When starting a new business, one of the first big decisions is which type of business entity to form. Many entrepreneurs choose a limited liability company (LLC) because of its many benefits. An LLC provides personal liability protection, for example, so that your assets are not at risk if your business is sued or cannot pay its debts.

Also, an LLC is a “pass-through entity” in taxes, meaning income passes through the company to the LLC owners or members, who report it on their tax returns.

LLCs also offer flexibility in management and tax status, yet another reason it’s popular in Wisconsin.

Here are the steps that you need to take to form an LLC in Wisconsin.

1. Name Your Wisconsin LLC

Naming your business can be challenging. You need a name that’s unique and easy to remember and conveys what your business does. To choose a name, you can try a few different methods:

- Decide on a Business Concept: Before you name your LLC, you need to have a clear idea of what your business will do.

- Ask People You Know for Suggestions: Reach out to people whose opinions you value and trust. Explain your business concept and ask for their thoughts on a name.

- Do a Web Search: Once you have a few name ideas, check their online presence. Is the domain name available? Are there companies with similar names that could create confusion?

- Use an Online Business Name Generator: They can provide inspiration and help you think about your business from different angles. Keep in mind, though, that these generators can’t replace human creativity and may not understand the nuances of your business as well as you do.

Your business name is your business identity and the first impression people will have of your company, so be sure to take your time with this step and get it right.

Once you have a few business name ideas, you’ll want to ensure they’re available. First, do a business name search on the Department of Financial Institution’s website. Here’s how to conduct a Wisconsin LLC name search and check the availability of your desired entity name.

Also, check your Wisconsin’s LLC naming regulations to ensure you comply.

In Wisconsin, your LLC name must include the phrase “limited liability company” or one of its abbreviations (LLC or L.L.C.). In addition, it cannot have any words or phrases that could confuse your LLC with a government agency.

Your business name cannot include words like bank, insurance, or university without state approval and must be distinguishable from all other business names in the state.

Next, check with the US Patent and Trademark Office to ensure the name is not trademarked and is thus available nationally.

Here are additional tips and suggestions provided to assist in the process of choosing a name for a Wisconsin LLC.

Once you’ve confirmed these, it’s a good idea to reserve the name with the state using its name reservation form.

2. Select a Registered Agent

Wisconsin requires LLCs to appoint a registered agent, a person or company authorized to accept and respond to official business correspondence, such as legal, tax, or financial documents.

The registered agent ensures all important notices and documents are received. In Wisconsin, the registered agent can be an LLC member, individual, or entity that meets state requirements. In Wisconsin, a registered agent must:

- Be 18 years or older

- Have a physical address in Wisconsin

- Be available during regular business hours

- Be registered to operate in Wisconsin, if it’s a business

Many business owners hire a registered agent service to ensure their LLC stays fully compliant and for convenience.

If you choose to be your registered agent, you must be at your registered agent’s address for all business hours. A registered agent service allows you to be wherever you need to be to run and grow your business.

Learn how to designate a registered agent for your Wisconsin LLC.

3. Determine Your Management Structure

Members or managers can manage LLCs. In a member-managed LLC, members handle all management duties. In a manager-managed LLC, non-member employees oversee operations and management duties.

Note that with a manager-managed LLC, a member can be a manager, but only in cooperation with another manager who is not a member.

Member-managed LLCs generally work best for LLCs with few members, all of whom can take an active role in day-to-day operations. Conversely, manager-managed LLCs are best for LLCs with multiple members, some of whom want to be “silent” or passive members and not involved in day-to-day operations.

Most LLCs are member-managed, as they are small businesses that cannot afford a management team. In Wisconsin, your LLC is considered member-managed if it’s not otherwise specified in the articles of organization.

Discover the difference between member-managed and manager-managed LLCs, and gain insights on selecting the appropriate management structure for your LLC.

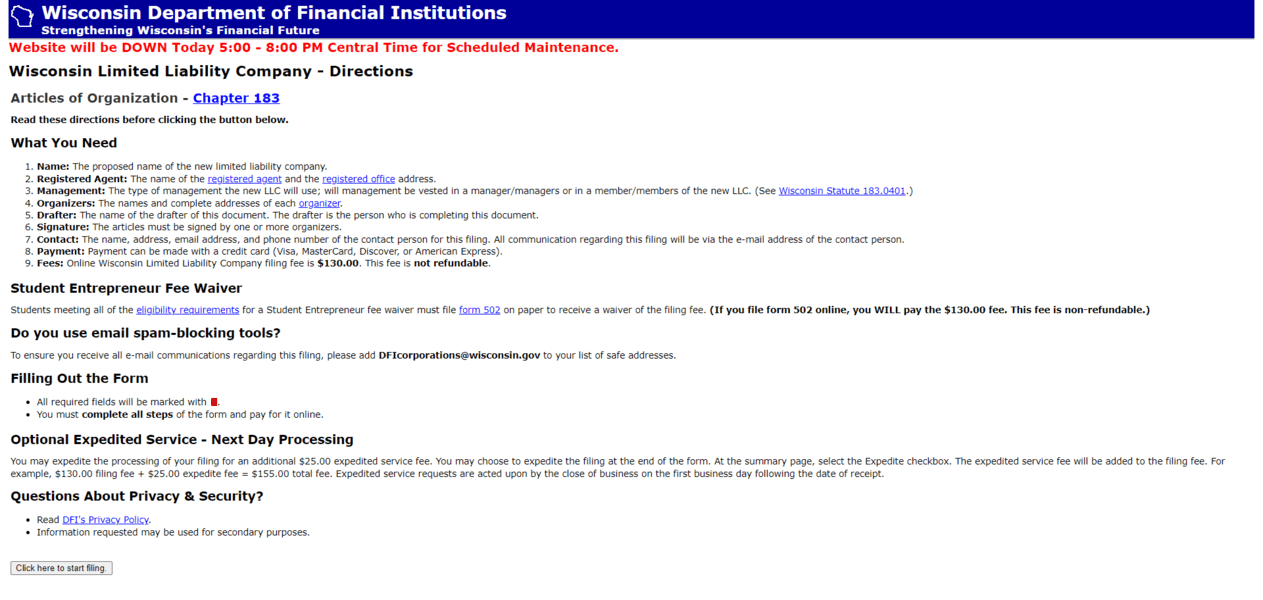

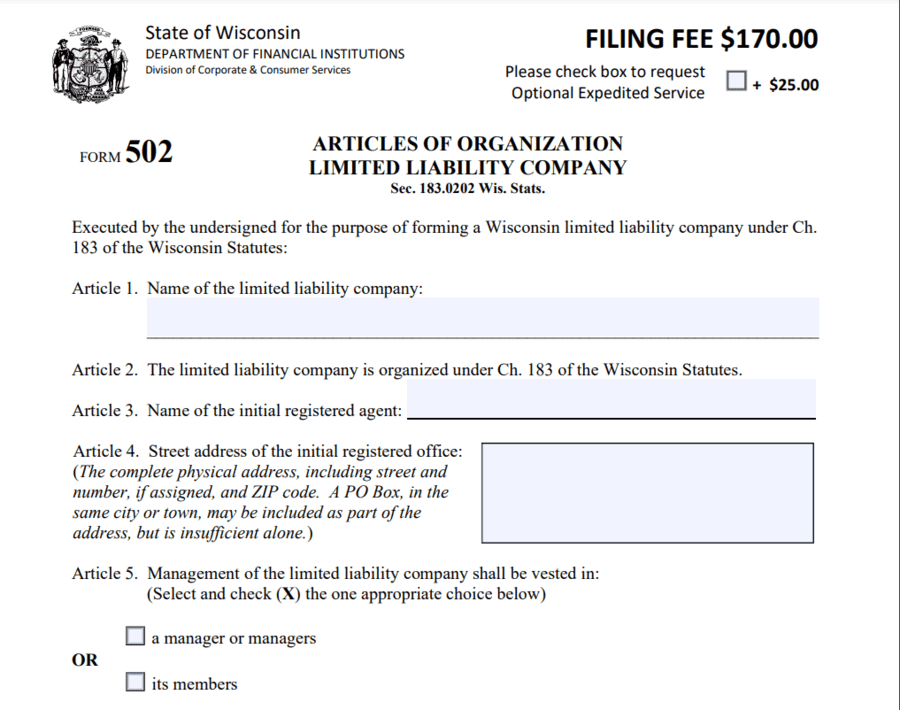

4. File Articles of Organization with the Wisconsin Department of Financial Institutions

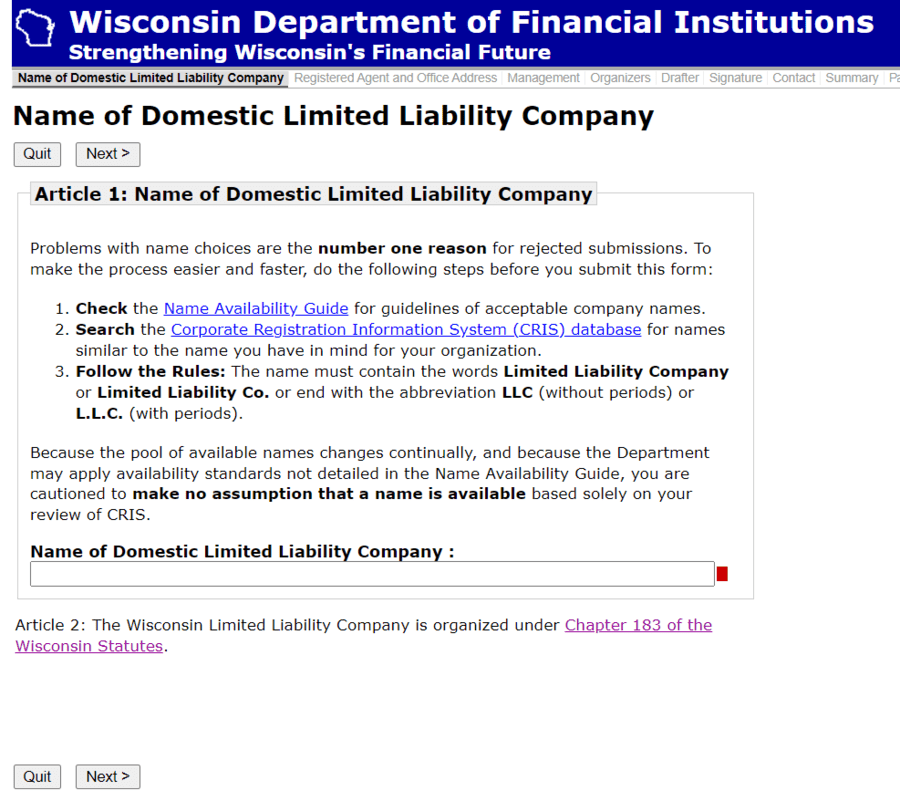

To start, visit the Department of Financial Institution’s website to access the articles of organization online.

In Wisconsin, the articles of organization require the following information:

At the bottom of the website’s homepage, click the button that says “click here to start filing.” The next screen will prompt you to do a name availability search to confirm your desired business name is available. If so, you’ll fill out your business name in the box.

The next screen prompts you to enter your registered agent information. Once entered, click to the next page and select whether your LLC will be member-managed or manager-managed.

On the following screen, enter the organizer’s name and address, followed by the drafter’s name, who may be the same individual as the organizer.

The last step is to fill out the contact information for your LLC. Review all your information to ensure it’s accurate, then confirm to move to the payment screen.

You can also complete and submit a paper form if you wish to file by mail.

The fee is $170 for paper and $130 for online filings, and your LLC should be approved and formed within five to seven business days.

Contact Information for the Department of Financial Institutions

Wisconsin Department of Financial Institutions Website

Phone: (608) 261-9555

Mailing Address:

Wisconsin Department of Financial Institutions

4822 Madison Yards Way, North Tower

Madison, WI 53705

5. Draft an Operating Agreement

An Operating Agreement is a legal document that outlines the ownership and member duties of your Limited Liability Company (LLC).

Wisconsin does not require an operating agreement, but it’s still a good idea to have one, even for single-member LLCs, as it can provide legal protections and more established operating procedures.

Here are the elements an LLC Operating Agreement should typically include:

- LLC’s name and principal address (primary location where business is registered)

- Duration of the LLC

- Registered agent name and address

- Membership Information

- Management and voting

- Financial matters (e.g. the way profits and losses will be divided)

- Changes and amendments (e.g. procedures for adding or removing members)

- Disputes, legalities, and policies

- Record keeping and communication

You can find operating agreement templates online, but it’s best to have them drawn up or reviewed by an attorney. The language of an operating agreement is crucial and can often help determine how member disputes will be resolved. For more information about the operating agreement, refer to our comprehensive guide on the Wisconsin LLC operating agreement, and you can also obtain a free template.

6. Get Your Employer Identification Number (EIN)

The IRS uses an EIN to identify your company for tax filing purposes. An EIN is required if your LLC has more than one member or if you are hiring employees.

Obtaining an EIN simply requires applying on the IRS website, as detailed here:

All EIN applications (mail, fax, electronic) must disclose the name and Taxpayer Identification Number (SSN, ITIN, or EIN) of the true principal officer, general partner, grantor, owner or trustor. This individual or entity, which the IRS will call the ‘responsible party,’ controls, manages, or directs the applicant entity and the disposition of its funds and assets. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity.

Learn how to get a Wisconsin Tax ID (EIN) for an LLC.

7. Obtain Business Licenses and Permits

Depending on the nature of your business, you may need to apply for various licenses and permits at the federal, state, and local levels.

At the federal level, licenses and permits are generally industry-specific and may include health licenses and permits from the Occupational Safety and Health Administration (OSHA). Check the SBA guide for specific licenses required for your business.

Wisconsin doesn’t have a general business license. However, depending on the industry your business works in, you may also be required to get a number of specialty state licenses.

If you sell tangible goods or services subject to sales tax, you’ll need a sales tax license, also known as a seller’s permit. Visit the Department of Revenue to obtain a seller’s permit.

For information about local licenses and permits, check the websites for any cities or counties where you will do business.

Here are some standard licenses and permits you may need:

- Industry-specific licenses for certain professions and industries, such as construction, plumbing, electrical, childcare, food handling, liquor, architecture, and finance

- Building and zoning permits

- Doing business as (DBA) permits using a name other than your LLC.

- Health licenses and permits at federal, state, and local levels

- Fire permits

- Sign permits

This is an important step in the LLC formation process, so make sure that you check with your state and local government offices to find out all the licenses and permits you need.

You could face steep fines and penalties if you operate without the proper licenses and permits.

Here are the steps to follow when obtaining business licenses in Wisconsin.

It’s a good idea to consult with a business attorney to make sure you’re in full compliance. You can also use a service like MyCorporation to do the research and provide you with all the forms you need to license your business entirely.

8. Determine Your Tax Status

By default, an LLC is a “pass-through” entity, which means the business itself does not pay income taxes. Instead, the business’s profits or losses are passed through to the members’ individual tax returns. The taxes are then paid at each member’s individual tax rate.

- Single-Member LLCs: If the LLC has only one member, it’s taxed like a sole proprietorship by default. This means the income from the LLC is reported on the member’s personal income tax return on Schedule C, and they’re responsible for paying self-employment taxes (Social Security and Medicare taxes) on that income.

- Multi-Member LLCs: If the LLC has more than one member, it’s taxed as a partnership by default. The LLC must file an informational tax return (Form 1065), but the income and deductions are passed through to the members. Each member reports their share of the income and deductions on their personal tax return. As with single-member LLCs, members must also pay self-employment taxes on their share of the profits.

An LLC can also choose to be taxed as a corporation by filing an election form with the IRS (Form 8832 for a C-Corp and Form 2553 for an S-Corp). This can be beneficial under certain circumstances:

- C-Corporation Taxation: Electing to be taxed as a C-Corporation can offer benefits to an LLC, particularly if the members want to retain earnings in the company. The corporation pays tax on its profits at the corporate rate (which was 21% as of 2022). If the profits are distributed to the members as dividends, the members must report these dividends on their tax returns and pay tax on them. This is known as “double taxation.” However, members aren’t subject to self-employment taxes on their dividends.

- S-Corporation Taxation: Choosing S-Corporation status can also be beneficial for an LLC. Under this scenario, the LLC does not pay corporate income tax. Instead, the income, deductions, and credits pass through to the shareholders, who report them on their individual tax returns. However, unlike a standard LLC, an S-Corp is required to pay its members a “reasonable” salary for the work they perform for the company. This salary is subject to payroll taxes, but any additional profits distributed to the members aren’t subject to self-employment taxes. This can result in significant tax savings, especially for businesses with high net income.

Other Requirements

Open Your Business Bank Account

When you have an LLC, it’s important to keep your business and personal finances separate for accounting and tax purposes. Commingling your business and personal funds can threaten your liability protection since the line between business and personal assets will not be clear.

Most banks offer business bank accounts, so check with your local bank. You’ll need your EIN and a copy of your articles of organization. Your bank may require other documents as well.

Apply for a Business Credit Card

A business credit card can help establish business credit so that if you apply for a business loan or line of credit in the future, you’ll have a better chance of getting approved. A business credit card can also help pay startup expenses, reducing out-of-pocket costs.

Get Business Insurance

Insurance is the right choice to protect the investment you’ve made in your business. There are several different types of insurance you may need.

- General liability: A comprehensive type of insurance covering many business elements. It includes coverage against bodily injury and property damage.

- Professional liability: Protects against claims from a customer who suffered a loss due to an error or omission in your work. It’s also known as errors and omissions (E&O) insurance.

- Workers’ compensation: Provides compensation to employees injured on the job.

- Property: Covers your physical business space.

- Business Property: Covers equipment and supplies.

- Equipment Breakdown Insurance: Covers the repair or replacement of broken equipment due to mechanical issues.

- Commercial auto: Covers your company-owned vehicles.

- Business owner’s policy (BOP): This option combines the above insurance types.

LLC Records

You’ll want to keep copies of your formation documents and operating agreement in a safe place. Any other official documents, such as vendor contracts and legal or financial documents, should also be kept in your records.

Annual Reporting

In Wisconsin, LLCs must file an annual report by the end of the quarter in which LLC formation initially occurred. The filing fee is $25.

How Much Does It Cost to Start an LLC in Wisconsin?

| Requirement | Cost |

| Name Reservation Fee | $15 |

| LLC Registration Fee | $130 |

| Business License Fees | Vary by localities and type of business |

| DBA fee | $15 |

| Annual Report Fee | $25 |