Turnaround times for acquiring the certificate vary greatly, so refer to your state for details.

What Is a Certificate of Good Standing and How to Get One

Written by: Carolyn Young

Carolyn Young has over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Sarah Ruddle

For over 15 years, Sarah Ruddle has been a noteworthy leader in the business and nonprofit world.

Updated on July 18, 2024

A key part of being a successful business owner is ensuring you have all the necessary documentation. This includes a certificate of good standing, an official document that confirms your company is authorized to do business in your state.

There are many reasons a business might need a certificate of good standing, from requesting a loan or new line of credit to purchasing a new office space. Getting a copy is a simple process, usually handled by the same state agency with which you registered your business.

This guide lays out all the essential information about certificates of good standing, including how to acquire one.

Who Needs a Certificate of Good Standing?

A certificate of good standing is not required for day-to-day business operations, but you might need one to deal with any situation.

When you open a dedicated business bank account, it’s common for the bank to request a copy of your certificate of good standing as part of the process. In addition, business insurance providers, creditors, and lenders often request such a certificate.

If you’re looking to merge with another company, that company will likely wish to see your certificate as proof of your legitimacy. You may also need a certificate of good standing if you’re looking to land a government contract. When selling your business, having your certificate readily available helps brokers and potential buyers assess your credibility.

Routine business transactions, like renewing permits and certificates, may require you to provide an updated copy of your certificate of good standing to complete the process. You will also likely need to produce a copy if you register to do business in other states.

In What Situations Would I Need a Certificate of Good Standing?

A bank or creditor might request a certificate of good standing as part of their due diligence and risk assessment if you apply for a business loan or business credit. They need to verify that you’re registered to do business in the state and fully compliant.

If you expand your business to other states, you’ll have to register as a foreign LLC. In such cases, the new state may request a certificate of good standing from your home state.

How To Obtain a Certificate of Good Standing

When it comes to obtaining government documents, the process can sometimes be a hassle. Fortunately, getting a certificate of good standing is relatively straightforward, and the steps are similar across the country.

Business Registration

First, it’s important to know that you can only get a certificate of good standing if you registered your business with the state. Not all business types are required to register, so keep this in mind. If your business is a corporation or a limited liability company (LLC), both must register when forming the business, so obtaining a certificate should be fairly straightforward.

However, registration requirements for other business entities, such as partnerships, limited partnerships (LP), and limited liability partnerships (LLP), vary from state to state. In addition, sole proprietorships are not required to register in any state.

In Good Standing

To obtain a certificate of good standing, your business must be in good standing. In other words, you must meet all of your state’s legal requirements and fully comply with state laws. This means that you’ve filed your quarterly and annual reports, filed and paid all your taxes, and acquired all the necessary licenses and permits.

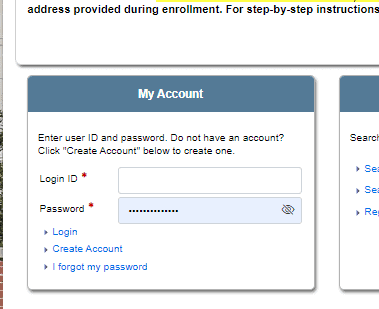

If you’re unsure of whether or not your business is in good standing, most states have a way to check your status online. If you registered your business online, you should be able to log into your state business portal and find the information you need.

Requesting a Certificate of Good Standing

The business filing agency in your state typically also handles issuing certificates of good standing. In many states, the agency is either the Secretary of State or the Department of Revenue, though it may be something else, so refer to your state business guidelines.

Most states allow you to request a copy of your certificate online, although some require a written request form. In addition, you can request a copy in person or over the phone.

Some states have fees associated with obtaining a certified copy, and some business owners hire a legal service company to obtain it on their behalf.

To learn what’s needed to acquire a Certificate of Good Standing in your state, select a state from the list below. You’ll discover all the essential details and additional resources necessary to obtain a Certificate of Good Standing in your state.

Choose Your State

- A

- C

- D

- F

- G

- H

- I

- K

- L

- M

- N

- O

- P

- R

- S

- T

- U

- V

- W

A-M

- alabama

- alaska

- arizona

- arkansas

- california

- colorado

- connecticut

- delaware

- florida

- georgia

- hawaii

- idaho

- illinois

- indiana

- iowa

- kansas

- kentucky

- louisiana

- maine

- maryland

- massachusetts

- michigan

- minnesota

- mississippi

- missouri

M-W

How to Get a Certificate of Existence in Alabama

To get a certificate, you must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to be up-to-date on all Alabama business licenses, permits, and reporting requirements for your LLC or corporation in Alabama.

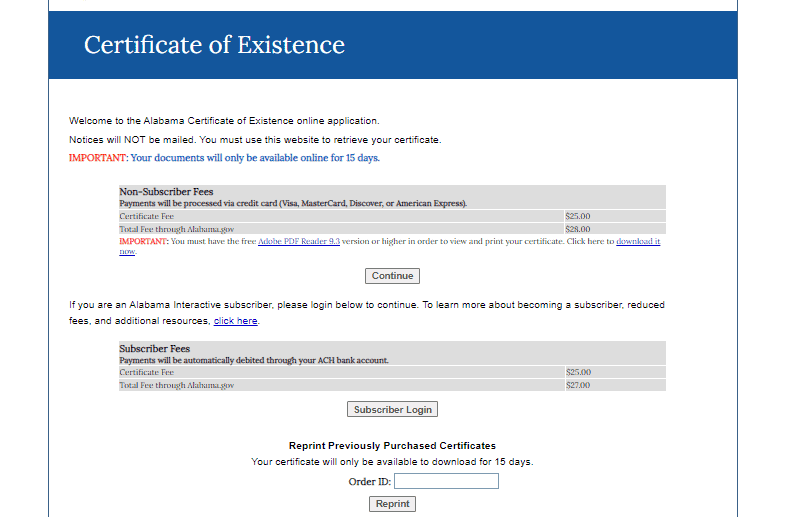

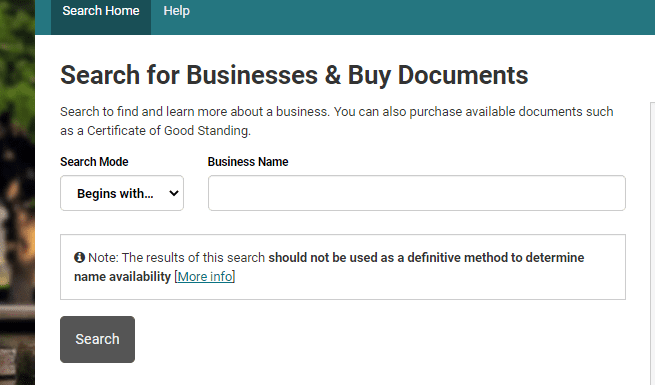

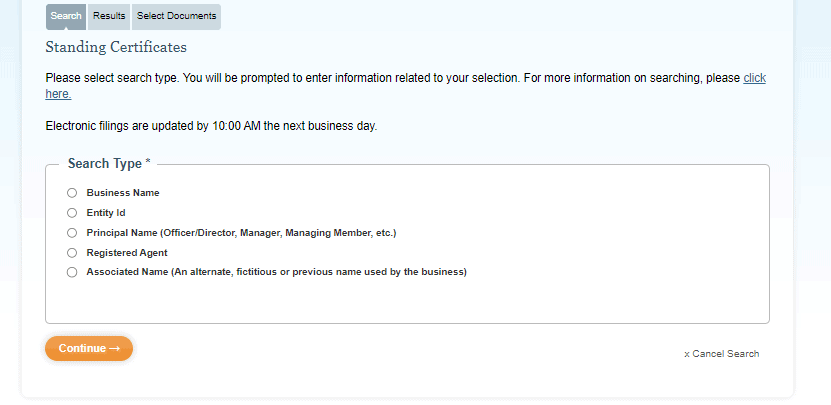

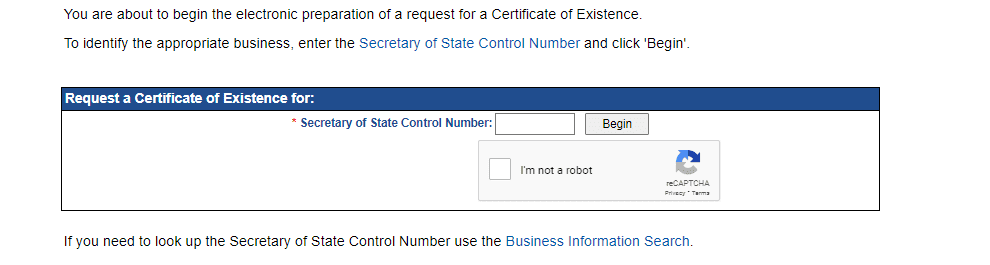

In Alabama, the Secretary of State issues certificates of existence. You can obtain one online by filling out an application on the Secretary of State’s website.

The fee is $25 by mail and $28 online. You should be able to access a certificate online immediately if your LLC is fully compliant. However, it will only be available online for 15 days after you apply.

The Department of Revenue issues certificates of compliance to verify that you have paid all required state taxes.

To obtain a certificate of compliance, visit the Department of Revenue’s website to apply. The fee is $14, and requests are generally processed within three to five business days. Once the form is available online, you’ll have 15 days to retrieve it.

How to Get a Certificate of Compliance in Alaska

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of compliance.

You’ll also need to be up-to-date on all Alaska business licenses, permits, and reporting requirements for your LLC or corporation in Alaska.

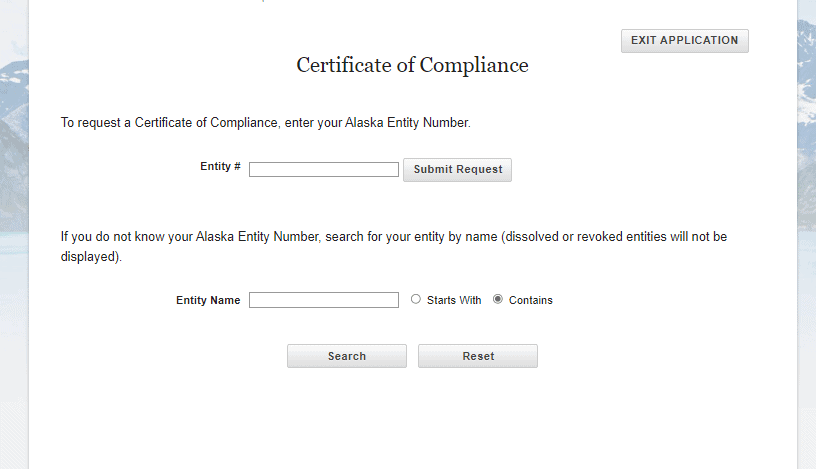

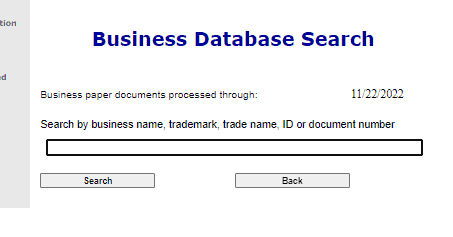

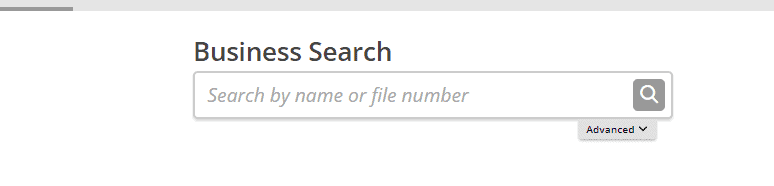

The Division of Corporations, Business, and Professional Licensing issues compliance certificates in Alaska. You can obtain one online at the Division of Corporations, Business, and Professional Licensing website.

Just enter your entity number and business name.

The fee is $10, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

To request your certificate of compliance by mail, you can download a copy request form and mail it, along with the $10 fee, to:

State of Alaska

Department of Commerce, Community, and Economic Development

Division of Corporations, Business and Professional Licensing

PO Box 110806

Juneau, Alaska 99811-0806

When filing by mail, expect a 10- to 15-day processing time.

How to Get a Certificate of Good Standing in Arizona

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to be up to date on all Arizona business licenses and permits, along with reporting requirements for your LLC or corporation in Arizona.

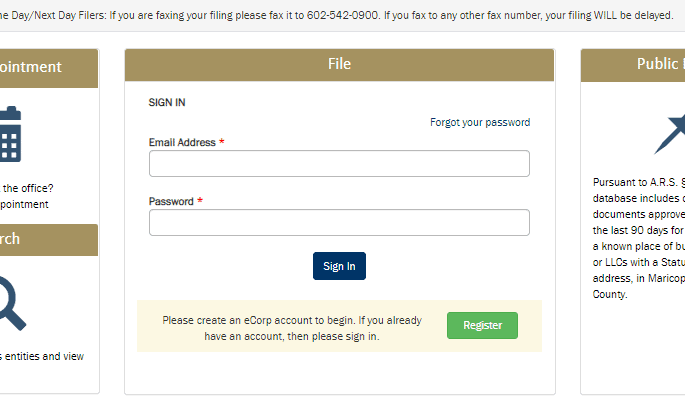

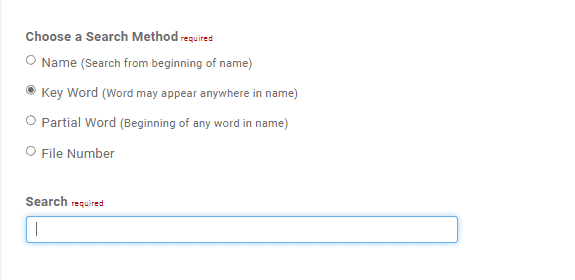

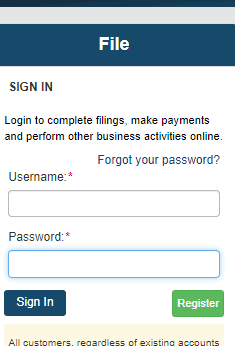

In Arizona, the Corporations Commission issues certificates of good standing. You can obtain one online by logging into your account at the Corporations Commission website.

Just fill out the request form. The fee is $10, and assuming your LLC is in full compliance, you should be able to access the certificate online immediately.

You can also download the request form and mail it, with the $10 fee, to:

Arizona Corporation Commission

Records Section

1300 W. Washington St.

Phoenix, Arizona 85007

How to Get a Certificate of Good Standing in Arkansas

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in Arkansas. You’ll need to be up-to-date on all Arkansas business licensing, permits, and reporting requirements.

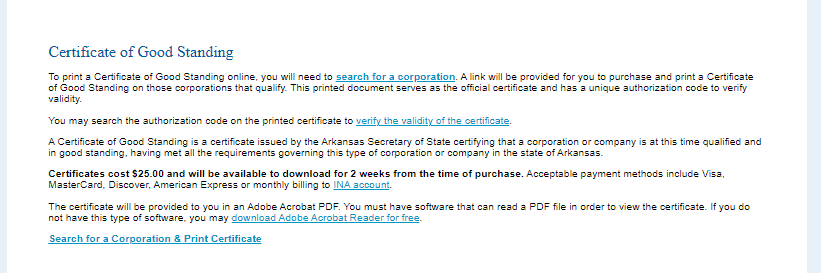

In Arkansas, the Secretary of State issues certificates of good standing. You can obtain one online.

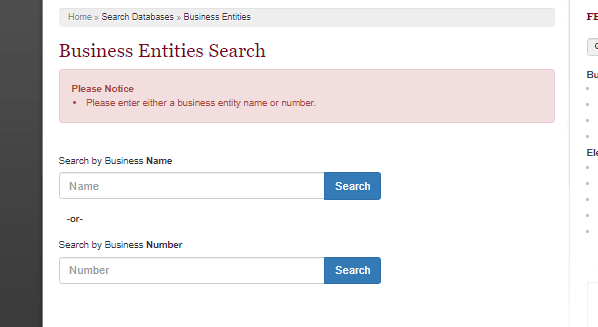

To get your certificate of good standing, head to the Secretary of State’s website to search for your business entity and print your certificate.

The fee is $25, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately. You’ll be able to access the form for two weeks from the time of purchase.

You cannot request a certificate by mail. You can only obtain it online.

How to Get a Certificate of Status in California

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of status.

You’ll also need to comply with all legal requirements for your LLC or corporation in California. That means you’ll need to be up to date on all California business licenses, permits, and reporting requirements.

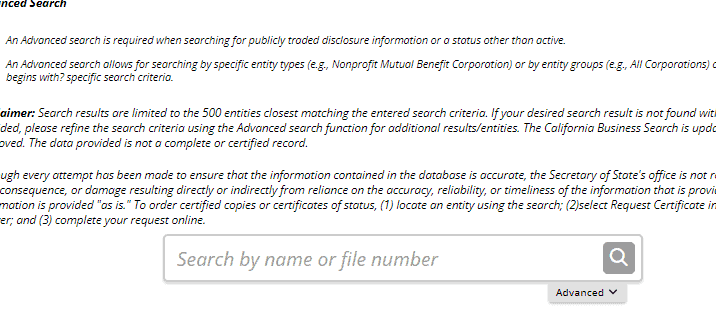

In California, the Secretary of State issues certificates of status. You can obtain one online.

To get your certificate of status, head to the Secretary of State’s website and search for your business entity.

When you find your business entity, click on it and click the “request certificate” icon.

The fee is $5, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

You can no longer request the certificate by mail. You can only obtain it onli

How to Get a Certificate of Good Standing in Colorado

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in Colorado. That means you’ll need to be up-to-date on all Colorado business licenses, permits, and reporting requirements.

In Colorado, the Secretary of State issues certificates of good standing. Unfortunately, you cannot request the form by mail. You can only obtain it online.

Visit the Secretary of State’s website and search for your business entity.

Click on your business name and “get a certificate of good standing.”

The fee is free, and assuming your LLC is in full compliance, you should be able to access your certificate immediately.

How to Get a Certificate of Legal Existence in Connecticut

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of legal existence.

You’ll also need to comply with all legal requirements for your LLC or corporation in Connecticut. That means you’ll need to be up to date on all Connecticut business licenses, permits, and reporting requirements.

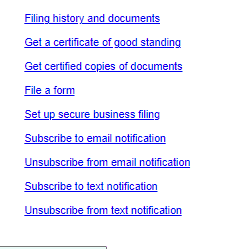

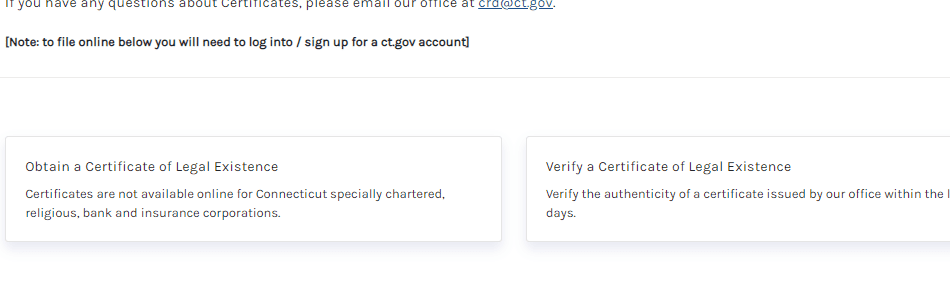

In Connecticut, the Business Department issues certificates of legal existence. You can obtain one online.

Visit the Business Department’s website and click “obtain a certificate of legal existence.”

You’ll need to sign into your account to obtain the certificate.

The fee is $50 for a short-form certificate and $100 for a long-form, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Alternatively, you can download the request form and mail it, along with the fee, to:

COMMERCIAL RECORDING DIVISION

CONNECTICUT SECRETARY OF THE STATE

P.O. BOX 150470

HARTFORD, CT 06115-0470

How to Get a Certificate of Good Standing in Delaware

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to be up to date on all Delaware business licenses, permits, and reporting requirements for your LLC or corporation in Delaware.

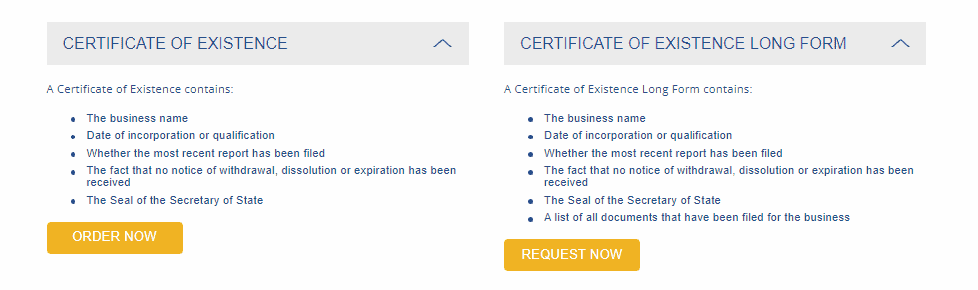

In Delaware, the Division of Corporations issues certificates of good standing by uploading your request to the Division of Corporations website.

The fee is $50 for a short-form certified certificate and $175 for a long form. Assuming your LLC is in full compliance, the certificate will be mailed to you by first-class mail as soon as your request is processed.

Alternatively, you can mail your request, along with the fee, to the following:

Division of Corporations

401 Federal Street

Suite 4

Dover, DE 19901

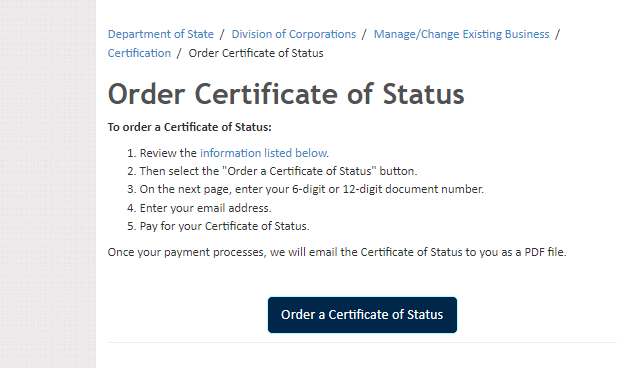

How to Get a Certificate of Status in Florida

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of status.

You’ll also need to be up to date on all Florida business licensing, permits, and reporting requirements for your LLC or corporation in Florida.

In Florida, the Division of Corporations issues certificates of status. You can obtain one through the Division of Corporations website.

Enter your Florida document number to locate your business, request your certificate, and pay the $5 fee if you are an LLC and $8.75 if you are a corporation. Assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Alternatively, you can submit your request for the certificate in writing. It needs to contain the following:

- Your entity’s name

- The Florida document or registration number

- The document type (e.g., Articles of Incorporation, Amendment, Dissolution)

- The date the document was filed with the Division of Corporations.

- Payment in the form of a check or money order.

You’ll mail the request to:

Department of State Division of Corporations

Section Name

P.O. Box 6327

Tallahassee, FL 32314

- Make all checks payable to the Florida Department of State.

- Must be payable in U.S. currency drawn from a U.S. bank.

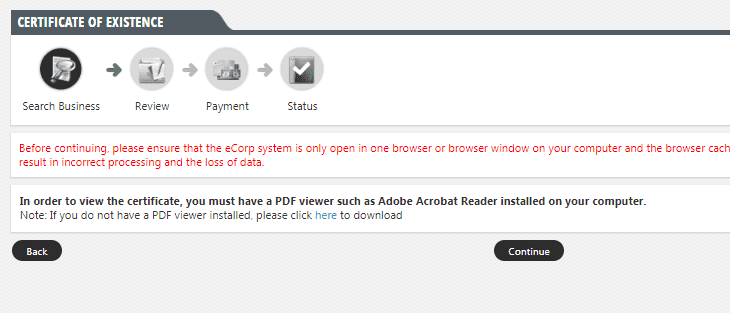

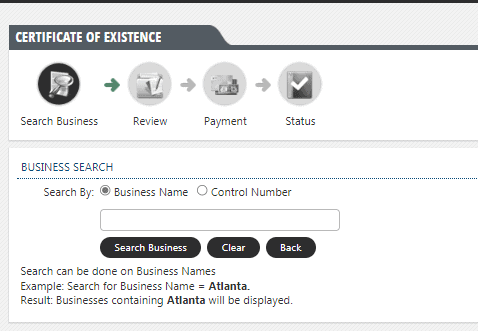

How to Get a Certificate of Existence in Georgia

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to be up to date on all Georgia business licenses, permits, and reporting requirements for your LLC or corporation in Georgia.

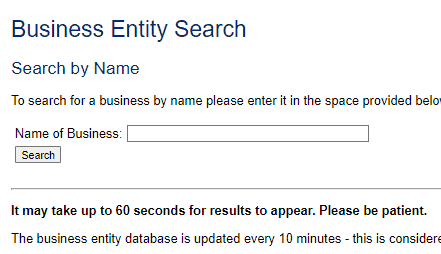

The state issues certificates of existence in Georgia through the Corporations Division website.

Just enter your business name or control number.

Then, review your LLC information, and pay the $10 fee for paper and online filing and $60 for expedited processing.

Assuming your LLC is compliant, you should be able to access your certificate online immediately.

You cannot request your certificate by mail. It’s only available online.

How to Get a Certificate of Good Standing in Hawaii

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to be up to date on all Hawaii business licensing, permits, and reporting requirements for your LLC or corporation in Hawaii.

In Hawaii, the Business Registration Division, in conjunction with the Department of Commerce and Consumer Affairs, issues certificates of good standing through the Hawaii business portal.

Enter your business name and add the certificate of good standing to your cart to purchase it.

The fee is $7.50, and assuming your LLC is compliant, you should be able to access your certificate online immediately.

Alternatively, requests for Good Standing Certificates can also be submitted via phone, email, mail, fax, or in person.

If you wish to mail your request, send it with the fee to:

Department of Commerce and Consumer Affairs

Business Registration Division

P.O. Box 40

Honolulu, HI 96810

How to Get a Certificate of Good Standing in Idaho

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to be up-to-date on all Idaho business licensing, permits, and reporting requirements for your LLC or corporation in Idaho.

In Idaho, the Secretary of State issues certificates of good standing. You can obtain one online at the Secretary of State’s website.

Search for your business, then click the “Request Certificate.”

The fee is $10, and assuming your LLC is in compliance, you should be able to access your certificate online immediately.

Alternatively, you can download the request form and mail it to the following:

Office of the Secretary of State

450 N 4th Street

PO Box 83720

Boise, ID 83720-0080

How to Get a Certificate of Good Standing in Illinois

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to be up to date on all Illinois business licensing, permits, and reporting requirements for your LLC or corporation in Illinois.

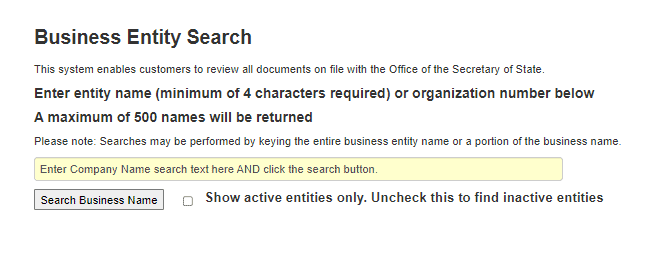

In Illinois, the Secretary of State issues certificates of good standing. You can obtain one online at the Secretary of State’s website.

Search for your business name, then select “Certificate of good standing.”

The fee is $25, and, assuming your LLC is in compliance, you should be able to access your certificate online immediately.

You cannot request your LLC certificate of good standing by mail. You can only obtain it online.

How to Get a Certificate of Existence in Indiana

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to comply with all legal requirements for your LLC or corporation in Indiana. That means you’ll need to be up to date on all Indiana business licenses, permits, and reporting requirements.

In Indiana, the Secretary of State issues certificates of good standing. You can obtain one online.

Visit the Secretary of State’s website and select either the basic certificate of existence or the long form.

Then you’ll need to log in to your account on the website and request the form.

The fee is $26 when you submit your request online, and assuming your LLC complies; you should be able to access your certificate online immediately.

Alternatively, you can download the request form and mail it, with the fee, to:

Indiana Secretary of State

Attn: Certification Clerk

302 West Washington Street

Room E-018

How to Get a Certificate of Standing in Iowa

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in Iowa. That means you’ll need to be up to date on all Iowa business licenses, permits, and reporting requirements.

In Iowa, the Secretary of State issues certificates of standing. You can obtain one online.

Visit the Secretary of State’s website and search for your business by name or business number.

Select your business and then click “print certificate of existence.”

The fee is $5, and assuming your LLC is in compliance, you should be able to access your certificate online immediately.

However, you cannot request your certificate by mail. You can only obtain it online.

How to Get a Certificate of Good Standing in Kansas

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in Kansas. That means you’ll need to be up to date on all Kansas business licenses, permits, and reporting requirements.

In Kansas, the Secretary of State issues certificates of good standing. You can obtain one online.

Visit the Secretary of State’s website and search for your business.

Click on “view record” and “certificate of good standing.”

The fee is $10 online and $15 by mail or phone. Assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Alternatively, you can download the request form and mail it, along with a fee, to:

Memorial Hall, 1st Floor

120 S.W. 10th Avenue

Topeka, KS 66612-1594

How to Get a Certificate of Existence in Kentucky

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to comply with all legal requirements for your LLC or corporation in Kentucky. That means you’ll need to be up to date on all Kentucky business licenses, permits, and reporting requirements.

In Kentucky, the Secretary of State issues certificates of existence. You can obtain one online.

Visit the Secretary of State’s website and search for your business.

Click on your business and select “certificates.” Then fill in the requested information and submit payment.

The fee is $10, and assuming your LLC complies; you should be able to access your certificate online immediately.

Alternatively, you can download the request form and mail it to the following:

Division of Business Filings

P.O. Box 718

How to Get a Certificate of Good Standing in Louisiana

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to be up to date on all Louisiana business licenses, permits, and reporting requirements for your LLC or corporation in Louisiana.

In Louisiana, certificates of good standing are issued through the Secretary of State’s website.

You can search for your business, click on “View details” next to your business name, and “Buy certificates and certified copies.” Then you’ll select to purchase a certificate of good standing.

The fee is $20, and, assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Alternatively, you can mail a written request for the certificate, along with the $20 fee, to:

Secretary of State

P.O. Box 94125

Baton Rouge, LA 70804

The request can also be faxed to 225.932.5313

How to Get a Certificate of Existence in Maine

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to be up to date on all Maine business licenses, permits, and reporting requirements for your LLC or corporation in Maine.

In Maine, the Bureau of Corporations issues certificates of existence but only accepts written requests. You can mail the request to:

Bureau of Corporations

101 State House Station

Augusta, ME 04333-0101

The fee is $30, and, assuming your LLC is in full compliance, you should receive your certificate within ten days.

How to Get a Certificate of Status in Maryland

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of status.

You’ll also need to be up to date on all Maryland business licenses, permits, and reporting requirements for your LLC or corporation in Maryland.

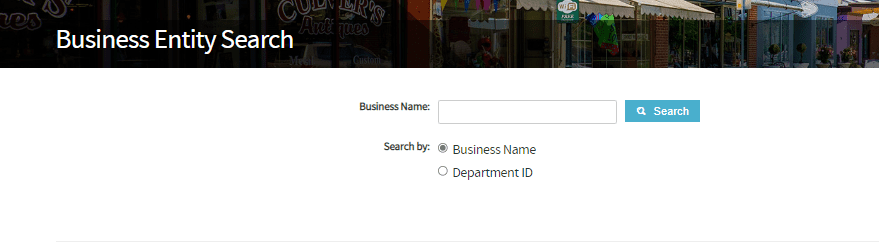

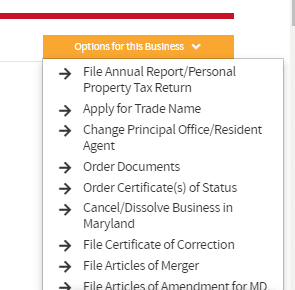

In Maryland, the Department of Assessments and Taxation issues certificates of status. You can obtain one online through the Maryland Business Express website.

Search for your business, then click on the name to bring up your LLC’s information. Next, click “Options for this business” to view the dropdown menu and select “Certificate of status.”

The fee is $20, and, assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Alternatively, you can send a written request for the certificate, along with the $20 fee, to:

SDAT – Corporate Charter Division

301 W. Preston Street, Room 801

Baltimore, MD 21201

How to Get a Certificate of Legal Existence in Massachusetts

You must have a registered business LLC in the state to receive a certificate of existence. Corporations can receive a certificate of good standing or legal existence. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of legal existence or good standing.

You’ll also need to be up to date on all Massachusetts business licenses, permits, and reporting requirements for your LLC or corporation in Massachusetts.

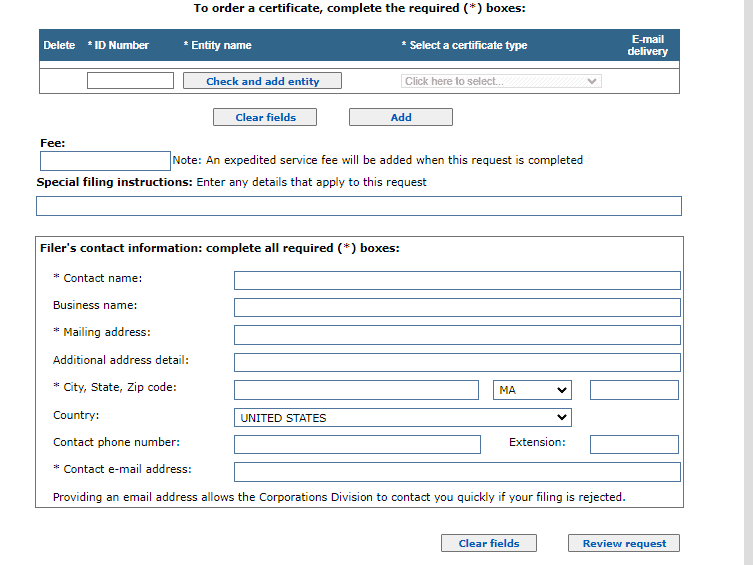

In Massachusetts, the Secretary of State issues certificates of legal existence. You can obtain one online at the Secretary of State’s website.

Fill in the requested information and choose to receive your certificate by email or regular mail.

The fee is $12, and, assuming your LLC is in full compliance, you should receive your certificate within 48 hours if you elect to receive it by email.

You cannot request your certificate by mail. You can only request it online.

In Massachusetts, you can also order a certificate of good standing that states that you’re up to date on all state tax payments. The Department of Revenue issues these certificates through your Mass Tax Connect account. There is no fee.

How to Get a Certificate of Good Standing in Michigan

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to be up to date on all Michigan business licenses, permits, and reporting requirements for your LLC or corporation in Michigan.

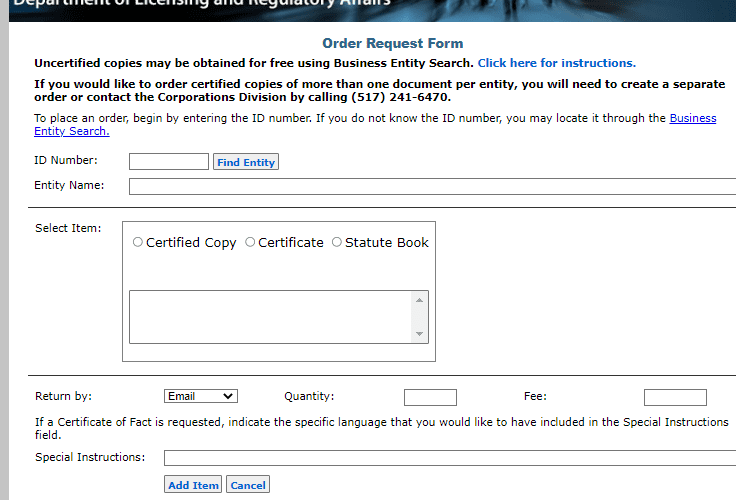

In Michigan, certificates are issued online through the Department of Licensing and Regulatory Affairs website.

Enter your business ID number and select the type of certificate you’re ordering and the method of return you request.

The fee is $12.50 in person and $10 online, by mail, or by phone. Assuming your LLC is in full compliance, you should receive your certificate within five days.

Alternatively, you can download the request form and mail it, along with the fee, to:

LARA, Corporations Division

P.O. Box 30054

Lansing, MI 48909

How to Get a Certificate of Good Standing in Minnesota

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to be up to date on all Minnesota business licenses, permits, and reporting requirements for your LLC or corporation in Minnesota.

In Minnesota, the Secretary of State issues certificates of good standing. You can obtain one online at the Secretary of State’s website.

Search for your business, then choose to see the details of your LLC and select “Order certificate.”

The fee is $15 online and $5 by mail and in person. Assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Alternatively, you can download the request form and mail it, along with the fee, to:

Minnesota Secretary of State – Certification

First National Bank Building

332 Minnesota Street, Suite N201

How to Get a Certificate of Good Standing in Mississippi

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to be up to date on all Mississippi business licenses, permits, and reporting requirements for your LLC or corporation in Mississippi.

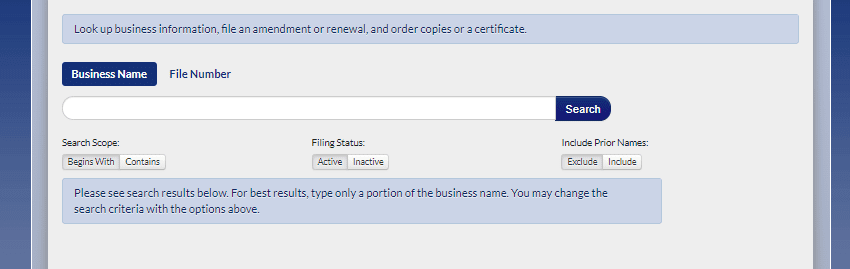

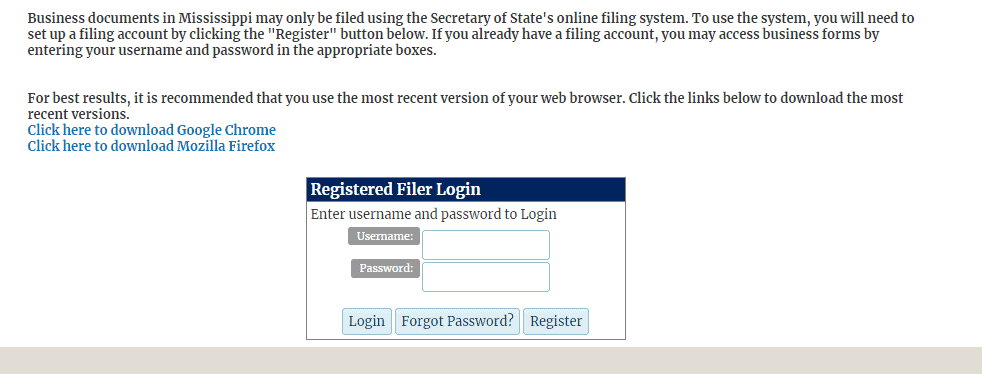

In Mississippi, certificates of good standing can be obtained from the Secretary of State’s website.

The fee is $25, and, assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Unfortunately, the certificate is only available online.

How to Get a Certificate of Good Standing in Missouri

ou must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to be up to date on all Missouri business licenses, permits, and reporting requirements for your LLC or corporation in Missouri.

In Missouri, the Secretary of State issues certificates of good standing. You can obtain one online at the Secretary of State’s website.

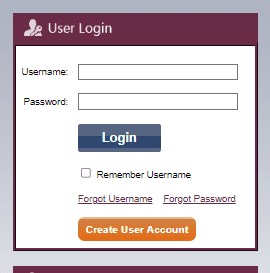

Sign into your account, select “Order copies/certificates” and “Certificate of good standing.”

The fee is $10, and, assuming your LLC is in full compliance, you should be able to access your certificate immediately online.

However, you cannot request your certificate by mail. You can only obtain it online.

How to Get a Certificate of Existence in Montana

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to comply with all legal requirements for your LLC or corporation in Montana. That means you’ll need to be up to date on all Montana business licenses, permits, and reporting requirements.

In Montana, the Secretary of State issues certificates of existence. You can obtain one online.

Visit the Secretary of State’s website and search for your business.

Once you’ve located your business, select the “request information” icon. Then you’ll choose order copies/certificates and follow the prompts.

The fee is $5, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

How to Get a Certificate of Good Standing in Nebraska

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in Nebraska. That means you’ll need to be up to date on all Nebraska business licenses, permits, and reporting requirements.

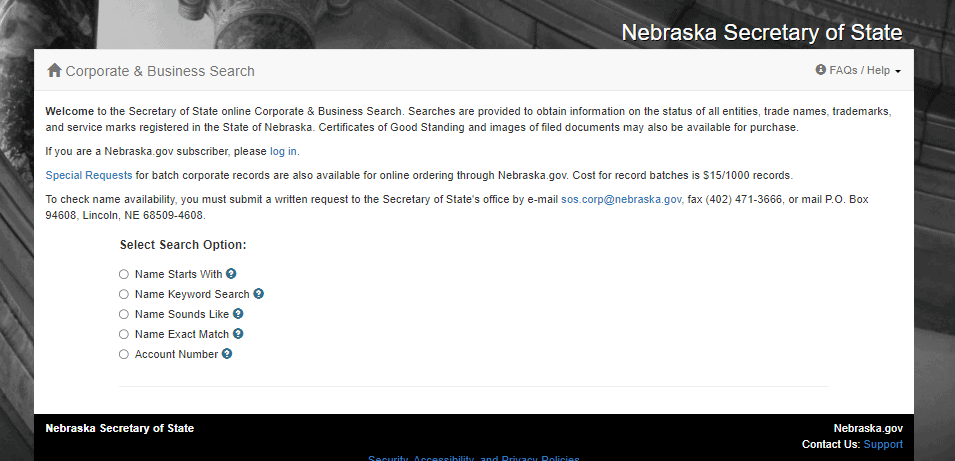

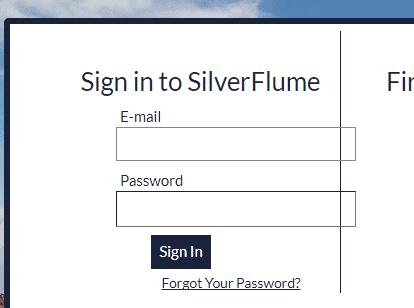

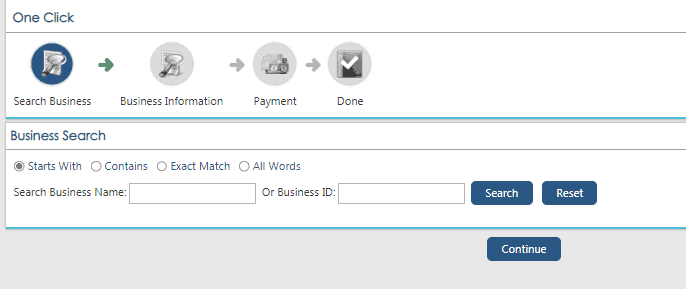

In Nebraska, the Secretary of State issues certificates of good standing. You can obtain one online.

Visit the Secretary of State’s website and search for your business.

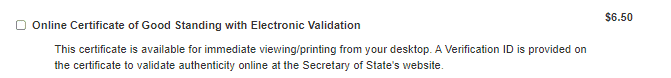

Select “details” to bring up your LLC’s information. Then you’ll select “Online certificate of good standing.”

The fee is $6.50, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately. However, if you wish to have the certificate mailed to you, the fee is $10.

You cannot request your certificate by mail. You can only order it online.

How to Get a Certificate of Good Standing in Nevada

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in Nevada. That means you’ll need to be up to date on all Nevada business licenses, permits, and reporting requirements.

In Nevada, the Secretary of State issues certificates of good standing. You can obtain one online.

Visit the Secretary of State’s website and sign into your account.

Then select “good standing certificate.”

The fee is $50, and assuming your LLC is in full compliance, you should receive your certificate by mail within five to seven business days.

Alternatively, you can submit a written request by mailing it, with the $50 fee, to:

Secretary of State Barbara K. Cegavske

202 North Carson Street

Carson City, Nevada 89701-4201

How to Get a Certificate of Good Standing in New Hampshire

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in New Hampshire. That means you’ll need to be up to date on all New Hampshire business licenses, permits, and reporting requirements.

In New Hampshire, the Department of State issues certificates of good standing. You can obtain one online.

Visit the Secretary of State’s website and search for your business.

Select your business to view your LLC’s information and click “order certificate of good standing.”

The fee is $5, and assuming your LLC is in full compliance, you should receive your certificate within ten days.

Alternatively, you can submit a written request by mailing it, along with the fee, to:

Corporation Division

NH Sec. of State

107 North Main Street, Room 204

How to Get a Standing Certificate in New Jersey

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a standing certificate.

You’ll also need to comply with all legal requirements for your LLC or corporation in New Jersey. That means you’ll need to be up to date on all New Jersey business licenses, permits, and reporting requirements.

In New Jersey, the Department of the Treasury issues standing certificates. You can obtain one online.

Visit the Department of the Treasury website and search for your business.

Then select whether you want the short-form or long-form certificate with filings.

The fee is $50 for the short form and $100 for the long, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Alternatively, you can submit a request in writing by mailing it, along with the fee, to:

NJ Division of Revenue and Enterprise Services,

Certification and Status Unit

PO Box 450

How to Get a Certificate of Good Standing in New Mexico

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in New Mexico. That means you’ll need to be up to date on all New Mexico business licenses, permits, and reporting requirements.

In New Mexico, the Corporations and Business Services Division issues certificates of good standing. You can obtain one online.

Visit the Corporations and Business Services website and sign into your account.

Then simply select to receive a certificate of good standing.

The fee is $25, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

You cannot request your certificate by mail. You can only obtain it online.

How to Get a Certificate of Status in New York

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of status.

You’ll also need to comply with all legal requirements for your LLC or corporation in New York. That means you’ll need to be up to date on all New York business licenses, permits, and reporting requirements.

In New York, the Department of State issues certificates of status.

In New York, you must submit a written request to obtain a certificate of status. The request must contain the following:

- A specific statement requesting a Certificate of Status.

- The exact name of the corporation or business entity.

- The Department of State ID number or the exact date of formation or authorization, if known.

- A statement as to whether the request is for routine or expedited processing.

- The mailing address where the Certificate of Status is to be mailed.

You’ll mail the request to:

New York State Department of State, Division of Corporations

One Commerce Plaza

99 Washington Avenue

Albany, NY 12231

The fee is $25, and assuming your LLC is in full compliance, your certificate will be mailed within 24 hours.

How to Get a Certificate of Existence in North Carolina

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to comply with all legal requirements for your LLC or corporation in North Carolina. That means you’ll need to be up to date on all North Carolina business licenses, permits, and reporting requirements.

In North Carolina, the Secretary of State issues certificates of existence. You can obtain one online.

Visit the Secretary of State’s website and sign into your account.

Then you’ll simply opt to order a certificate of status.

The fee is $10, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

You can also request the certificate by phone by calling 919-814-5400. The fee when ordering by phone is $15.

How to Get a Certificate of Good Standing North Dakota

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in North Dakota. That means you’ll need to be up to date on all North Dakota business licenses, permits, and reporting requirements.

In North Dakota, the Secretary of State issues certificates of good standing.

Certificates can be obtained upon request with payment by check, money order, credit card (Visa, MasterCard, Discover, or American Express), or pre-authorized credit. The request can be made by:

- Calling 701-328-4284 or 800-352-0867 (Ext. 328-4284)

- Fax at 701-328-2992 addressed to the Business Division

- Email to [email protected]

- Mail addressed to

Business Division

Secretary of State

600 E. Boulevard Ave. Dept. 108

Bismarck ND 58505-0500

The fee is $20, and assuming your LLC is in full compliance, your request should be processed within one to two business days.

How to Get a Certificate of Good Standing in Ohio

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in Ohio. That means you’ll need to be up to date on all Ohio business licenses, permits, and reporting requirements.

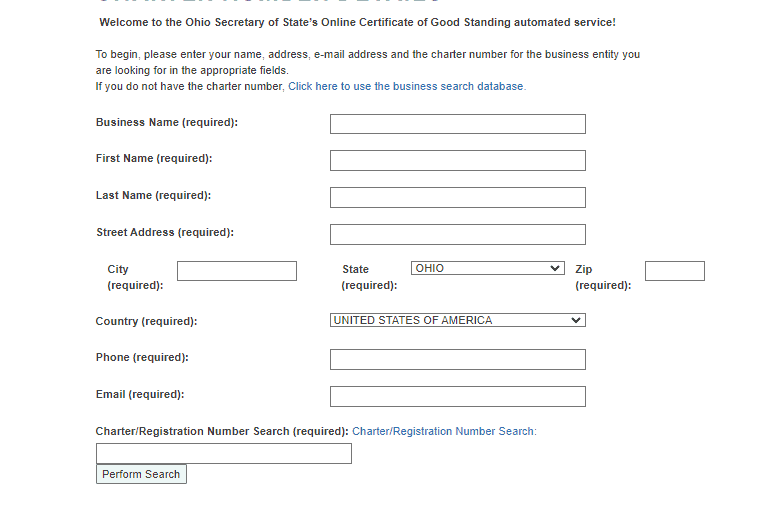

In Ohio, the Secretary of State issues certificates of good standing. You can obtain one online.

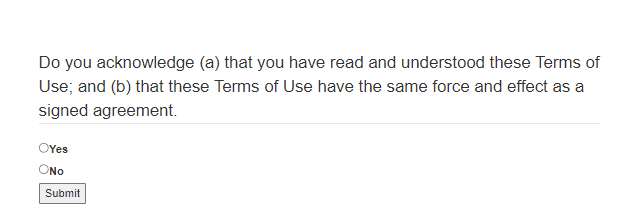

Visit the Secretary of State’s website, read the terms and conditions, and click submit.

Then you’ll search for your business.

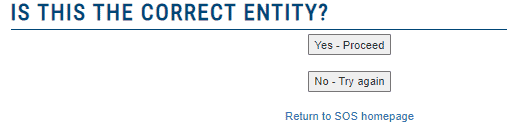

Your LLC’s information will appear, asking you to confirm that it’s the correct entity.

Next, you’ll be taken to the payment screen.

The fee is $5, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Alternatively, you can download the request form and mail it to the following:

Client Service Center

22 North Fourth Street

Columbus, Ohio 43215

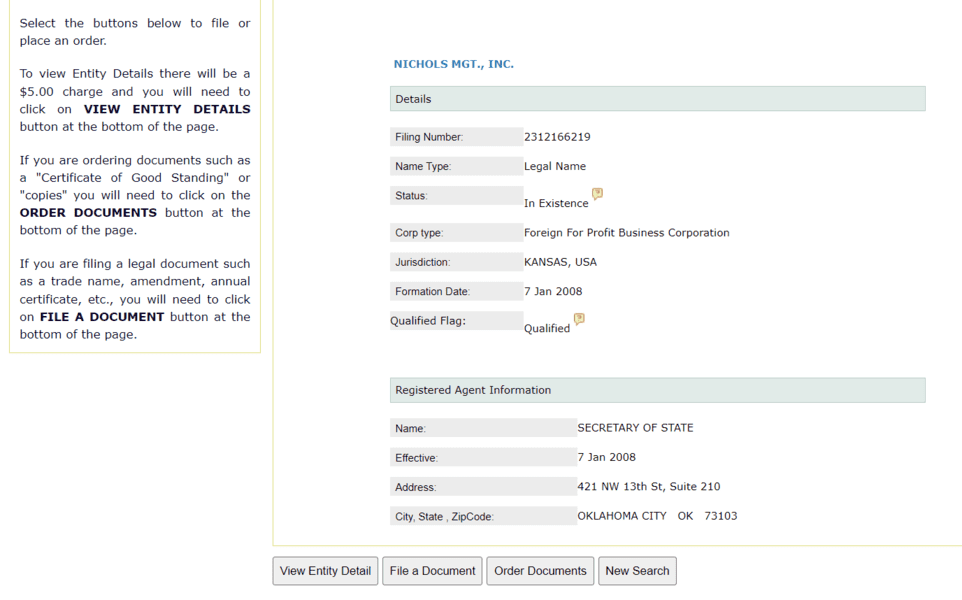

How to Get a Certificate of Good Standing in Oklahoma

You must have a registered business entity in the state, LLC, corporation, or limited partnership. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC, corporation, or limited partnership in Oklahoma. That means you’ll need to be up to date on all Oklahoma business licenses, permits, and reporting requirements.

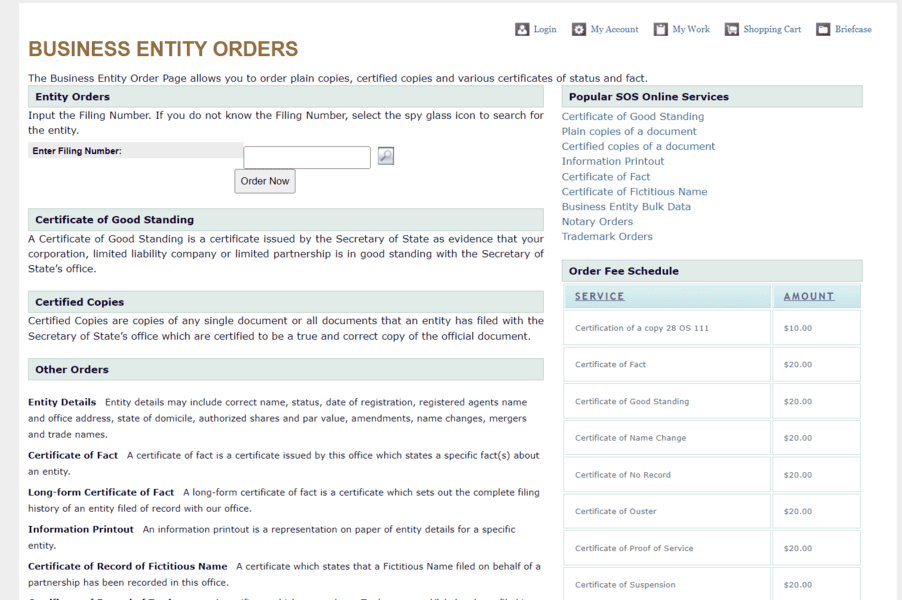

In Oklahoma, the Secretary of State issues certificates of good standing. You can obtain one online.

First, visit the Oklahoma Secretary of State’s Business Entity Orders page.

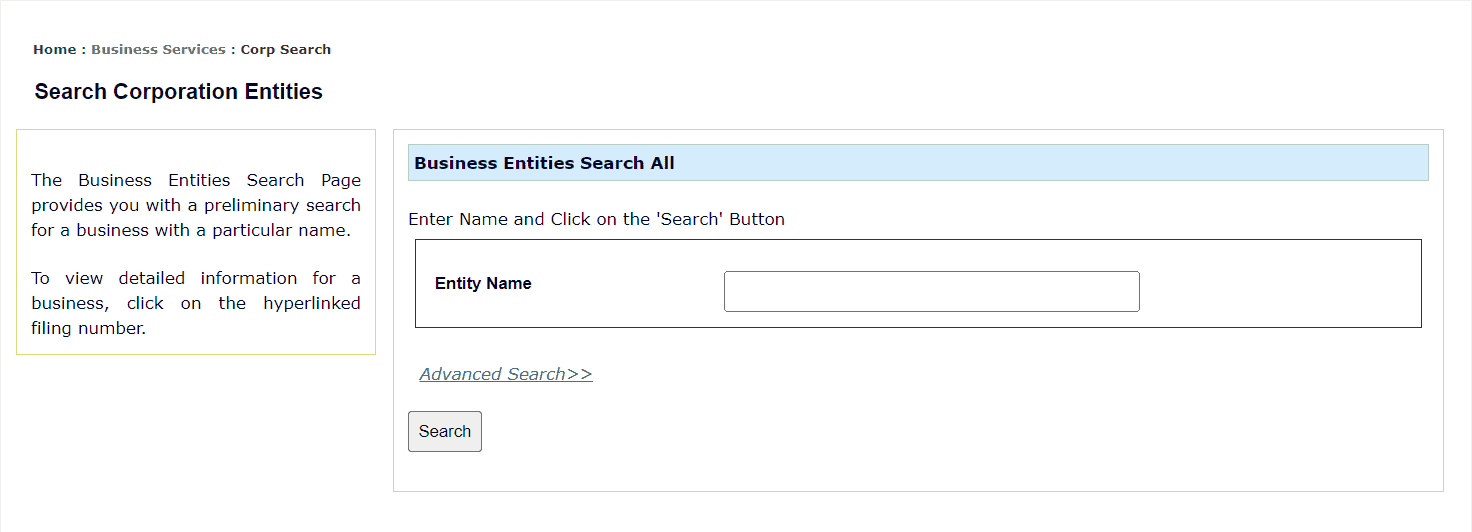

On the right-hand side, under “Popular SOS Online Services,” click “Certificate of Good Standing.” Then, on this next page, search for your business by name.

From the results, click on the filing number for your business, which will take you to this page. At the bottom, select “Order Documents.”

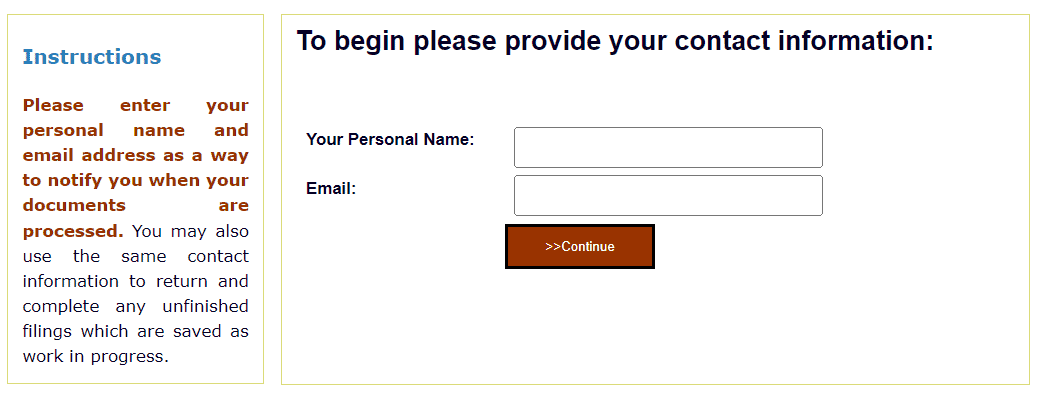

Enter your contact information.

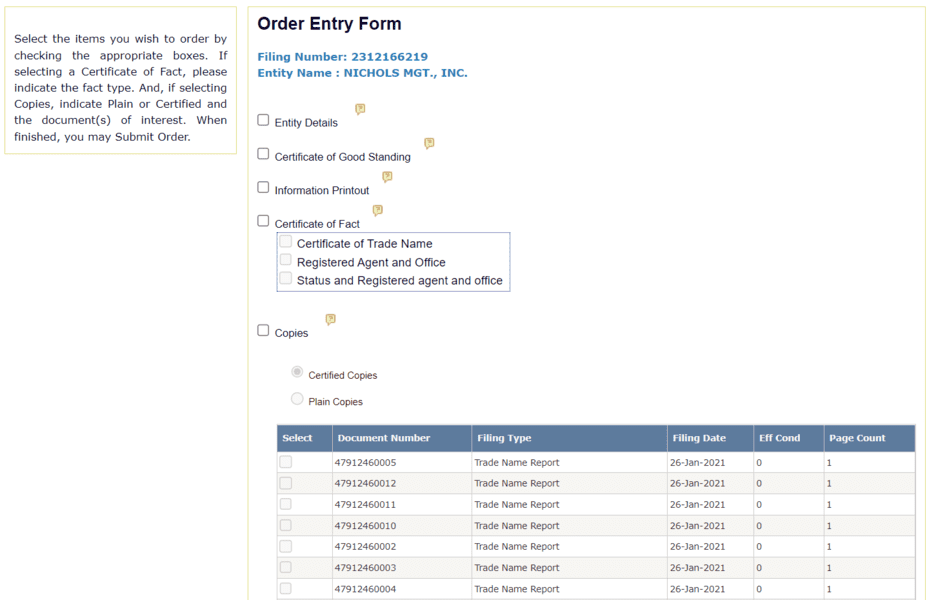

Select “Certificate of Good Standing” near the top on this next page. You can also choose other items to order.

Go through the checkout process. For example, you can create or log in to an SOS account or checkout as a guest.

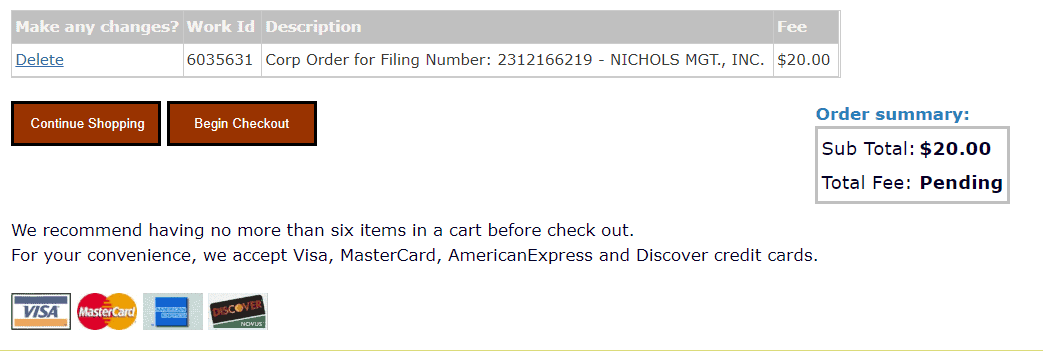

Once the order has been processed, you will receive an email through which you can pay for your order and retrieve your documents.

The fee is $20, with a 4% convenience fee for credit cards. Assuming your LLC is in full compliance, you should be able to download your certificate once you get the email and pay.

You cannot request your certificate by mail. You can only obtain it online.

How to Get a Certificate of Existence in Oregon

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to comply with all legal requirements for your LLC or corporation in Oregon, which means you’ll need to be up to date on all Oregon business licenses, permits, and reporting requirements.

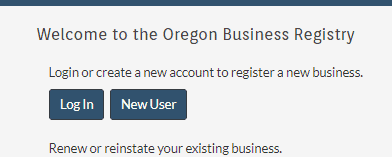

In Oregon, the Secretary of State issues certificates of existence. You can obtain one online.

Visit the Secretary of State’s business registry and sign into your account.

Then select “certificate of existence” and follow the prompts to place your order.

The fee is $10, and assuming your LLC is in full compliance, you should receive your certificate within three business days.

Alternatively, you can download the request form and mail it to the following:

Secretary of State

Corporation Division

255 Capitol St. NE, Suite 151

Salem, OR 97310-1327

You can also submit your request by fax at 503-378-6520.

How to Get a Subsistence Certificate in Pennsylvania

You must have a registered business entity in the state, which means an LLC, corporation, limited partnership, or limited liability partnership. Sole proprietorships do not register with the state, so they cannot obtain a subsistence certificate.

You’ll also need to comply with all legal requirements for your LLC, corporation, or partnership in Pennsylvania. That means you’ll need to be up to date on all Pennsylvania business licenses, permits, and reporting requirements.

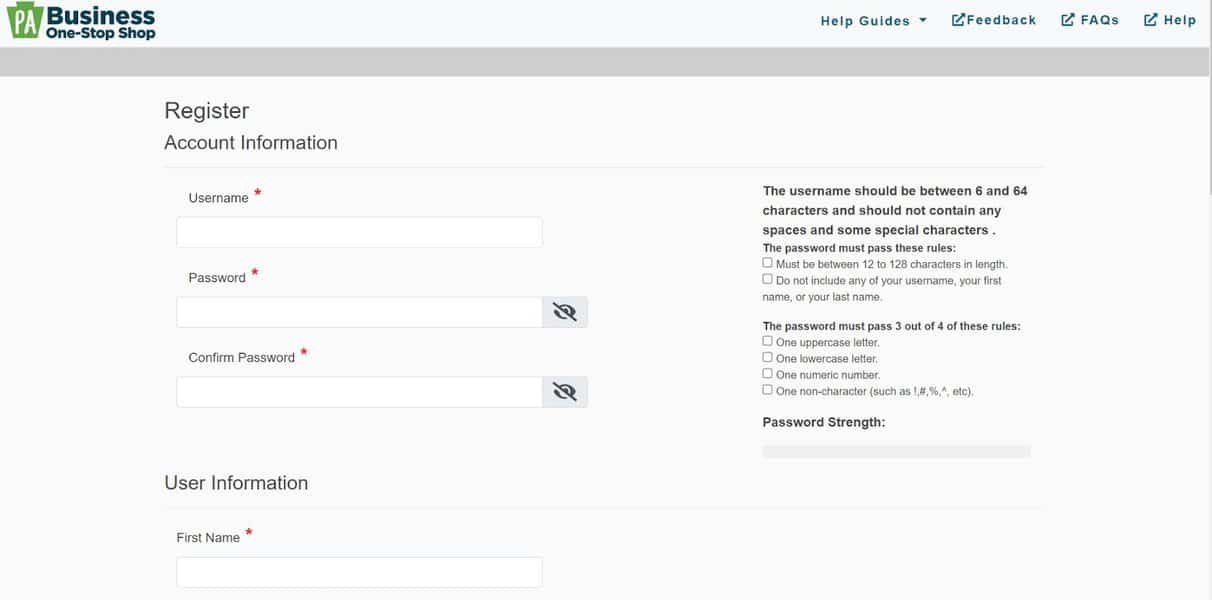

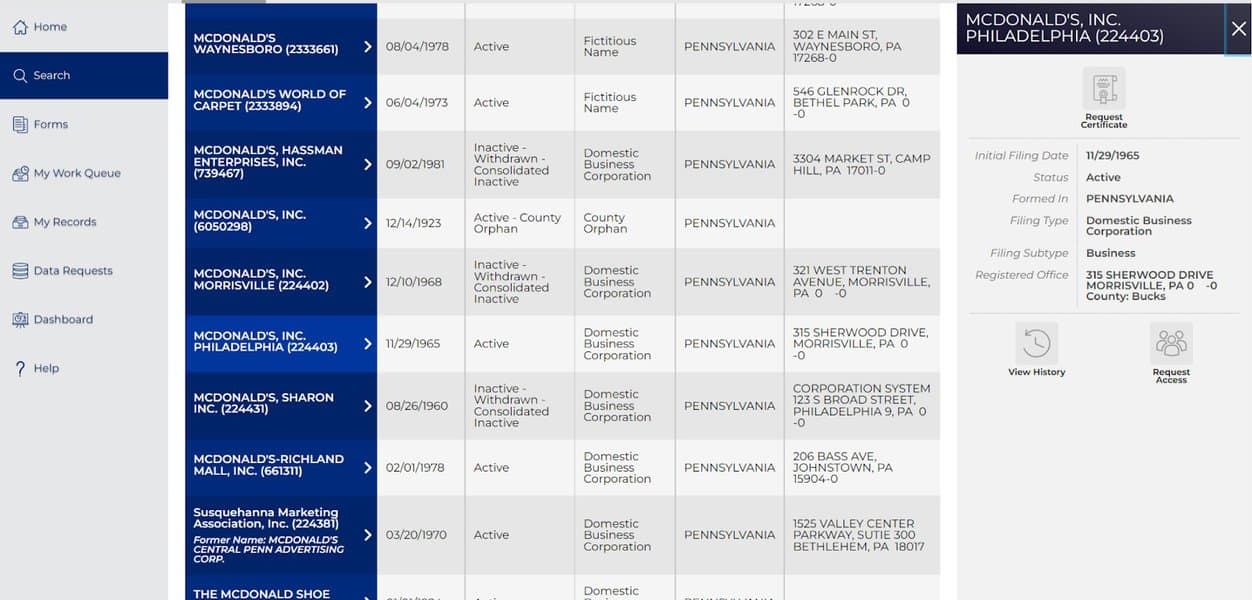

In Pennsylvania, the Department of State issues subsistence certificates. You can obtain one online.

Before you start, you’ll need to create an account in the Department of State’s Business Filing Services system.

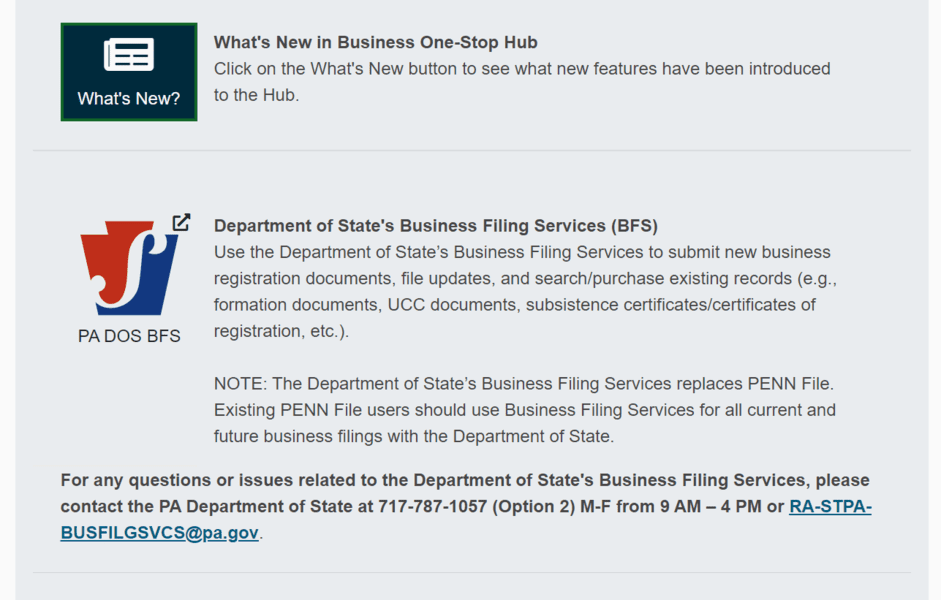

Once you complete that, head to the Department of State’s Business Certifications page. From your dashboard, click the red-and-blue icon for the Department of State’s Business Filing Services (BFS).

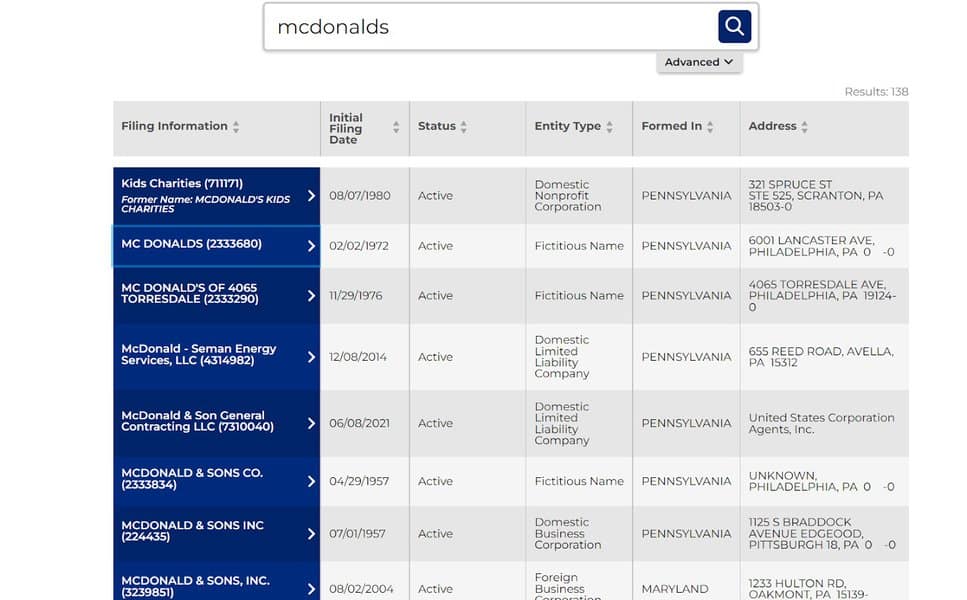

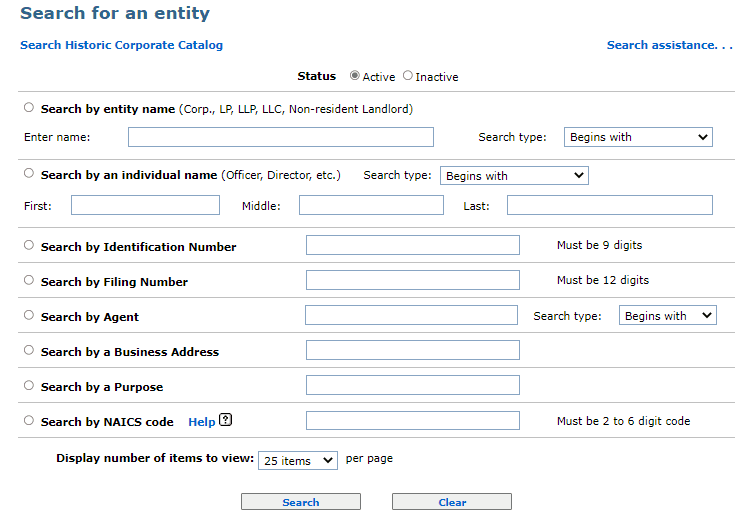

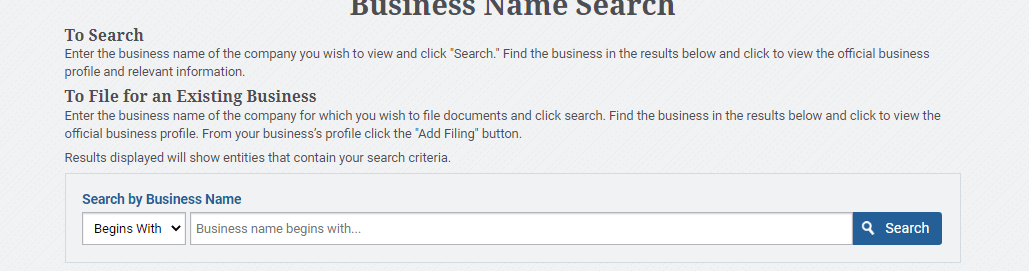

On the left-hand menu, click “Search” and search for your business by name.

Once you click on your business, a menu will appear on the right-hand side. At the top, there’ll be an icon labeled “Request Certificate” that you can click.

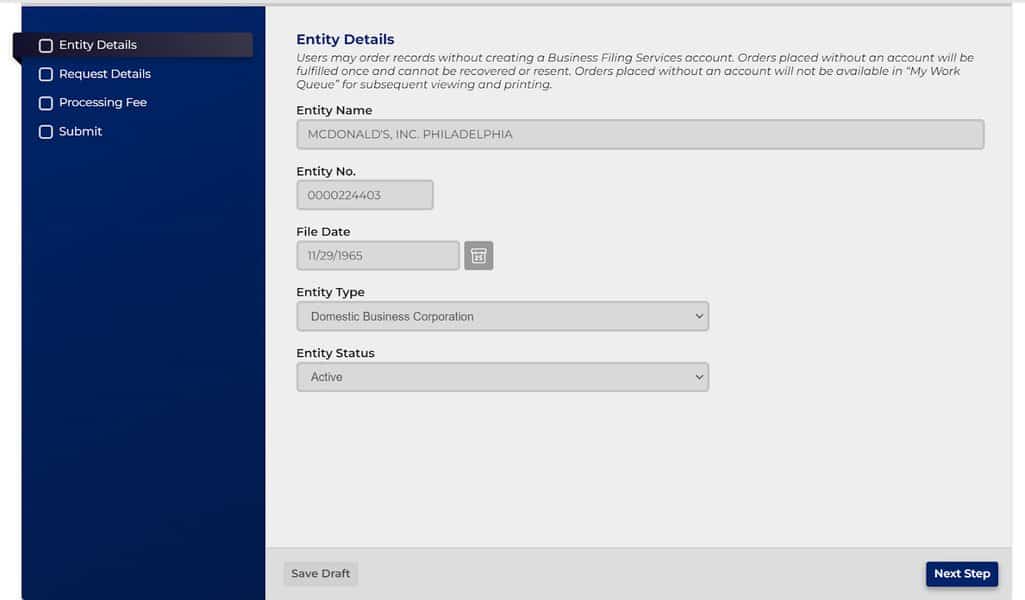

A new interface will appear. Your business’s details will already be pre-filled on the first page so that you can click “next step” at the bottom.

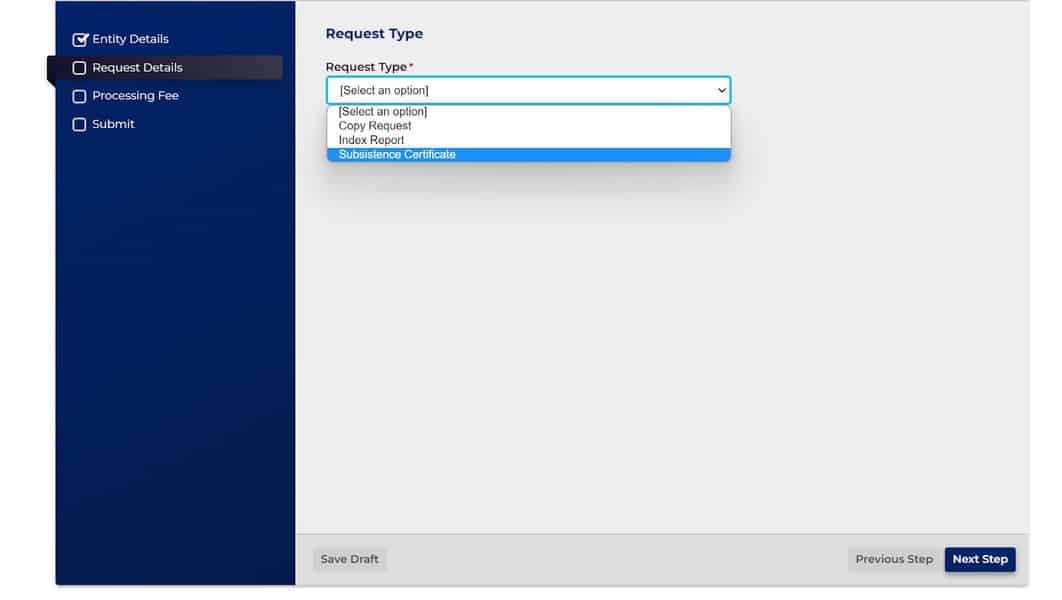

Next, select “subsistence certificate” from the drop-down menu, and click “next step.”

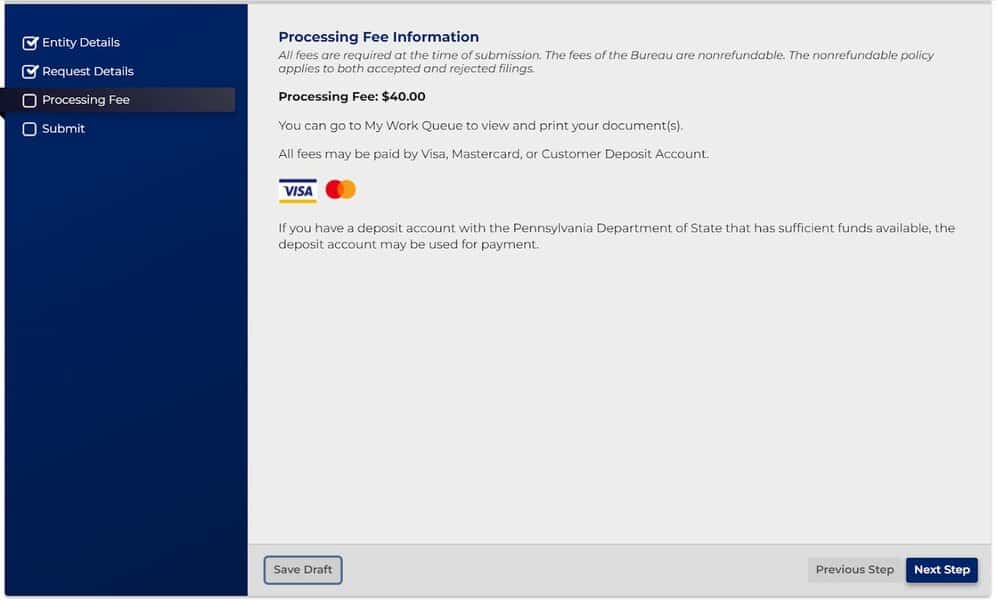

Click through the processing fee information.

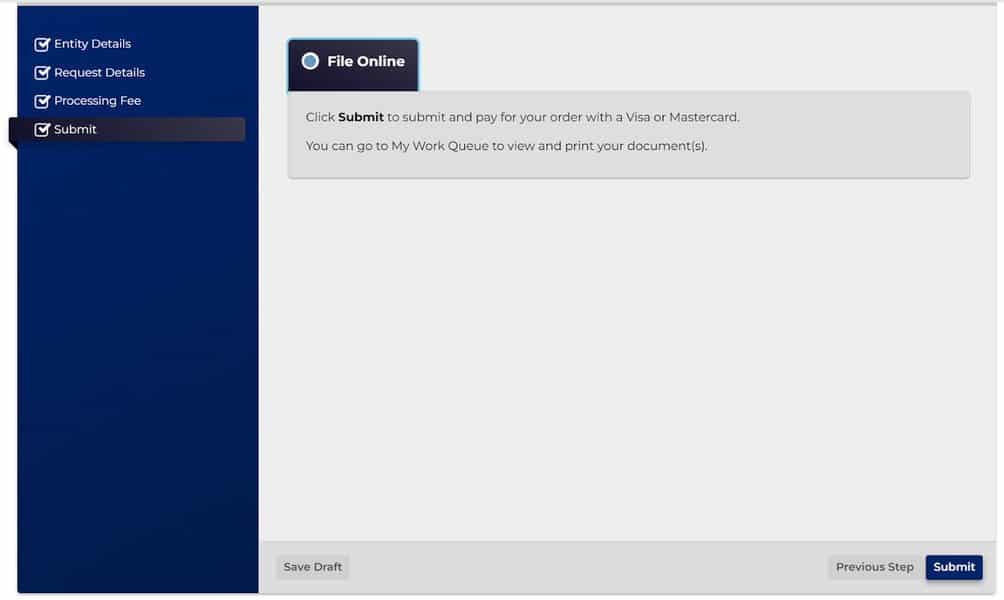

Finally, click “Submit” and pay your processing fee.

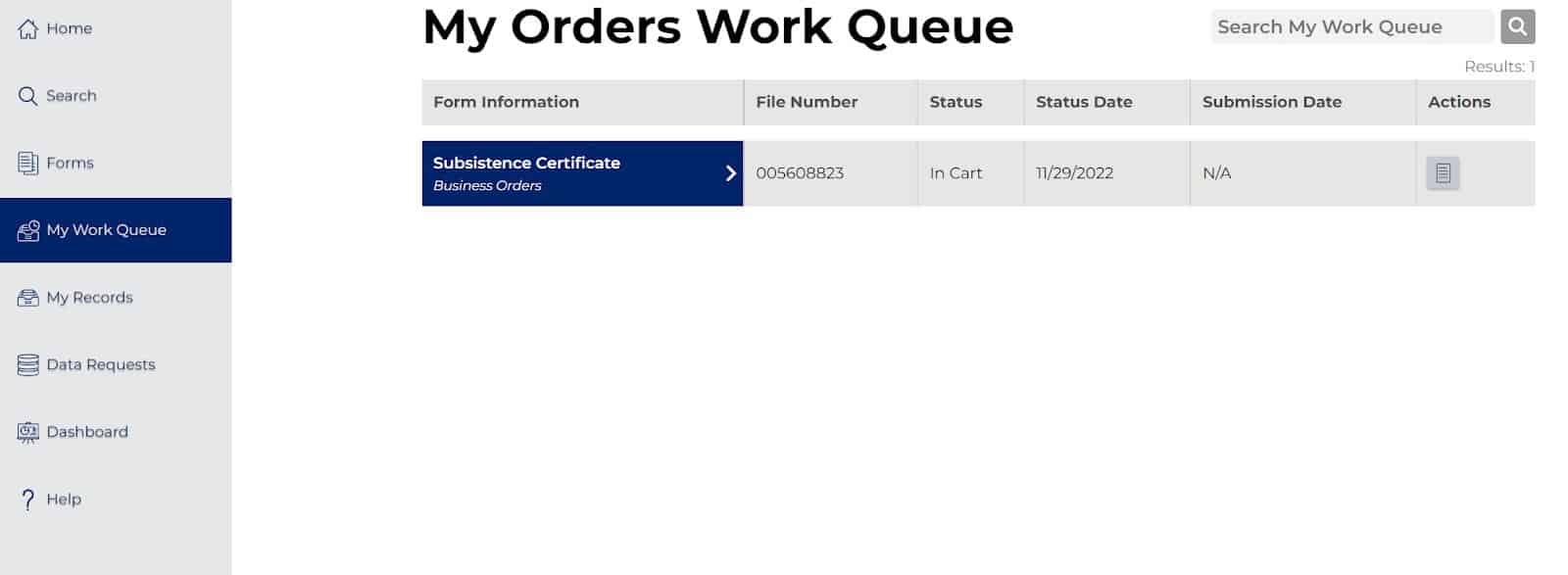

On the home screen, click “My Work Queue” on the right-hand menu to view your order and download your subsistence certificate.

The fee is $40, and, assuming your LLC has been filed correctly, you should be able to access your certificate online immediately.

You cannot request your certificate by mail. You can only obtain it online.

How to Get a Certificate of Good Standing in Rhode Island

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in Rhode Island. That means you’ll need to be up to date on all Rhode Island business licenses, permits, and reporting requirements.

In Rhode Island, the Secretary of State issues certificates of good standing. You can obtain one online.

Visit the Secretary of State’s website and search for your business.

Then simply click “request certificate.”

The fee is $22, and assuming your LLC is in full compliance, you should be able to access your certificate online within two business days.

Alternatively, you can submit a written request by mailing it, with the fee, to:

Business Services Division

148 W. River St.

Providence, RI 02904-2615

How to Get a Certificate of Existence in South Carolina

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to comply with all legal requirements for your LLC or corporation in South Carolina. That means you’ll need to be up to date on all South Carolina business licenses, permits, and reporting requirements.

In South Carolina, the Secretary of State issues certificates of existence. You can obtain one online.

Visit the Secretary of State’s website and search for your business.

Then you’ll click “order documents” and be prompted to sign into your account. Once you sign in, just follow the prompts to get your certificate.

The fee is $10, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

You cannot request your certificate by mail. You can only obtain it onli

How to Get a Certificate of Good Standing/Existence in South Dakota

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

Additionally, South Dakota does not allow general partnerships, reserved names, registered names, and Doing Business As (DBA) business names to request a certificate of good standing/existence.

You’ll also need to comply with all legal requirements for your LLC or corporation in South Dakota. That means you’ll need to be up to date on all South Dakota business licenses, permits, and reporting requirements.

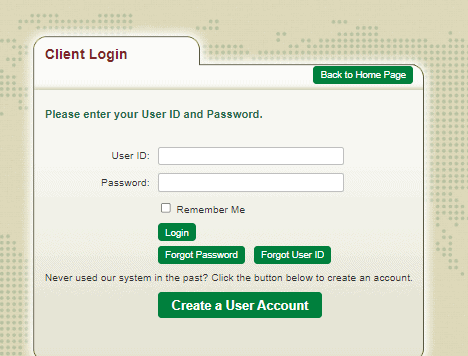

In South Dakota, the Secretary of State issues certificates of good standing/existence. You can obtain one online.

Visit the Secretary of State’s Certificate of Good Standing page.

Click on the green button to get started.

On the next page, enter your Business ID. To double-check your business ID, visit South Dakota’s Business Information Search, where you can search for your business by name.

Go through the following pages, filling out your personal information, email address (if you’d like to receive a copy of the download link), and payment information.

The fee is $20, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Alternatively, from this page, you can print out your document and mail it in with a check to this address:

Secretary of State

Capitol Building

500 East Capitol Avenue

Pierre, SD 57501-5070

Your certificate will be mailed to the address you previously provided.

How to Get a Certificate of Existence in Tennessee

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to comply with all legal requirements for your LLC or corporation in Tennessee. That means you’ll need to be up to date on all Tennessee business licenses, permits, and reporting requirements.

In Tennessee, the Secretary of State issues certificates of existence. You can obtain one online.

Visit the Secretary of State’s website and enter your LLC’s control number.

Then you’ll simply follow the prompts to order your certificate.

The fee is $20, and assuming your LLC is in full compliance, you should be able to access your certificate online within two business days.

Alternatively, you can fill out the request online and print it, then mail it, with the fee, to:

Business Services

312 Rosa L. Parks Avenue

6th floor

Nashville, TN 37243-1102

How to Get a Certificate of Fact Status in Texas

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of fact status.

You’ll also need to comply with all legal requirements for your LLC or corporation in Texas. That means you’ll need to be up to date on all Texas business licenses, permits, and reporting requirements.

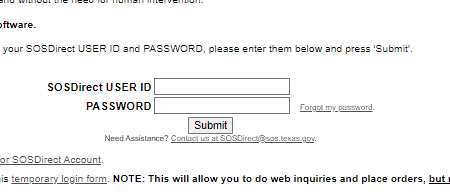

In Texas, the Secretary of State issues certificates of fact status. You can obtain one online.

Visit the Secretary of State’s website and sign into your account.

Then:

- Click on the Business Organizations link from the menu bar at the top of the page.

- From the menu, click on Order – Certificates and Copies.

- Under Order Type, choose Certificate of Fact.

- Under Fact Type, choose Status.

- Enter the SOS File Number and Click Add Order Item.

The fee is $15, and assuming your LLC is in full compliance, you should be able to access your certificate within three business days.

Alternatively, you can order the certificate:

- By phone: (512) 463-5578

- By email: [email protected]

- By written request to:

Certifying Team

Secretary of State

P. O. Box 13697

Austin, Texas 78711-3697

How to Get a Certificate of Existence in Utah

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to comply with all legal requirements for your LLC or corporation in Utah. That means you’ll need to be up to date on all Utah business licenses, permits, and reporting requirements.

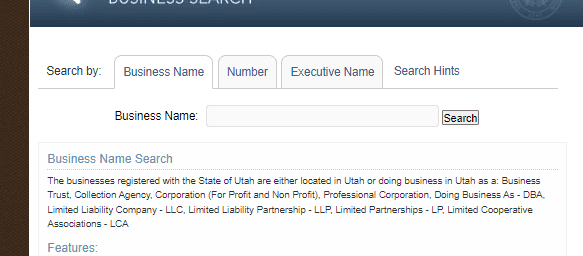

In Utah, the Division of Corporations and Commercial Code issues certificates of existence. You can obtain one online.

Visit the Division of Corporation website and search for your business.

Click “details” to view your LLC information, then select “purchase certificate of existence.”

The fee is $12, and assuming your LLC is in full compliance, you should receive your certificate within ten days.

Alternatively, you can download the request form and mail it, along with the fee, to:

Division of Corporations

PO Box 146705

Salt Lake City, Utah 84114-6705

How to Get a Certificate of Good Standing in Vermont

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in Vermont. That means you’ll need to be up to date on all Vermont business licenses, permits, and reporting requirements.

In Vermont, the Secretary of State issues certificates of good standing. You can obtain one online.

Visit the Secretary of State’s website and sign into your account.

Then from the online services drop-down menu, select “certificate of good standing.”

The fee is $25, and assuming your LLC is in full compliance, you should receive your certificate within 14 days.

You cannot request your certificate by mail. You can only obtain it online.

How to Get a Certificate of Fact of Existence in Virginia

You must have a registered LLC in the state. Corporations can obtain a certificate of good standing. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of fact of the existence or a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in Virginia. That means you’ll need to be up to date on all Virginia business licenses, permits, and reporting requirements.

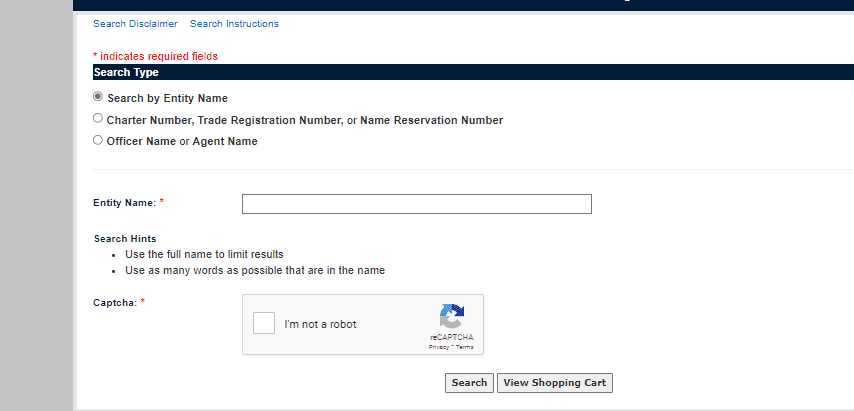

In Virginia, the Corporations Commission issues certificates of fact of existence. You can obtain one online.

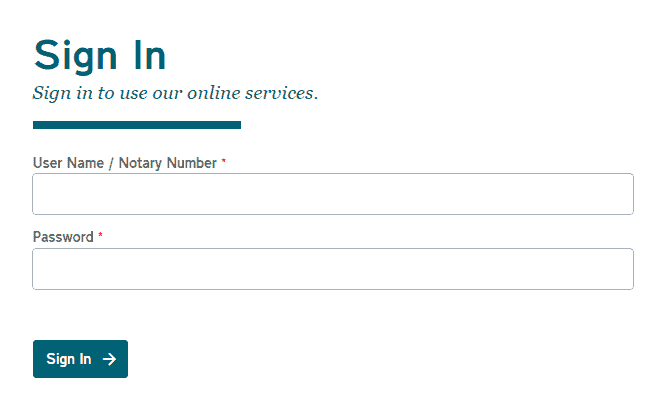

Visit the Corporations Commission website and sign into your account.

Then you’ll do the following:

- Click Online Services on the top left

- Under Services, click Certificate of Fact of Existence/Registration (LLCs)

- Click the Select button next to your business’s name. DO NOT click the green entity name.

- Click Continue.

- Click Next.

- Enter your Entity Name or Entity ID and click Search

- Click Add To Shopping Cart

The fee is $6, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Alternatively, you can submit a written request by mailing it, along with the $6 fee, to:

Clerk’s Office, State Corporation Commission

PO Box 1197

How to Get a Certificate of Existence in Washington

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to comply with all legal requirements for your LLC or corporation in Washington. That means you’ll need to be up to date on all Washington business licenses, permits, and reporting requirements.

In Washington, the Secretary of State issues certificates of existence. You can obtain one online.

Visit the Secretary of State’s website and sign into your account.

Then just opt to order a certificate of existence.

The fee is $20, and assuming your LLC is in full compliance, you should be able to access your certificate within two business days for expedited service and within seven business days for all mail-in orders.

You cannot request your certificate by mail. You can only obtain it online.

How to Get a Certificate of Existence in West Virginia

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of existence.

You’ll also need to comply with all legal requirements for your LLC or corporation in West Virginia. That means you’ll need to be up to date on all West Virginia business licenses, permits, and reporting requirements.

In West Virginia, the Secretary of State issues certificates of existence. You can obtain one online.

Visit the Secretary of State’s website and search for your business.

Click “details” to view your LLC’s information. At the bottom of the page, you’ll select “order a certificate of existence.”

The fee is $10, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Alternatively, you can download the request form and mail it, along with the $10 fee, to:

WV One Stop Business Center

13 Kanawha Blvd. W.

Suite 201

Charleston, WV 25302

How to Get a Certificate of Status in Wisconsin

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in Wisconsin. That means you’ll need to be up to date on all Wisconsin business licenses, permits, and reporting requirements.

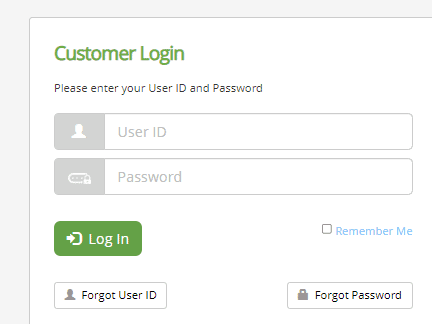

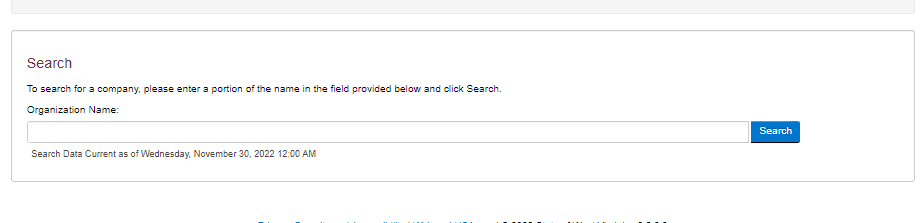

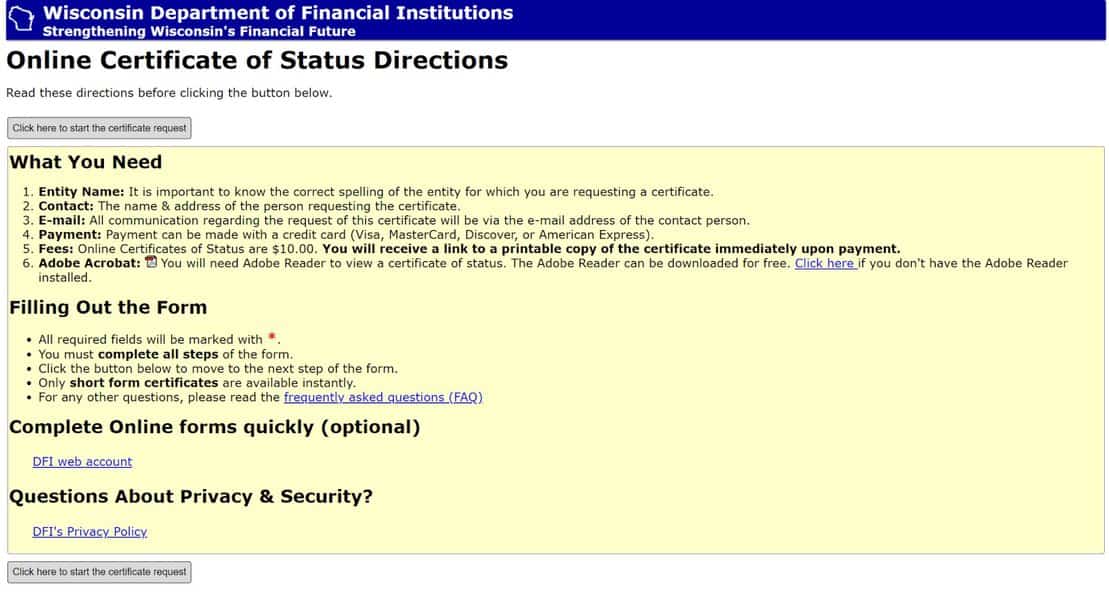

In Wisconsin, the Department of Financial Institutions issues certificates of status. You can obtain one online.

Visit the Department of Financial Institutions’ online certificate of status request page. To start your request, click the button at the top or bottom of the page.

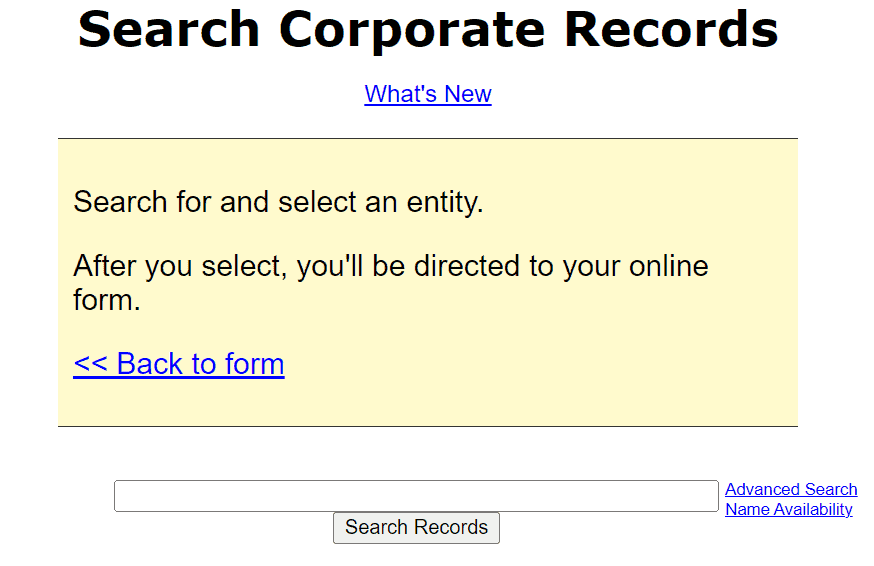

Click through the next page by selecting Choose Entity. Then, search for your business using significant words.

Select your business from the list, and confirm that you’ve selected the right business.

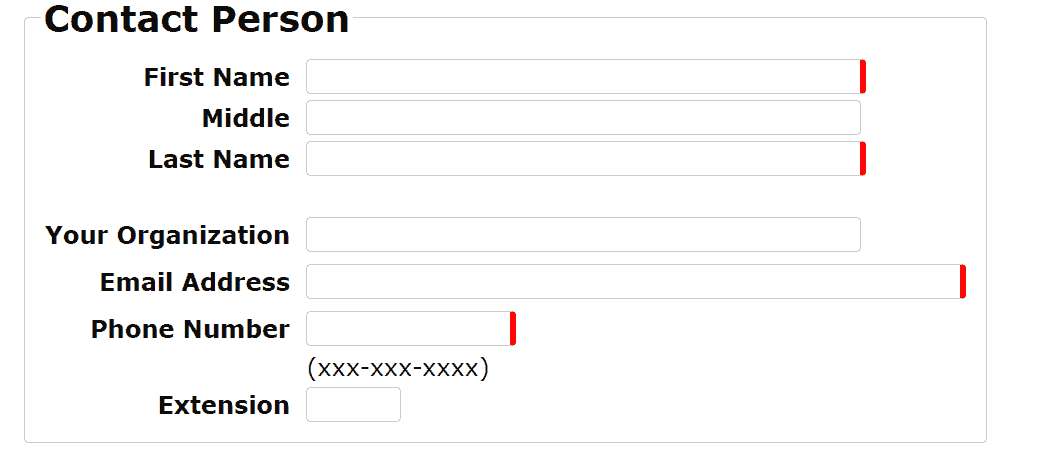

Fill out your contact information in the fields below.

Once you’ve reviewed the business and contact information, you’ll be able to add the certificate of status to your cart and pay for it.

The fee is $10, and assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

Alternatively, you can have the form delivered through email or physical mail or pick it up at the Department of Financial Institutions. You’ll pay an additional $25 for expedited service for these options.

You cannot request your certificate by mail. You can only request it online.

How to Get a Certificate of Good Standing in Wyoming

You must have a registered business entity in the state, either an LLC or a corporation. Sole proprietorships and partnerships do not register with the state, so they cannot obtain a certificate of good standing.

You’ll also need to comply with all legal requirements for your LLC or corporation in Wyoming. That means you’ll need to be up to date on all Wyoming business licenses, permits, and reporting requirements.

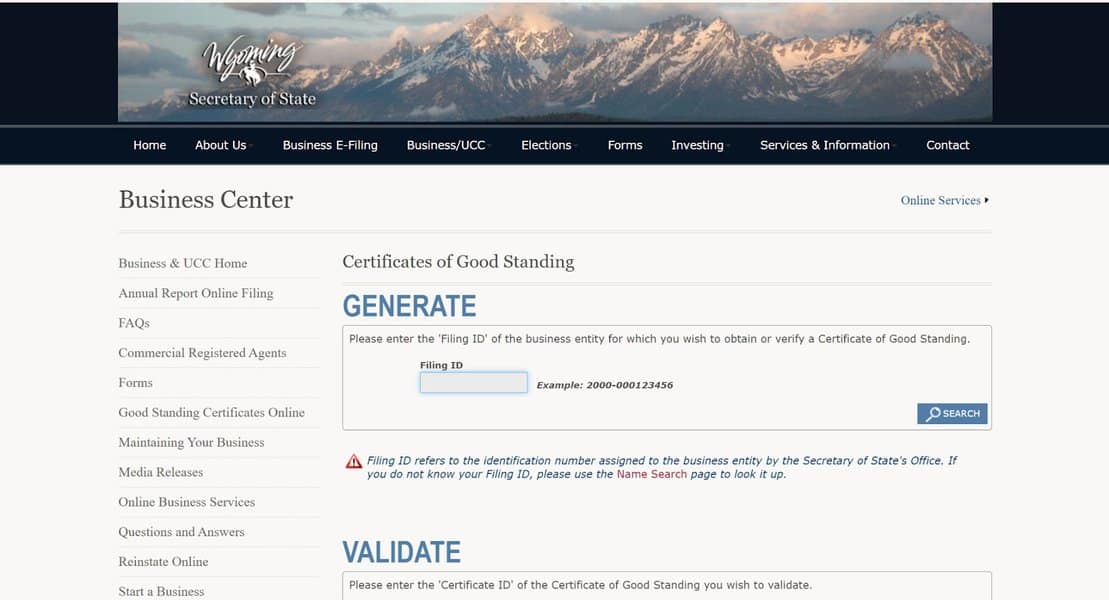

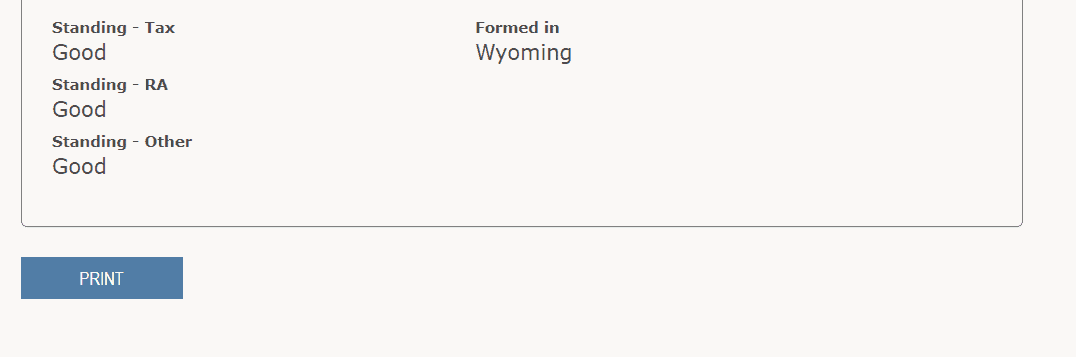

In Wyoming, the Secretary of State issues certificates of good standing. You can obtain one online.

Visit the Wyoming Secretary of State’s online Business Center.

Enter your Filing ID in the “Generate” field. The Secretary of State Office assigned your Filing ID to your business. If you want to double-check your Filing ID, you can search for it by the name of your business on the Business Center’s Filing Search page.

The next page will display your business’s name and relevant information. At the bottom of the page, click “Print” to download a pdf of your certificate of good standing.

The fee is $0 if done online, and, assuming your LLC is in full compliance, you should be able to access your certificate online immediately.

If filing by mail, the processing fee is $10, and you will receive your document within seven business days.

Wyoming doesn’t accept certificate requests by mail; you can only obtain them online.

Expiration Dates

Once you have a copy of your certificate of good standing, you’ll need to be mindful of the expiration date. Certificates typically expire within 30, 60, or 90 days from the date, but check with your state to be sure.

If you’re planning on doing business in another state, check that state’s expiration dates, as they may differ from those of your home state.