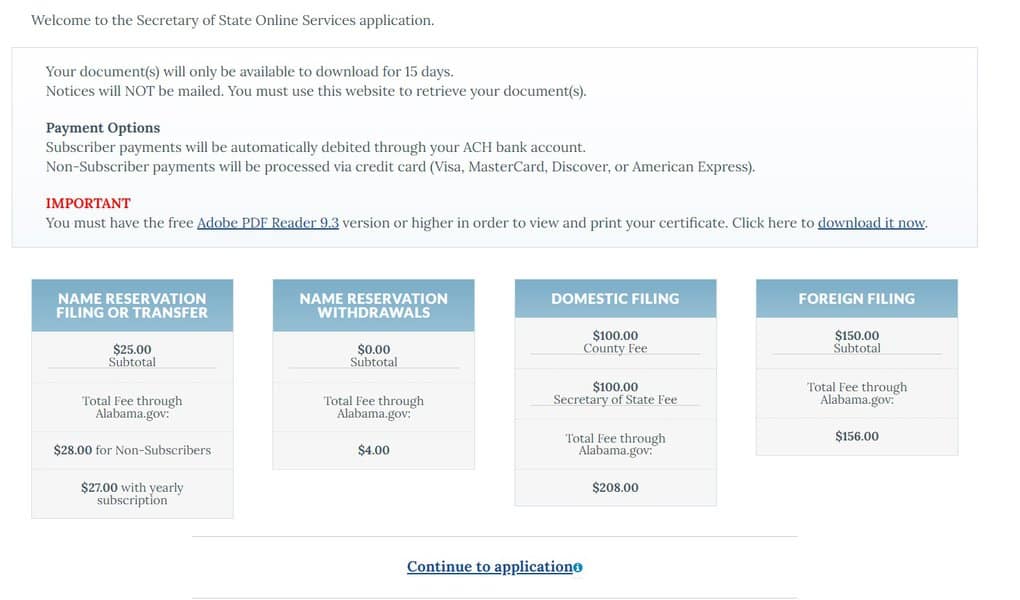

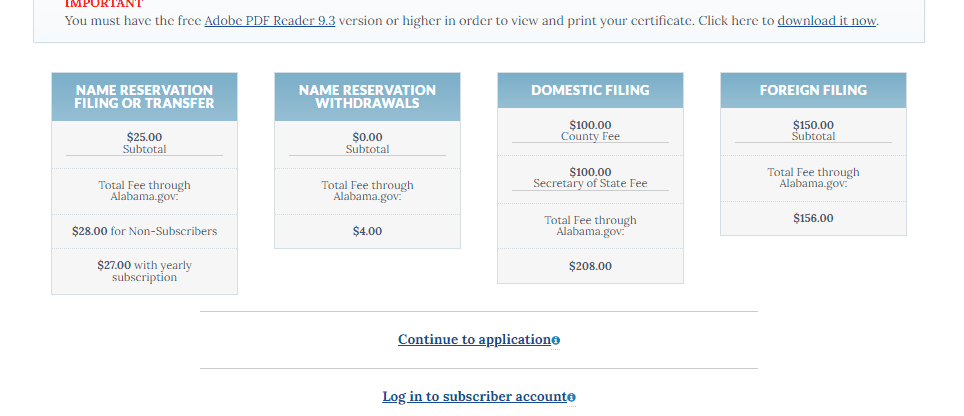

The cost to file a name reservation online in Alabama is $28. The fee for a mail-in application is $25. Once your application is processed, your LLC name will be reserved for one year.

How to Start Your Own LLC in Alabama

Written by: Carolyn Young

Carolyn Young has over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Sarah Ruddle

For over 15 years, Sarah Ruddle has been a noteworthy leader in the business and nonprofit world.

Updated on June 6, 2025

Thinking about launching your own business in Alabama? Starting an LLC is a smart, flexible way to protect your personal assets and establish credibility—without all the legal headaches.

In this step-by-step guide, you’ll learn exactly how to form your Alabama LLC, from choosing a name to filing the right paperwork and staying compliant.

1. Name Your Alabama LLC

Naming your business can be challenging. You need a name that’s unique and easy to remember and conveys what your business does. To choose a name, you can try a few different methods:

- Decide on a Business Concept: Before you name your LLC, you need to have a clear idea of what your business will do.

- Ask People You Know for Suggestions: Reach out to people whose opinions you value and trust. Explain your business concept and ask for their thoughts on a name.

- Do a Web Search: Once you have a few name ideas, check their online presence. Is the domain name available? Are there companies with similar names that could create confusion?

- Use an Online Business Name Generator: They can provide inspiration and help you think about your business from different angles. Keep in mind, though, that these generators can’t replace human creativity and may not understand the nuances of your business as well as you do.

Your business name is your business identity and the first impression people will have of your company, so take care with this step of the LLC formation process.

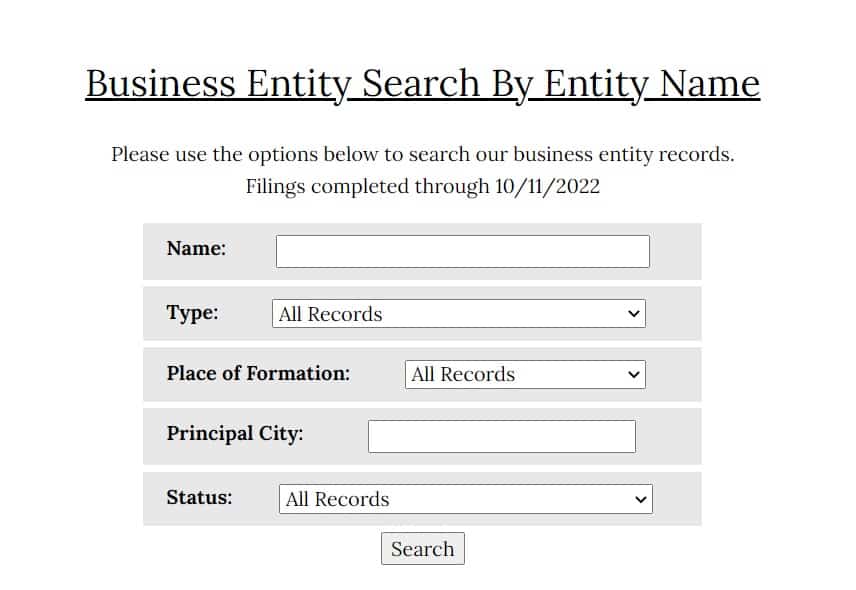

Check for availability in Alabama

Go to the Secretary of State’s website and enter your business name. You should also search for similar business names, as you don’t want a name that can be easily confused with other businesses in Alabama.

Check Alabama’s LLC name regulations

In Alabama, your LLC name must include “limited liability company,” or an abbreviation such as LLC or L.L.C. Also, business name cannot have words that could confuse your Alabama LLC with any government agency or include words like bank, insurance, or university without approval from state authorities.

Your business name must not be too similar to other business names in the state. It can only imply that your business does a different type of business than what is stated in your Certificate of Formation.

Check Trademarks

Check with the US Patent and Trademark Office to ensure the name has not been trademarked and is available nationally.

Once you’ve confirmed these, it’s a good idea to reserve the name using the state’s name reservation form.

How to file an Alabama LLC Name Reservation

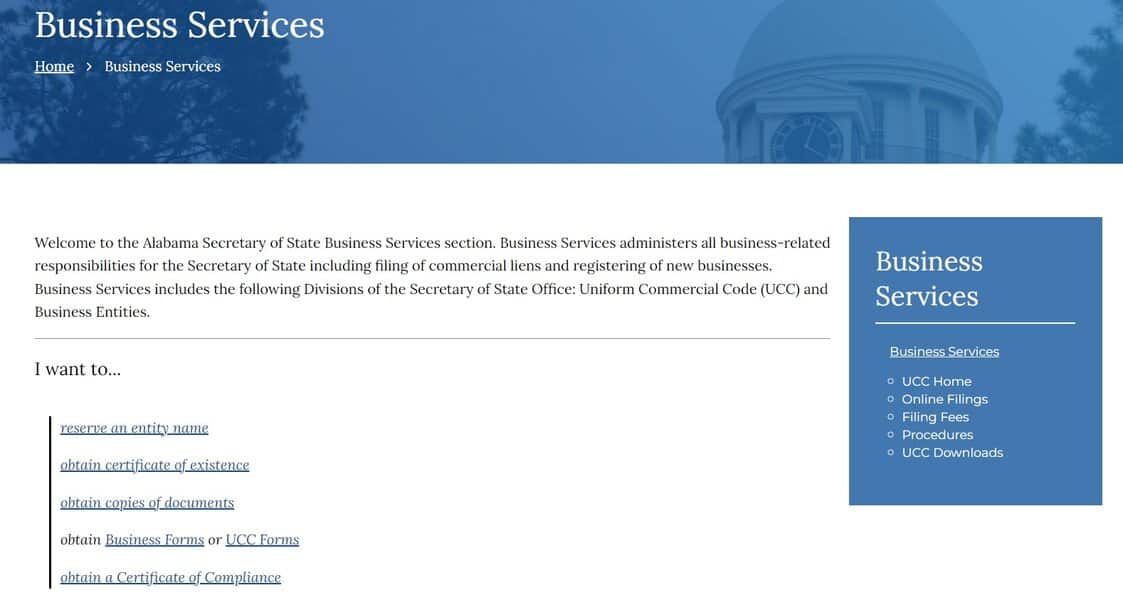

Visit the Secretary of State’s Business Services website to reserve an LLC name in Alabama.

Click on the “reserve an entity name” link, then click on the “name reservation menu” link. Then, click on “name reservation.”

Review the application information, which includes details on filing fees. Then, click “Continue to application” to begin the name reservation process. Alternatively, you can complete and submit a paper form.

Doing Business As (DBA)

You may want to do business under a name other than your LLC name. You’ll need to register a “doing business as” or DBA name. There are two main reasons you might want to use a DBA.

- Suppose you want to add new product lines. For example, if your business name is “JJ’s Waffles,” you want to expand and offer “JJ’s Muffins.” You can have multiple DBAs under the umbrella of your one LLC.

- When you have a DBA, you can have a business bank account under that name. So if you add “JJ’s Muffins,” customers can pay “JJ’s Muffins,” and you can deposit those payments into the bank account with that name.

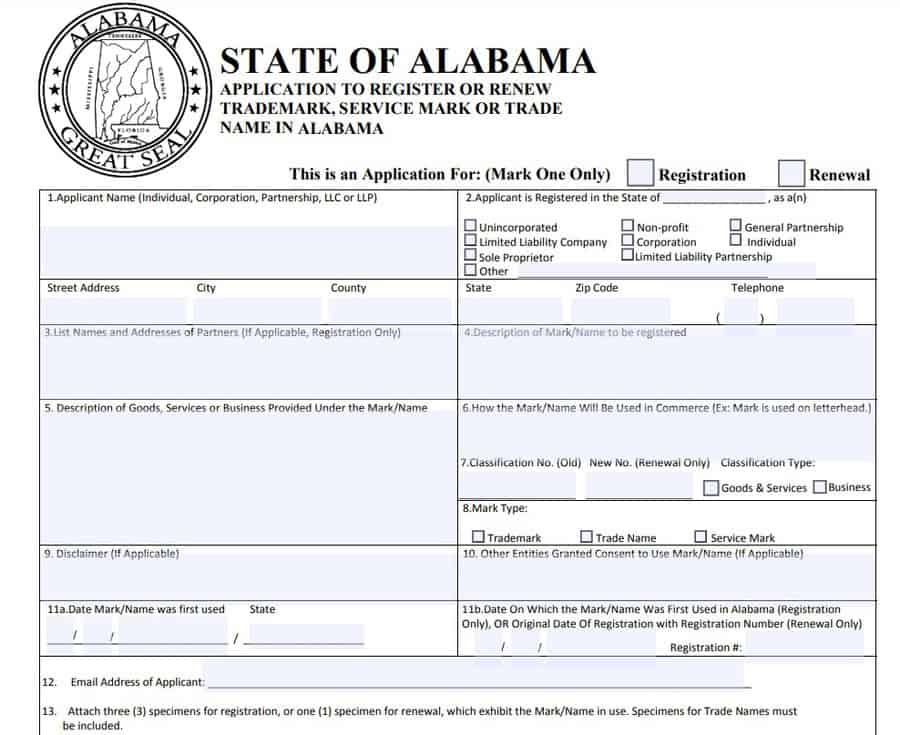

In Alabama, a DBA is known as a trade name. To register a trade name in Alabama, go to the Secretary of State website and download the application.

Here are additional tips and suggestions provided to assist in the process of choosing a name for an Alabama LLC.

2. Select a Registered Agent

Alabama requires LLCs to appoint a registered agent, a person or company authorized to accept official correspondence on behalf of your business, such as legal, tax, or financial documents. A registered agent ensures your business stays in compliance with state laws.

In Alabama, an LLC member can be the registered agent, or you can choose an individual that meets state requirements. In Alabama, the requirements are that the registered agent:

- Be 18 years or older

- Have a physical address in Alabama

- Be available during regular business hours

- Be registered to operate in Alabama, if it’s a business entity

Many business owners hire a registered agent service to ensure all important documents are received and addressed promptly. In addition, a registered agent service offers convenience.

If you choose to be your registered agent, you’ll have to be available at your registered agent’s address during regular business hours. However, a registered agent service will allow you the flexibility to run and grow your business wherever you need to be.

3. Determine Your Management Structure

Members or managers can manage LLCs. In a member-managed LLC, members handle all management duties. In a manager-managed LLC, non-member employees oversee operations and management duties.

Note that with a manager-managed LLC, a member can be a manager, but only in cooperation with another manager who is not a member.

Member-managed LLCs generally work best for LLCs with few members, all of whom can take an active role in day-to-day operations. Conversely, manager-managed LLCs are best for LLCs with more members, some of whom want to be “silent” or passive members and not involved in day-to-day operations.

Most LLCs are member-managed, as they are small businesses that cannot afford a management team. In Alabama, your LLC is considered member-managed if it’s not otherwise specified in the certificate of formation.

Discover the differences between member-managed and manager-managed LLCs, and gain insights on selecting the appropriate management structure for your LLC.

4. File a Certificate of Formation with the State of Alabama

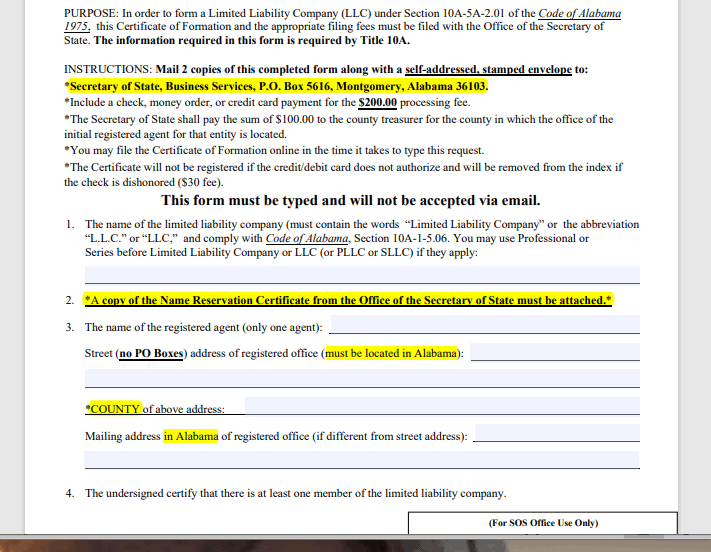

To form an LLC, you’ll need to file a Certificate of Formation with the Alabama Secretary of State.

In Alabama, the certificate of formation requires the following information:

- Contact information

- LLC name

- Principal office address

- Registered agent information

- Registered office address

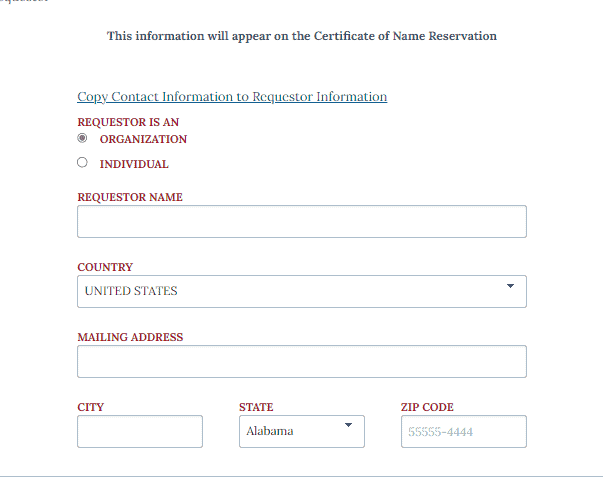

The first step is filling out your contact information. The page will then prompt you to reserve your chosen business name.

You’ll then be asked if you want just to reserve the name or go ahead with the document filing. After you select document filing, you’ll be prompted to enter your name as the requestor or person requesting the certificate of formation filing.

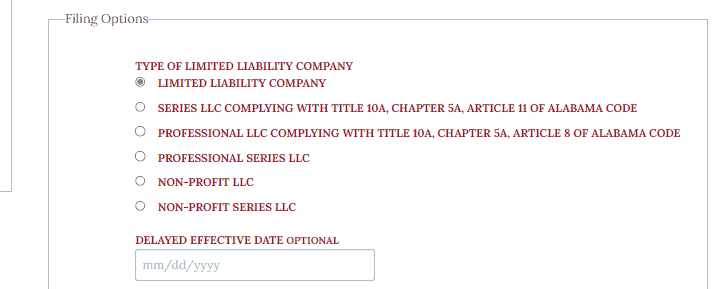

Then you will fill out your county and the type of LLC you are forming.

Finally, if applicable, you’ll fill out your registered agent name, address, and mailing address. You’ll have a chance to review all the information before payment.

The filing fee is $200 plus $25 for name reservation and an $11 online processing fee. You should receive confirmation in 7-10 days if you file online.

But remember that you’ll need to reserve the name first and include your name reservation certificate with your mailed-in certificate of formation. This tends to make for a lengthy process, and turnaround could take up to three weeks.

Contact Information for the Alabama Secretary of State

P.O. Box 5616

Montgomery, AL

36103-5616

Phone: (334) 242-7200

Fax: (334) 242-4993

5. Draft an LLC Operating Agreement

An Operating Agreement is a legal document that outlines the ownership and member duties of your Limited Liability Company (LLC).

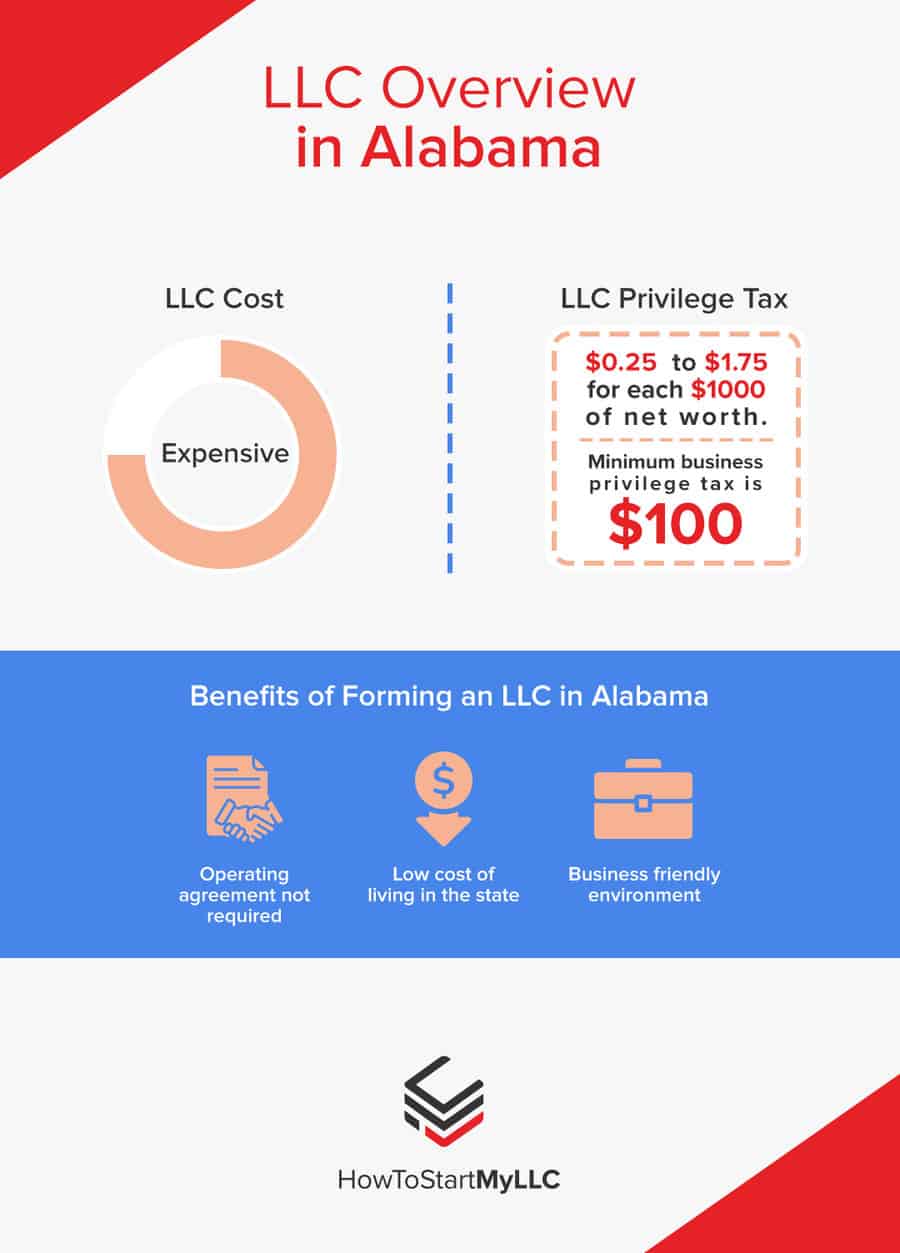

Alabama does not require an operating agreement, but it’s still a good idea to have one, even for single-member LLCs, as it can provide legal protections and more established operating procedures.

Here are the elements an LLC Operating Agreement should typically include:

- LLC’s name and principal address (primary location where business is registered)

- Duration of the LLC

- Registered agent name and address

- Membership Information

- Management and voting

- Financial matters (e.g. the way profits and losses will be divided)

- Changes and amendments (e.g. procedures for adding or removing members)

- Disputes, legalities, and policies

- Record keeping and communication

You can find operating agreement templates online, but it’s best to have them drawn up or reviewed by an attorney. The language of an operating agreement is crucial and often determines how member disputes are resolved. For more information about the operating agreement, refer to our comprehensive guide on the Alabama LLC operating agreement, and you can also obtain a free template.

6. Get an Employer Identification Number (EIN)

The IRS uses an EIN to identify your company, just as a Social Security number does for individuals. It’s used for tax filing purposes.

An EIN is required if your LLC has more than one member or if you are hiring employees. Obtaining an EIN requires applying on the IRS website.

The IRS rules for obtaining an EIN are as follows:

All EIN applications (mail, fax, electronic) must disclose the name and Taxpayer Identification Number (SSN, ITIN, or EIN) of the true principal officer, general partner, grantor, owner or trustor. This individual or entity, which the IRS will call the ‘responsible party,’ controls, manages, or directs the applicant entity and the disposition of its funds and assets. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity.

Learn how to get an Alabama Tax ID (EIN) for an LLC.

7. Obtain Business Licenses and Permits

Depending on the nature of your business, you may need to apply for licenses and permits at the federal, state, and local levels.

At the federal level, licenses and permits are generally industry-specific and may include health licenses and permits from the Occupational Safety and Health Administration (OSHA). Check the SBA guide for specific licenses required for your business.

Visit the Business Licensing section on the Alabama Department of Revenue’s website to obtain guidance and information regarding the necessary licenses and permits required for running your business within the state.

If you sell tangible goods or services subject to sales tax, you’ll need a sales tax license, also known as a seller’s permit.

For information about local licenses and permits, check the websites or offices for any cities or counties where you will do business.

Here are some standard licenses and permits you may need:

- Industry-specific licenses for certain professions and industries, such as construction, plumbing, electrical, childcare, food handling, liquor, architecture, and finance

- Building and zoning permits

- Doing business as (DBA) permits using a name other than your LLC.

- Health licenses and permits at federal, state, and local levels

- Fire permits

- Sign permits

This is a very important step in the LLC formation process, so make sure that you check with your state and local government offices to find out all the licenses and permits you need.

You could face steep fines and penalties if you operate without the proper licenses and permits.

If you need help, it’s a good idea to consult a business attorney to ensure you’re in full compliance. You can also use a service like MyCorporation to do the research and provide you with all the forms you need to license your business.

8. Choose Your Tax Status

By default, an LLC is a “pass-through” entity, which means the business itself does not pay income taxes. Instead, the business’s profits or losses are passed through to the members’ individual tax returns. The taxes are then paid at each member’s individual tax rate.

- Single-Member LLCs: If the LLC has only one member, it’s taxed like a sole proprietorship by default. This means the income from the LLC is reported on the member’s personal income tax return on Schedule C, and they’re responsible for paying self-employment taxes (Social Security and Medicare taxes) on that income.

- Multi-Member LLCs: If the LLC has more than one member, it’s taxed as a partnership by default. The LLC must file an informational tax return (Form 1065), but the income and deductions are passed through to the members. Each member reports their share of the income and deductions on their personal tax return. As with single-member LLCs, members must also pay self-employment taxes on their share of the profits.

An LLC can also choose to be taxed as a corporation by filing an election form with the IRS (Form 8832 for a C-Corp and Form 2553 for an S-Corp). This can be beneficial under certain circumstances:

- C-Corporation Taxation: Electing to be taxed as a C-Corporation can offer benefits to an LLC, particularly if the members want to retain earnings in the company. The corporation pays tax on its profits at the corporate rate (which was 21% as of 2022). If the profits are distributed to the members as dividends, the members must report these dividends on their tax returns and pay tax on them. This is known as “double taxation.” However, members aren’t subject to self-employment taxes on their dividends.

- S-Corporation Taxation: Choosing S-Corporation status can also be beneficial for an LLC. Under this scenario, the LLC does not pay corporate income tax. Instead, the income, deductions, and credits pass through to the shareholders, who report them on their individual tax returns. However, unlike a standard LLC, an S-Corp is required to pay its members a “reasonable” salary for the work they perform for the company. This salary is subject to payroll taxes, but any additional profits distributed to the members aren’t subject to self-employment taxes. This can result in significant tax savings, especially for businesses with high net income.

Other Requirements

Open Your Business Bank Account

When you have an LLC, it’s important to keep your business and personal finances separate for accounting and tax purposes. Commingling your business and personal funds can threaten your liability protection since the line between business and personal assets will not be clear.

Most banks in Alabama offer business bank accounts, so check with your local bank. You’ll need your EIN and a copy of your Certificate of Formation. Your bank may require other documents as well.

Apply for a Business Credit Card

A business credit card can help establish business credit so that if you apply for a business loan or business line of credit in the future, you’ll have a better chance of getting approved. A business credit card can also help you with your startup expenses.

Obtain Business Insurance

Insurance is the right choice to protect the investment you’ve made in your business. There are several different types of insurance you may need.

- General liability: A comprehensive type of insurance covering many business elements. It includes coverage against bodily injury and property damage.

- Professional liability: Protects against claims from a customer who suffered a loss due to an error or omission in your work. It’s also known as errors and omissions (E&O) insurance.

- Workers’ compensation: Provides compensation to employees injured on the job.

- Property: Covers your physical business space.

- Business Property: Covers equipment and supplies.

- Equipment Breakdown Insurance: Covers the repair or replacement of broken equipment due to mechanical issues.

- Commercial auto: Covers your company-owned vehicles.

- Business owner’s policy (BOP): This option combines the above insurance types.

Keep LLC Records

You’ll need to keep a copy of your formation documents and your operating agreement in a safe place. Any other official documents, such as legal or financial documents, should also be kept in your records, vendor contracts, and any other documents you use during the business.

File an Annual Report and a Business Privilege Tax

LLCs must file an annual report with the state of Alabama to remain in good standing, and the filing fee is $100.

Alabama LLCs also must file a Business Privilege Tax Return, and the tax is based on the amount of income the LLC earned. You can find the form here.

Both are due no later than two and a half months after the beginning of the taxpayer’s taxable year.

Alabama LLC FAQs

Requirement Cost

Name Reservation Fee $25

LLC Registration Fee $250

Business License Fees Vary by localities and type of business

DBA fee $30

Annual Report Fee $10 plus calculated business privilege tax

To look up an LLC in Alabama, visit the Alabama Secretary of State Business Entity Search page. You can search by entity name, number, or registered agent.

The search will show key details like formation date, status, type, and principal address.

Click the entity name or ID for full business details, including filing history and registered agent info.

To add a DBA (trade name) to your Alabama LLC, file the Application to Register or Renew a Trademark, Service Mark, or Trade Name with the Secretary of State.

You must already be using the trade name and provide three examples (specimens) showing use. The filing fee is $30 by mail or $31.20 online. Trade names must be renewed every 5 years.

If you file online, your Alabama LLC is approved immediately. Mail filings take about 1 week total, including 1–2 business days for processing plus mailing time.

Alabama LLCs pay state income tax (2–6%), Business Privilege Tax, and possibly sales tax. Owners also pay federal income and self-employment taxes. If the LLC has employees, payroll taxes apply.

To maintain an LLC in Alabama, file the Business Privilege Tax Return and Annual Report by April 15 each year, keep a registered agent and office, update your records with the state, renew necessary licenses and permits, and remain current on all state and federal taxes.

Yes, you can be your own registered agent in Alabama as long as you are a resident of the state, have a physical address to serve as the registered office address, and are on-site during normal business hours to receive legal paperwork and certified mail.

Alabama LLCs are not required to have an operating agreement. That said, having a well-drafted operating agreement on hand is essential for many aspects of your business.