary of State Office

500 E Capitol Ave

Pierre, SD 57501

The fee for filing dissolution papers in South Dakota is $10.

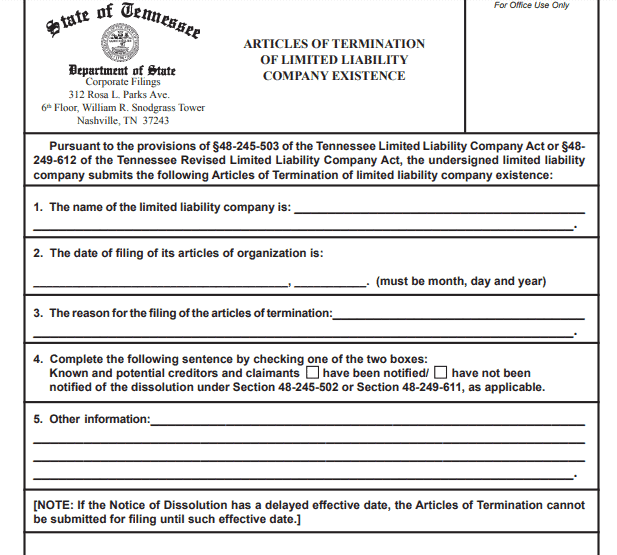

Tennessee

In Tennessee, the process to officially dissolve your LLC is to file articles of termination. You’ll need to download the form and mail it.

The mailing address is::

Department of State

Corporate Filings

12 Rosa L. Parks Ave., 6th Floor

William R. Snodgrass Tower

Nashville, TN 3724

The fee for filing the dissolution papers in Tennessee is $20.

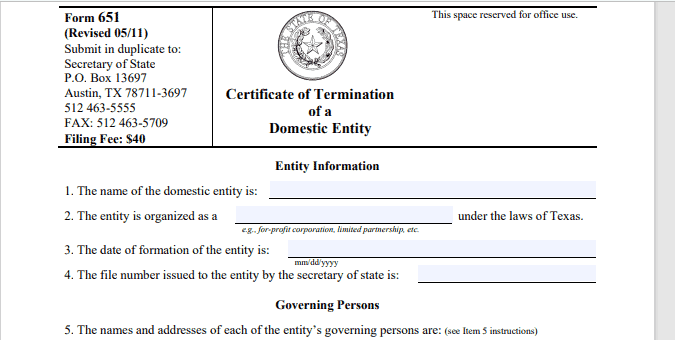

Texas

In Texas; the process to officially dissolve your LLC is to file a certificate of termination. First, download the form and fill it out.

Next, mail two copies of the completed form, along with the filing fee and certificate of account status, to:

P.O. Box 13697

Austin, Texas 78711-3697

The certificate of account status, which states that all taxes have been paid, must accompany the certificate of termination.

The fee for filing dissolution papers in Texas is $40.

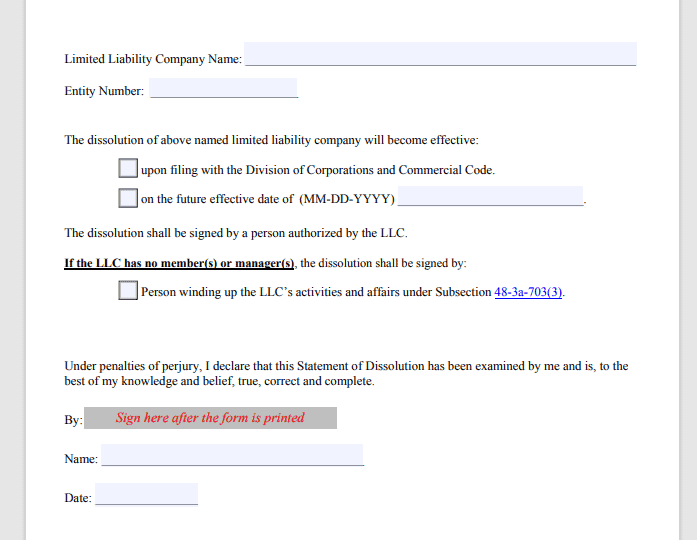

Utah

In Utah, the process to officially dissolve your LLC is to download a statement of dissolution and mail it to:

Division of Corporations and Commercial Code

PO Box 146705

Salt Lake City, Utah 84114-6705

Additional filing requirements:

If the filer requests a copy of the Statement of Dissolution, an additional exact copy of the filed document along with a return-addressed envelope with adequate first-class postage must also be submitted.

The fee for filing the dissolution papers in Utah is $0.

Vermont

In Vermont, the process to officially dissolve your LLC is to file articles of termination. You can do so on the Corporations Division’s website by signing into your account or requesting a form from the Corporations Division that you’ll file by mail.

The mailing address is:

Vermont Secretary of State

Corporations Division

128 State Street

Montpelier, VT 05633-1104

The fee for filing the dissolution papers in Vermont is $20.

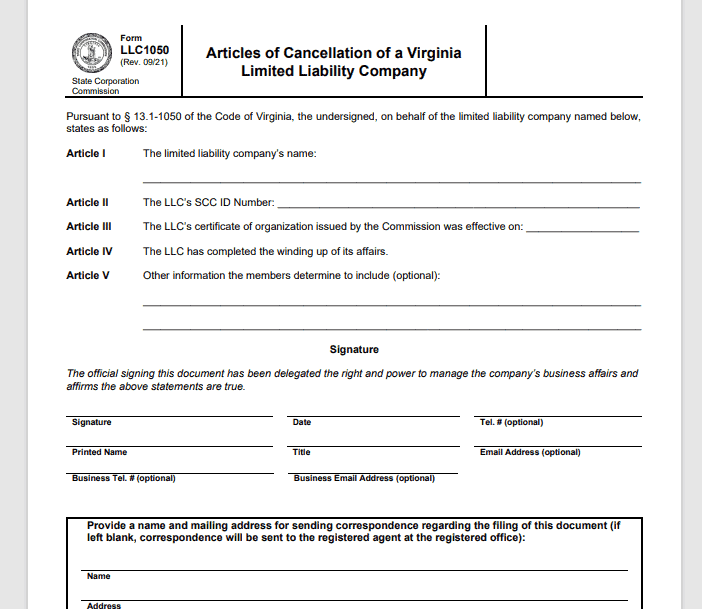

Virginia

In Virginia, the process to officially dissolve your LLC is to file articles of cancellation with the state. By signing into your account, this can be done on the Corporation Commission’s website.

Alternatively, you can download the form and mail it to:

State Corporation Commission

Clerk’s Office

P.O. Box 1197

Richmond, VA 23218-1197

The articles of cancellation contain a statement that you have completed the winding up of the LLC’s affairs.

The fee for filing the dissolution papers in Virginia is $25.

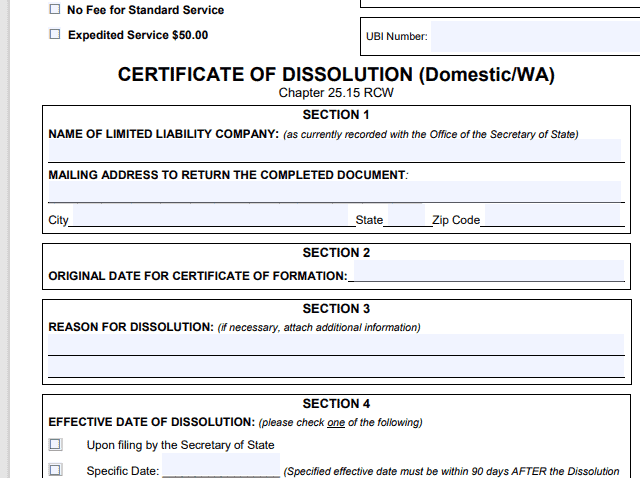

Washington

In Washington, you file a certificate of dissolution to dissolve an LLC. You can do so at the Secretary of State’s website or by downloading the form, filling it out, and mailing it in.

The mailing address is:

Washington Secretary of State

Corporations and Charities Division

801 Capitol Way S

Olympia, WA 98504-0234

Filing dissolution papers in Washington is free.

West Virginia

In West Virginia, the process to officially dissolve your LLC is to sign into your account on the Secretary of State’s website and fill out the articles of dissolution form.

If you prefer to file by mail, you can request the form from the WV one-stop business center at (304) 558-8000. The mailing address is:

WV One Stop Business Center

13 Kanawha Blvd. W.

Suite 201

Charleston, WV 25302

The fee for filing the dissolution papers in West Virginia is $25.

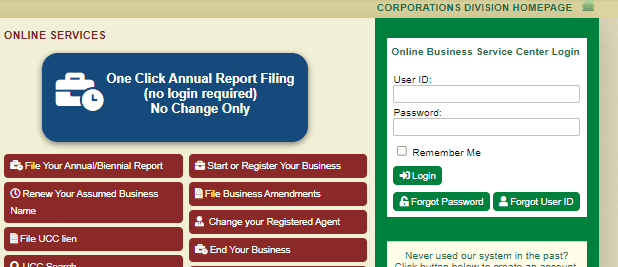

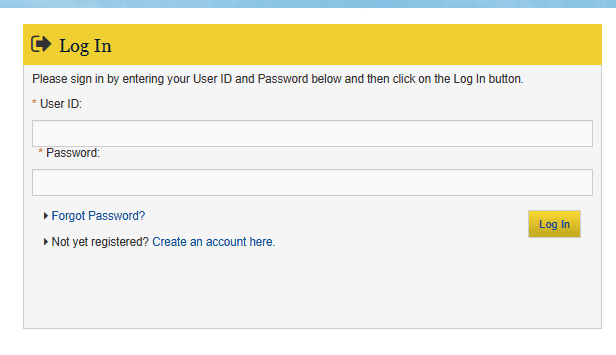

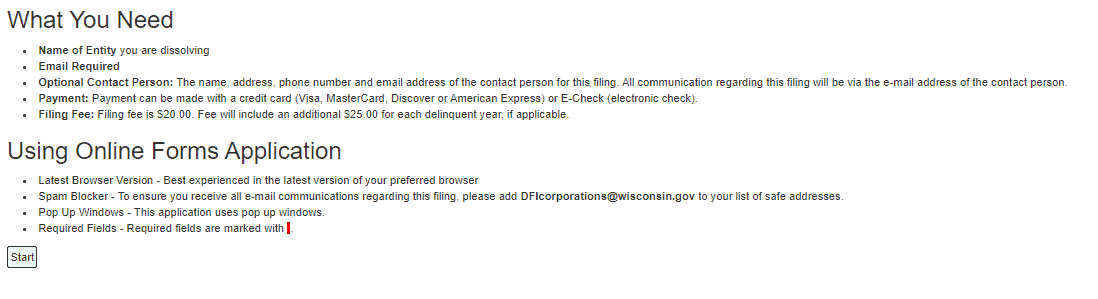

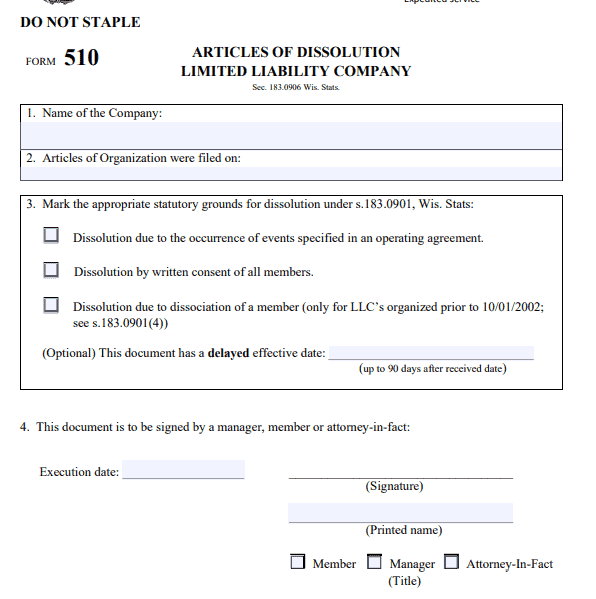

Wisconsin

In Wisconsin, the process to officially dissolve your LLC is to file articles of dissolution with the state. You can do so at the Department of Financial Institutions’ website or by downloading the form, filling it out, and mailing it in.

The mailing address is:

State of WI-Dept. of Financial Institutions

Box 93348

Milwaukee, WI, 53293-0348

The fee for filing the dissolution papers in Wisconsin is $20.

Wyoming

In Wyoming, you’ll submit articles of dissolution to the Secretary of State to officially dissolve your LLC.

Mail the form to:

Wyoming Secretary of State

Herschler Building East, Suite 101

122 W 25th Street

Cheyenne, WY 82002-002

The fee for filing the dissolution papers in Wyoming is $60.